Carefull Announces GreyMatter: The First AI For Elder Fraud Prevention and Aging Financial Risk Management

Carefull Announces GreyMatter: The First AI For Elder Fraud Prevention and Aging Financial Risk Management

Multi-year project aims to help institutions better support aging customers and their families through the complex financial threats facing older adults today.

NEW YORK--(BUSINESS WIRE)--Fueled by artificial intelligence, new scams and fraud schemes targeting older adults are evolving daily, costing families over $29 billion in 2024 alone according to the FTC. In parallel, research continues to shed more light on the intersection of brain health, age, and finance. Today, Carefull, the company redefining financial safety for older adults and their families, announced live from the Money20/20 stage the launch of GreyMatter, its proprietary artificial intelligence engine built to detect, prevent, and predict the complex risks of aging and money.

“GreyMatter wasn’t built once—it’s built every day. It learns, adapts, and gets smarter with every new transaction, behavior and emerging scam.

Share

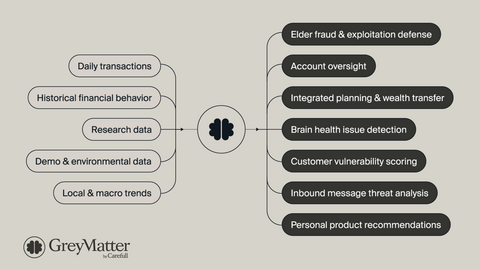

GreyMatter is the AI intelligence layer powering Carefull’s financial safety platform, used by financial institutions nationwide to help families spot early signs of financial risk, from scams and fraud to cognitive decline and elder abuse, before small issues become lasting harm. GreyMatter is an evolving system trained on millions of transactions and behavioral data points to identify what traditional fraud and risk systems typically miss.

“Social engineering, industrialized scam organizations, and now AI… the latest tactics and technologies now prey directly upon those who once protected us,” said Todd Rovak, Co-Founder and Co-CEO of Carefull. “Aging is complex, multi-stakeholder, and is more about behavior, brain health, and family relationships than it is about transactions alone. AI presents an unprecedented opportunity to combine these elements to create a massive positive impact.”

Fire, Meet Fire

Since 2020, Carefull has been building the industry’s first AI platform focused on aging and money, an area long overlooked by traditional fraud systems. Carefull stops elder fraud by putting a preventative solution directly in the hands of customers, detecting and resolving concerning patterns, before the “big one” that irreparably harms a family. GreyMatter represents the next step in Carefull’s mission, delivering new proprietary intelligence and expanded behavioral insight to support older customers in a manner Carefull calls “oversight without overreach.”

GreyMatter brings innovation to the rapidly evolving fraud landscape filled with romance scams and emotional manipulation schemes. Beyond flagging transactions, GreyMatter detects an ever-growing set of more than 60 behavioral and complex risk patterns, including forgetfulness, potential vulnerability, decline in judgment, and even potential financial exploitation by a trusted person. To do this, Carefull pulls in insights from the ecosystem of medical research, data science, psychology, and of course, financial fraud prevention.

“GreyMatter wasn’t built once—it’s built every day. It learns, adapts, and gets smarter with every new transaction, behavior and emerging scam. That’s how we stay one step ahead of the problem: by crafting a system that never stops learning how to protect its users,” said Max Goldman, Co-Founder and Co-CEO of Carefull.

Powering a New Era of Longevity Finance

Today, GreyMatter powers Carefull, helping banks, credit unions, and wealth advisory firms support older adults and the sandwich generation of financial caregivers. Tomorrow, GreyMatter will unlock a new category Carefull is calling “longevity finance,” where banks, advisors, governments, and nonprofits can collaborate to bring safety, trust, and dignity back into financial aging.

“Financial safety for our aging population is one of the biggest challenges our society faces, and Carefull has been ahead of this curve for years,” said Christian Ostberg, General Partner at Fin Capital. “GreyMatter bolsters their leadership in longevity finance and shows how AI can be used to protect, not exploit, people.”

A Call to Collaborate

GreyMatter is continuously evolving, reflecting Carefull’s commitment to building the future of financial safety. To support this continued growth, Carefull has established a waitlist for organizations—from financial institutions to insurance, retail, telecommunications, utilities, universities, and more—to partner and collaborate in this shared mission. With aging recognized as a societal challenge that touches everyone, the goal is to bring more organizations to the table and keep advancing the work together.

Organizations are invited to join the effort to protect those who once protected us. To collaborate, share findings, or explore partnership opportunities with GreyMatter, visit getcarefull.com/greymatter or contact greymatter@getcarefull.com.

About GreyMatter by Carefull

Carefull is the first financial safety platform built to protect older adults’ daily finances and support their next-generation caregivers. Through continuous monitoring, fraud detection, and tools for financial caregiving, Carefull helps families and financial institutions prevent and detect scams, fraud and money mistakes. Carefull is powered by GreyMatter, the AI for elder fraud and aging financial risk built to protect those who once protected us.

Learn more at getcarefull.com/greymatter

Contacts

Media:

Becky Ross

Head of Marketing

press@getcarefull.com