IRVINE, Calif.--(BUSINESS WIRE)--CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, released its monthly Southern California home sales report for March 2023. The report includes data for new and resale single-family homes and resale condominiums from six counties in the region: Los Angeles, Orange, Riverside, San Bernardino, San Diego and Ventura.

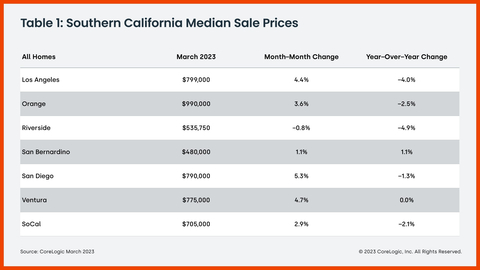

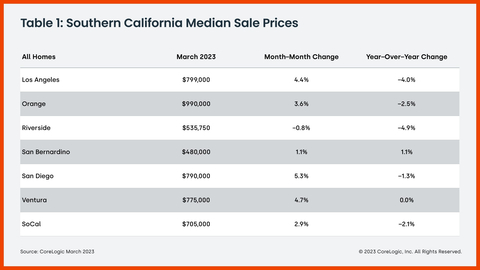

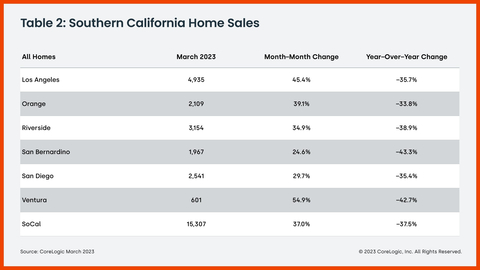

The median home sales price in Southern California ended March at $705,000, a 2.1% decrease from one year earlier. Still, five of six tracked counties showed slight price increases from February, a trend that is likely partially due to seasonal patterns, as prospective homebuyers typically become more active as spring begins. The annual home price declines throughout most of Southern California reflect the mortgage rate increases seen in early 2022, while the continued sales drops are indicative of the region’s prolonged inventory shortages.

“While Southern California home sales activity is still trending notably below 2022 levels, the seasonal rebound and falling mortgage rates have attracted more buyers to the market,” said Selma Hepp, chief economist for CoreLogic. “However, while spring reinvigorated buyer activity, many sellers are still on the sidelines, keeping the inventory of for-sale homes in the region consistently low. Due to the shortage of homes on the market, both home prices and market competition have bounced back.”

Key Takeaways:

- Orange County posted Southern California’s highest median sales price for all tracked residential property types in March, at $990,000. It was followed by Los Angeles ($799,000), San Diego ($790,000), Ventura ($775,000), Riverside ($536,000) and San Bernardino ($480,000).

- Four of six Southern California counties saw annual median home price losses from March 2022, ranging from -4.9% in Riverside County to -1.3% in San Diego County. Annual home prices were unchanged in Ventura County and up by 1.1% in San Bernardino County.

- Southern California home sales volume declined by -37.5% year over year in March. All six counties saw similar drops as the regional average, ranging from -43.3% in San Bernardino County to -33.8% in Orange County.

The next CoreLogic Southern California Home Sales press release, featuring April 2023 data, will be released in May 2023.

Note: Data in this release is taken from county records and not from local multiple listing services.

Source: CoreLogic

The data provided are for use only by the primary recipient or the primary recipient's publication or broadcast. This data may not be resold, republished or licensed to any other source, including publications and sources owned by the primary recipient’s parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data are illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact Robin Wachner at newsmedia@corelogic.com. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. The data are compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic is a leading global property information, analytics and data-enabled solutions provider. The company's combined data from public, contributory and proprietary sources includes over 4.5 billion records spanning more than 50 years, providing detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. The markets CoreLogic serves include real estate and mortgage finance, insurance, capital markets, and the public sector. CoreLogic delivers value to clients through unique data, analytics, workflow technology, advisory and managed services. Clients rely on CoreLogic to help identify and manage growth opportunities, improve performance and mitigate risk. Headquartered in Irvine, Calif., CoreLogic operates in North America, Western Europe and Asia Pacific. For more information, please visit www.corelogic.com.

CORELOGIC, the CoreLogic logo, CoreLogic HPI and CoreLogic HPI Forecast are trademarks of CoreLogic, Inc. and/or its subsidiaries. All other trademarks are the property of their respective owners.