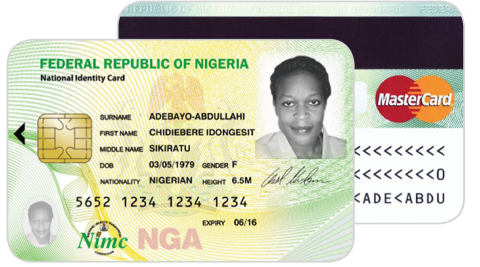

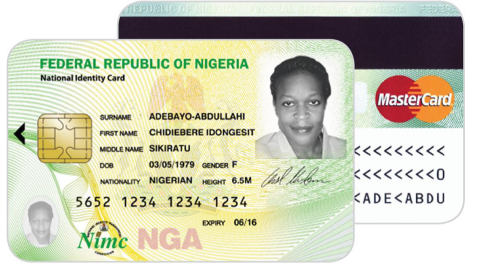

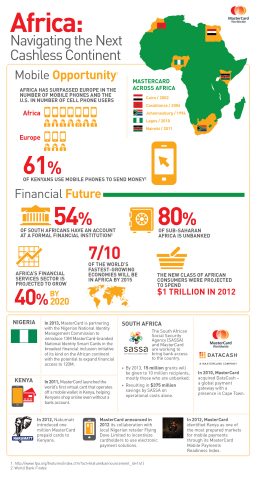

CAPE TOWN, South Africa--(BUSINESS WIRE)--The Nigerian National Identity Management Commission (NIMC) and MasterCard today announced at the World Economic Forum on Africa the roll-out of 13 million MasterCard-branded National Identity Smart Cards with electronic payment capability as a pilot program. The National Identity Smart Card is the Card Scheme under the recently deployed National Identity Management System (NIMS). This program is the largest roll-out of a formal electronic payment solution in the country and the broadest financial inclusion initiative of its kind on the African continent.

As part of the program, in its first phase, Nigerians 16 years and older, and all residents in the country for more than two years, will get the new multipurpose identity card which has 13 applications including MasterCard’s prepaid payment technology that will provide cardholders with the safety, convenience and reliability of electronic payments. This will have a significant and positive impact on the lives of these Nigerians who have not previously had access to financial services.

The Project will have Access Bank Plc as the pilot issuer bank for the cards and Unified Payment Services Limited (Unified Payments) as the payment processor. Other issuing banks will include United Bank for Africa, Union Bank, Zenith, Skye Bank, Unity Bank, Stanbic, and First Bank.

The announcement was witnessed by Dr. Ngozi Okonjo-Iweala, Minister of Finance and Coordinating Minister for the Economy in Nigeria, who stressed the importance of the National Identity Smart Card Scheme in moving Nigeria to an electronic platform. This program is good practice for us to bring all the citizens on a common platform for interacting with the various government agencies and for transacting electronically. We will implement this initiative in a collaborative manner between the public and private sectors, to achieve its full potential of inclusive citizenship and more effective governance,” she said.

“Today’s announcement is the first phase of an unprecedented project in terms of scale and scope for Nigeria,” said Michael Miebach, President, Middle East and Africa, MasterCard. “MasterCard has been a firm supporter of the Central Bank of Nigeria’s (CBN) Cashless Policy as we share a vision of a world beyond cash. From the program’s inception, we have provided the Federal Government of Nigeria with global insights and best practices on how electronic payments can enable economic growth and create a more financially inclusive economy”.

Chris ‘E Onyemenam, the Director General and Chief Executive of the National Identity Management Commission, said “We have chosen MasterCard to be the payment technology provider for the initial rollout of the National Identity Smart Card project because the Company has shown a commitment to furthering financial inclusion through the reduction of cash in the Nigerian economy.” He added “MasterCard has pioneered large scale card schemes that combine biometric functionality with electronic payments and we want to capitalize on their experience in this field to make our program rollout a sustainable success for the country and for the continent.”

“Access Bank’s involvement in this project is testament to our ongoing efforts to expand financial inclusion in Nigeria,” said Aigboje Aig-Imoukhuede, CEO of Access Bank. “The new identity card will revolutionize the Nigerian economic landscape, breaking down one of the most significant barriers to financial inclusion – proof of identity, while simultaneously providing Nigerians with a world class payment solution”.

“Unified Payments is the foremost transaction processor and pioneer of EMV processing and acquiring in Nigeria, owned by leading Nigerian banks. We will use our expertise and experience to guarantee the success of the project and ensure that the data of Nigerians are protected. We look forward to working with other partners in delivering value to all stakeholders’’, said Agada Apochi, Managing Director and CEO, Unified Payments.

The new National Identity Smart Card will incorporate the unique National Identification Numbers (NIN) of duly registered persons in the country. The enrollment process involves the recording of an individual’s demographic data and biometric data (capture of 10 fingerprints, facial picture and digital signature) that are used to authenticate the cardholder and eliminate fraud and embezzlement. The resultant National Identity Database will provide the platform for several other value propositions of the NIMC including identity authentication and verification.

Thanks to the unique and unambiguous identification of individuals under the NIMS, other identification card schemes like the Driver’s License, Voters Registration, Health Insurance, Tax, SIM and the National Pension Commission (PENCOM) will benefit and can all be integrated, using the NIN, into the multi-function Card Scheme of the NIMS. When fully utilizing the card as a prepaid payment tool, the cardholder can deposit funds on the card, receive social benefits, pay for goods and services at any of the 35 million MasterCard acceptance locations globally, withdraw cash from all ATMs that accept MasterCard, or engage in many other financial transactions that are facilitated by electronic payments. All in a secure and convenient environment enabled by the EMV Chip and Pin standard.

Upon completion of the National ID registration process, NIMC aims to introduce more than 100 million cards to Nigeria’s 167 million citizens.

About MasterCard

MasterCard(NYSE: MA), www.mastercard.com, is a technology company in the global payments industry. We operate the world’s fastest payments processing network, connecting consumers, financial institutions, merchants, governments and businesses in more than 210 countries and territories. MasterCard’s products and solutions make everyday commerce activities – such as shopping, traveling, running a business and managing finances – easier, more secure and more efficient for everyone. Follow us on Twitter @MasterCardNews, join the discussion on the Cashless Conversations Blog and subscribe for the latest news.

About NIMC

The National Identity Management Commission (NIMC) was established by the NIMC Act No.23, 2007 as the primary legal, regulatory and institutional mechanism for implementing a reliable and sustainable national identity management system that will enable Nigerian citizens and legal residents assert their identity. The Act mandates the NIMC to create, own, operate and manage a national identity database, issue national identification numbers to registered individuals, provide identity authentication and verification services, issue multipurpose smartcards, integrate identity databases across government agencies and foster the orderly development of the identity sector in Nigeria. The Act also empowered the NIMC to collaborate with any public and or private sector organization to realize its objectives.

About Unified Payments

Unified Payments is owned by a consortium of Nigerian Banks. Our core businesses comprise Processing, Merchant Acquiring, Switching, Payment Terminal Services and provision of Value Added Services & Solutions. Unified Payments pioneered the issuance and acceptance of EMV Chip + PIN cards in Nigeria, leading to reduction of ATM fraud in Nigeria by over 95%. The company enabled Nigerian banks and merchants for the first time ever to accept foreign cards at ATMs and Points of Sale Terminals, and also pioneered the issuance of Naira cards that are globally accepted.

About Access Bank

Access Bank Plc is a full service commercial Bank operating through a network of over 300 branches and service outlets located in major centres across Nigeria, Sub Saharan Africa and the United Kingdom. Listed on the Nigerian Stock Exchange, the Bank has over 800,000 shareholders and has enjoyed what is arguably Africa's most successful banking growth trajectory in the last ten years ranking amongst Africa's top 20 banks by total assets and capital in 2011. As part of its continued growth strategy, Access Bank has made sustainable business core to all its operations. The Bank strives to deliver sustainable economic growth that is profitable, environmentally responsible and socially relevant.