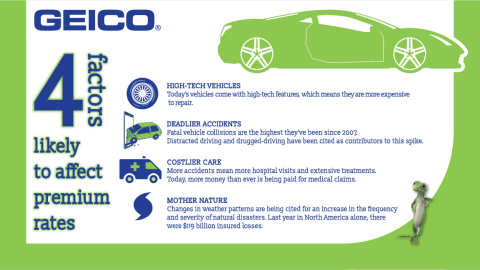

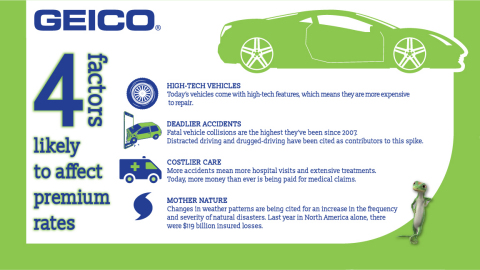

WASHINGTON--(BUSINESS WIRE)--Driving record and vehicle make are things that have always affected how much Americans pay for automobile insurance. But these days, a number of not-so-obvious factors have been cited as well.

Here are a few:

-

High-tech Cars

New vehicles come with a variety of high-tech features. While many of them are designed to make driving safer, the cost of repairing newer vehicles, should a collision occur, has nearly tripled in recent years. The rise in the cost of auto parts has also increased the number of auto thefts, according to the National Insurance Crime Bureau. -

Deadlier Collisions

Despite improvements in safety features, automobile crashes are on the rise. According to the latest figures from the Institute for Highway Safety, 37,461 Americans died in crashes in 2016. The last time auto fatalities were higher was in 2007. A number of factors have been cited for the uptick, including distracted driving and drug- and alcohol-impaired driving. -

Costly Care

More accidents mean more medical claims, and the cost of medical treatments is on the rise. Claimed economic losses–which include medical, lost wages and other out-of-pocket expenditures–rose 10 percent from 2012 to 2017, more than three-times the medical inflation rate, according to the Insurance Research Council. -

Weather Patterns

Severe weather is occurring much more frequently. Last year, for example, the Insurance Information Institute recorded 187 natural disasters around the world, resulting in $119 billion insured losses in North America alone.

GEICO has a number of discount programs aimed at providing customers with the best price possible. From special programs for the military to reduced rates for students, GEICO has a range of discounts suited for nearly every driver. Learn more about them at https://www.geico.com/save/discounts/.

About GEICO

GEICO (Government Employees Insurance Company), the second-largest auto insurer in the U.S., was founded in 1936 and insures more than 27 million vehicles.

To make changes, report claims, print insurance cards and purchase additional products, policyholders can access their insurance policy here, connect via GEICO Mobile, phone or by visiting a GEICO local agent.

Homeowners, renters, condo, flood, identity theft and term life coverages are written through non-affiliated insurance companies and are secured through the GEICO Insurance Agency, Inc. Commercial auto and personal umbrella coverages are also available.

Visit www.geico.com for a quote or to learn more.