BOSTON--(BUSINESS WIRE)--How are Americans feeling six months into the COVID-19 pandemic? According to Fidelity Investments®’ Moving Forward study, anxiety has been on the rise since social distancing first began and the market was sent into a tailspin in March—and that anxiety is expected to continue into the new year. Looking ahead to 2021, nearly 70% do not see stress relief happening—and perhaps as a result, 58% say they are financially preparing differently for the new year. Despite an unprecedented level of uncertainty, the study also reveals that in dealing with the crisis, Americans are expressing confidence in their abilities to take on the challenges ahead.

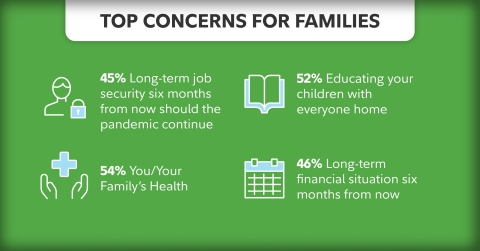

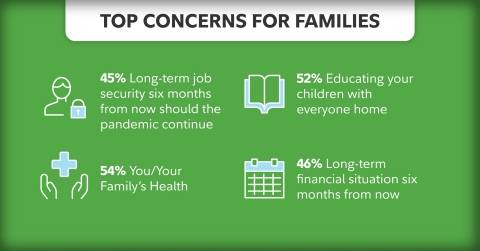

The Fidelity study, which examines how Americans are handling major life events during the pandemic and subsequent economic downturn, found that living in a pandemic environment for nearly half a year has increased individual stress levels. Day-to-day concerns that rose to the top:

“The events of the past six months are unlike any other, and they are especially stressful since our way of living and working continues to evolve,” said Stacey Watson, senior vice president with oversight for Life Event Planning at Fidelity Investments. “Even with these challenges, it’s encouraging that many families have discovered this experience has brought them closer together, taught them not to take anything for granted, and above all, made them realize they possess strength and resiliency they never knew they had.”

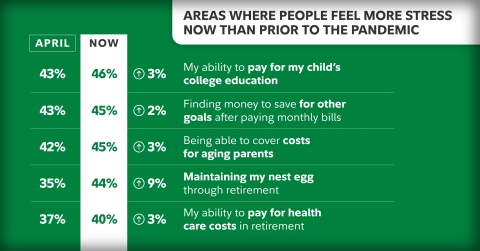

Compounding the stress of day-to-day life during these tumultuous months has been a steady stream of life-changing events. More than two-thirds of respondents report experiencing some sort of major life event—most commonly, job loss (24%), the loss of a loved one (18%), caregiving responsibilities (14%) or making a major purchase (13%). The study also found a number of key financial stressors during the pandemic have actually increased since April 20201, even though the market was far more volatile at that time:

Many Americans Are Digging Deep to Find Silver Linings Despite the Uncertainty

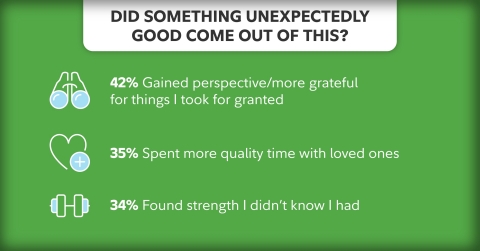

Even in troubling times, there are some encouraging findings. A large majority (80%) of respondents feel the pandemic has taught them they can handle more than they realized. In addition, 77% say the experience has put life’s challenges into a different perspective; two-thirds indicate the experience has renewed and strengthened connections with friends and family. And, when thinking about challenging events, many discovered something unexpectedly good came out of the experience.

People are taking action, too. Fidelity reports it has experienced a dramatic increase in planning interactions during the second quarter 2020, up 24% from the same period in 2019. “The fact that more people are interested in having deeper planning discussions about their finances during this period is encouraging,” noted Watson. “As the research shows, having a detailed plan in place can provide greater peace of mind and better ensure people are taking the necessary steps to safeguard their financial security for the long run.”

For those looking for online assistance, Fidelity’s newly-introduced Life Events offering is designed to help people plan for, anticipate and react to major moments that happen in their lives.

Three Life Hacks to Help Handle the Unexpected

Fidelity’s research uncovered best practices for handling mounting pressure:

- To prepare for the future, spend some time learning from the past. Those who learned a new skill, found strength they didn’t know they had or built resilience as a result of the pandemic are more likely to be planning differently for 2021 (64% vs. 54% who didn’t).

- Take an active approach to problem solving, bit by bit. Forty-two percent (42%) of respondents say they tackle obstacles by breaking challenges down into pieces and solving them one at a time, while 32% wait until they have an action plan fully developed before facing the challenge. The delay can be costly: people who did so also worry more, suffer from greater stress and were less likely to have learned anything from the experience.

- Don’t be afraid to get by with a little help from others, in good times or bad. This isn’t easy, as many survey respondents indicated they receive the greatest support during joyous rather than challenging events. However, that may be because people tend to make others aware of the positive moments in life, while holding back on sharing the negative.

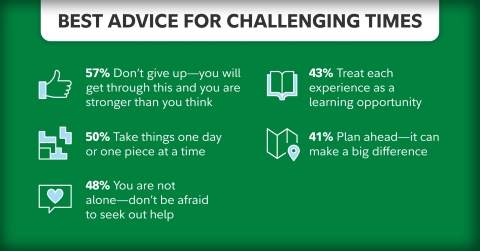

The importance of reaching out for help, however, came through loud and clear when people were asked for advice to make life easier for others experiencing similar challenges. Top tips include:

“Our research shows all major life events come with challenges, but when looking back on negative experiences, 89% of respondents were at least able to find something positive associated with it,” added Watson. “The events of the past six months are unlike any other, so silver linings may be difficult to see. However, to move from confused to confident, the research speaks to the importance of seeking out help—because some days, all of us need assistance moving forward.”

Fidelity Offers Guidance, Resources on How to Make Moving Forward Less Stressful

For those looking for help, Fidelity has resources, tools and the guidance to help sort through things where and when you need it, regardless of life stage and investing experience—whether it’s a roadmap from end to end, the ability to dive into a topic to get trusted insights and suggested next steps or a chance to look ahead and learn what to expect. They include:

- Fidelity’s Life Events offering, an online experience designed to help people plan for, anticipate and react to major moments that happen in their lives—where and when they need it. This includes guidance on the top life events that two-thirds of respondents say they experienced during this pandemic, including job loss, losing a loved one, caring for loved ones, making a major purchase or buying/selling a home.

- For people looking for general guidance during uncertain times, Fidelity has a Resource Center to help people make appropriate decisions during this challenging time, to share insights, answers to top questions, and common online services.

- Fidelity hosts a weekly Women Talk Money live discussion series on Wednesdays at noon ET. Topics covered range from tips for planning at different ages, to addressing specific life events, to working with an advisor. Viewers are encouraged to ask questions.

- In-person guidance at Fidelity’s 197 nationwide investor centers or by calling 800-FIDELITY.

About the Fidelity Investments Moving Forward Study

This study presents findings from a nationwide survey of 1,000 U.S. adults ages 18+ who have ever experienced a listed life event. This survey was fielded in August 2020 by Engine Insights, an independent research firm not affiliated with Fidelity Investments. The results of this survey may not be representative of all adults meeting the same criteria as those surveyed for this study. For additional findings from the study, a Fact Sheet and Infographic can be found on Fidelity.com.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $9.0 trillion, including discretionary assets of $3.5 trillion as of August 31, 2020, we focus on meeting the unique needs of a diverse set of customers: helping more than 32 million people invest their own life savings, 22,000 businesses manage employee benefit programs, as well as providing more than 13,500 institutions with investment and technology solutions to invest their own clients’ money. Privately held for more than 70 years, Fidelity employs more than 45,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit www.fidelity.com/about-fidelity/our-company.

Fidelity Investments and Fidelity are registered service marks of FMR LLC.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC

200 Seaport Boulevard, Boston, MA 0211

948092.1.0

© 2020 FMR LLC. All rights reserved.

1 SOURCE: Current stats compared against Fidelity’s Market Sentiment study, April 2020