BOSTON--(BUSINESS WIRE)--Please replace the graphics issued October 10, 2018 with the accompanying corrected graphics.

The release reads:

NEW FIDELITY CHARITABLE RESEARCH SHOWS DONORS INTEND TO MAINTAIN GIVING LEVELS, BUT MAY NOT UNDERSTAND TAX REFORM’S IMPACT ON DONATIONS

Fidelity Charitable provides resources to help donors get the most out of their giving

Fidelity Charitable’s new research indicates that donors’ commitment to giving remains strong in the wake of tax reform—82% of donors who itemized deductions on their 2017 taxes plan to maintain or increase their giving in 2018.

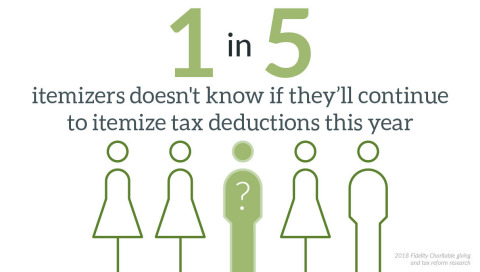

However, the research also demonstrates these taxpayers may not fully understand how the Tax Cuts and Jobs Act will impact them. Experts predict the increased standard deduction will lead to a 60% decrease in the number of households itemizing tax deductions, because what individuals once itemized, such as property taxes and charitable contributions, may not add up to exceed the higher standard deduction thresholds. More than half of donors (58%) are still planning to itemize in 2018—though itemizing may not be right for their situation. These findings make it clear that many taxpayers have not worked through how tax reform might affect them personally.

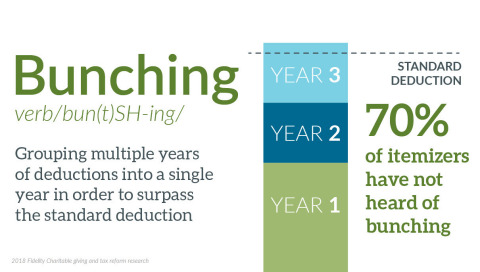

Given the confusion around the new tax law, it is not surprising donors are unaware of strategies available to manage deductions, such as bunching. Only 30% of itemizers have heard of bunching or stacking—meaning 70% of donors who have previously itemized tax deductions have never heard of this strategy and could be missing out on ways to maximize their tax savings—including their charitable deductions.

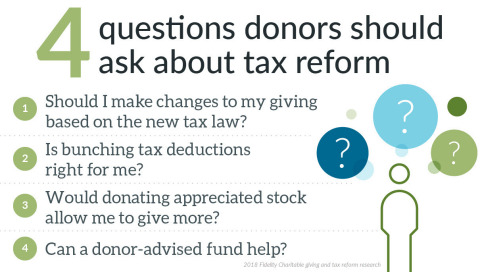

With this in mind, Fidelity Charitable has provided questions and resources for donors and financial and tax advisors to ensure they can keep the tax deductions they are expecting while maintaining their charitable giving habits.

Methodology

The data for these summary graphics was obtained from Fidelity Charitable’s 2018 research on giving and tax reform. Data about itemizing income tax deductions is from a survey of 3,000 Americans who in 2017 made charitable donations and itemized deductions on their tax returns. Data about 2018 giving and bunching is from a survey of 475 Americans who made donations to charity within the last two years and itemized tax deductions on their last federal tax return.

About Fidelity Charitable

Fidelity Charitable is an independent public charity that has helped donors support more than 255,000 nonprofit organizations with $30 billion in grants. Established in 1991, Fidelity Charitable launched the first national donor-advised fund program. The mission of the organization is to grow the American tradition of philanthropy by providing programs that make charitable giving accessible, simple and effective. For more information about Fidelity Charitable, visit https://www.fidelitycharitable.org.

861743.1.0