BOSTON--(BUSINESS WIRE)--After a year of double-digit equity returns and strong performance for bonds, investment experts from across the Natixis organization are keeping an eye on the uncertainties around the US presidential election cycle and elevated asset prices, according to the Natixis Strategist 2020 Outlook, published today by the Natixis Investment Institute.

The report explores the findings from a survey of 24 strategists, economists, and portfolio managers representing Natixis Investment Managers, its affiliated investment managers and Natixis Corporate & Investment Banking, and provides insight into what investors might expect in 2020 and beyond.

Risk: What could possibly go wrong? Or right?

The Natixis Investment Managers Midyear Strategist Outlook cited Brexit as the most likely downside risk, but strategists have shifted their focus to growing concerns around the US presidential election. Geopolitical conflict still ranks in the top three risks, followed by the likelihood of a US, European and/or global recession. Similarly, apart from a soft or no Brexit scenario, Natixis strategists don’t expect much upside from external market catalysts either.

Mixed opinions towards US presidential election

Though survey respondents don’t expect obvious shocks to markets, projections as to who will win the election in November 2020 are evenly divided, with half expecting Donald Trump’s re-election and the other half expecting a new candidate to triumph.

“What’s most remarkable is just how clearly the survey results are split down the middle,” said Dave Lafferty, Chief Market Strategist at Natixis Investment Managers. “It seems as though every optimistic outlook is balanced out by a more pessimistic one. Even though next year’s US presidential election is on the minds of strategists, it remains a murky situation with no obvious outcome in sight.”

Asset class outlook

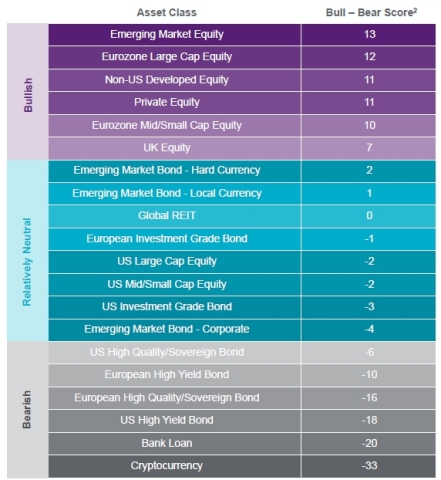

Compared to Natixis’ midyear outlook, respondents were overall more optimistic across assets in general, with bullish/bearish scores higher on 15 of 19 asset classes comparatively. That said, even the most bullish scores were only modestly above “neutral” and expectations remain muted.

With hopes for a softer Brexit, sentiment toward UK stocks improved with significant upgrades to UK and European equities. The biggest gainers across the report’s bullish/bearish ranking of 20 asset classes were by far UK Equities, Eurozone Large Equities, and Non-US Developed Equities. Emerging Markets Equity is still beloved, moving to the number one spot.

Respondents were relatively neutral on US equities. On average, respondents set a year-end 2020 target forecast for the S&P 500® at 3,074, implying little change in the coming year (-0.2%) compared to its level when the survey was in field. But opinions were perfectly split: 12 strategists call for higher returns and 12 call for lower. The highest upside projections implied a 9.9% gain, while the lowest projections implied an 11.2% loss.

The road to 2030

Looking a decade ahead, the most important investment and economic trends include policy concerns, the ability to navigate inflation, rates and central bank policy. According to respondents, another upcoming trend will be climate change and its effects on the global economy. Respondents said that there are a few potential investment opportunities correlated to a changing climate, such as the effects of technology and productivity to raise potential growth. However, strategists say trends in populism and deglobalization could undermine economic progress in the next decade.

Added Lafferty, “The aggregated view of our strategists shows the challenge many investors will face as the world enters the new decade: Economic growth that is positive but hardly above stall-speed, valuations that are elevated but not exorbitant and geopolitical events that could either boost or sap market confidence.”

To download the full report, visit im.natixis.com/us/markets/natixis-strategist-2020-outlook.

About the Natixis Strategist 2020 Outlook

The Natixis Strategist 2020 Outlook is based on responses from 24 experts, including 17 representatives from 10 of Natixis’ affiliated investment managers, 4 representatives from 4 operating groups at Natixis Investment Managers, and 3 representatives from Natixis Bank:

- Michael J. Acton, CFA®, Director of Research, AEW

- Axel Botte, Global Strategist, Ostrum Asset Management

- Michael Buckius, CFA®, Chief Investment Officer, Gateway Investment Advisers

- Elisabeth Colleran, CFA®, Portfolio Manager, Emerging Market Credit Team, Loomis Sayles

- Rafael Calvo, Managing Partner, Head of Senior Debt and Co-Head of Origination, MV Credit

- François-Xavier Chauchat, Chief Economist and member of the Investment Committee, Dorval Asset Management

- Esty Dwek, Head of Global Market Strategy, Natixis Investment Managers Solutions

- James Grabovac, CFA®, Investment Strategist, Municipal Fixed Income Team, Loomis Sayles

- Brian Horrigan, CFA®, Chief Economist, Loomis Sayles

- Jack Janasiewicz, CFA®, Senior Vice President and Portfolio Manager, Natixis Investment Managers Solutions

- Kathryn M. Kaminski, PhD, CAIA®, Chief Research Strategist, Portfolio Manager, AlphaSimplex Group

- Brian P. Kennedy, Portfolio Manager, Full Discretion Team, Loomis Sayles

- David Lafferty, CFA®, Senior Vice President and Chief Market Strategist, Natixis Investment Managers

- Joseph Lavorgna, Chief Economist for the Americas, Natixis Corporate & Investment Banking

- Maura Murphy, CFA®, Portfolio Manager, Alpha Strategies Team, Loomis Sayles

- Jens Peers, CFA®, CEO and CIO, Mirova9

- Cyril Regnat, Head of Research Solutions, Natixis Global Markets Research

- Dirk Schumacher, European Head of Macro Research, Natixis Corporate & Investment Banking

- Lynda L. Schweitzer, CFA®, Portfolio Manager, Global Fixed Income Team, Loomis Sayles

- Christopher Sharpe, Senior Vice President and Portfolio Manager, Natixis Advisors, L.P.

- Richard Skaggs, Vice President, Senior Equity Strategist, Loomis Sayles

- Hans Vrensen, CFA®, MRE, Managing Director and Head of Research & Strategy, AEW Europe

- Philippe Waechter, Chief Economist, Ostrum Asset Management

- Chris D. Wallis, CFA®, CPA, CEO, CIO, Senior Portfolio Manager, Vaughan Nelson Investment Management

CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.

About the Natixis Investment Institute

The Natixis Investment Institute applies Active Thinking® to critical issues shaping the investment landscape. A global effort, the Institute combines expertise in the areas of investor sentiment, macroeconomics, and portfolio construction within Natixis Investment Managers, along with the unique perspectives of our affiliated investment managers and experts outside the greater Natixis organization. The goal is to fuel a more substantive discussion of issues with a 360° view of markets and insightful analysis of investment trends.

About Natixis Investment Managers

Natixis Investment Managers serves financial professionals with more insightful ways to construct portfolios. Powered by the expertise of more than 20 specialized investment managers globally, we apply Active Thinking® to deliver proactive solutions that help clients pursue better outcomes in all markets. Natixis Investment Managers ranks among the world’s largest asset management firms3 with more than $1 trillion assets under management4 (€921.5 billion).

Headquartered in Paris and Boston, Natixis Investment Managers is a subsidiary of Natixis. Listed on the Paris Stock Exchange, Natixis is a subsidiary of BPCE, the second-largest banking group in France. Natixis Investment Managers’ affiliated investment management firms include AEW; Alliance Entreprendre; AlphaSimplex Group; Darius Capital Partners; DNCA Investments;5 Dorval Asset Management; Flexstone Partners; Gateway Investment Advisers; H2O Asset Management; Harris Associates; Investors Mutual Limited; Loomis, Sayles & Company; Mirova; MV Credit; Naxicap Partners; Ossiam; Ostrum Asset Management; Seeyond; Seventure Partners; Thematics Asset Management; Vauban Infrastructure Partners;6 Vaughan Nelson Investment Management; Vega Investment Managers;7 and WCM Investment Management. Investment solutions are also offered through Natixis Advisors and Natixis Investment Managers Solutions.8 Not all offerings available in all jurisdictions. For additional information, please visit Natixis Investment Managers’ website at im.natixis.com | LinkedIn: linkedin.com/company/natixis-investment-managers.

Natixis Investment Managers’ distribution and service groups include Natixis Distribution, L.P., a limited purpose broker-dealer and the distributor of various registered investment companies for which advisory services are provided by affiliated firms of Natixis Investment Managers, Natixis Investment Managers S.A. (Luxembourg), Natixis Investment Managers International and its global affiliated distribution and investment management entities.

1 Probability score is the calculated average of the likelihood on a 1-5 scale with 1 being least likely and 5 being most likely. Natixis Strategist 2020 Outlook conducted by CoreData Research, October-November, 2019.

2 Bull-Bear score is the weighted sum of bullish responses (>5) minus bearish responses (<5) for each asset class based on a 0-10 scale (0 = most bearish, 10 = most bullish) with 5 being neutral. Natixis Strategist 2020 Outlook conducted by CoreData Research, October-November 2019.

3 Cerulli Quantitative Update: Global Markets 2019 ranked Natixis Investment Managers as the 17th largest asset manager in the world based on assets under management as of December 31, 2018.

4 Net asset value as of September 30, 2019 is $1,004.5 billion. Assets under management (“AUM”), as reported, may include notional assets, assets serviced, gross assets, assets of minority-owned affiliated entities and other types of non-regulatory AUM managed or serviced by firms affiliated with Natixis Investment Managers.

5 A brand of DNCA Finance.

6 Not yet licensed – currently pending authorization process as a portfolio management company with the French Autorité des marchés financiers (the “AMF”).

7 A wholly-owned subsidiary of Natixis Wealth Management.

8 Natixis Investment Managers Solutions teams, based in several locations (Paris, London, Geneva), gather the asset allocation, portfolio construction, multi-asset portfolio management and structuring expertise of Natixis Investment Managers. Only the entity based in Paris has the portfolio management company certification.

9 Operated in the US through Mirova U.S., LLC (Mirova US). Prior to April 1, 2019, Mirova operated through Ostrum Asset Management U.S., LLC (Ostrum US).

2871393.1.1