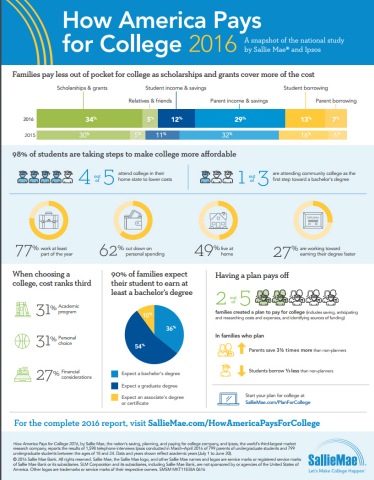

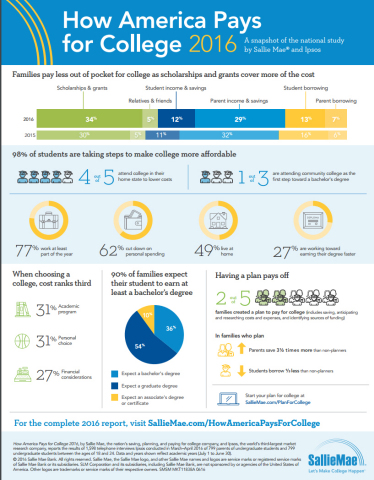

NEWARK, Del.--(BUSINESS WIRE)--Families spent less out-of-pocket for college in academic year 2015-16 compared to the prior year as families took advantage of more scholarships and grants to foot the bill, according to “How America Pays for College 2016,” the national study from Sallie Mae—the nation’s saving, planning, and paying for college company—and Ipsos—a global independent market research company. This year’s report—now in its ninth year—found scholarships and grants covered 34 percent of college costs, the largest percentage of any resource over the last five years. Approximately half of families used a scholarship or grant to help pay for college.

Families used parent income and savings (29 percent), student borrowing (13 percent), student income and savings (12 percent), parent borrowing (7 percent), and contributions from relatives and friends (5 percent) to cover remaining college costs. Compared to academic year 2014-15, families paid seven percent or approximately $1,100 less from out-of-pocket funds, which includes income, savings, and borrowed funds.

“Families wrote smaller checks for college this year as they looked less to their wallets and more toward free money to make college happen,” said Raymond Quinlan, chairman and chief executive officer, Sallie Mae. “Scholarships and grants have become an increasingly important part of the pay-for-college mix, and it’s encouraging to see organizations, schools, and the government stepping up to provide them. It’s equally gratifying to see families’ consistent belief in the value of college while they also take deliberate steps to make it more affordable.”

Families Taking Steps to Make College More Affordable

While families are willing to stretch financially, they are also taking deliberate steps to make college more affordable. Nearly all families, 98 percent, took at least one cost-saving measure, with most taking five or more. Specifically, 77 percent of students worked during the year, 62 percent cut personal spending, 49 percent lived at home, and 27 percent accelerated coursework to earn their degree faster. In addition, four in five students attended college in their home state, and one in three started at a community college as a first step toward a bachelor’s degree. Eighty-five percent of families completed the Free Application for Federal Student Aid (FAFSA).

Bachelor’s Degree is the New Norm

Families are firmly in agreement on the value of college: 97 percent believe it’s an investment in their student’s future, but this year, “How America Pays for College” dug a bit deeper to explore family expectations by degree. An overwhelming majority of families, 90 percent, expected their college student to earn a bachelor’s degree. What’s more, 54 percent of families expected their student to earn a graduate degree. The study also found 86 percent of families were willing to stretch themselves financially to make college happen, and 83 percent felt confident they made the right decisions when choosing how to pay.

Borrowing Not a Forgone Conclusion

Fewer than half of families borrowed last year. In fact, the proportions of funding from family savings and income and scholarships and grants were twice as high as the proportion of funds borrowed. Student borrowing paid 13 percent of all college costs, down from 16 percent in academic year 2014-15. In addition, families used borrowed money to reach for schools with a higher price tag: on average, those who borrowed spent 55 percent more for college than those who did not.

“The results of this important annual study shed light on critical financial decisions families are making for and with their college-bound students,” said Julia Clark, senior vice president at Ipsos Public Affairs. “The changing roles that college cost, borrowing, and savings play in this process are essential to understand as key factors in the broader higher education landscape.”

Cost is a Factor, But Where it Ranks May Surprise You

Sixty-seven percent of families narrow college choices based on cost but when it comes to making the final decision on where to attend, cost takes a back seat to other factors. The primary reasons in choosing a college were split between academic program (31 percent) and personal choice (31 percent), which includes campus culture, extracurricular activities, and student population. Cost ranked third, cited by 27 percent. Cost was the chief consideration among those attending two-year public colleges (38 percent), but less of a factor among students at four-year public schools (23 percent) and four-year private colleges (20 percent).

Planning for College Still Pays Off

While 86 percent of families believe a college degree is more important than ever, only 40 percent have a plan to pay for it. The proportion of planners differs by family income: nearly 64 percent of high-income families created a plan to pay for college, while only 25 percent of low-income families and 36 percent of middle-income families had a plan. In families with plans, students are more likely to pursue a bachelor’s degree, there is more willingness and ability to spend on college, and students borrow 37-percent less than those without a plan.

“How America Pays for College 2016” reports the results of 1,598 telephone interviews Ipsos conducted in April 2016 of 799 parents of undergraduate students and 799 undergraduate students between the ages of 18 and 24. Data and years shown reflect academic years (July 1 to June 30).

The complete “How America Pays for College 2016” report and a related infographic are available at SallieMae.com/HowAmericaPaysForCollege. Join the conversation using #HowAmericaPays.

Start your plan for college at Salliemae.com/PlanforCollege.

Ipsos is an independent market research company controlled and managed by research professionals. Founded in France in 1975, Ipsos has grown into a worldwide research group with a strong presence in all key markets, and is the world’s third largest survey-based market research company. Ipsos delivers insightful expertise across five research specializations: advertising, customer loyalty, marketing, media, and public affairs research. Ipsos researchers assess market potential and interpret market trends. They develop and build brands. They help clients build long-term relationships with their customers. They test advertising and study audience responses to various media and they measure public opinion around the globe. Ipsos has been listed on the Paris Stock Exchange since 1999 and generated global revenues of €1,669.5 billion (2.218 billion USD) in 2014. Visit http://www.ipsos-na.com to learn more.

Sallie Mae (NASDAQ: SLM) is the nation’s saving, planning, and paying for college company. Whether college is a long way off or just around the corner, Sallie Mae offers products that promote responsible personal finance, including private education loans, Upromise rewards, scholarship search, college financial planning tools, and online retail banking. Learn more at SallieMae.com. Commonly known as Sallie Mae, SLM Corporation and its subsidiaries are not sponsored by or agencies of the United States of America.