SAN FRANCISCO--(BUSINESS WIRE)--Home valuation fintech pioneer HouseCanary, today announced the continued review of states with sufficient property listing and transaction volume in the HouseCanary platform adding four states and the District of Columbia this week to the 41 states that have been reviewed since the first report. This issue of Market Pulse compares data between the week ending May 1, 2020, and the week ending March 13, 2020, including 22 listing-derived metrics, a major increase from the last report which included 4 metrics.

Nationwide new listing volume remains down compared to pre-COVID-19 data although we are beginning to see early signs of a recovery. The most recent weekly volume of new listings for single-family detached homes was down 33.7% nationwide compared to the week ending March 13, when most COVID-19 measures were implemented. Although, weekly new listing volume is 5.4% above its lowest level which occurred during the week ending April 17.

For the week ending May 1, weekly volume of listings going into contract for single-family detached homes was down 13.3% nationwide compared to the week ending March 13, when most COVID-19 measures were implemented. Notably, this volume is up 33.3% above its lowest level during the week ending April 10. Nationwide, weekly contract volume has been increasing each week since April 10.

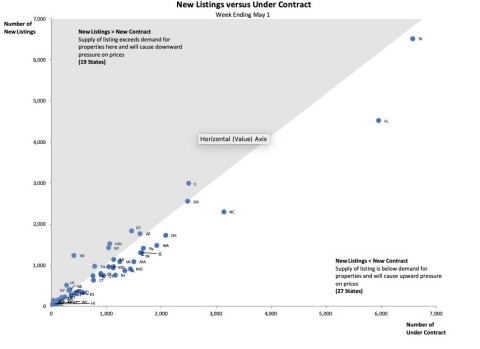

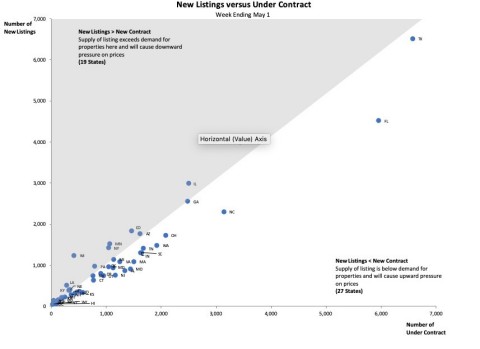

As states begin to loosen shelter in place orders, for the week of May 1, 27 of 46 states have shown more properties entering contracts than supply of new listings. In economic terms, demand (under contract) exceeds supply (new listings). It is too early to tell if this will be a sustained trend. A comparison of properties entering contract versus new listings are shown in the exhibit below.

The total nationwide available inventory of single-family detached homes is down by 6.1% compared to the week ending March 13 when most COVID-19 measures were implemented. Nationwide inventory has remained relatively constant over the past five weeks as the decline in new listing activity has been largely offset by a corresponding decline in contract activity.

For the week ending May 1, median list price per-square-foot for all single-family detached homes remains up in most states on a year-over-year basis, with the exception of New York and New Jersey, two of the hardest-hit states in the nation, where COVID-19 cases remain relatively high.

The median list price per-square-foot for all single-family detached homes is flat to slightly down since the week ending March 13 across most states. New Jersey has experienced the largest decline over this period at -4.8%.

“Although HouseCanary data continues to show an overall decrease in new listing volume compared to volumes prior to the onset of COVID-19 stay-home and shelter-in-place measures we are starting to see early signs of recovery over the past two weeks,” said Jeremy Sicklick, Co-Founder and CEO of HouseCanary. “Wide-sweeping closures of city and county offices continue to push volumes well below norms for this time of the year but it looks like market participants are finding ways to complete transactions and we are seeing some activity return.”

As a nationwide real estate broker, HouseCanary’s broad multiple listing service (MLS) participation allows us to evaluate listing data and aggregate the number of new listings as well as the number of new listings going into contract for all single-family detached homes observed in the HouseCanary database. Using this data, HouseCanary continues to track listing volume, new listings, and median list price for 46 states and 48 individual MSAs.

HouseCanary will continue to monitor these and other economic indicators for the U.S. housing market and local markets on a weekly basis and report results to the news media. HouseCanary is committed to sharing trusted, real-time information given how quickly the housing markets are evolving. For more information about the data that HouseCanary is following, please visit www.housecanary.com.

About HouseCanary:

Founded in 2013, valuation-focused real estate brokerage HouseCanary provides software and services to reshape the real estate marketplace. Financial institutions, investors, lenders, mortgage investors, and consumers turn to HouseCanary for industry-leading valuations, forecasts, and transaction-support tools. These clients trust HouseCanary to fuel acquisition, underwriting, portfolio management, and more. Learn more at www.housecanary.com.