LOS ANGELES--(BUSINESS WIRE)--Sinai Capital Partners, a multi-strategy private equity company encompassing Sinai Ventures and New Slate Ventures, announced today that it has raised more than $600 million in new capital between the two funds. A tech-focused venture capital firm, Sinai Ventures has closed $500 million while media fund New Slate Ventures added $100 million. With the additional capital, the combined assets under management by the LA-based group now totals $800 million.

Sinai Ventures, a uniquely global and distributed venture capital fund based in Los Angeles with presence throughout the world, will use the money to invest in late-stage software and technology companies across various categories. Incubated in a multibillion-dollar family office, Sinai Ventures currently has more than 85 portfolio companies including Pinterest, Carta, Roman Health, Compass, Unqork, and Hippo Insurance.

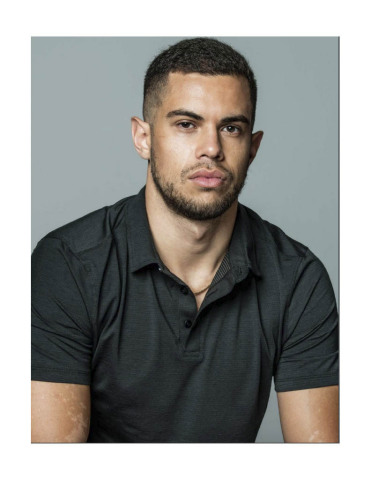

“Much like the entrepreneurs we back, Sinai believes the adoption of technology presents a global opportunity to change lives for the better,” said Managing Partner Jordan Fudge. “To that end, we are mission-driven to discover teams building impactful companies across the world.”

Partner Zach White adds, “We have long been dedicated to the thesis that the power of technology is the key to creating a more prosperous future. Sinai is singularly dedicated to supporting founders with large ideas that are looking to make meaningful changes in the communities we live, work, and invest in.”

Moving forward, Sinai Ventures will look to invest across all stages, with a targeted focus on growth-stage and pre-IPO companies. At $500 million, Sinai Ventures III, L.P. is the single largest Venture Fund in Los Angeles history.

New Slate Ventures finances and produces films, documentaries, and television programs with stories that are intersectional, inclusive, and culturally impactful. The Fund aims to expand its slate of original IPs and grow its business by capitalizing on stories with authentic connections to drive its audiences to action.

Led by partners Jordan Fudge, Jeremy Allen and Zach White, New Slate Ventures 2020 slate includes the Lena Waithe produced title THE 40-YEAR-OLD VERSION, directed, written by, and starring Radha Blank which was acquired out of Sundance and released by Netflix; THE UNITED STATES VS. BILLIE HOLIDAY, directed and co-written by Oscar-nominated filmmaker Lee Daniels and starring Grammy-nominated singer Andra Day, Trevante Rhodes, and Garrett Hedlund, acquired by Paramount through the Cannes virtual market; UNTITLED MAGIC JOHNSON, a documentary focused on the life and careers of NBA legend and entrepreneur Earvin Magic Johnson; and THE 24TH, directed and written by Oscar- winner Kevin Willmott and starring Trai Byers which was an official selection at SXSW and premiered in August through Vertical Entertainment. In development is an Untitled Michael Milken Limited Series to be written by Academy-Award Nominated writer Terrence Winter (The Wolf of Wall Street, The Sopranos).

About Sinai Capital Partners

Sinai Capital Partners (SCP) is an investment firm that manages a diverse portfolio of private equity strategies that span media, entertainment, and technology. Based in Los Angeles, SCP has more than $800 million in assets under management.

About Sinai Ventures

Sinai Ventures is the Los Angeles-based venture arm of SCP. The firm invests in growth to late-stage software, internet, and technology-enabled companies.

About New Slate Ventures

New Slate Ventures is a media-focused subsidiary fund of SCP. The group finances and produces films, documentaries, and television programs with stories that are intersectional, inclusive, and culturally impactful.