ST. LOUIS--(BUSINESS WIRE)--Advantage Capital surveyed 183 small business portfolio companies on their economic, social and community impact during the first half of 2020. Even with the economic challenges related to the global pandemic, these small businesses supported more than 13,000 jobs across 17 industries, and anticipate hiring another 2,365 before July 2021. Mid-year 2020 job retention findings mirror mid-year 2019, with companies preserving 47 jobs each, on average.

“Given the sobering realities of the global health crisis and resulting economic turmoil, this is one of the most important surveys we’ve ever run,” said Sandra M. Moore, chief impact officer at Advantage Capital. “We invest in tough times and tough places – where loss of a paycheck even over short periods can have a significant impact on households and entire communities. Survey findings show that, with support, our portfolio companies are keeping people on payrolls and reducing job churn that can set both employee savings and income and career potential back.”

Twice a year, Advantage Capital portfolio companies complete a survey to help the firm better understand the community impact of its portfolio companies, and in turn, the investment programs that help to power business growth. The mid-year 2020 survey also included questions to identify the effect of COVID-19 on businesses and workers’ financial health.

While not all companies responded to the COVID-19 questions, out of 170 responses, 14% indicated that COVID-19 had no impact on their business (staff, revenues or operations), compared to 22% who were impacted at the most severe level. Though staffing was not completely immune to economic conditions, layoffs during the first six months of 2020 represent just 7% of the workforce. The companies who reported furloughs and layoffs expect to rehire 60% of the impacted employees within six months.

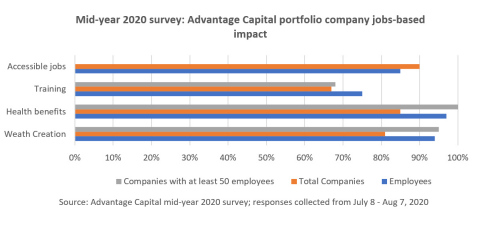

With payroll numbers holding relatively steady, mid-year survey findings also illuminate portfolio companies’ investment in programs that have the potential to positively impact households and communities.

Averaging just over $56,000 a year, wages are 5% higher than the national average (U.S. Bureau of Labor Statistics), and more than nine out of every 10 employees have access to a 401(k) or similar wealth creation program. Eighty-five percent of employees hold jobs that are accessible with a high school degree or equivalent. Further, more than three-fourths receive training, boosting skills needed to advance.

Survey findings also illustrate the impact of a new job on state public assistance programs. Nine percent of companies responding to the survey indicated that company-provided benefits or wages allowed new employees (hired within the past six months) to replace one or more of the three public assistance programs we track: Medicaid, food stamps and unemployment benefits.

“We invest in small businesses because that growth, and corresponding job creation and retention, strengthens local economies, communities and households,” said Moore. “Through our investment approach, bringing capital to fuel business growth and quality jobs in underserved communities, we have spent decades tackling many of the issues that the current economic crisis has laid bare.”

About Advantage Capital

Advantage Capital provides financing to established and emerging companies located in communities underserved by conventional sources of capital. Since 1992, the firm has invested more than $3.4 billion in companies from a diverse array of industry sectors and has helped support more than 50,000 jobs. Learn more at www.advantagecap.com, or via Twitter or LinkedIn.

Advantage Capital is an investment adviser registered under the Investment Advisers Act of 1940. Registration does not imply a certain level of skill or training. The information in this release is not intended to be an advertisement concerning investment advisory services or an offer to buy or sell securities of any type. Advantage Capital is an equal opportunity lender.