NEW YORK--(BUSINESS WIRE)--The frequency of M&A insurance claims is rising as large deals prove risky and the average payout on the most severe category of claims tops $20 million, according to an American International Group, Inc. (NYSE:AIG) study of its representation and warranty (R&W) claims. AIG is one of the largest writers of R&W insurance globally.

The M&A claims study, now in its second year, examined policy years 2011 to 2015. This year, the study looked into claims severity for the first time, revealing that more than half of all material claims (those incurring more than $100,000) during the period were $1 million or more.

A closer look at the distribution of material claims shows a substantial amount of dollars paid across the severity spectrum.

- Slightly fewer than 47 percent of claims were between $100,000 and $1 million, with an average payout of $300,000.

- 47 percent were between $1 million and $10 million, with an average payout of $3.5 million.

- Slightly fewer than seven percent were more than $10 million, with an average payout of $22 million.

“The bigger and more complicated a deal is, the more likely there is an unknown liability lingering,” said Mary Duffy, Global Head of M&A Insurance, AIG. “We are paying sizeable claims, sometimes writing eight-figure checks in different geographies.”

CLAIMS FREQUENCY

The study found one-in-four policies written on deals over $1 billion resulted in a claim. Overall, 18 percent of all global R&W policies written by AIG during the 2011 to 2015 period resulted in a claim.

The main driver of the increase was a seven-point jump in the claims count from policies written in the 2011 to 2014 period (to 21 percent) compared to the prior year study. R&W policies have potential claims tails as long as seven years, which means policies written in the 2011 to 2014 period are still subject to claims, and this explains the higher claims percentage in this year’s study versus the 14 percent reported for the same policy period in last year’s Global M&A Insurance Claims study.

“A maturing market mixed with pressure to execute transactions quickly could be a leading factor behind the increase in frequency,” said Michael Turnbull, Americas M&A Manager, AIG. “At the same time, we’re seeing claims across the board in terms of severity, which means that the product is responding to a host of different situations.”

While a good portion of claims (27 percent) are reported in the first six months following a deal, the majority of claims (48 percent) are reported between six and 18 months after a transaction. A substantial 17 percent of claims were reported in the 18-24 month period following a deal, and eight percent were reported 24 months or later.

CLAIM TRIGGERS

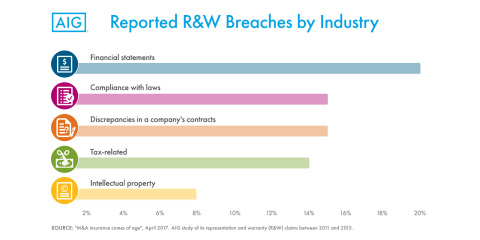

Claim triggers were mostly steady year-over-year with one standout exception: “compliance with laws” jumped to 15 percent of alleged deal breaches, compared to just five percent last year, making it the second leading claims trigger.

The top five common breaches claimed, according to the study include:

- Financial statements (20 percent)

- Compliance with laws (15 percent)

- Discrepancies in a company’s contracts (14 percent)

- Tax-related (14 percent)

- Intellectual property (8 percent)

Also new to this year’s study, AIG delved more deeply into claims involving financial statements. The top reasons given for this type of claim include:

- Accounting rules statement breaches (26 percent) and misstatement of accounts receivable/payable (25 percent) are the two most common reasons;

- Undisclosed liabilities (19 percent), misstatement of inventory (17 percent) and overstatement of cash holdings or profit (13 percent) are also ranked as reasons for financial statement claims.

“You can pick up all sorts of complex issues that are not flagged during the diligence process,” Ms. Duffy said. “We help cover these unknowns.”

R&W TRENDS

Buyers in a transaction purchase R&W insurance to help protect against financial loss arising from breaches of representations and warranties (whether innocent or otherwise) made by a seller during the deal process. Sellers also purchase the insurance to help protect against financial loss arising from buyers claiming such breaches. While the study found fewer policies are sold on the sell-side, these do result in a much higher frequency of claims, at 29 percent versus 18 percent on the buy-side.

About the Study: AIG is one of the largest writers of M&A policies in the world. It has been writing M&A policies covering representation and warranties since the late 1990s. The claims data between 2014 to 2015 cover a significantly larger pool of transactions than in prior periods, reflecting an increase in M&A activity and the growing acceptance and use of R&W policies as part of the deal process. The total number of claims during the study period was approximately 300, spanning policies covering approximately 1,600 deals, worth more than $400 billion in deal value, though the number of material claims was smaller. Policies written during the study period still hold the potential for a claim.

American International Group, Inc. (AIG) is a leading global insurance organization. Founded in 1919, today AIG member companies provide a wide range of property casualty insurance, life insurance, retirement products, and other financial services to customers in more than 80 countries and jurisdictions. These diverse offerings include products and services that help businesses and individuals protect their assets, manage risks and provide for retirement security. AIG’s core businesses include Commercial Insurance and Consumer Insurance, as well as Other Operations. Commercial Insurance comprises two modules – Liability and Financial Lines, and Property and Special Risks. Consumer Insurance comprises four modules – Individual Retirement, Group Retirement, Life Insurance and Personal Insurance. AIG common stock is listed on the New York Stock Exchange and the Tokyo Stock Exchange.

Additional information about AIG can be found at www.aig.com and www.aig.com/strategyupdate | YouTube: www.youtube.com/aig | Twitter: @AIGinsurance | LinkedIn: http://www.linkedin.com/company/aig. These references with additional information about AIG have been provided as a convenience, and the information contained on such websites is not incorporated by reference into this press release.

AIG is the marketing name for the worldwide property-casualty, life and retirement, and general insurance operations of American International Group, Inc. For additional information, please visit our website at www.aig.com. All products and services are written or provided by subsidiaries or affiliates of American International Group, Inc. Products or services may not be available in all countries, and coverage is subject to actual policy language. Non-insurance products and services may be provided by independent third parties. Certain property-casualty coverages may be provided by a surplus lines insurer. Surplus lines insurers do not generally participate in state guaranty funds, and insureds are therefore not protected by such funds.