--(BUSINESS WIRE)--Wolters Kluwer Tax & Accounting:

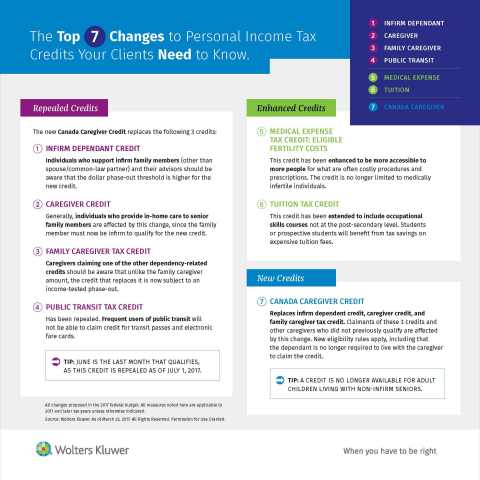

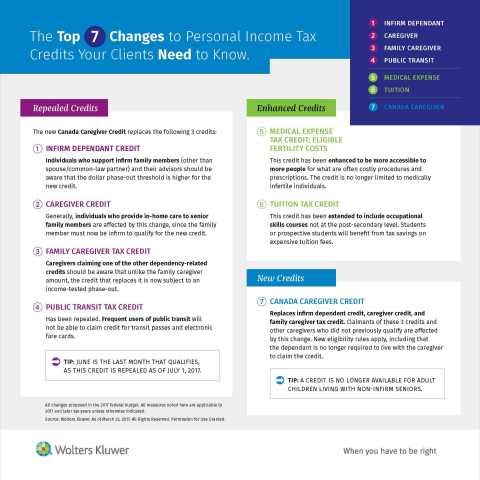

What: Wednesday’s federal budget contains changes to income tax credits which directly affect caregivers, students, transit riders and would-be parents. The accompanying infographic summarizes the Top 7 personal tax credits that tax practitioners need to know to assist their clients in planning for, and leveraging the changes. For an in-depth review of all key budget provisions that affect corporations as well as individuals, Wolters Kluwer will be hosting a virtual briefing on Friday, March 24th at noon EDT.

Why: The Government’s second budget continues the Liberal’s ongoing theme of supporting the middle class through tuition tax credit enhancements and implementing measures to improve tax fairness.

Key for accountants and lawyers, the federal budget also takes aim at billed-basis accounting by taxing work-in-progress (WIP) including contingency fees, while closing some longstanding loopholes in retirement and education planning. Investors can no longer straddle losses and gains, shining a spotlight on selected anti-avoidance provisions.

Who: Wolters Kluwer and the tax lawyers of Dentons Canada LLP will present their considered opinion on key budget considerations such as:

- Work-in-progress and contingency billing by professional service providers

- Changes to tax credits

- Selected taxation anti-avoidance provisions

- Introduction of new sales tax measures

Contact: For journalists interested in attending the free webinar, register here. To arrange an interview with a tax expert from Wolters Kluwer Tax & Accounting on this or any other tax-related topics, please contact: