‘Til Debt Do Us Part: Student Loan Debt Crisis Drives Surge in Prenups, LegalShield Research Reveals

‘Til Debt Do Us Part: Student Loan Debt Crisis Drives Surge in Prenups, LegalShield Research Reveals

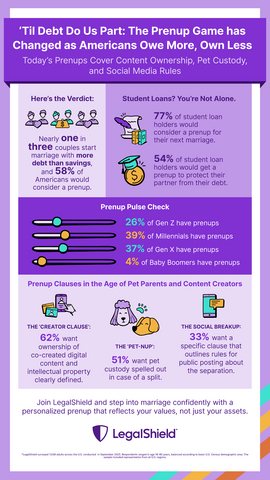

- 77% with student debt would consider a prenup

- Couples with student debt 6x more likely to have a prenup

- 54% with student loans would get a prenup to protect their partner from debt

- Millennials sign prenups at 10x rate of Baby Boomers

ADA, Okla.--(BUSINESS WIRE)--Student debt has transformed prenuptial (prenup) agreements from wealth preservation tools into debt shields. Seventy-seven percent of Americans with student loans would consider a prenup, according to new LegalShield research.

“While marriage is usually based on love, it is now defined by debt,” said Warren Schlichting, CEO of LegalShield.

Share

The shift reflects a broader financial reality: Americans carry nearly $2 trillion in student debt, with $500 billion added in the past decade alone. Among those with student loans, 54% would sign a prenup to protect their partner from their own debt. Half of respondents said protecting themselves from a partner's debt would motivate them to get a prenup. The Pew Research Center also found that nearly half of those in their late twenties carry student loans.

“While marriage is usually based on love, it is now defined by debt,” said Warren Schlichting, CEO of LegalShield. “Prenups have become essential protection for young couples facing heavy financial burdens due to the student debt crisis.”

Generational Divide and Modern Insights

Approximately 50% of Americans view prenups as protection and nearly one-third now enter marriage with more debt than savings. And the generational divide is stark. Millennials are 10 times more likely than Baby Boomers to have a prenup, 39% compared to just 4%. Gen X follows at 37% and 26% of Gen Z couples have a prenup.

The modern prenup now goes beyond just finances. The research found Americans want unconventional clauses that demonstrate today’s trends, including:

- The 'Creator Clause': 62% said a prenup should define ownership of YouTube channels or podcasts created together.

- The 'Pet-nup': Over half (51%) believe custody of shared pets should be included.

- The Social Breakup: A third (33%) seek social media breakup rules controlling what ex-partners can post online.

"Some people still think a prenup is a sign of mistrust, but it’s really an act of transparency,” said Rebecca A. Carter, a LegalShield provider lawyer with Friedman, Framme & Thrush, PA. “Many simply don’t want their spouse to pay for their past debt mistakes. Prenups create space for honest conversations and financial clarity before marriage.”

The LegalShield study was conducted in September 2025 and surveyed 1,038 U.S. adults, ages 18-80. The sample was balanced by age, among other demographic variables, according to the U.S. Census.

About LegalShield:

For more than 50 years, LegalShield has provided everyday Americans with easy and affordable access to legal advice, counsel, protection, and representation. Serving millions, LegalShield is one of the world's largest platforms for legal, identity, and reputation management services protecting individuals and businesses across North America. Founded in 1972, LegalShield, and its privacy management product, IDShield, has provided individuals, families, businesses, and employers with tools and services needed to affordably live a just and secure life. Through technology and innovation, LegalShield is disrupting the traditional legal system and transforming how and where people receive legal guidance and services, with access to hundreds of qualified, trusted attorneys and law firms. LegalShield and IDShield are products of Pre-Paid Legal Services, Inc. To learn more about LegalShield and IDShield, visit LegalShield.com and IDShield.com.

Contacts

LegalShield Media Contact:

Hollon Kohtz, Director of Communications

hollonkohtz@pplsi.com