TROY, Mich.--(BUSINESS WIRE)--The perennial dominance of the agent channel in the insurance industry continues to face strong headwinds due to increased competition and evolving consumer expectations that have been highlighted by the COVID-19 pandemic. According to the J.D. Power 2020 U.S. Independent Agent Performance and Satisfaction Study,SM released today, misalignment and poor execution continue to place agent-based carriers on their heels in their ongoing battle with direct-to-consumer insurers as the channel of choice among modern property and casualty insurance consumers.

The study, now in its third year, was developed in alliance with the Independent Insurance Agents & Brokers of America (IIABA). It evaluates the evolving role of independent agents in P&C insurance distribution, general business outlook, management strategy and overall satisfaction with personal lines and commercial lines insurers in the United States.

“The effects of COVID-19 have highlighted the importance of personalized insurance as consumers seek help navigating their way through this period,” said Tom Super, head of property & casualty insurance intelligence at J.D. Power. “Ironically, in many instances it was direct-based carriers, which have made a concerted effort in recent years to emulate the high-touch and high-quality agent experience, that were able to step up and deliver during this crisis. The independent agent channel should use this as a learning experience and redouble efforts toward improved alignment, execution and efficiency to drive more beneficial customer outcomes.”

Following are key findings of the 2020 study:

- Effects of pandemic put spotlight on independent agent challenges: More than one-third (36%) of agents say they were unaware of their carriers’ efforts during the pandemic. Agents, too, have been falling short in leveraging their strategic advantage during the pandemic. Only 42% of independent agent customers say they were contacted to help manage their policy costs during the crisis vs. 52% of direct customers who say the same.

- Progressive wields influence on independent agent growth: While independent agents write 58% of all P&C policies, their market share is falling, particularly in personal lines auto, in which independent agents write just 31% of all policies. Notably, Progressive’s agency channel accounts for 52% of all personal lines’ growth among independent agents, solidifying its growth across both direct and agent channels.

- Digital support could improve agent satisfaction: Digital channels are independent agents’ preferred means of communication with insurers, with email and online dashboards leading the way. Specific digital tools that drive agent satisfaction focus on sales and product training and identification of cross-sell opportunities. Though these digital offerings are associated with high levels of agent satisfaction, they are used by fewer than 60% of agents.

- “Help me help you”: Satisfaction among independent agents is highest among carriers with diversified product offerings, such as enabling agents to offer flexible design and onboarding or enabling them to offer product bundling. Fewer than half (43%) of independent agents indicate receiving this level of support from insurers.

- Cost efficiency not linked to agent satisfaction: The notion that simply paying agents a higher commission translates to higher agent satisfaction and improved business outcomes is not true. Many of the top-performing agent-based insurers have been able to maintain expense discipline while also delivering on agent expectations.

- Independent agents focused on alignment with carriers: Among independent agents, overall satisfaction with carriers that demonstrate better market alignment, as evidenced by providing adequate support for targeted industries, is 126 points higher (on a 1,000-point scale) than with those carriers that do not provide adequate support to targeted industries.

- Traditional agents face competition from virtual agents: More than three-fourths (81%) of consumers say they would be open to working with virtual insurance agents to perform core insurance activities. This indicates that traditional agency distribution is increasingly threatened by technological innovation that is helping to close the gap on expertise by leveraging data and machine learning.

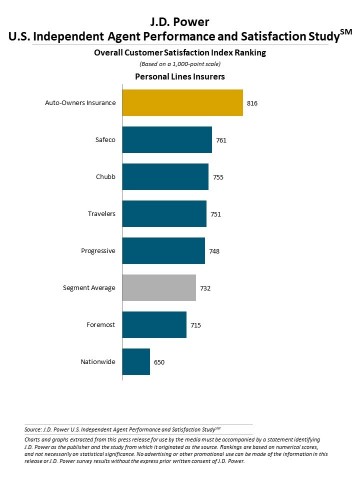

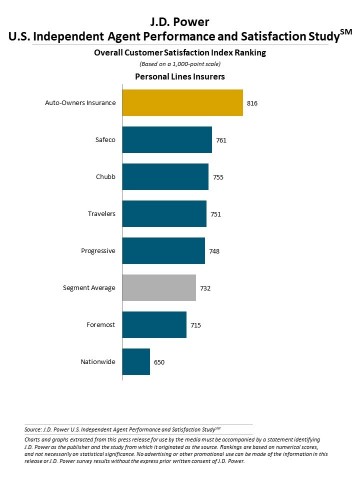

Study Ranking

Auto-Owners Insurance ranks highest among personal lines with an overall satisfaction score of 816. Safeco (761) ranks second and Chubb (755) ranks third.

The 2020 U.S. Independent Agent Performance and Satisfaction Study surveyed P&C insurance independent agents and gathered 1,817 evaluations of personal lines insurers with which agents had placed policies during the prior 12 months. The study was fielded in two waves: September through November 2019 and July through September 2020.

For more information about the U.S. Independent Insurance Agent Performance and Satisfaction Study, visit https://www.jdpower.com/business/resource/us-independent-agent-performance-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2020005.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power is headquartered in Troy, Mich., and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info