SANTA MONICA, Calif.--(BUSINESS WIRE)--Institutional assets tracked by Wilshire Trust Universe Comparison Service® (Wilshire TUCS®) posted an all-plan median return of 11.07 percent for second quarter and 3.36 percent for the year ending June 30, 2020. Wilshire TUCS, a cooperative effort between Wilshire Analytics, the investment technology foundation of Wilshire Associates Incorporated (Wilshire®), and custodial organizations, is widely considered the definitive benchmark for U.S. institutional plan assets performance and allocation.

“While most asset classes delivered positive returns during the second quarter, sizable allocations to U.S. equities was the primary driver of returns,” said Jason Schwarz, Chief Operating Offer, Wilshire Associates. “Large plans underperformed small plans, likely due to their larger allocation to alternative investments, which should be expected to participate to a lesser degree in rapidly rising equity markets,” Schwarz added.

A recovery from the COVID-19 downturn first quarter 2020 made second quarter the best for TUCS plans since the first quarter of 1987.

U.S. equities, represented by the Wilshire 5000 Total Market Index℠, rose 21.94 percent second quarter and 6.78 percent for the year; meanwhile, international equities, represented by the MSCI AC World ex U.S., rose 16.12 percent second quarter and fell -4.80 percent for the year. U.S. bonds, represented by the Wilshire Bond Index℠, gained 4.54 percent second quarter, fueling a 7.63 percent gain for the one-year median.

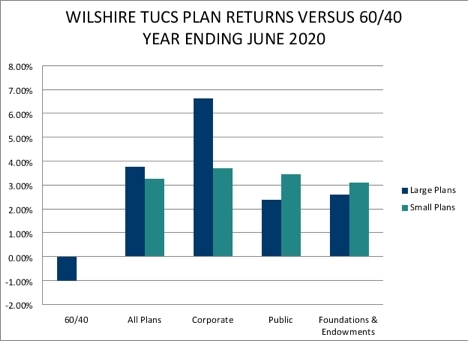

Across all plan types, quarterly median gains ranged from 7.90 to 12.43 percent for very large public funds (assets above $5 billion) and foundations and endowments, respectively. One-year median returns ranged from 2.37 to 6.63 percent for large public funds (assets above $1 billion) and large corporate funds (assets above $1 billion), respectively.

For the quarter, large and small plan types underperformed the 12.52 percent gain for the 60/40 portfolio. Small plans outperformed large across all plan types second quarter, and most plan types for the one-year median due to greater U.S. equity exposure. Allocation trends continue to show significant exposure for large foundations and endowments to alternatives, with a median second quarter allocation of 54.12 percent.

For the one-year, all plan types outperformed the 60/40 portfolio -1.01 percent loss due to greater U.S. equity exposure.

Large plans (assets above $1 billion) overall posted 8.85 and 3.78 percent median gains for the quarter and year ending June 30, respectively; meanwhile small plans (assets less than $1 billion) outperformed large for the quarter but not the year with 12.04 and 3.27 percent gains, respectively.

Data and charts in this article are copyrighted and owned by Wilshire Associates Incorporated.

About Wilshire Associates

Wilshire Associates is a leading global financial services firm, dedicated to improving outcomes for investors worldwide. An independent firm since its founding in 1972, Wilshire advises on over $1 trillion in assets and manages $68 billion in assets. Specializing in innovative investment solutions, consulting services and multi-asset analytics, Wilshire serves more than 500 institutional and intermediary clients worldwide from 10 offices around the globe. Please visit www.wilshire.com or follow us on Twitter: @WilshireAssoc