VENICE, Calif. & SANTA CLARA, Calif.--(BUSINESS WIRE)--Stable Road Acquisition Corp (“SRAC”) and Momentus Inc. (“Momentus”) announced an amendment to their merger agreement signed in October 2020 that reflects recently announced changes to Momentus’ anticipated launch schedule and allows public equity holders and PIPE investors to also benefit from Momentus’ recent repurchase of its co-founders’ shares. Recent events and associated revisions to the forward outlook include:

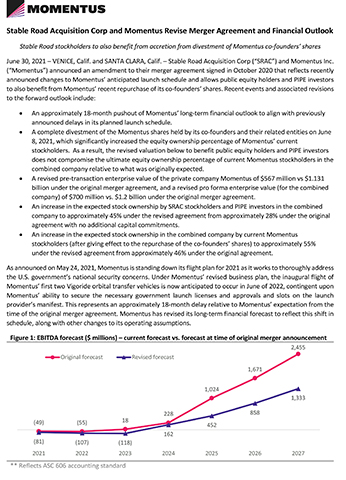

- An approximately 18-month pushout of Momentus’ long-term financial outlook to align with previously announced delays in its planned launch schedule.

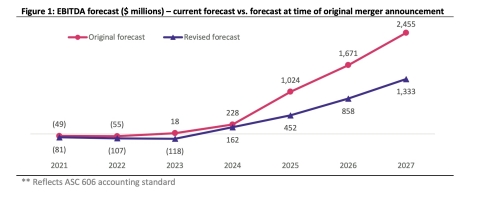

- A complete divestment of the Momentus shares held by its co-founders and their related entities on June 8, 2021, which significantly increased the equity ownership percentage of Momentus’ current stockholders. As a result, the revised valuation below to benefit public equity holders and PIPE investors does not compromise the ultimate equity ownership percentage of current Momentus stockholders in the combined company relative to what was originally expected.

- A revised pre-transaction enterprise value of the private company Momentus of $567 million vs $1.131 billion under the original merger agreement, and a revised pro forma enterprise value (for the combined company) of $700 million vs. $1.2 billion under the original merger agreement.

- An increase in the expected stock ownership by SRAC stockholders and PIPE investors in the combined company to approximately 45% under the revised agreement from approximately 28% under the original agreement with no additional capital commitments.

- An increase in the expected stock ownership in the combined company by current Momentus stockholders (after giving effect to the repurchase of the co-founders’ shares) to approximately 55% under the revised agreement from approximately 46% under the original agreement.

As announced on May 24, 2021, Momentus is standing down its flight plan for 2021 as it works to thoroughly address the U.S. government’s national security concerns. Under Momentus’ revised business plan, the inaugural flight of Momentus’ first two Vigoride orbital transfer vehicles is now anticipated to occur in June of 2022, contingent upon Momentus’ ability to secure the necessary government launch licenses and approvals and slots on the launch provider’s manifest. This represents an approximately 18-month delay relative to Momentus’ expectation from the time of the original merger agreement. Momentus has revised its long-term financial forecast to reflect this shift in schedule, along with other changes to its operating assumptions (see Figure 1 above).

“We continue to see meaningful long-term revenue and earnings growth potential for Momentus as evidenced by our pipeline of potential business under discussion,” said Momentus Chief Executive Officer Dawn Harms. “In order to fully realize this potential, our current focus must be on alleviating any remaining U.S. government concerns and we’re actively working toward that resolution.”

As was previously disclosed on June 9, 2021, Momentus and its co-founders jointly signed a National Security Agreement (“NSA”) with the Department of Defense and the Department of the Treasury as representatives of the Committee on Foreign Investment in the United States (“CFIUS”). Upon execution of the NSA, the Momentus co-founders and their related entities sold all of their Momentus stock and equity options, representing approximately 36% of total Momentus equity, to Momentus for up to $50 million in future cash consideration expected to be paid after the completion of its planned merger with Stable Road.

Momentus and SRAC have revised the enterprise valuation of the private company Momentus in the merger agreement to compensate SRAC’s public stockholders and PIPE investors for the launch delays. Momentus’ recent repurchase of its co-founders’ shares more than offsets the impact of the revised valuation on the equity ownership percentage of Momentus’ current stockholders in the combined company. Pursuant to the revised agreement, Momentus’ current stockholders will own approximately 55% of the issued and outstanding shares of Class A common stock of the combined company immediately following the consummation of the merger, assuming no redemptions by Stable Road’s existing public stockholders. SRAC shareholders and PIPE investors will hold approximately 45% (including the sponsor’s holdings), implying a pro forma enterprise value of approximately $700 million. Momentus’ co-founders will have no ownership in the combined company (see Figures 2 and 3 above).

“Given the pushout in Momentus’ financial outlook as a result of its previously announced decision to stand down its 2021 launch plan, we sought to secure more favorable deal terms for our public stockholders and PIPE investors. I am grateful to the Momentus board for its partnership in achieving this outcome,” said SRAC Chief Executive Officer Brian Kabot. “We believe this revised merger agreement significantly helps to compensate our investors for the change in schedule and results in a more attractive investment case for them.”

Figure 4: Reconciliation of private company Momentus enterprise value to pro |

Amended |

Original |

||

forma combined enterprise value ($ millions) (excluding PIPE and cash in Trust) |

Agreement |

agreement |

||

Consideration paid to Momentus holders * |

567 |

1,131 |

||

Stock and option repurchase from co-founders |

50 |

- |

||

Estimated transaction fees and expenses |

49 |

35 |

||

Estimated sponsor promote |

34 |

34 |

||

Proforma enterprise value of combined company |

700 |

1,200 |

*The aggregate merger consideration payable to the holders of Momentus equity interests (including convertible securities) will be paid in shares of newly issued Combined Company Class A common stock (or securities exercisable for Combined Company Class A common stock) having a value equal to $566,600,000, minus Momentus’ indebtedness for borrowed money as of the closing of the Mergers (the “Closing”), plus the amount of Momentus’ cash and cash equivalents as of the Closing, plus the aggregate exercise price of all Momentus options and warrants outstanding as of immediately prior to the Closing. The Combined Company Class A common stock issued (or reserved for issuance upon exercise of options or warrants) in connection with the Mergers will be based on a deemed value of $10.00 per share. |

| Figure 5: Sources and uses of cash | $ mil |

% of total |

||

Existing Momentus holders * |

551 |

61% |

||

SPAC cash in trust |

173 |

19% |

||

PIPE equity |

175 |

19% |

||

Total sources |

899 |

100% |

||

|

|

|

||

|

$ mil |

% of total |

||

Existing Momentus holders * |

551 |

61% |

||

Cash to balance sheet * |

248 |

28% |

||

Stock and option repurchase from co-founders |

50 |

6% |

||

Estimated transaction fees and expenses |

49 |

5% |

||

Total uses |

899 |

100% |

*Estimated net debt on Momentus balance sheet at close of ~$15.3M, inclusive of options exercise |

Forward-looking statements

This press release contains a number of “forward-looking statements”. Forward-looking statements include statements about the planned business combination between Stable Road Acquisition Corp. (“Stable Road”) and Momentus, the timing of Momentus’ inaugural flight and forecasted financial information of Momentus. These forward-looking statements are based on Stable Road’s and Momentus’ management’s current expectations, estimates, projections and beliefs, as well as a number of assumptions concerning future events. When used in this press release, the words “begin,” “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “hopes” “seeks,” “may,” “will,” “should,” “future,” “propose” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements.

These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside Stable Road’s or Momentus’ management’s control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. These risks, uncertainties, assumptions and other important factors include, but are not limited to: (i) the inability of Stable Road and Momentus to successfully or timely consummate the proposed business combination; (ii) risks related to Momentus’ ability to fully develop, test and validate its technology in space, including its water plasma propulsion technology, which technology remains in the experimental stages; (iii) the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed business combination; (iv) the risk that the approval of the stockholders of Stable Road or Momentus is not obtained; (v) the inability of Momentus to obtain necessary licenses and approvals for its planned missions in a timely manner or at all; (vi) failure to realize the anticipated benefits of the proposed business combination; (vii) risks relating to the uncertainty of the projected financial information with respect to Momentus; (viii) risks related to the ability of customers to cancel contracts for convenience; (ix) risks related to the rollout of Momentus’ business and the timing of expected business milestones; (x) the effects of competition on Momentus’ future business; (xi) the level of product service or product or launch failures that could lead customers to use competitors’ services; (xii) developments and changes in laws and regulations, including increased regulation of the space transportation industry; (xiii) the impact of significant investigative, regulatory or legal proceedings; (xiv) the amount of redemption requests made by Stable Road’s public stockholders; (xv) the ability of Stable Road or the combined company to issue equity or equity-linked securities in connection with the proposed business combination or in the future; (xvi) changes in domestic and foreign business, market, financial, political and legal conditions; and (xvii) other risks and uncertainties indicated from time to time in the definitive proxy statement/consent solicitation statement/prospectus relating to the proposed business combination, including those under “Risk Factors” therein, and other documents filed or to be filed with the SEC by Stable Road. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made.

Forward-looking statements included in this press release speak only as of the date of this press release. Except as required by law, neither Stable Road nor Momentus undertakes any obligation to update or revise its forward-looking statements to reflect events or circumstances after the date of this release. Additional risks and uncertainties are identified and discussed in the Stable Road’s reports filed with the SEC and available at the SEC’s website at www.sec.gov.

Additional Information and Where to Find It

In connection with the proposed transaction contemplated by the merger agreement between Stable Road and Momentus (the “Proposed Transaction”), Stable Road has filed with the SEC a registration statement on Form S-4 (the “Registration Statement”) that includes a proxy statement of Stable Road, a consent solicitation statement of Momentus and prospectus of Stable Road, and each party will file other documents with the SEC regarding the Proposed Transaction. The Registration Statement has not been declared effective by the SEC. A definitive proxy statement/consent solicitation statement/prospectus and other relevant documents will be sent to the stockholders of Stable Road and Momentus, seeking any required stockholder approval, and is not intended to provide the basis for any investment decision or any other decision in respect of such matters. STABLE ROAD’S STOCKHOLDERS AND OTHER INTERESTED PERSONS ARE ADVISED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/CONSENT SOLICITATION STATEMENT/PROSPECTUS WHICH FORMS A PART OF THE REGISTRATION STATEMENT, AS WELL AS ANY AMENDMENTS THERETO, AND THE EFFECTIVE REGISTRATION STATEMENT AND DEFINITIVE PROXY STATEMENT/CONSENT SOLICITATION/PROSPECTUS IN CONNECTION WITH STABLE ROAD’S SOLICITATION OF PROXIES FOR STABLE ROAD’S SPECIAL MEETING OF STOCKHOLDERS TO APPROVE THE TRANSACTIONS CONTEMPLATED BY THE MERGER AGREEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. When available, the definitive proxy statement/consent solicitation statement/prospectus will be mailed to Stable Road’s stockholders as of a record date to be established for voting on the Proposed Transaction and the other matters to be voted upon at the special meeting of stockholders. Stable Road’s stockholders will also be able to obtain copies of the proxy statement/consent solicitation statement/prospectus, and all other relevant documents filed or that will be filed with the SEC in connection with the Proposed Transaction, without charge, once available, at the SEC’s website at http://www.sec.gov or by directing a request to: Stable Road Capital LLC, James Norris, CPA, Chief Financial Officer, 1345 Abbot Kinney Blvd., Venice, CA 90291; Tel: 310-956-4919; james@stableroadcapital.com.

Participants in the Solicitation

Stable Road, Momentus and certain of their respective directors, executive officers and other members of management and employees may be deemed participants in the solicitation of proxies of Stable Road’s stockholders in connection with the Proposed Transaction. STABLE ROAD’S STOCKHOLDERS AND OTHER INTERESTED PERSONS MAY OBTAIN, WITHOUT CHARGE, MORE DETAILED INFORMATION REGARDING THE DIRECTORS AND OFFICERS OF STABLE ROAD IN ITS ANNUAL REPORT ON FORM 10-K/A FOR THE FISCAL YEAR ENDED DECEMBER 31, 2020, WHICH WAS FILED WITH THE SEC ON JUNE 10, 2021. INFORMATION REGARDING THE PERSONS WHO MAY, UNDER SEC RULES, BE DEEMED PARTICIPANTS IN THE SOLICITATION OF PROXIES TO STABLE ROAD’S STOCKHOLDERS IN CONNECTION WITH THE PROPOSED TRANSACTION AND OTHER MATTERS TO BE VOTED AT THE PROPOSED TRANSACTION SPECIAL MEETING WILL BE SET FORTH IN THE REGISTRATION STATEMENT FOR THE PROPOSED TRANSACTION WHEN AVAILABLE. Additional information regarding the interests of participants in the solicitation of proxies in connection with the Proposed Transaction is included in the Registration Statement that Stable Road has filed with the SEC.

No Offer or Solicitation

This press release is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote in any jurisdiction pursuant to the Proposed Transaction or otherwise, nor shall there be any sale, issuance or transfer or securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.