NEW YORK--(BUSINESS WIRE)--FaceBank Group, Inc. (d/b/a fuboTV) (OTCQB: FUBO) today will file an amended Form 8K to include pro forma financials for the first quarter ended March 31, 2020, relating to its recent merger with fuboTV, Inc., which was completed on April 1, 2020. In the filing, the company will announce unaudited financial results from the acquired fuboTV on a standalone basis for the first quarter ended March 31, 2020.

Highlights will include:

-

Revenues for the first quarter 2020 were $51 million, a 78% increase compared to the first quarter of the prior year, driven by growth in subscribers, subscription Average Revenue Per User (ARPU) and advertising sales.

- Subscription revenue in the first quarter increased 74% year over year to $46.4 million.

- Advertising revenue in the first quarter increased 120% year over year to $4.1 million.

- Total streaming hours by fuboTV users (paid and free trial) in the first quarter increased 120% year over year to 107.2 million hours.

- Monthly active users (MAUs) watched 120 hours per month on average in the quarter, an increase of 52% year over year.

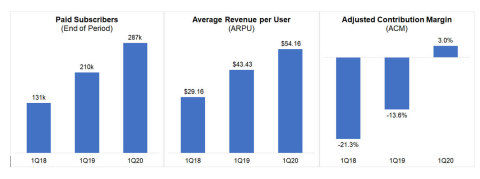

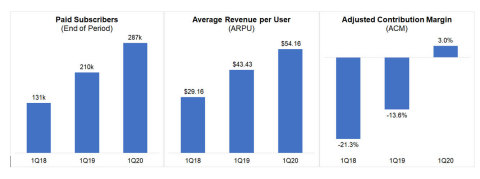

- Paid subscribers at quarter end totaled 287,316, an increase of 37% year over year.

- Average Revenue Per User (ARPU) per month was $54.16, an increase of 25% year over year.

- The company strengthened its balance sheet with an additional $46 million in equity funding from institutional and private investors since closing the merger. Specifically, on July 2, 2020, the company received $20 million from Credit Suisse Capital through a common stock issuance at $9.25 per share.

Note: fuboTV states its key metrics on a year-over-year basis given the seasonality of sports content.

In a letter released to shareholders today, fuboTV CEO David Gandler described in greater detail the results of the recently completed first quarter and the current state of the business. The complete shareholder letter is below.

fuboTV CEO David Gandler’s Letter to Shareholders

July 8, 2020

Fellow Shareholders,

I’m pleased to share our Q1 2020 fuboTV standalone unaudited financial results and recent business updates with you today. As highlighted in our 2019 Shareholder Letter released in May 2020, we completed the merger of fuboTV and FaceBank Group, Inc. in April 2020. The combined entity, FaceBank Group, Inc. (d/b/a fuboTV) currently trades on the OTC market under the symbol “FUBO.” Most recently, Shareholders approved the proposed amendment to change the name of the company from FaceBank Group, Inc. to fuboTV Inc. We continue to actively progress in discussions for listing on a major stock exchange in the coming months.

We encourage you to read our full set of financial statements and SEC filings, and to sign up for email alerts, on the recently launched investor relations section of our website at ir.fubo.tv.

In 2020, we continued to strengthen our balance sheet by adding $46 million in equity funding from institutional and private investors, including Credit Suisse Capital, LLC.

We believe fuboTV is at the forefront of the streaming revolution and has a significant advantage not only over peers in the vMVPD space but also over traditional cable television. We offer cord-cutters a total cable TV replacement with top Nielsen-ranked sports, news and entertainment channels. What sets fuboTV apart is our internally built tech stack that keeps us innovating ahead of the industry. With premium features like 4K streaming, personalized live TV recommendations and recent app updates that integrate live video into the product experience, we believe a fuboTV subscription offers consumers the best value of any other live TV streaming platform. We believe consumers will continue to choose streaming over traditional pay television because of this more personalized, premium viewing experience that is also less expensive.

fuboTV had an extremely productive Q1, despite a complete shutdown of sports, and we have made several significant recent announcements that highlight the competitive strength of our company and further differentiate us in the marketplace. While we expect that the COVID-19 pandemic will have lasting effects on consumer behavior and live television viewing, vMVPDs are also a more affordable alternative to pay TV, which, we believe, in this current economic climate, further accelerates adoption. We believe we are well positioned as a leader in the industry.

According to a June 2020 Nielsen Report, even as states eased shelter-in-place orders and businesses reopened, connected TV usage remained well above pre-COVID-19 levels, while traditional TV usage normalized. Households using pure-play virtual multichannel video programming distributors (“vMVPDs”) also increased 70% year over year during the three months ending April 2020, according to Comscore OTT Intelligence. fuboTV usage also increased: during the second quarter viewing hours peaked at 8.5 hours/day or 145 hours/month while consumers were sheltering at home. With the increasing likelihood of sports resuming with empty stadiums and limited in-person viewership, we believe fans will turn to streaming solutions.

Looking ahead, we continue to focus on growing our advertising revenue stream as we attract national advertisers across a number of verticals. Additionally, since the closing of the merger, we have focused on optimizing the operations at FaceBank Group. We expect to drive revenue growth, continue to diversify our revenue mix, make progress on our path to profitability, and that our losses will decrease as a percentage of revenue.

Key Q1 2020 Financial and Operating Highlights

Our key metrics should be considered on a year-over-year basis given the seasonality of sports content. Sports content has historically contributed to higher subscription revenue and subscriber additions in the third and fourth quarters, and slower growth in the first and second quarters. For example, in 2018 and 2019, our third and fourth quarters combined represented 60% and 65% of our total gross paid subscriber additions, respectively. To take advantage of the higher levels of purchase intent in the second half of the year, we have historically incurred the majority of our sales and marketing expenses to these periods.

- Q1 2020 revenue increased 78% YoY to $51.0 million, driven by growth in our subscriber base, subscription ARPU and advertising sales.

-

fuboTV’s revenue is primarily driven by monthly subscription and advertising sales:

- In Q1 2020 subscription revenue increased 74% YoY to $46.4 million.

- The advertising component to our revenues continued to rapidly grow and in Q1 2020 reached $4.1 million, up 120% YoY.

- Adjusted Contribution Margin was positive reaching 3.0% in Q1 2020, up from negative (13.6)% in 1Q 2019

- fuboTV users (paid and trial/free) streamed 107.2 million hours in Q1 2020, a 124% increase YoY.

- fuboTV’s monthly active users (MAUs) watched 120 hours per month on average in the quarter, a 52% increase YoY.

- We ended Q1 2020 with 287,316 paid subscribers, up 37% YoY.

- Average Revenue Per User (ARPU) increased 25% YoY to $54.16.

- We strengthened our balance sheet by adding $46 million in equity funding from institutional and private investors to date in 2020. Specifically, on July 2, 2020, we received over $20 million from Credit Suisse Capital at a purchase price of $9.25 per share.

Recent Business Highlights

- Named renowned media executive Edgar Bronfman Jr. to lead our Board of Directors as Executive Chair. One of the most recognized names in the global media industry, he is the former Chairman and CEO of Warner Music. Additionally in Q2 2020 Par-Jorgen Parson, Spotify’s earliest investor and former Board Director of 10 years, joined our Board of Directors.

- Closed a multi-year carriage agreement with Disney Media Networks for distribution of ESPN (all channels) and Walt Disney Television networks (ABC, Disney Channel, Freeform, FX, Nat Geo, etc.) in Q2 2020, which will become available in August 2020. This deal reinforces fuboTV as the undisputed leader in sports programming, which we believe also sets up a unique interactive wagering opportunity for the company.

- Grew our sports programming lineup with content from NHL Network (launched March 2020) and MLB Network (to launch in summer 2020). Broadened our news and entertainment offering with the addition of Insight TV and Law and Crime.

- Closed first-of-its-kind partnership with satellite internet provider Viasat to become first virtual MVPD to stream in-flight at 35,000 feet. Through the partnership, Viasat will make fuboTV’s sports, news and entertainment programming available to all passengers - at no charge - on U.S. flights equipped with Viasat satellite internet.

- Expanded distribution of fuboTV to Hisense TVs (with VIDAA operating system) and through broadband partners Google Fiber and WOW!.

- In Spain, we closed a carriage agreement with Viacom to bring MTV, Comedy Central, Nickelodeon and other channels to our local streaming service.

Looking ahead, we are focused on driving both top-line growth while making progress on our path to profitability. Our financial model is driven by strong unit economics, and margin improvement should continue over time, aided by a number of initiatives, including the growth of advertising on our platform along with strong attach rates on value-added services including cloud DVR storage and the ability to view multiple streams.

Summary

Our strong first quarter is an indication of the health of the streaming business and fuboTV’s continued growth. While the pandemic continues to be an ongoing concern globally, shelter in place requirements have accelerated the adoption of streaming globally. We believe streaming has become more important than ever as a safe source of information and entertainment. As live sports begin to return, most without spectators, streaming hours are expected to continue to grow. We’ve already seen many of the international soccer leagues return and this month is expected to include the return of MLB, NBA and NHL. We are especially excited about the expected start of the NFL and college football seasons in August; with our upcoming launch of ESPN and Walt Disney Television (ABC), alongside our current channel lineup, fuboTV will have the most complete NFL game coverage of any vMVPD and major college football leagues for the first time.

We could not be more excited about fuboTV’s future and believe that our company is stronger than ever. We look forward to sharing more information with you, and will be attending a number of virtual investor conferences and fireside chats in the coming months.

Sincerely,

David Gandler, co-founder and CEO

More Information

Additional information is available at www.sec.gov under FaceBank Group, Inc.’s filings, as well as https://ir.fubo.tv and https://ir.facebankgroup.com/.

fuboTV intends to use its website as a disclosure channel and investors are encouraged to refer to it, as well as press releases and SEC filings. The company encourages reading the full set of financial statements, including pro forma financial statements for the combined company, and related disclosures for both FaceBank Group, as filed in its Form 10-Q for the quarter ended March 31, 2020, filed on July 6, 2020, and fuboTV, as filed in FaceBank’s 8-K/A, originally filed on April 7, 2020 and as amended on June 17, 2020 and as further amended today.

About fuboTV

fuboTV (OTCQB: FUBO) merged with FaceBank Group in April 2020 to create a leading digital entertainment company, combining fuboTV’s direct-to-consumer live TV streaming platform for cord-cutters with FaceBank’s technology-driven IP in sports, movies and live performances.

Named to Forbes’ Next Billion Dollar Startup list in 2019, fuboTV is the live TV streaming platform with more top Nielsen-ranked sports, news and entertainment channels for cord-cutters than any other live platform.

Continually innovating to give subscribers a premium viewing experience they can’t find with cable TV, fuboTV is regularly first-to-market with new product features and is the only virtual MVPD to stream in 4K. Other industry “firsts” for the company include entering Europe with the launch of fuboTV España in 2018. fubo Sports Network, the live, free-to-consumer TV network featuring sports stories on and off the field, launched in 2019.

Forward-Looking Statements

This letter contains forward-looking statements of FaceBank Group, Inc. (“FaceBank”) that involve substantial risks and uncertainties. All statements contained in this press release are forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. The words “could,” “will,” “plan,” “intend,” “anticipate,” “approximate,” “expect,” “potential,” or the negative of these terms or other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that FaceBank makes due to a number of important factors, including (i) risks related to the ability to realize the anticipated benefits of the merger, (ii) risks related to the combined entity’s access to capital and fundraising prospects to fund its ongoing operations and its ability to continue as a “going concern”, (iii) risks related to the combined entity’s ability to uplist to a national securities exchange, (iv) risks related to diverting management’s attention from FaceBank’s ongoing business operations to address integration and fundraising efforts, and (v) other business effects, including the effects of industry, market, economic, political or regulatory conditions, future exchange and interest rates, and changes in tax and other laws, regulations, rates and policies, including the impact of COVID-19 on the broader market. Further risks that could cause actual results to differ materially from those matters expressed in or implied by such forward-looking statements are discussed in FaceBank’s periodic filings with the Securities and Exchange Commission and we encourage you to read such risks in detail. The forward-looking statements in this press release represent FaceBank’s views as of the date of this press release. FaceBank anticipates that subsequent events and developments will cause its views to change. However, while it may elect to update these forward-looking statements at some point in the future, it specifically disclaims any obligation to do so. You should, therefore, not rely on these forward-looking statements as representing FaceBank’s views as of any date subsequent to the date of this letter

Key Metrics and Non-GAAP Measures

Paid Subscribers

Total subscribers that have completed registration with fuboTV, have activated a payment method (only reflects one paying user per plan), from which fuboTV has collected payment from in the month ending the relevant period.

Monthly Active Users (MAUs)

Monthly Active Users (MAU) refers to the total count of Paid Subscribers that have consumed content for greater than 10 seconds in the 30-days preceding the period-end indicated.

Content Hours

Content Hours is defined as the sum of total hours of content watched on the fuboTV platform for a given period.

Monthly Content Hours Watched per MAU

Content Hours per MAU refers to the total hours of content viewed by MAUs in a given month divided by the MAU count in the period.

Monthly Average Revenue per User (Monthly ARPU)

ARPU (Average Revenue Per User) is a fuboTV measure defined as total subscriber revenue collected in the period (subscriber and advertising revenues excluding other revenues) divided by the average daily paid subscribers in such period divided by the number of months in the period.

Average Cost Per User (ACPU)

Average Cost Per User (ACPU) reflects variable COGS per user defined as subscriber related expenses less minimum guarantees expensed, payment processing for deferred revenue, IAB fees for deferred revenue and other subscriber related expenses in a given period, divided by the average daily subscribers in the period, divided by the number of months in the period.

Adjusted Contribution Margin

Adjusted Contribution Margin (ACM) is a non-GAAP figure to measure the variable costs against subscriber revenue. ACM is calculated by subtracting ACPU from ARPU.

Reconciliation of Non-GAAP Financial Measures

Our non-GAAP financial measures have limitations as analytical tools and you should not consider them in isolation or as a substitute for an analysis of our results under GAAP. There are a number of limitations related to the use of these non-GAAP financial measures versus their nearest GAAP equivalents. First, these non-GAAP financial measures are not a substitute for GAAP revenue. Second, these non-GAAP financial measures may not provide information directly comparable to measures provided by other companies in our industry, as those other companies may calculate their non-GAAP financial measures differently.

The following table reconciles the most directly comparable GAAP financial measure to the non-GAAP financial measure.

|

Three Months Ended March 31, 2020 |

|

|

Adjusted Contribution Margin: |

(in thousands) |

|

|

GAAP Revenue |

$51,047 |

|

|

Subtract: |

|

|

|

Other Revenue |

$(538) |

|

|

December Subscriber Deferred Revenue (prior year) |

$(9,377) |

|

|

Add: |

|

|

|

December Subscriber Deferred Revenue (current year) |

$8,066 |

|

|

Subscriber Revenue Collected |

$49,198 |

|

|

Subtract: |

|

|

|

Subscriber Related Expenses |

$(58,000) |

|

|

Payment Processing for Subscriber Collections (current year) IAB fees for Subscriber Collections (current year) |

$(161) $(41) |

|

|

Add: |

|

|

|

Minimum Guarantees Expensed |

$9,567 |

|

|

Payment Processing for Subscriber Collections (prior year) |

$206 |

|

|

IAB fees for Subscriber Collections (prior year) |

$53 |

|

|

Other Subscriber Related Expenses |

$629 |

|

|

Adjusted Contribution Margin |

$1,452 |

|

|

Adjusted Contribution Margin as a Percentage of Subscriber Revenue Collected |

3% |

|

|