HOUSTON--(BUSINESS WIRE)--Cadence Bancorporation (NYSE:CADE) (“Cadence”) today announced net income for the quarter ended September 30, 2018 of $47.1 million, or $0.56 per diluted common share (“per share”), compared to $32.6 million, or $0.39 per share, in the third quarter of 2017 and $48.0 million, or $0.57 per share, in the second quarter of 2018. Tangible book value per share(1) was $13.15 in the third quarter of 2018, an increase of $1.05 from $12.10 for the third quarter 2017, and an increase of $0.30 from $12.85 per share as of June 30, 2018.

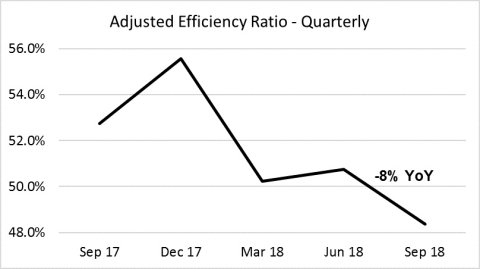

“We are very pleased to report to you another quarter of strong organic growth and improving operating performance for the third quarter of 2018,” stated Paul B. Murphy, Jr., Chairman and Chief Executive Officer of Cadence Bancorporation. “Several aspects of our performance warrant a mention: First, loans and deposits maintained meaningful growth in the quarter as we continue to expand our customer base - new clients are moving to Cadence. Our adjusted efficiency ratio(1) further improved to 48.3%, a result of 11 consecutive quarters of revenue growth and focused expense control. Our asset quality and credit metrics remain solid with net charge-offs of 9 basis points for the first nine months of the year and nonperforming assets declining 48% from the prior year. During this quarter, we also completed the last secondary offering of Cadence stock previously owned by Cadence Bancorp, LLC (the “LLC”), resulting in 100% of CADE stock now in public float. We received OCC approval for the State Bank merger and are awaiting final regulatory approval. I continue to feel great about the State Bank team and I note their operating performance is tracking in line with our expectations. The State Bank core deposit franchise and low deposit betas are a great fit, especially now. I am proud of our dedicated team of bankers and the consistent performance we have generated since becoming a public company in April 2017, most notably this quarter’s ROAA of 1.61% and ROTCE of 17.32%(1).”

Highlights:

-

Third quarter of 2018 net income was $47.1 million, representing

strong overall business performance and an increase of $14.5 million,

or 44.5%, compared to third quarter of 2017, and a decrease of $0.8

million, or 1.7% compared to the second quarter of 2018 due to second

quarter’s income being impacted favorably by non-routine items(2)

including the gain on sale of the insurance subsidiary and a discrete

tax deduction.

-

On a per-share basis, net income was $0.56 per share for the third

quarter of 2018, a 43.8% increase from $0.39 per share for the

third quarter of 2017 and down 1.8% from $0.57 per share for the

second quarter of 2018.

- Adjusted earnings per share(1) reflects the impact of non-routine items. The third quarter adjusted earnings per share of $0.58 increased $0.08 compared to the linked quarter adjusted earnings per share of $0.50 and increased $0.20 compared to the prior year’s quarter adjusted earnings per share of $0.38.

-

Annualized returns on average assets, common equity and tangible

common equity(1) for the third quarter of 2018 were

1.61%, 13.40% and 17.32%, respectively, compared to 1.29%, 9.78%

and 13.04%, respectively, for the third quarter of 2017, and

1.72%, 14.16% and 18.58%, respectively, for the second quarter of

2018.

- Adjusted annualized returns on average assets(1) and tangible common equity(1) reflect the impact of non-routine items(2). Adjusted annualized returns on average assets(1) and tangible common equity(1) for the third quarter of 2018 were 1.69% and 18.11%, respectively, compared to 1.26% and 12.77%, respectively, for the third quarter of 2017, and 1.51% and 16.40%, respectively, for the second quarter of 2018.

-

On a per-share basis, net income was $0.56 per share for the third

quarter of 2018, a 43.8% increase from $0.39 per share for the

third quarter of 2017 and down 1.8% from $0.57 per share for the

second quarter of 2018.

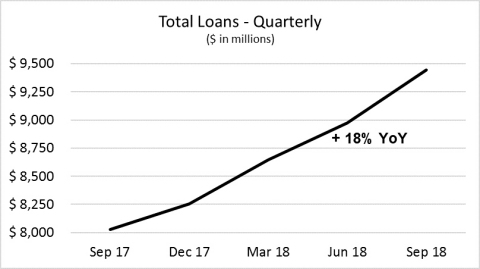

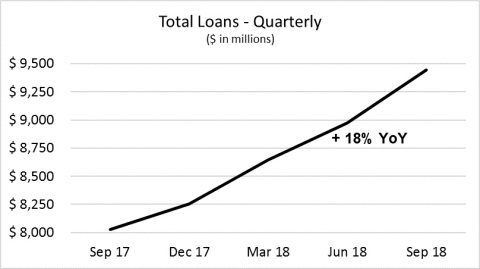

- Cadence continued to demonstrate its strong business development with loan growth ending the quarter at $9.4 billion as of September 30, 2018, an increase of $1.4 billion, or 17.6%, since September 30, 2017, and an increase of $468.1 million, or 5.2%, since June 30, 2018.

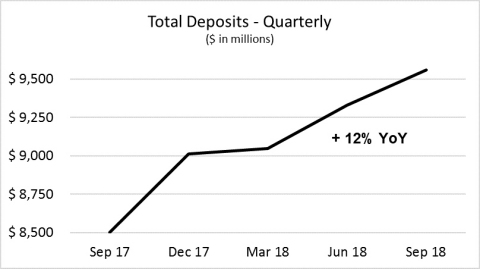

- Core deposits (total deposits excluding brokered) reflected solid growth at $8.8 billion as of September 30, 2018, up $1.2 billion, or 15.0%, from September 30, 2017, and up $252.2 million, or 2.9%, from June 30, 2018. Brokered deposits decreased $97.8 million or 11.9% from September 30, 2017 and decreased $25.0 million from June 30, 2018.

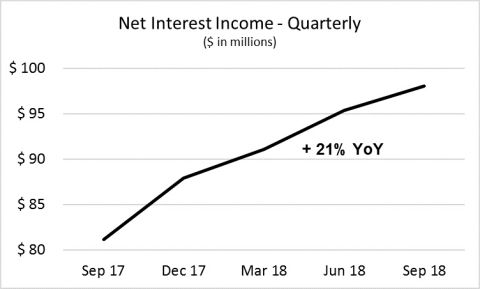

- The strong balance sheet growth and increasing rate environment translated into total revenue increasing for the 11th consecutive quarter, with the third quarter of 2018 at $122.1 million.

- The efficiency ratio(1) continued to be an impressive demonstration of our profitable growth, with the third quarter of 2018 at 50.2%, an improvement from both prior year and linked efficiency ratios of 52.2% and 52.0%, respectively. The adjusted efficiency ratio(1) , which reflects the impact of non-routine items(2), was 48.3% for the third quarter of 2018, compared to an adjusted efficiency ratio of 52.7% and 50.7% for the third quarter of 2017 and second quarter of 2018, respectively.

- Credit remained solid during the quarter, and loan loss provisions included a reversal of ($1.4) million for the third quarter of 2018 as compared to a provision of $1.7 million in the prior year’s quarter and $1.3 million in the linked quarter. Continued improvement in the energy sector and that impact on the performance of our energy credits affected the loan provision reversal in the third quarter of 2018, as well as, refinement of our portfolio loss rates amid an overall stable credit backdrop. These combined factors more than offset loan provisions associated with the third quarter net loan growth.

(1) Considered a non-GAAP financial measure. See Table 7 “Reconciliation of Non-GAAP Financial Measures” for a reconciliation of our non-GAAP measures to the most directly comparable GAAP financial measure.

(2) See Table 7 for a detail of non-routine income and expenses.

Balance Sheet:

Cadence continued its strong growth during the quarter with total assets reaching $11.8 billion as of September 30, 2018, an increase of $1.3 billion, or 12.0%, from September 30, 2017, and an increase of $454.3 million, or 4.0%, from June 30, 2018.

Loans at September 30, 2018 were $9.4 billion, an increase of $1.4 billion, or 17.6%, from September 30, 2017, and an increase of $468.1 million, or 5.2%, from June 30, 2018. Average loans for the third quarter of 2018 were $9.3 billion, an increase of $1.4 billion, or 17.8%, from third quarter of 2017, and an increase of $416.9 million, or 4.7%, from second quarter of 2018. Increases in loans reflect continued demand primarily in our energy mid-stream, specialized, CRE and residential portfolios compared to linked quarter and in our specialized, general C&I and residential portfolios compared to prior year.

Total deposits at September 30, 2018 were $9.6 billion, an increase of $1.1 billion, or 12.4%, from September 30, 2017, and an increase of $227.2 million, or 2.4%, from June 30, 2018. Average total deposits for the third quarter of 2018 were $9.5 billion, an increase of $1.3 billion, or 16.6%, from third quarter of 2017, and an increase of $353.9 million, or 3.9%, from second quarter of 2018.

- Deposit increases reflect growth in core deposits, specifically with success in expanding commercial deposit relationships and treasury management services. Core deposits (total deposits excluding brokered) were $8.8 billion as of September 30, 2018, up $1.2 billion, or 15.0%, from September 30, 2017, and up $252.2 million, or 2.9%, from June 30, 2018.

- Noninterest bearing deposits as a percent of total deposits were 21.9%, compared to 24.4% at September 30, 2017 and 22.9% at June 30, 2018 as growth in interest bearing deposits outpaced the growth in non-interest bearing deposits during the last year.

Shareholders’ equity was $1.4 billion at September 30, 2018, an increase of $74.0 million from September 30, 2017, and an increase of $24.9 million from June 30, 2018.

- Tangible common shareholders’ equity(1) was $1.1 billion at September 30, 2018, an increase of $88.1 million from September 30, 2017, and an increase of $25.5 million from June 30, 2018 which resulted primarily from net income of $47.1 million less dividends of $12.5 million and a decrease of $11.1 million in other comprehensive income.

- Driven by strong earnings, tangible book value per share(1) was $13.15 in the third quarter of 2018, an increase of $1.05 from $12.10 for the third quarter 2017, and an increase of $0.30 from $12.85 per share as of June 30, 2018.

- In September 2018, Cadence paid a $0.15 per common share dividend totaling $12.5 million.

(1) Considered a non-GAAP financial measure. See Table 7 “Reconciliation of Non-GAAP Financial Measures” for a reconciliation of our non-GAAP measures to the most directly comparable GAAP financial measure.

Asset Quality:

Credit quality reflected continued improvement in the energy portfolio and environment, as well as overall credit stability in the third quarter of 2018.

- Net-charge offs for the quarter ended September 30, 2018 were $3.1 million, $0.2 million for the three months ended September 30, 2017, and compared to $2.2 million for the three months ended June 30, 2018. Annualized net-charge offs as a percent of average loans for the quarter ended September 30, 2018 were 0.13%, compared to 0.06% for the full year of 2017. Year-to-date 2018 annualized net-charge offs were 0.09%. Total third quarter 2018 charge-offs of $3.3 million were primarily due to one seasoned energy credit that has been in active resolution and was previously reserved for the full amount of the charge-off.

- NPAs totaled $62.8 million, or 0.7%, of total loans, OREO and other NPAs as of September 30, 2018, down 48.4% from $121.8 million, or 1.5% of total loans, as of September 30, 2017, and up slightly compared to $56.8 million, or 0.6%, as of June 30, 2018.

- The allowance for credit losses (“ACL”) was $86.2 million, or 0.91% of total loans, as of September 30, 2018, as compared to $94.8 million, or 1.18% of total loans, as of September 30, 2017, $90.6 million, or 1.01% of total loans, as of June 30, 2018. The declines in the ACL as a percentage of total loans and the related negative loan provision in the third quarter of 2018 resulted overall stable credit, continued improvement in the energy sector, as well as refinements of our portfolio loss rates. These factors more than offset loan provisions associated with the third quarter net loan growth.

Total Revenue:

Total revenue grew for the 11th consecutive quarter, with the third quarter of 2018 at $122.1 million, up 12.7% from the same period in 2017 and up 1.7% from the linked quarter. The revenue increases were primarily a result of robust loan growth during the period and improved margins as a result of our asset sensitive balance sheet.

Net interest income reflected the strong growth in our overall business lines. Net interest income for the third quarter of 2018 was $98.1 million, an increase of $16.9 million, or 20.9%, from the same period in 2017, and an increase of $2.7 million, or 2.8%, from the second quarter of 2018. Breaking it down, interest income for the third quarter of 2018 was $131.8 million and interest expense was $33.7 million, an increase of $32.3 million in interest income and an increase of $15.3 million in interest expense compared to the third quarter of 2017. Compared to the second quarter of 2018, interest income increased $7.8 million and interest expense increased $5.1 million.

- Our fully tax-equivalent NIM for the third quarter of 2018 was 3.58% as compared to 3.52% for the third quarter of 2017 and 3.66% for the second quarter of 2018. The linked quarter decrease in NIM was impacted by the LIBOR spread to IOER (Interest on Excess Reserves) contracting in the third quarter of 2018, while increasing in the first two quarters of 2018. Over 71% of our loan portfolio is floating rate, of which 77% is tied to one-month LIBOR. Further, the second quarter rebalancing of the municipal securities portfolio served to reduce securities yields compared to both the prior year and linked quarters. At the same time, the deposit costs in the third quarter continued to be impacted by federal funds rate increases in the March, June and September periods. Our NIM excluding recovery accretion for acquired-impaired loans was 3.57%, 3.50% and 3.64% for the third quarter of 2018, third quarter of 2017, and second quarter of 2018, respectively.

Earning asset yields for the third quarter of 2018 were 4.80%, up 50 basis points from 4.30% in the third quarter of 2017, and up 5 basis points from 4.75% in the second quarter of 2018.

- Yield on loans, excluding acquired-impaired loans, increased to 5.08% for the third quarter of 2018, as compared to 4.41% and 5.04% for the third quarter of 2017 and second quarter of 2018, respectively.

- Total accretion for acquired-impaired loans was $5.2 million in the third quarter compared to $5.8 million from the third quarter of 2017 compared to $5.6 million in the second quarter of 2018. The year-over-year decline in accretion was due to a decline in volume. Recovery accretion was $0.4 million, $0.3 million and $0.6 million for the third quarter of 2018, third quarter of 2017, second quarter of 2018, respectively.

- Total loan yields increased to 5.18% for the third quarter of 2018 compared to 4.55% for the third quarter of 2017 and 5.16% for the second quarter of 2018.

-

Total cost of funds for the third quarter of 2018 was 1.33% compared

to 0.84% for the third quarter of 2017 and 1.18% in the linked quarter.

- Total cost of deposits for the third quarter of 2018 was 1.15% compared to 0.64% for the third quarter of 2017, and 0.98% for the linked quarter.

- The current quarter’s increase in deposit costs reflected the six-month cumulative lag effect of the March, June and September federal funds rate increases, consistent with our forecasted 55% total deposit beta.

Noninterest income for the third quarter of 2018 was $24.0 million, a decrease of $3.1 million, or 11.6%, from the same period of 2017, and a decrease of $0.7 million, or 2.8%, from the second quarter of 2018.

- Total service fees and revenue for the third quarter of 2018 were $20.5 million, a decrease of $2.5 million, or 11.0%, from the same period of 2017, and a decrease of $0.9 million, or 4.2%, from the second quarter of 2018. The third quarter of 2018 decrease compared to the linked quarter and prior year quarter was driven by the decrease in insurance revenue due to the sale of the assets of our insurance company in the second quarter of 2018 and to a $0.8 million decrease in interchange fees limited by the Durbin Amendment. The third quarter of 2018 is the first quarter in which the Durbin Amendment applied to the Company’s interchange fees.

- Total other noninterest income for the third quarter of 2018 was $3.5 million, a decrease of $0.6 million from the same period of 2017 and an increase of $0.2 million from the second quarter of 2018. The variances between quarters primarily relate to the sale of the insurance company, offset by securities losses in the second quarter of 2018(2).

Noninterest expense for the third quarter of 2018 was $61.2 million, an increase of $4.7 million, or 8.3%, from $56.5 million during the same period in 2017, and a decrease of $1.2 million, or 1.9%, from $62.4 million for the second quarter of 2018. The linked quarter included a decrease of $2.5 million in salaries and benefits primarily associated with the second quarter sale of the insurance company, offset by an increase of $1.8 million in consulting and professional fees due to costs associated with two secondary offerings in the third quarter compared to one offering in the second quarter(2). The increase in expenses from the prior year’s quarter was due to an increase of $1.9 million in consulting and professional fees related to secondary offerings(2), an increase of $0.4 million in FDIC insurance, and an increase of $1.3 million in other noninterest expenses due to broad-based business growth.

- Adjusted noninterest expenses(1) , which reflects the impact of non-routine items(2), of $59.0 million for the third quarter of 2018 was up 4.4% from $56.5 million for the third quarter of 2017 and down slightly from $59.4 million for the second quarter of 2018.

Our efficiency ratio(1) has declined every quarter this year, with the third quarter of 2018 at 50.2%, as compared to the third quarter of 2017 and second quarter of 2018 ratios of 52.2% and 52.0%, respectively. The improvement in the efficiency ratio reflects continued expansion of revenue on a foundation of well-managed expenses. The third quarter of 2018 included certain non-routine revenues and expenses related to secondary offerings and merger costs(2). Excluding these non-routine revenues and expenses, the adjusted efficiency ratio(1) was 48.4% for the third quarter of 2018. This compares to an adjusted efficiency ratio of 52.7% and 50.7% for the third quarter of 2017 and second quarter of 2018, respectively.

Taxes:

The effective tax rate for the quarter ended September 30, 2018 was 24.2% as compared to 34.9% in the third quarter of 2017 and 14.9% in the second quarter of 2018. The rate in the second quarter of 2018 was due primarily to a one-time bad debt deduction related to the legacy loan portfolio. The third quarter of 2018 tax rate was primarily impacted by the nondeductible expenses associated with two secondary offerings(2). Our annualized effective tax rate for 2018 is currently expected to be approximately 21.4%.

(1) Considered a non-GAAP financial measure. See Table 7 “Reconciliation of Non-GAAP Financial Measures” for a reconciliation of our non-GAAP measures to the most directly comparable GAAP financial measure.

(2) See Table 7 for a detail of non-routine income and expenses.

Quarterly Dividend:

On October 19, 2018, the Board of Directors of Cadence declared a quarterly cash dividend in the amount of $0.15 per share of common stock, representing an annualized dividend of $0.60 per share. The dividend will be paid on December 17, 2018 to holders of record of Cadence’s Class A common stock on December 3, 2018. As previously disclosed, after the completion of the State Bank merger, the Board of Directors plans to increase the annualized dividend to $0.70 per share.

Share Repurchase Program Authorization:

In October 2018, the Company’s Board of Directors authorized a share repurchase program in an amount of up to $50 million as part of the Company’s overall capital management strategies.

Cadence Bancorp, LLC Activity:

- In November 2017, February 2018, May 2018, and July 2018, Cadence completed secondary offerings whereby the LLC sold 10,925,000, 9,200,000, 20,700,000, and 12,500,000 of Cadence shares, respectively, reducing its ownership in Cadence to 76.6%, 65.6%, 40.9%, and 25.9%, respectively. All proceeds from these transactions were received by the LLC and did not impact Cadence Bancorporation’s equity or outstanding shares.

- On September 10, 2018, the LLC completed an in-kind distribution (the “Distribution”) of effectively all of the Cadence shares held by the LLC to its unitholders (other than a de minimis amount of shares representing the aggregate fractional shares in lieu of which unitholders are to receive cash). As a result of the Distribution, the LLC now owns only 58 Cadence shares and will not execute any further secondary offerings.

- On September 14, 2018, certain unitholders of the LLC who elected to sell the Cadence shares they received in the Distribution completed a secondary offering of 12,099,757 Cadence shares. Cadence did not receive any proceeds from the sale of such shares.

- The LLC anticipates dissolving during the fourth quarter of 2018.

Supplementary Financial Tables (Unaudited):

Supplementary Financial Tables (Unaudited) are included in this release following the customary disclosure information.

Third Quarter 2018 Earnings Conference Call:

Cadence Bancorporation executive management will host a conference call to discuss third quarter 2018 results on Monday, October 22, 2018, at 12:00 p.m. CT / 1:00 p.m. ET. Slides to be presented by management on the conference call can be viewed by visiting www.cadencebancorporation.com and selecting “Events & Presentations” then “Presentations”.

Conference Call Access:

To access the conference call, please dial one of the following numbers approximately 10-15 minutes prior to the start time to allow time for registration and use the Elite Entry Number provided below.

| Dial in (toll free): | 1-888-317-6003 | |

| International dial in: | 1-412-317-6061 | |

| Canada (toll free): | 1-866-284-3684 | |

| Participant Elite Entry Number: | 6002871 |

For those unable to participate in the live presentation, a replay will be available through November 5, 2018. To access the replay, please use the following numbers:

| US Toll Free: | 1-877-344-7529 | |

| International Toll: | 1-412-317-0088 | |

| Canada Toll Free: | 1-855-669-9658 | |

| Replay Access Code: | 10124522 | |

| End Date: | November 5, 2018 |

Webcast Access:

A webcast of the conference call presented by management can be viewed by visiting www.cadencebancorporation.com and selecting “Events & Presentations” then “Event Calendar”. Slides are available under the “Presentations” tab.

About Cadence Bancorporation

Cadence Bancorporation (NYSE:CADE), headquartered in Houston, Texas, is a regional bank holding company with $11.8 billion in assets. Through its affiliates, Cadence operates 66 locations in Alabama, Florida, Mississippi, Tennessee and Texas, and provides corporations, middle-market companies, small businesses and consumers with a full range of innovative banking and financial solutions. Services and products include commercial and business banking, treasury management, specialized lending, commercial real estate, foreign exchange, wealth management, investment and trust services, financial planning, retirement plan management, personal insurance, consumer banking, consumer loans, mortgages, home equity lines and loans, and credit cards. Clients have access to leading-edge online and mobile solutions, interactive teller machines, and 56,000 ATMs. The Cadence team of 1,200 associates is committed to exceeding customer expectations and helping their clients succeed financially. Cadence Bank, N.A. and Linscomb & Williams are subsidiaries of Cadence Bancorporation.

Cautionary Statement Regarding Forward-Looking Information

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect our current views with respect to, among other things, future events and our results of operations, financial condition and financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Such factors include, without limitation, the “Risk Factors” referenced in our Registration Statement on Form S-3 filed with the Securities and Exchange Commission (the “SEC”) on May 21, 2018, and our Registration Statement on Form S-4 filed with the SEC on July 20, 2018, other risks and uncertainties listed from time to time in our reports and documents filed with the SEC, including our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, and the following factors: business and economic conditions generally and in the financial services industry, nationally and within our current and future geographic market areas; economic, market, operational, liquidity, credit and interest rate risks associated with our business; lack of seasoning in our loan portfolio; deteriorating asset quality and higher loan charge-offs; the laws and regulations applicable to our business; our ability to achieve organic loan and deposit growth and the composition of such growth; increased competition in the financial services industry, nationally, regionally or locally; our ability to maintain our historical earnings trends; our ability to raise additional capital to implement our business plan; material weaknesses in our internal control over financial reporting; systems failures or interruptions involving our information technology and telecommunications systems or third-party servicers; the composition of our management team and our ability to attract and retain key personnel; the fiscal position of the U.S. federal government and the soundness of other financial institutions; the composition of our loan portfolio, including the identify of our borrowers and the concentration of loans in energy-related industries and in our specialized industries; the portion of our loan portfolio that is comprised of participations and shared national credits; the amount of nonperforming and classified assets we hold; the occurrence of any event, change or other circumstances that could give rise to the right of Cadence or State Bank to terminate the definitive merger agreement between Cadence and State Bank; the failure to obtain necessary regulatory approvals and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction or to satisfy any of the other conditions to the transaction on a timely basis or at all; the possibility that the anticipated benefits of the merger with State Bank are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where Cadence and State Bank do business; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction. Cadence can give no assurance that any goal or plan or expectation set forth in forward-looking statements can be achieved and readers are cautioned not to place undue reliance on such statements. The forward-looking statements are made as of the date of this communication, and Cadence does not intend, and assumes no obligation, to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by applicable law.

About Non-GAAP Financial Measures

Certain of the financial measures and ratios we present, including “efficiency ratio,” “adjusted efficiency ratio,” “adjusted noninterest expenses,” “adjusted operating revenue,” “tangible common equity ratio,” “tangible book value per share” and “return on average tangible common equity,” “adjusted return on average tangible common equity,” “adjusted return on average assets,” “adjusted diluted earnings per share” and “pre-tax, pre-provision net earnings,” are supplemental measures that are not required by, or are not presented in accordance with, U.S. generally accepted accounting principles (GAAP). We refer to these financial measures and ratios as “non-GAAP financial measures.” We consider the use of select non-GAAP financial measures and ratios to be useful for financial and operational decision making and useful in evaluating period-to-period comparisons. We believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance by excluding certain expenditures or assets that we believe are not indicative of our primary business operating results or by presenting certain metrics on a fully taxable equivalent basis. We believe that management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when planning, forecasting, analyzing and comparing past, present and future periods.

These non-GAAP financial measures should not be considered a substitute for financial information presented in accordance with GAAP and you should not rely on non-GAAP financial measures alone as measures of our performance. The non-GAAP financial measures we present may differ from non-GAAP financial measures used by our peers or other companies. We compensate for these limitations by providing the equivalent GAAP measures whenever we present the non-GAAP financial measures and by including a reconciliation of the impact of the components adjusted for in the non-GAAP financial measure so that both measures and the individual components may be considered when analyzing our performance. A reconciliation of non-GAAP financial measures to the comparable GAAP financial measures is included at the end of the financial statement tables (Table 7).

|

Table 1 - Selected Financial Data |

|||||||||||||||||||

| As of and for the Three Months Ended | |||||||||||||||||||

| (In thousands, except share and per share data) |

September 30,

2018 |

June 30,

2018 |

March 31,

2018 |

December 31,

2017 |

September 30,

2017 |

||||||||||||||

| Statement of Income Data: | |||||||||||||||||||

| Interest income | $ | 131,753 | $ | 123,963 | $ | 113,093 | $ | 108,370 | $ | 99,503 | |||||||||

| Interest expense | 33,653 | 28,579 | 21,982 | 20,459 | 18,340 | ||||||||||||||

| Net interest income | 98,100 | 95,384 | 91,111 | 87,911 | 81,163 | ||||||||||||||

| Provision for credit losses | (1,365 | ) | 1,263 | 4,380 | (4,475 | ) | 1,723 | ||||||||||||

| Net interest income after provision | 99,465 | 94,121 | 86,731 | 92,386 | 79,440 | ||||||||||||||

| Noninterest income - service fees and revenue | 20,490 | 21,395 | 23,904 | 22,405 | 23,014 | ||||||||||||||

|

- other noninterest income |

3,486 | 3,277 | 1,079 | 3,251 | 4,110 | ||||||||||||||

| Noninterest expense | 61,231 | 62,435 | 61,939 | 66,371 | 56,530 | ||||||||||||||

| Income before income taxes | 62,210 | 56,358 | 49,775 | 51,671 | 50,034 | ||||||||||||||

| Income tax expense | 15,074 | 8,384 | 10,950 | 36,980 | 17,457 | ||||||||||||||

| Net income | $ | 47,136 | $ | 47,974 | $ | 38,825 | $ | 14,691 | $ | 32,577 | |||||||||

| Period-End Balance Sheet Data: | |||||||||||||||||||

| Investment securities | $ | 1,206,387 | $ | 1,049,710 | $ | 1,251,834 | $ | 1,262,948 | $ | 1,198,032 | |||||||||

| Total loans, net of unearned income | 9,443,819 | 8,975,755 | 8,646,987 | 8,253,427 | 8,028,938 | ||||||||||||||

| Allowance for credit losses | 86,151 | 90,620 | 91,537 | 87,576 | 94,765 | ||||||||||||||

| Total assets | 11,759,837 | 11,305,528 | 10,999,382 | 10,948,926 | 10,502,261 | ||||||||||||||

| Total deposits | 9,558,276 | 9,331,055 | 9,048,971 | 9,011,515 | 8,501,102 | ||||||||||||||

| Noninterest-bearing deposits | 2,094,856 | 2,137,407 | 2,040,977 | 2,242,765 | 2,071,594 | ||||||||||||||

| Interest-bearing deposits | 7,463,420 | 7,193,648 | 7,007,994 | 6,768,750 | 6,429,508 | ||||||||||||||

| Borrowings and subordinated debentures | 662,658 | 471,453 | 471,335 | 470,814 | 572,683 | ||||||||||||||

| Total shareholders’ equity | 1,414,826 | 1,389,956 | 1,357,103 | 1,359,056 | 1,340,848 | ||||||||||||||

| Average Balance Sheet Data: | |||||||||||||||||||

| Investment securities | $ | 1,141,704 | $ | 1,183,055 | $ | 1,234,226 | $ | 1,228,330 | $ | 1,169,182 | |||||||||

| Total loans, net of unearned income | 9,265,754 | 8,848,820 | 8,443,951 | 8,226,294 | 7,867,794 | ||||||||||||||

| Allowance for credit losses | 92,783 | 93,365 | 89,097 | 94,968 | 94,706 | ||||||||||||||

| Total assets | 11,585,969 | 11,218,432 | 10,922,274 | 10,586,245 | 10,024,871 | ||||||||||||||

| Total deposits | 9,489,268 | 9,135,359 | 9,012,390 | 8,635,473 | 8,139,969 | ||||||||||||||

| Noninterest-bearing deposits | 2,153,097 | 2,058,255 | 2,128,595 | 2,170,758 | 1,982,784 | ||||||||||||||

| Interest-bearing deposits | 7,336,171 | 7,077,104 | 6,883,795 | 6,464,715 | 6,157,185 | ||||||||||||||

| Borrowings and subordinated debentures | 567,864 | 595,087 | 444,557 | 502,428 | 484,798 | ||||||||||||||

| Total shareholders’ equity | 1,395,061 | 1,358,770 | 1,342,445 | 1,348,867 | 1,320,884 | ||||||||||||||

|

Table 1 (Continued) - Selected Financial Data |

||||||||||||||||||||

| As of and for the Three Months Ended | ||||||||||||||||||||

| (In thousands, except share and per share data) |

September 30,

2018 |

June 30,

2018 |

March 31,

2018 |

December 31,

2017 |

September 30,

2017 |

|||||||||||||||

| Per Share Data:(3) | ||||||||||||||||||||

| Earnings | ||||||||||||||||||||

| Basic | $ | 0.56 | $ | 0.57 | $ | 0.46 | $ | 0.18 | $ | 0.39 | ||||||||||

| Diluted | 0.56 | 0.57 | 0.46 | 0.17 | 0.39 | |||||||||||||||

| Book value per common share | 16.92 | 16.62 | 16.23 | 16.25 | 16.03 | |||||||||||||||

| Tangible book value (1) | 13.15 | 12.85 | 12.32 | 12.33 | 12.10 | |||||||||||||||

| Weighted average common shares outstanding | ||||||||||||||||||||

| Basic | 83,625,000 | 83,625,000 | 83,625,000 | 83,625,000 | 83,625,000 | |||||||||||||||

| Diluted | 84,660,256 | 84,792,657 | 84,674,807 | 84,717,005 | 83,955,685 | |||||||||||||||

| Cash dividends declared | $ | 0.150 | $ | 0.125 | $ | 0.125 | $ | — | $ | — | ||||||||||

| Dividend payout ratio | 26.79 | % | 21.93 | % | 27.17 | % | — | % | — | % | ||||||||||

| Performance Ratios: | ||||||||||||||||||||

| Return on average common equity (2) | 13.40 | % | 14.16 | % | 11.73 | % | 4.32 | % | 9.78 | % | ||||||||||

| Return on average tangible common equity (1) (2) | 17.32 | 18.58 | 15.52 | 5.71 | 13.04 | |||||||||||||||

| Return on average assets (2) | 1.61 | 1.72 | 1.44 | 0.55 | 1.29 | |||||||||||||||

| Net interest margin (2) | 3.58 | 3.66 | 3.64 | 3.59 | 3.52 | |||||||||||||||

| Efficiency ratio (1) | 50.16 | 52.00 | 53.35 | 58.44 | 52.20 | |||||||||||||||

| Adjusted efficiency ratio (1) | 48.36 | 50.74 | 50.22 | 55.57 | 52.74 | |||||||||||||||

| Asset Quality Ratios: | ||||||||||||||||||||

| Total nonperforming assets ("NPAs") to total loans and OREO and other NPAs | 0.66 | % | 0.63 | % | 0.84 | % | 0.85 | % | 1.51 | % | ||||||||||

| Total nonperforming loans to total loans | 0.50 | 0.44 | 0.60 | 0.58 | 0.96 | |||||||||||||||

| Total ACL to total loans | 0.91 | 1.01 | 1.06 | 1.06 | 1.18 | |||||||||||||||

| ACL to total nonperforming loans ("NPLs") | 182.52 | 230.60 | 175.30 | 183.62 | 122.66 | |||||||||||||||

| Net charge-offs to average loans (2) | 0.13 | 0.10 | 0.02 | 0.13 | 0.01 | |||||||||||||||

| Capital Ratios: | ||||||||||||||||||||

| Total shareholders’ equity to assets | 12.0 | % | 12.3 | % | 12.3 | % | 12.4 | % | 12.8 | % | ||||||||||

| Tangible common equity to tangible assets (1) | 9.6 | 9.8 | 9.7 | 9.7 | 10.0 | |||||||||||||||

| Common equity tier 1 (CET1) (4) | 10.4 | 10.5 | 10.4 | 10.6 | 10.8 | |||||||||||||||

| Tier 1 leverage capital (4) | 10.7 | 10.7 | 10.6 | 10.7 | 11.1 | |||||||||||||||

| Tier 1 risk-based capital (4) | 10.7 | 10.9 | 10.8 | 10.9 | 11.2 | |||||||||||||||

| Total risk-based capital (4) | 12.4 | 12.7 | 12.6 | 12.8 | 13.2 | |||||||||||||||

| _____________________ | ||||||||||||||||||||

| (1) | Considered a non-GAAP financial measure. See Table 7 "Reconciliation of Non-GAAP Financial Measures" for a reconciliation of our non-GAAP measures to the most directly comparable GAAP financial measure. | |

| (2) | Annualized. | |

| (3) | As of the completion of the in-kind distribution on September 10, 2018, 58 of our outstanding shares are owned by Cadence Bancorp, LLC, down from 34,175,000 shares as of June 30, 2018. | |

| (4) | Current quarter regulatory capital ratios are estimates. | |

|

Table 2 - Average Balances/Yield/Rates |

||||||||||||||||||||||||||

| For the Three Months Ended September 30, | ||||||||||||||||||||||||||

| 2018 | 2017 | |||||||||||||||||||||||||

|

Average Balance |

Income/ Expense |

Yield/ Rate |

Average Balance |

Income/ Expense |

Yield/ Rate |

|||||||||||||||||||||

| (In thousands) | ||||||||||||||||||||||||||

| ASSETS | ||||||||||||||||||||||||||

| Interest-earning assets: | ||||||||||||||||||||||||||

| Loans, net of unearned income (1) | ||||||||||||||||||||||||||

| Originated and ANCI loans | $ | 9,036,566 | $ | 115,814 | 5.08 | % | $ | 7,587,556 | $ | 84,321 | 4.41 | % | ||||||||||||||

| ACI portfolio | 229,188 | 5,243 | 9.08 | 280,238 | 5,840 | 8.27 | ||||||||||||||||||||

| Total loans | 9,265,754 | 121,057 | 5.18 | 7,867,794 | 90,161 | 4.55 | ||||||||||||||||||||

| Investment securities | ||||||||||||||||||||||||||

| Taxable | 928,275 | 6,248 | 2.67 | 760,269 | 4,610 | 2.41 | ||||||||||||||||||||

| Tax-exempt (2) | 213,429 | 2,195 | 4.08 | 408,913 | 5,046 | 4.90 | ||||||||||||||||||||

| Total investment securities | 1,141,704 | 8,443 | 2.93 | 1,169,182 | 9,656 | 3.28 | ||||||||||||||||||||

| Federal funds sold and short-term investments | 458,491 | 2,039 | 1.76 | 267,684 | 1,072 | 1.59 | ||||||||||||||||||||

| Other investments | 54,762 | 675 | 4.89 | 49,661 | 380 | 3.04 | ||||||||||||||||||||

| Total interest-earning assets | 10,920,711 | 132,214 | 4.80 | 9,354,321 | 101,269 | 4.30 | ||||||||||||||||||||

| Noninterest-earning assets: | ||||||||||||||||||||||||||

| Cash and due from banks | 71,777 | 60,760 | ||||||||||||||||||||||||

| Premises and equipment | 62,422 | 65,308 | ||||||||||||||||||||||||

| Accrued interest and other assets | 623,842 | 639,188 | ||||||||||||||||||||||||

| Allowance for credit losses | (92,783 | ) | (94,706 | ) | ||||||||||||||||||||||

| Total assets | $ | 11,585,969 | $ | 10,024,871 | ||||||||||||||||||||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||||||||||||||||||||

| Interest-bearing liabilities: | ||||||||||||||||||||||||||

| Demand deposits | $ | 5,175,915 | $ | 17,046 | 1.31 | % | $ | 4,329,086 | $ | 7,300 | 0.67 | % | ||||||||||||||

| Savings deposits | 181,449 | 149 | 0.33 | 180,099 | 113 | 0.25 | ||||||||||||||||||||

| Time deposits | 1,978,807 | 10,312 | 2.07 | 1,648,000 | 5,665 | 1.36 | ||||||||||||||||||||

| Total interest-bearing deposits | 7,336,171 | 27,507 | 1.49 | 6,157,185 | 13,078 | 0.84 | ||||||||||||||||||||

| Other borrowings | 432,279 | 3,673 | 3.37 | 349,925 | 2,926 | 3.32 | ||||||||||||||||||||

| Subordinated debentures | 135,585 | 2,473 | 7.24 | 134,873 | 2,336 | 6.87 | ||||||||||||||||||||

| Total interest-bearing liabilities | 7,904,035 | 33,653 | 1.69 | 6,641,983 | 18,340 | 1.10 | ||||||||||||||||||||

| Noninterest-bearing liabilities: | ||||||||||||||||||||||||||

| Demand deposits | 2,153,097 | 1,982,784 | ||||||||||||||||||||||||

| Accrued interest and other liabilities | 133,776 | 79,220 | ||||||||||||||||||||||||

| Total liabilities | 10,190,908 | 8,703,987 | ||||||||||||||||||||||||

| Stockholders' equity | 1,395,061 | 1,320,884 | ||||||||||||||||||||||||

| Total liabilities and stockholders' equity | $ | 11,585,969 | $ | 10,024,871 | ||||||||||||||||||||||

| Net interest income/net interest spread | 98,561 | 3.11 | % | 82,929 | 3.20 | % | ||||||||||||||||||||

| Net yield on earning assets/net interest margin | 3.58 | % | 3.52 | % | ||||||||||||||||||||||

| Taxable equivalent adjustment: | ||||||||||||||||||||||||||

| Investment securities |

(461 |

) |

(1,766 | ) | ||||||||||||||||||||||

| Net interest income | $ | 98,100 | $ | 81,163 | ||||||||||||||||||||||

| _____________________ | ||||||||||||||||||||||||||

| (1) | Nonaccrual loans are included in loans, net of unearned income. No adjustment has been made for these loans in the calculation of yields. | |

| (2) | Interest income and yields are presented on a fully taxable equivalent basis using a tax rate of 21% for the three months ended September 30, 2018, and a tax rate of 35% for the three months ended September 30, 2017. | |

|

For the Three Months Ended

September 30, 2018 |

For the Three Months Ended

June 30, 2018 |

|||||||||||||||||||||||||

|

Average Balance |

Income/ Expense |

Yield/ Rate |

Average Balance |

Income/ Expense |

Yield/ Rate |

|||||||||||||||||||||

| (In thousands) | ||||||||||||||||||||||||||

| ASSETS | ||||||||||||||||||||||||||

| Interest-earning assets: | ||||||||||||||||||||||||||

| Loans, net of unearned income (1) | ||||||||||||||||||||||||||

| Originated and ANCI loans | $ | 9,036,566 | $ | 115,814 | 5.08 | % | $ | 8,606,253 | $ | 108,130 | 5.04 | % | ||||||||||||||

| ACI portfolio | 229,188 | 5,243 | 9.08 | 242,567 | 5,610 | 9.28 | ||||||||||||||||||||

| Total loans | 9,265,754 | 121,057 | 5.18 | 8,848,820 | 113,740 | 5.16 | ||||||||||||||||||||

| Investment securities | ||||||||||||||||||||||||||

| Taxable | 928,275 | 6,248 | 2.67 | 838,842 | 5,518 | 2.64 | ||||||||||||||||||||

| Tax-exempt (2) | 213,429 | 2,195 | 4.08 | 344,213 | 3,547 | 4.13 | ||||||||||||||||||||

| Total investment securities | 1,141,704 | 8,443 | 2.93 | 1,183,055 | 9,065 | 3.07 | ||||||||||||||||||||

| Federal funds sold and short-term investments | 458,491 | 2,039 | 1.76 | 452,074 | 1,269 | 1.13 | ||||||||||||||||||||

| Other investments | 54,762 | 675 | 4.89 | 55,909 | 634 | 4.55 | ||||||||||||||||||||

| Total interest-earning assets | 10,920,711 | 132,214 | 4.80 | 10,539,858 | 124,708 | 4.75 | ||||||||||||||||||||

| Noninterest-earning assets: | ||||||||||||||||||||||||||

| Cash and due from banks | 71,777 | 80,000 | ||||||||||||||||||||||||

| Premises and equipment | 62,422 | 62,711 | ||||||||||||||||||||||||

| Accrued interest and other assets | 623,842 | 629,228 | ||||||||||||||||||||||||

| Allowance for credit losses | (92,783 | ) | (93,365 | ) | ||||||||||||||||||||||

| Total assets | $ | 11,585,969 | $ | 11,218,432 | ||||||||||||||||||||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||||||||||||||||||||

| Interest-bearing liabilities: | ||||||||||||||||||||||||||

| Demand deposits | $ | 5,175,915 | $ | 17,046 | 1.31 | % | $ | 4,712,302 | $ | 11,700 | 1.00 | % | ||||||||||||||

| Savings deposits | 181,449 | 149 | 0.33 | 189,567 | 133 | 0.28 | ||||||||||||||||||||

| Time deposits | 1,978,807 | 10,312 | 2.07 | 2,175,235 | 10,497 | 1.94 | ||||||||||||||||||||

| Total interest-bearing deposits | 7,336,171 | 27,507 | 1.49 | 7,077,104 | 22,330 | 1.27 | ||||||||||||||||||||

| Other borrowings | 432,279 | 3,673 | 3.37 | 459,678 | 3,785 | 3.30 | ||||||||||||||||||||

| Subordinated debentures | 135,585 | 2,473 | 7.24 | 135,409 | 2,464 | 7.30 | ||||||||||||||||||||

| Total interest-bearing liabilities | 7,904,035 | 33,653 | 1.69 | 7,672,191 | 28,579 | 1.49 | ||||||||||||||||||||

| Noninterest-bearing liabilities: | ||||||||||||||||||||||||||

| Demand deposits | 2,153,097 | 2,058,255 | ||||||||||||||||||||||||

| Accrued interest and other liabilities | 133,776 | 129,216 | ||||||||||||||||||||||||

| Total liabilities | 10,190,908 | 9,859,662 | ||||||||||||||||||||||||

| Stockholders' equity | 1,395,061 | 1,358,770 | ||||||||||||||||||||||||

| Total liabilities and stockholders' equity | $ | 11,585,969 | $ | 11,218,432 | ||||||||||||||||||||||

| Net interest income/net interest spread | 98,561 | 3.11 | % | 96,129 | 3.26 | % | ||||||||||||||||||||

| Net yield on earning assets/net interest margin | 3.58 | % | 3.66 | % | ||||||||||||||||||||||

| Taxable equivalent adjustment: | ||||||||||||||||||||||||||

| Investment securities | (461 | ) | (745 | ) | ||||||||||||||||||||||

| Net interest income | $ | 98,100 | $ | 95,384 | ||||||||||||||||||||||

| _____________________ | ||||||||||||||||||||||||||

| (1) | Nonaccrual loans are included in loans, net of unearned income. No adjustment has been made for these loans in the calculation of yields. | |

| (2) | Interest income and yields are presented on a fully taxable equivalent basis using a tax rate of 21%. | |

|

Table 3 – Loan Interest Income Detail |

||||||||||||||||||||

| For the Three Months Ended, | ||||||||||||||||||||

| (In thousands) |

September 30,

2018 |

June 30,

2018 |

March 31,

2018 |

December 31,

2017 |

September 30,

2017 |

|||||||||||||||

| Loan Interest Income Detail | ||||||||||||||||||||

| Interest income on loans, excluding ACI loans | $ | 115,814 | $ | 108,130 | $ | 97,168 | $ | 89,762 | $ | 84,321 | ||||||||||

| Scheduled accretion for the period | 4,881 | 5,016 | 5,192 | 5,348 | 5,550 | |||||||||||||||

| Recovery income for the period | 362 | 594 | 431 | 2,797 | 290 | |||||||||||||||

| Accretion on acquired credit impaired (ACI) loans | 5,243 | 5,610 | 5,623 | 8,145 | 5,840 | |||||||||||||||

| Loan interest income | $ | 121,057 | $ | 113,740 | $ | 102,791 | $ | 97,907 | $ | 90,161 | ||||||||||

| Loan yield, excluding ACI loans | 5.08 | % | 5.04 | % | 4.81 | % | 4.47 | % | 4.41 | % | ||||||||||

| ACI loan yield | 9.08 | 9.28 | 8.96 | 12.21 | 8.27 | |||||||||||||||

| Total loan yield | 5.18 | % | 5.16 | % | 4.94 | % | 4.72 | % | 4.55 | % | ||||||||||

|

Table 4 - Allowance for Credit Losses |

||||||||||||||||||||

| For the Three Months Ended | ||||||||||||||||||||

| (In thousands) |

September 30,

2018 |

June 30,

2018 |

March 31,

2018 |

December 31,

2017 |

September 30,

2017 |

|||||||||||||||

| Balance at beginning of period | $ | 90,620 | $ | 91,537 | $ | 87,576 | $ | 94,765 | $ | 93,215 | ||||||||||

| Charge-offs | (3,265 | ) | (3,650 | ) | (812 | ) | (2,860 | ) | (581 | ) | ||||||||||

| Recoveries | 161 | 1,470 | 393 | 146 | 408 | |||||||||||||||

| Net charge-offs | (3,104 | ) | (2,180 | ) | (419 | ) | (2,714 | ) | (173 | ) | ||||||||||

| Provision for (reversal of) credit losses | (1,365 | ) | 1,263 | 4,380 | (4,475 | ) | 1,723 | |||||||||||||

| Balance at end of period | $ | 86,151 | $ | 90,620 | $ | 91,537 | $ | 87,576 | $ | 94,765 | ||||||||||

|

Table 5 - Noninterest Income |

|||||||||||||||||||

| For the Three Months Ended | |||||||||||||||||||

| (In thousands) |

September 30,

2018 |

June 30,

2018 |

March 31,

2018 |

December 31,

2017 |

September 30,

2017 |

||||||||||||||

| Noninterest Income | |||||||||||||||||||

| Investment advisory revenue | $ | 5,535 | $ | 5,343 | $ | 5,299 | $ | 5,257 | $ | 5,283 | |||||||||

| Trust services revenue | 4,449 | 4,114 | 5,015 | 4,836 | 4,613 | ||||||||||||||

| Service charges on deposit accounts | 3,813 | 3,803 | 3,960 | 3,753 | 3,920 | ||||||||||||||

| Credit-related fees | 3,549 | 3,807 | 3,577 | 3,372 | 3,306 | ||||||||||||||

| Insurance revenue | — | 417 | 2,259 | 1,470 | 1,950 | ||||||||||||||

| Bankcard fees | 1,078 | 1,915 | 1,884 | 1,833 | 1,803 | ||||||||||||||

| Mortgage banking revenue | 747 | 650 | 577 | 687 | 965 | ||||||||||||||

| Other service fees earned | 1,319 | 1,346 | 1,333 | 1,197 | 1,174 | ||||||||||||||

| Total service fees and revenue | 20,490 | 21,395 | 23,904 | 22,405 | 23,014 | ||||||||||||||

| Securities gains (losses), net | 2 | (1,813 | ) | 12 | 16 | 1 | |||||||||||||

| Other | 3,484 | 5,090 | 1,067 | 3,235 | 4,109 | ||||||||||||||

| Total other noninterest income | 3,486 | 3,277 | 1,079 | 3,251 | 4,110 | ||||||||||||||

| Total noninterest income | $ | 23,976 | $ | 24,672 | $ | 24,983 | $ | 25,656 | $ | 27,124 | |||||||||

|

Table 6 - Noninterest Expense |

|||||||||||||||||||

| For the Three Months Ended | |||||||||||||||||||

| (In thousands) |

September 30,

2018 |

June 30,

2018 |

March 31,

2018 |

December 31,

2017 |

September 30,

2017 |

||||||||||||||

| Noninterest Expenses | |||||||||||||||||||

| Salaries and employee benefits | $ | 35,811 | $ | 38,268 | $ | 37,353 | $ | 35,162 | $ | 35,007 | |||||||||

| Premises and equipment | 7,561 | 7,131 | 7,591 | 7,629 | 7,419 | ||||||||||||||

| Intangible asset amortization | 650 | 715 | 792 | 1,085 | 1,136 | ||||||||||||||

| Net cost of operation of other real estate owned | 398 | 112 | (52 | ) | 1,075 | 453 | |||||||||||||

| Data processing | 1,989 | 2,304 | 2,365 | 2,504 | 1,688 | ||||||||||||||

| Consulting and professional fees | 4,335 | 2,545 | 2,934 | 4,380 | 2,069 | ||||||||||||||

| Loan related expenses | 821 | 645 | 255 | 810 | 532 | ||||||||||||||

| FDIC insurance | 1,237 | 1,223 | 955 | 939 | 889 | ||||||||||||||

| Communications | 682 | 703 | 704 | 857 | 650 | ||||||||||||||

| Advertising and public relations | 679 | 575 | 341 | 683 | 521 | ||||||||||||||

| Legal expenses | 242 | 468 | 2,627 | 2,626 | 612 | ||||||||||||||

| Other | 6,826 | 7,746 | 6,074 | 8,621 | 5,554 | ||||||||||||||

| Total noninterest expenses | $ | 61,231 | $ | 62,435 | $ | 61,939 | $ | 66,371 | $ | 56,530 | |||||||||

|

Table 7 - Reconciliation of Non-GAAP Financial Measures |

||||||||||||||||||||

| As of and for the Three Months Ended | ||||||||||||||||||||

| September 30, | June 30, | March 31, | December 31, | September 30, | ||||||||||||||||

| (In thousands) | 2018 | 2018 | 2018 | 2017 | 2017 | |||||||||||||||

| Efficiency ratio | ||||||||||||||||||||

| Noninterest expenses (numerator) | $ | 61,231 | $ | 62,435 | $ | 61,939 | $ | 66,371 | $ | 56,530 | ||||||||||

| Net interest income | $ | 98,100 | $ | 95,384 | $ | 91,111 | $ | 87,911 | $ | 81,163 | ||||||||||

| Noninterest income | 23,976 | 24,672 | 24,983 | 25,656 | 27,124 | |||||||||||||||

| Operating revenue (denominator) | $ | 122,076 | $ | 120,056 | $ | 116,094 | $ | 113,567 | $ | 108,287 | ||||||||||

| Efficiency ratio | 50.16 | % | 52.00 | % | 53.35 | % | 58.44 | % | 52.20 | % | ||||||||||

| Adjusted efficiency ratio | ||||||||||||||||||||

| Noninterest expenses | $ | 61,231 | $ | 62,435 | $ | 61,939 | $ | 66,371 | $ | 56,530 | ||||||||||

| Less: Merger related expenses | 178 | 756 | — | — | — | |||||||||||||||

| Less: Secondary offerings expenses | 2,022 | 1,165 | 1,365 | 1,302 | — | |||||||||||||||

| Less: Other non-routine expenses(2) | — | 1,145 | 2,278 | 1,964 | — | |||||||||||||||

| Adjusted noninterest expenses (numerator) | $ | 59,031 | $ | 59,369 | $ | 58,296 | $ | 63,105 | $ | 56,530 | ||||||||||

| Net interest income | $ | 98,100 | $ | 95,384 | $ | 91,111 | $ | 87,911 | $ | 81,163 | ||||||||||

| Noninterest income | 23,976 | 24,672 | 24,983 | 25,656 | 27,124 | |||||||||||||||

| Less: Gain on sale of insurance assets | — | 4,871 | — | — | 1,093 | |||||||||||||||

| Less: Securities gains (losses), net | 2 | (1,813 | ) | 12 | 16 | 1 | ||||||||||||||

| Adjusted noninterest income | 23,974 | 21,614 | 24,971 | 25,640 | 26,030 | |||||||||||||||

| Adjusted operating revenue (denominator) | $ | 122,074 | $ | 116,998 | $ | 116,082 | $ | 113,551 | $ | 107,193 | ||||||||||

| Adjusted efficiency ratio | 48.36 | % | 50.74 | % | 50.22 | % | 55.57 | % | 52.74 | % | ||||||||||

| Tangible common equity ratio | ||||||||||||||||||||

| Shareholders’ equity | $ | 1,414,826 | $ | 1,389,956 | $ | 1,357,103 | $ | 1,359,056 | $ | 1,340,848 | ||||||||||

| Less: Goodwill and other intangible assets, net | (314,998 | ) | (315,648 | ) | (327,247 | ) | (328,040 | ) | (329,124 | ) | ||||||||||

| Tangible common shareholders’ equity | 1,099,828 | 1,074,308 | 1,029,856 | 1,031,016 | 1,011,724 | |||||||||||||||

| Total assets | 11,759,837 | 11,305,528 | 10,999,382 | 10,948,926 | 10,502,261 | |||||||||||||||

| Less: Goodwill and other intangible assets, net | (314,998 | ) | (315,648 | ) | (327,247 | ) | (328,040 | ) | (329,124 | ) | ||||||||||

| Tangible assets | $ | 11,444,839 | $ | 10,989,880 | $ | 10,672,135 | $ | 10,620,886 | $ | 10,173,137 | ||||||||||

| Tangible common equity ratio | 9.61 | % | 9.78 | % | 9.65 | % | 9.71 | % | 9.95 | % | ||||||||||

| Tangible book value per share | ||||||||||||||||||||

| Shareholders’ equity | $ | 1,414,826 | $ | 1,389,956 | $ | 1,357,103 | $ | 1,359,056 | $ | 1,340,848 | ||||||||||

| Less: Goodwill and other intangible assets, net | (314,998 | ) | (315,648 | ) | (327,247 | ) | (328,040 | ) | (329,124 | ) | ||||||||||

| Tangible common shareholders’ equity | $ | 1,099,828 | $ | 1,074,308 | $ | 1,029,856 | $ | 1,031,016 | $ | 1,011,724 | ||||||||||

| Common shares issued | 83,625,000 | 83,625,000 | 83,625,000 | 83,625,000 | 83,625,000 | |||||||||||||||

| Tangible book value per share | $ | 13.15 | $ | 12.85 | $ | 12.32 | $ | 12.33 | $ | 12.10 | ||||||||||

| (1) | Annualized. |

| (2) | Other non-routine expenses for the second quarter of 2018 were $1.1 million and included expenses related to the sale of the assets of our insurance company. This compares to $2.3 million and $2.0 million for the first quarter of 2018 and fourth quarter of 2017, respectively, each representing legal costs associated with litigation related to a pre-acquisition matter of a legacy acquired bank that has been resolved. |

|

Table 7 (Continued) – Reconciliation of Non-GAAP Measures |

||||||||||||||||||||

| As of and for the Three Months Ended | ||||||||||||||||||||

| September 30, | June 30, | March 31, | December 31, | September 30, | ||||||||||||||||

| (In thousands) | 2018 | 2018 | 2018 | 2017 | 2017 | |||||||||||||||

| Return on average tangible common equity | ||||||||||||||||||||

| Average common equity | $ | 1,395,061 | $ | 1,358,770 | $ | 1,342,445 | $ | 1,348,867 | $ | 1,320,884 | ||||||||||

| Less: Average intangible assets | (315,382 | ) | (323,255 | ) | (327,727 | ) | (328,697 | ) | (329,816 | ) | ||||||||||

| Average tangible common shareholders’ equity | $ | 1,079,679 | $ | 1,035,515 | $ | 1,014,718 | $ | 1,020,170 | $ | 991,068 | ||||||||||

| Net income | $ | 47,136 | $ | 47,974 | $ | 38,825 | $ | 14,691 | $ | 32,577 | ||||||||||

| Return on average tangible common equity(1) | 17.32 | % | 18.58 | % | 15.52 | % | 5.71 | % | 13.04 | % | ||||||||||

| Adjusted return on average tangible common equity | ||||||||||||||||||||

| Average tangible common shareholders’ equity | $ | 1,079,679 | $ | 1,035,515 | $ | 1,014,718 | $ | 1,020,170 | $ | 991,068 | ||||||||||

| Net income | $ | 47,136 | $ | 47,974 | $ | 38,825 | $ | 14,691 | $ | 32,577 | ||||||||||

| Non-routine items: | ||||||||||||||||||||

| Plus: Merger related expenses | 178 | 756 | — | — | — | |||||||||||||||

| Plus: Secondary offerings expenses | 2,022 | 1,165 | 1,365 | 1,302 | — | |||||||||||||||

| Plus: Other non-routine expenses(2) | — | 1,145 | 2,278 | 1,964 | — | |||||||||||||||

| Less: Gain on sale of insurance assets | — | 4,871 | — | — | 1,093 | |||||||||||||||

| Less: Securities gains (losses), net | 2 | (1,813 | ) | 12 | 16 | 1 | ||||||||||||||

| Tax expense: | ||||||||||||||||||||

| Plus: One-time tax charge related to Tax Reform | — | — | — | 19,022 | — | |||||||||||||||

| Less: Benefit of legacy loan bad debt deduction for tax | — | 5,991 | — | — | — | |||||||||||||||

| Less: Income tax effect of tax deductible non-routine items | 41 | (352 | ) | 529 | 721 | (405 | ) | |||||||||||||

| Total non-routine items, after tax | 2,157 | (5,631 | ) | 3,102 | 21,551 | (689 | ) | |||||||||||||

| Adjusted net income | $ | 49,293 | $ | 42,343 | $ | 41,927 | $ | 36,242 | $ | 31,888 | ||||||||||

| Adjusted return on average tangible common equity(1) | 18.11 | % | 16.40 | % | 16.76 | % | 14.09 | % | 12.77 | % | ||||||||||

| Adjusted return on average assets | ||||||||||||||||||||

| Average assets | $ | 11,585,969 | $ | 11,218,432 | $ | 10,922,274 | $ | 10,586,245 | $ | 10,024,871 | ||||||||||

| Adjusted net income | $ | 49,293 | $ | 42,343 | $ | 41,927 | $ | 36,242 | $ | 31,888 | ||||||||||

| Adjusted return on average assets(1) | 1.69 | % | 1.51 | % | 1.56 | % | 1.36 | % | 1.26 | % | ||||||||||

| Adjusted diluted earnings per share | ||||||||||||||||||||

| Diluted weighted average common shares outstanding | 84,660,256 | 84,792,657 | 84,674,807 | 84,717,005 | 83,955,685 | |||||||||||||||

| Net income allocated to common stock | $ | 47,080 | $ | 47,914 | $ | 38,825 | $ | 14,691 | $ | 32,577 | ||||||||||

| Total non-routine items | 2,157 | (5,631 | ) | 3,102 | 21,551 | (689 | ) | |||||||||||||

| Adjusted net income allocated to common stock | $ | 49,237 | $ | 42,283 | $ | 41,927 | $ | 36,242 | $ | 31,888 | ||||||||||

| Adjusted diluted earnings per share(1) | $ | 0.58 | $ | 0.50 | $ | 0.50 | $ | 0.43 | $ | 0.38 | ||||||||||

| Pre-tax, pre-provision net earnings | ||||||||||||||||||||

| Income before taxes | $ | 62,210 | $ | 56,358 | $ | 49,775 | $ | 51,671 | $ | 50,034 | ||||||||||

| Plus: Provision for credit losses | (1,365 | ) | 1,263 | 4,380 | (4,475 | ) | 1,723 | |||||||||||||

| Pre-tax, pre-provision net earnings | $ | 60,845 | $ | 57,621 | $ | 54,155 | $ | 47,196 | $ | 51,757 | ||||||||||

| (1) | Annualized. |

| (2) | Other non-routine expenses for the second quarter of 2018 were $1.1 million and included expenses related to the sale of the assets of our insurance company. This compares to $2.3 million and $2.0 million for the first quarter of 2018 and fourth quarter of 2017, respectively, each representing legal costs associated with litigation related to a pre-acquisition matter of a legacy acquired bank that has been resolved. |