TROY, Mich.--(BUSINESS WIRE)--The pandemic-driven consumer shift to digital channels should have created the perfect environment for direct banks to excel, but overall customer satisfaction with branchless banking has declined significantly this year. According to the J.D. Power 2021 U.S. Direct Banking Satisfaction Study,SM released today, top-line declines in customer satisfaction are driven primarily by historically low interest rates and a tough economic environment, but several key performance metrics show direct banks are continuing to set the standard for digital transformation in the retail banking sector.

“Direct banks have been showing consistent improvement in customer satisfaction, significantly outperforming traditional retail banks for the past several years,” said John Cabell, director of wealth and lending intelligence at J.D. Power. “So, it may come as a surprise to see such a sharp decline in overall customer satisfaction this year—at a time when digital banking has prominently been in the spotlight. Digging deeper into the data, the primary drivers of this year-over-year decline are macroeconomic. Looking at the core functionality of direct banks—primarily the digital and mobile channel usage—they continue to set the pace for the industry, but study results also highlight areas where there is room for improvement.”

Following are some key findings of the 2021 study:

- Direct bank satisfaction declines during pandemic: The overall satisfaction for direct banks is 852 (on a 1,000-point scale), down 12 points from last year’s study. Declines are most pronounced among customers who say they are worse off financially than a year ago and those with deposit-only accounts. The top performance attribute driving the decline is competitiveness of rates on checking, savings, CD and money market accounts.

- Increased digital channel traffic exposes some weaknesses: Mobile and online utilization increases significantly, but satisfaction with those channels shows declines. Specific shortcomings include clarity of information; ease of navigation; and appearance of interface. Additionally, customers this year are less likely to say that direct bank websites provide enough information to answer all their questions.

- Pandemic pushes traditional retail bank customers to direct bank priorities: According to data from the J.D. Power 2021 Retail Banking Study,SM the percentage of traditional retail bank customers who use online and mobile channels only—with no branch use—increased to 41% from 28% in 2018, setting the stage for continued growth of direct banking.

- Proactive communication of pandemic response drives customer satisfaction: Overall satisfaction scores among customers who feel their direct bank has been completely supporting them by waiving fees during the COVID-19 pandemic, for example, is more than 200 points higher (902) than among those who say they have received no support (701).

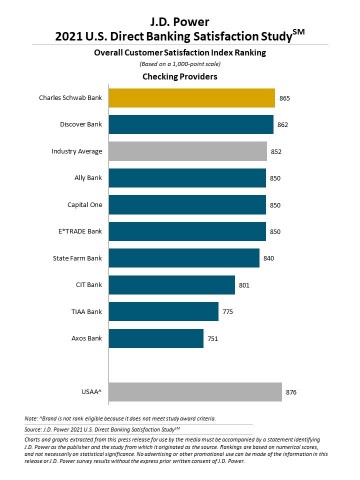

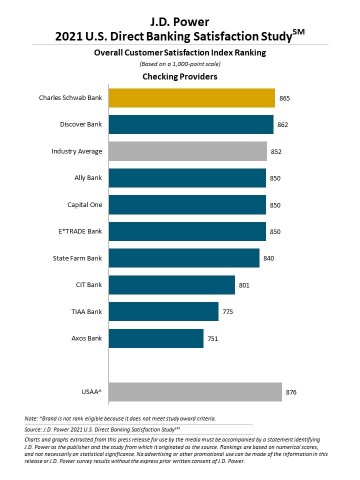

Study Ranking

Charles Schwab Bank ranks highest in overall satisfaction for a third consecutive year with a score of 865. Discover Bank (862) ranks second. The industry average is 852.

The U.S. Direct Banking Satisfaction Study, now in its fifth year, measures overall satisfaction with direct banks based on five factors (in order of importance): channel activities; communication; products and fees; new account opening; and problem resolution. The channel activities factor includes five subfactors: website; mobile; assisted online; call center; and IVR. The study is based on responses from 3,212 direct bank customers nationwide and was fielded in December 2020-January 2021.

To learn more about the U.S. Direct Banking Satisfaction Study, visit

https://www.jdpower.com/business/resource/us-direct-banking-satisfaction-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2021030.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power is headquartered in Troy, Mich., and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info