TROY, Mich--(BUSINESS WIRE)--Even before the COVID-19 pandemic thrust digital banking into the global spotlight, branchless—or direct—banks were already taking deposit market share from traditional retail banks, particularly among younger customers. According to the J.D. Power 2020 U.S. Direct Banking Satisfaction Study,SM released today, direct banks continue to significantly outperform traditional retail banks in overall customer satisfaction—but challenges persist when it comes to call center interactions.

“While direct banks are delivering high customer satisfaction,” said Bob Neuhaus, vice president of financial services intelligence at J.D. Power, “they have challenges in key areas such as call center operations, new client onboarding and consistent digital engagement. Getting the formula right on customer service and client communications will be particularly important as direct banks contend with the fallout of the COVID-19 pandemic in terms of account servicing and a significantly lower interest rate environment.”

Following are some key findings of the 2020 study:

- Direct banks outperform traditional retail banks: The overall satisfaction for direct banks is 864 (on a 1,000-point scale). This is substantially higher than the overall satisfaction for customers who use branches at traditional branch-based retail banks, based on findings of the J.D. Power 2019 U.S. Retail Banking Satisfaction Study.SM Direct banks’ overall satisfaction also is substantially higher than the average score at the Big Six retail banks among customers who are not conducting branch transactions.1

- Direct banks gain market share from retail banks: On average, direct banks capture 47% of total deposit share of average customers, compared with 71% among traditional retail banks. However, bank customers with both traditional retail and direct banking accounts hold significantly smaller deposits in their traditional accounts than do those who only have traditional retail bank accounts.

- Call center challenges persist: One area where direct banks consistently lag traditional retail banks is in interactions with the call center. Direct bank customers access the call center at nearly twice the frequency of traditional bank customers. In fact, 40% of direct banking customers who accessed their bank’s call center say they waited five minutes or longer on hold before speaking to a live representative. On average, overall customer satisfaction scores fall 34 points when on-hold wait times exceed four minutes.

- Direct bank customers skew younger and are also less loyal: Gen Z2 customers have a significantly higher percentage of their deposit accounts with a direct bank than customers in other generational groups. Also, study data suggests that younger customers are using direct banks as their primary banking institution significantly more often than older customers. However, overall satisfaction among Gen Z customers (814) is lower than among older customers, and this segment of customers are significantly more likely to switch banks.

- Customers place high levels of trust in digital banks: Direct banks rate higher on the J.D. Power Trust Index than do other financial services providers, including mortgage originators and servicers, small business banking providers and traditional retail banks. This index measures customer perceptions across several attributes including protection of personal identity, putting customer first and absence of hidden fees. The gap in J.D. Power Trust Index ratings between direct banks and traditional retail banks is 65 points (on a 1,000-point scale).

- Direct banks that offer checking outperform direct savings banks: Direct savings banks have satisfaction scores ranging from 836 to 861—all of which are below the average for direct banks that offer checking (864).

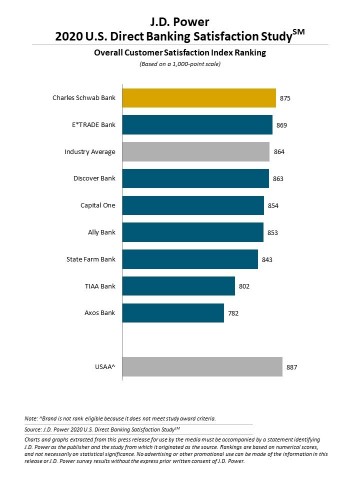

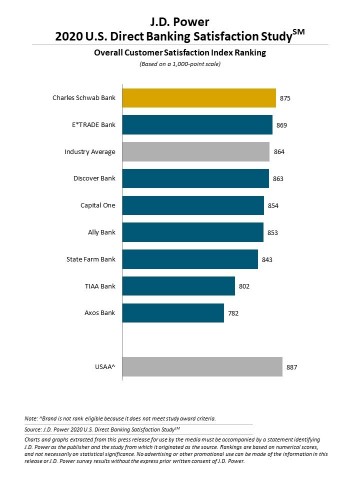

Study Rankings

Charles Schwab Bank ranks highest in overall satisfaction with a score of 875. E*TRADE Bank (869) ranks second. All other providers included in the study rank below the industry average.

The U.S. Direct Banking Satisfaction Study, now in its fourth year, measures overall satisfaction with direct banks based on five factors (in order of importance): channel activities; communication; products and fees; new account opening; and problem resolution. The channel activities factor includes five subfactors: website; mobile; assisted online; call center; and IVR. The study is based on responses from 3,147 direct bank customers nationwide and was fielded in December 2019-January 2020.

To learn more about the U.S. Direct Banking Satisfaction Study, visit https://www.jdpower.com/business/resource/us-direct-banking-satisfaction-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2020037.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, Asia Pacific and Europe.

1 The average for the Big Six retail banks is not weighted for market share.

2 J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2004). Millennials (1982-1994) are a subset of Gen Y.