MELVILLE, N.Y.--(BUSINESS WIRE)--Verint® Systems Inc. (Nasdaq:VRNT) today announced that it has filed a preliminary proxy statement with the Securities and Exchange Commission disclosing that Neuberger Berman, a Verint stockholder holding approximately 2.6% of the Company’s outstanding shares, has nominated three board candidates for election at Verint’s 2019 Annual Meeting of Stockholders.

In response to the nominations, Verint issued the below statement. The Company also issued a letter from its Chairman to stockholders that outlines the strong performance of the Company and its growth strategy (see letter below).

“Over the last two years, Verint’s Board has developed a new growth strategy centered on accelerating our pace of innovation in cloud and automation. This strategy has driven strong financial performance, including accelerating revenue growth with expanding margins, and the Board believes the strategy will continue to deliver significant growth. This momentum is driving strong shareholder returns with Verint’s stock price increasing approximately 56% over the last 12 months – strongly outperforming both the Russell 2000 and NASDAQ indices, which have increased 5% and 15%, respectively, over the same period. Given this momentum, the Board believes that Neuberger Berman’s nomination of directors is demonstrably unwarranted.”

“We believe our Board, which is comprised of eight highly qualified individuals with a balance of experiences and skills, is highly capable of evaluating strategic decisions and providing management oversight to ensure we maximize the Company’s potential. Verint continuously assesses the composition of the Board, and in just the last three years we have added three new directors, including one Board member who was added in 2017 at the recommendation of Neuberger Berman. We are committed to continuing to refresh our Board with qualified directors focused on driving incremental shareholder value, including with candidates proposed by our stockholders, but we are doing this as part of a long-term and orderly process to find the best candidates.”

The Board has carefully reviewed Neuberger Berman’s candidates, and determined that none of these candidates’ skills are additive to the current Board.

Verint’s preliminary proxy, which includes information relating to its interactions with Neuberger Berman, is available at http://www.sec.gov.

Jones Day is acting as legal advisor to Verint.

Letter from our Chairman

April 9, 2019

Dear Verint Stockholder:

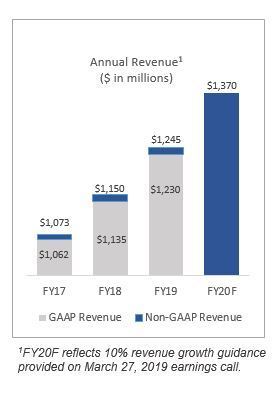

As we discussed during our earnings call in March, I am pleased with our accelerating revenue growth and expanding margins both on a GAAP and non-GAAP basis for the year ended January 31, 2019 (“FYE 19”), overachieving both our internal goals for key performance metrics and our guidance for both revenue and EPS. I am also pleased with our GAAP cash from operations of $215 million, a 22% year-over-year increase. With the momentum we experienced throughout last year and improving visibility, we recently raised our guidance for the second time for the year ending January 31, 2020 (“FYE 20”). We believe that our overachievement, as well as our improved guidance, reflect the successful execution of the growth strategy we started to implement approximately two years ago. This growth strategy -- which we have been sharing with investors in our regular quarterly earning calls -- has been focused on accelerating our pace of innovation while simultaneously creating greater operational agility across Verint.

Accelerating our Pace of Innovation

We estimate the size of our Actionable Intelligence market to be approximately $10 billion and growing at a double-digit rate. With about 2,000 R&D professionals, we believe we have one of the strongest Actionable Intelligence R&D teams in the industry. And, by leveraging that team, we have increased the pace of our innovation in automation and cloud, differentiating Verint as the vendor of choice in our market. Our Actionable Intelligence platform is backed by close to 1,000 patents and applications worldwide across data capture, unstructured data analytics, artificial intelligence, and automation. We believe the strength of our platform and the investments we have made in automation and cloud are behind our momentum and improved outlook.

Actionable Intelligence for a Smarter World

In our Customer Engagement segment, I am pleased with our continued momentum, particularly in the areas of automation and cloud. Our strategy is to leverage our Actionable Intelligence platform to help organizations, simplify, modernize, and automate their customer engagement operations. We believe the market is at an inflection point looking for new automation technology to elevate customer experience while reducing operating costs. Our broad portfolio brings automation across the enterprise, makes employees more productive, enables an emerging hybrid workforce in which humans and robots work together, and captures the voice of the customer distilling it into actionable insights.

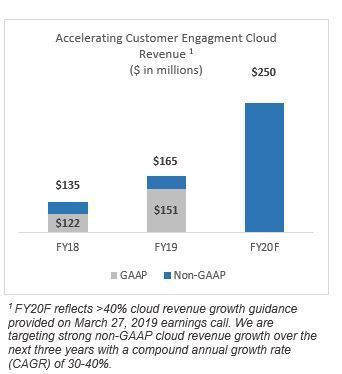

As we discussed during our recent earnings call, our cloud growth accelerated last year and, we expect non-GAAP cloud revenue in the current year to increase to nearly $250 million. Based on our cloud leadership, increased market cloud adoption, the level of growth we have recently achieved, and the potential for our installed base to migrate to the cloud, we are targeting strong non-GAAP cloud revenue growth over the next three years with a compound annual growth rate (CAGR) of 30-40%. With a broad and highly scalable customer engagement portfolio offered in the cloud, Verint is well positioned to address the needs of both large enterprise and SMB customers. Our strong customer relationships drive high renewal rates and the opportunity to land and expand with our broad portfolio. In addition to our success in the enterprise market, we see an opportunity for growth in the SMB market and have expanded our partner program with a growing set of cloud partners that sell our products to both SMB and enterprise customers. For FYE 20, as we discussed during our recent earnings call, we expect continued momentum with 10% non-GAAP revenue growth and margin expansion in our Customer Engagement segment driven by strong cloud growth.

Actionable Intelligence for a Safer World

In our Cyber Intelligence segment, I am also pleased with our continued momentum, particularly with the progress we have made in our transition to more of a software business model, driving significant margin expansion. Our strategy is to leverage our Actionable Intelligence platform to introduce advanced data mining software that can further automate and shorten the investigative processes for our customers, reducing dependency on large numbers of intelligence analysts and data scientists.

Today, we offer organizations a broad solution portfolio across three security domains: cyber intelligence, cyber security, and situational intelligence. Over the last two years, we have invested to transition our cyber intelligence segment to more of a software business model. As we discussed during our recent earnings call, we have already achieved accelerating adjusted EBITDA margin improvement over the last two years, and over the next three years, we are targeting an additional five percentage points of margin expansion. We now have more than 1,000 customers globally, including a diversified set of 400 government agencies across more than 100 countries, and 600 enterprise customers across many verticals, such as telecom service providers, financial services, retail, and critical infrastructure. For FYE20, as we discussed during our recent earnings call, we expect continued momentum with 10% non-GAAP revenue growth and margin expansion in our cyber intelligence segment driven by our on-going transition to more of a software business model.

Well Positioned for Sustained Growth and Market Leadership

As I noted above, we believe our results and overachievement reflect the successful execution of the growth strategy that we launched approximately two years ago. With this strategy we have accelerated our pace of innovation to further differentiate Verint in a market that is increasingly embracing Actionable Intelligence solutions. We are experiencing momentum driven by automation and cloud adoption and recently provided investors with additional metrics that we are using to track our progress. Looking ahead, we believe that our addressable market is growing at a double-digit rate and that we are well positioned for sustained growth and market leadership.

Enhanced Stockholder Engagement

From a corporate governance perspective, we further enhanced the stockholder engagement program that we initiated in the prior year, deepening the level of engagement we had with our stockholders on strategy, compensation, and governance related topics. We greatly value the feedback we receive from our stockholders through this process and incorporate their input. Finally, we continued to refresh the composition of our Board of Directors with another new director in 2018, our third new director in three years.

On behalf of the Board of Directors, I would like to express our appreciation for your continued support of Verint.

| Sincerely, | |

|

Dan Bodner |

|

| Chairman and Chief Executive Officer | |

SUPPLEMENTAL INFORMATION REGARDING NON-GAAP FINANCIAL MEASURES

This document contains non-GAAP financial measures and non-GAAP forward looking statements. The tables below reconcile the non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with Generally Accepted Accounting Principles (“GAAP”).

The presentation of these non-GAAP financial measures is not intended to be considered in isolation from, as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP, and may be different from non-GAAP financial measures used by other companies. In addition, non-GAAP financial measures have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP.

| Year Ended January 31, | |||||||||||||||

| (in thousands) | 2019 | 2018 | 2017 | ||||||||||||

|

Segment Revenue |

|||||||||||||||

| GAAP Revenue by Segment | |||||||||||||||

| Customer Engagement | $ | 796,287 | $ | 740,067 | $ | 705,897 | |||||||||

| Cyber Intelligence | 433,460 | 395,162 | 356,209 | ||||||||||||

| GAAP Total Revenue | $ | 1,229,747 | $ | 1,135,229 | $ | 1,062,106 | |||||||||

| Revenue Adjustments | |||||||||||||||

| Customer Engagement | $ | 15,059 | $ | 14,971 | $ | 10,266 | |||||||||

| Cyber Intelligence | 293 | 258 | 324 | ||||||||||||

| Total Revenue Adjustments | $ | 15,352 | $ | 15,229 | $ | 10,590 | |||||||||

| Non-GAAP Revenue by Segment | |||||||||||||||

| Customer Engagement | $ | 811,346 | $ | 755,038 | $ | 716,163 | |||||||||

| Cyber Intelligence | 433,753 | 395,420 | 356,533 | ||||||||||||

| Non-GAAP Total Revenue | $ | 1,245,099 | $ | 1,150,458 | $ | 1,072,696 | |||||||||

| Year Ended January 31, | |||||||||||||||

| (in thousands) | 2019 | 2018 | |||||||||||||

| Table of Reconciliation from GAAP Cloud Revenue to Non-GAAP Cloud Revenue | |||||||||||||||

|

Customer Engagement |

|||||||||||||||

| Cloud revenue - GAAP | $ | 150,743 | $ | 122,043 | |||||||||||

| Estimated revenue adjustments | 14,690 | 12,976 | |||||||||||||

| Cloud revenue - non-GAAP | $ | 165,433 | $ | 135,019 | |||||||||||

Financial Outlook for FY2020 (Year Ending January 31, 2020)

Our non-GAAP outlook for revenue and EPS for the year ending January 31, 2020 is as follows:

-

Revenue: Increasing by $25 million to $1.37 billion with a range of

+/- 2%

- Reflects 10% year-over-year growth

-

EPS: Increasing by 10 cents to $3.60 at the midpoint of our revenue

guidance

- Reflects 12% year-over-year growth

Our non-GAAP outlook for the year ending January 31, 2020 excludes the following GAAP measures which we are able to quantify with reasonable certainty:

- Amortization of intangible assets of approximately $56 million for the year ending January 31, 2020.

- Amortization of discount on convertible notes of approximately $12 million for the year ending January 31, 2020.

Our non-GAAP outlook for the year ending January 31, 2020 excludes the following GAAP measures for which we are able to provide a range of probable significance:

- Revenue adjustments are expected to be between approximately $21 million and $25 million for the year ending January 31, 2020.

- Stock-based compensation is expected to be between approximately $66 million and $70 million for the year ending January 31, 2020, assuming market prices for our common stock approximately consistent with current levels.

Our non-GAAP outlook does not include the potential impact of any in-process business acquisitions that may close after the date hereof, and, unless otherwise specified, reflects foreign currency exchange rates approximately consistent with current rates.

We are unable, without unreasonable efforts, to provide a reconciliation for other GAAP measures which are excluded from our non-GAAP outlook, including the impact of future business acquisitions or acquisition expenses, future restructuring expenses, and non-GAAP income tax adjustments due to the level of unpredictability and uncertainty associated with these items. For these same reasons, we are unable to assess the probable significance of these excluded items. While historical results may not be indicative of future results, actual amounts for the year ended January 31, 2019 and 2018 for the GAAP measures excluded from our non-GAAP outlook appear in Table 3 to our earnings press release filed on March 27, 2019.

About Verint Systems Inc.

Verint® (Nasdaq: VRNT) is a global leader in Actionable Intelligence® solutions with a focus on customer engagement optimization and cyber intelligence. Today, over 10,000 organizations in more than 180 countries—including over 85 percent of the Fortune 100—count on intelligence from Verint solutions to make more informed, effective and timely decisions. Learn more about how we’re creating A Smarter World with Actionable Intelligence® at www.verint.com.

VERINT, ACTIONABLE INTELLIGENCE, THE CUSTOMER ENGAGEMENT COMPANY, NEXT IT, FORESEE, OPINIONLAB, KIRAN ANALYTICS, TERROGENCE, SENSECY, CUSTOMER ENGAGEMENT SOLUTIONS, CYBER INTELLIGENCE SOLUTIONS, EDGEVR, RELIANT, VANTAGE, STAR-GATE, SUNTECH, and VIGIA are trademarks or registered trademarks of Verint Systems Inc. or its subsidiaries. Other trademarks mentioned are the property of their respective owners.

Important Information

In connection with its 2019 Annual Meeting, Verint Systems Inc. (“Verint”) has filed a preliminary proxy statement and other documents, and will file a definitive proxy statement, with the Securities and Exchange Commission (“SEC”). Verint will mail solicitation materials, including a WHITE proxy card, to stockholders of record entitled to vote at the 2019 Annual Meeting. STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS FILED BY VERINT WITH THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders will be able to obtain free copies of these documents through the website maintained by the SEC at http://www.sec.gov and through the website maintained by Verint at http://www.verint.com/investor-relations.

Certain Information Regarding Participants

Verint, its directors and certain of its officers and other employees will be deemed to be participants in the solicitation of Verint’s stockholders in connection with Verint’s 2019 Annual Meeting. Information regarding the names, affiliations and direct and indirect interests (by security holdings or otherwise) of these persons is set forth in the proxy statement filed with the SEC in connection with Verint’s 2019 Annual Meeting. Additional information regarding the interests of participants of Verint in the solicitation of proxies in respect of Verint’s 2019 Annual Meeting will be filed with the SEC when they become available. Stockholders will be able to obtain a free copy of the proxy statement and other documents filed by Verint with the SEC from the sources listed above.

This press release contains “forward-looking statements,” including statements regarding expectations, predictions, views, opportunities, plans, strategies, beliefs, and statements of similar effect relating to Verint Systems Inc. These forward-looking statements are not guarantees of future performance and they are based on management’s expectations that involve a number of risks, uncertainties and assumptions, any of which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. For a detailed discussion of these risk factors, see our Annual Report on Form 10-K for the fiscal year ended January 31, 2019, and other filings we make with the SEC. The forward-looking statements contained in this press release are made as of the date of this press release and, except as required by law, Verint assumes no obligation to update or revise them or to provide reasons why actual results may differ.