Schroders Global Investor Study 2021: Many Canadian Investors Interested in ESG, but Lag Global Counterparts

Schroders Global Investor Study 2021: Many Canadian Investors Interested in ESG, but Lag Global Counterparts

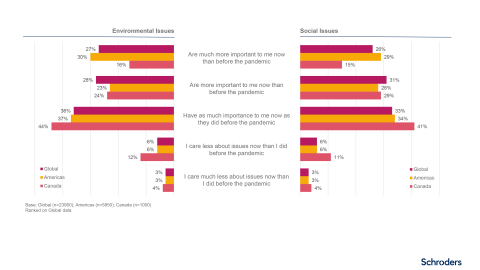

NEW YORK--(BUSINESS WIRE)--Canadian investors have sharpened their focus on environmental and social issues due to the pandemic, but less so than the rest of the world, the Schroders Global Investor Study has found.

The sustainability-focused findings of the annual flagship study, which surveyed over 23,000 investors from 33 locations globally, found that 44% and 40% of Canadian investors, respectively, are now placing greater importance on social and environmental issues, compared to 55% and 57% of investors globally.

More than half (54%) of Canadian investors believe that data/evidence demonstrating that investing sustainably delivers better returns would encourage them to increase their allocations. A further 36% of investors said that regular reporting that highlights the impact their investments are having would motivate them to increase their sustainable investments and just over a third (34%) would like their financial advisor to provide them with more information aligned to their sustainability preferences.

While many Canadians are at ease with the prospect of embracing sustainability, they are slightly behind their global counterparts. Forty-three percent stated they would feel positive with their advisor moving their assets to an entirely sustainable portfolio, so long as the same level of risk and diversification was maintained, compared to 57% of investors globally and 68% of U.S. investors.

Of that 43%, three quarters said the opportunity to have a positive impact on the world was the most appealing factor, ahead of 41% who were confident about returns.

“Across the globe, ESG has firmly cemented its place in mainstream investing,” said Sarah Bratton Hughes, Head of Sustainability, North America, at Schroders. “As we begin to see externalities related to climate change, corporate governance and other factors materialize, Canadian investors can not only have a positive impact on the world but also uncover risks and opportunities to potentially enhance returns through their allocation strategy.”

Canadian investors seek to avoid financial, climate risks with ESG investing

The study also asked what controversies would drive people to withdraw from investments. Financial scandals are the most likely to occur, with these issues creating greater investment obstacles than cyber security hacks or climate change catastrophes. With that, some 63% of Canadian investors stated they would sell out if their investments were impacted by financial or accounting scandals.

This was ahead of 52% of investors who cited human rights scandals, and the same percentage who identified a scandal relating to treatment of a company’s workforce. Interestingly, Canadian investors were less concerned than their global counterparts with a climate change catastrophe. Only 48% identified they would sell out of a company experiencing this, versus 60% of investors globally.

“The pandemic has encouraged investors to want more from the companies they are invested in, with a microscope put on the way management teams treat employees and the communities they serve,” said Bratton Hughes. “Many Canadians want to ensure that they are only owning those that are having a positive impact on the world, with less risk of scandals that may hurt returns and company reputation.”

At an increasing level, investors are expecting global action to be taken to address climate change. The study found that pressure was growing on almost all key global stakeholders – from governments, companies and even asset managers – to mitigate the impact.

Over three-quarters of Canadian survey respondents (71% 77%) agreed that this responsibility should fall on the shoulders of national governments and regulators, while 70% placed responsibility on companies for tackling climate change.

Note to Editors

In 2021, Schroders commissioned Raconteur Media and iResearch to conduct an independent online survey of 23,950 people who invest from 33 locations around the globe.

The research defines “people” as:

- Those who will invest at least CAD17,300 (or equivalent) in the next 12 months

- Have changed their investments within the last 10 years

Due to this threshold, Schroders acknowledges that this group and thus the research findings are not representative of everyone's experience.

Note: Figures in this document may not add up to 100 per cent due to rounding and multiple selection questions.

For trade press only. To view the latest press releases from Schroders visit: https://www.schroders.com/en/media-relations/newsroom/

Schroders plc

As a global active asset manager, the way we direct capital not only shapes the financial returns we achieve for our clients but also the impact that the companies in which we invest on their behalf might have on society. The relationship between these two outcomes has rapidly evolved as we see a fundamental shift in how companies are viewed and valued. Understanding the impact that they can have on society and the planet is crucial in assessing their ability to deliver risk-adjusted profits.

Our ongoing success is built on a history of experience and expertise, whereby we partner with our clients to construct innovative products and solutions across our five business areas consisting of Private Assets & Alternatives, Solutions, Mutual Funds, Institutional and Wealth Management and invest in a wide range of assets and geographies. By combining our commitment to active management and focus on sustainability, our strategic capabilities are designed to deliver positive outcomes for our clients.

We are responsible for £700.4 billion (€815.8 billion/$967.5 billion/)* assets of our clients, managed locally by 42 investment teams worldwide. As a global business with over 5,500 talented staff across 37 locations, we are able to stay close to our clients and understand their needs. We have over 200 years of experience in investment and innovation and remain committed to creating a better future by investing responsibly for our clients.

Further information about Schroders can be found at www.schroders.com.

Important Information:

All investments involve risk, including the loss of principal. Diversification cannot ensure profits or abate all risk. The views and opinions stated are those of the individuals quoted and are subject to change. This document does not purport to provide investment advice and the information contained is for informational purposes and not to engage in any trading activities. The material is not intended to provide, and should not be relied on for accounting, legal or tax advice, or investment recommendations.

Issued by Schroder Investment Management Limited. Registration No 1893220 England. Authorised and regulated by the Financial Conduct Authority. For regular updates by e-mail please register online at www.schroders.com for our alerting service.

*as at 30 June 2021

Contacts

Sarah Levine

Prosek Partners

slevine@prosek.com

646.818.9289