HOUSTON--(BUSINESS WIRE)--A combination of low oil prices, a rapidly expanding middle class in Asia and booming freight markets driven by expanding world trade and e-commerce are fueling increased demand for jet fuel worldwide. However, that growth does have potential risks that could hamper demand, namely a greater penetration of sustainable aviation fuels (SAF) and efficiency gains, according to new research from refining market analysis by business information provider IHS Markit (Nasdaq: INFO).

Global jet fuel demand will rise from around 8 percent of total refined product demand in 2017 to more than 10 percent by 2040, according to the IHS Markit Refining and Marketing Insight: Jet fuel demand flies high, but some clouds on the horizon analysis. The global market for jet fuel will reach more than 9.5 million barrels per day by 2040, compared with demand of nearly 7.45 million barrels per day in 2018, IHS Markit said.

“Thanks largely to low oil prices and strong growth in air travel, particularly in Asia, jet fuel is a fast-growing product, with global jet-fuel demand growth comfortably exceeding 4 percent in the last two years,” said Louise Vertz, director, refining and marketing research at IHS Markit, and lead author of the IHS Markit analysis. “In a refined-fuel market that has had sluggish annual growth of just shy of 1.5 percent overall, that is a bright spot for refiners, and is one of the few refined products we expect to see gain consistent demand growth through 2040. However, there are some potential challenges that could inhibit that demand growth, particularly increased market penetration of sustainable aviation fuels and increased fleet efficiency.”

Air travel growth is set to continue its strong performance. The International Air Transport Association’s (IATA) mid-year economic report for passenger traffic—measured in revenue passenger kilometers (RPKs)— is expected to grow by 7 percent in 2018, after increases of 7.4 percent and 8.1 percent in 2016 and 2017, respectively. Freight, which is measured in freight ton kilometers (FTKs), is expected to grow 4 percent in 2018, down from 9.7 percent in 2017, which, for context, was more than double the 3.6 percent performance seen in 2016, and the strongest year since the rebound from the global financial crisis.

It is little surprise then that jet fuel has outperformed most other oil products in registering annual growth of more than 4 percent in 2016 and 2017, and will continue to perform well, with average annual growth projected at more than 2 percent to 2025, IHS Markit said.

Although low oil prices have contributed greatly to recent growth in air transportation, price is only part of the picture, IHS Markit said. “With lower fuel costs, airlines have lowered ticket prices, which has certainly contributed to the strong performance, and jet fuel has a high degree of price elasticity,” said Sandeep Sayal, vice president of refining and markets research at IHS Markit, and a co-author of the IHS Markit analysis. “One of the biggest factors in jet-fuel demand, on a global level, has to do with increased wealth in the form of rapid expansion of the middle class, particularly in Asia. This has had a major impact on air travel, and we expect this trend to continue, particularly in emerging markets, as about 160 million people are expected to join the middle class each year to 2025,” Sayal said.

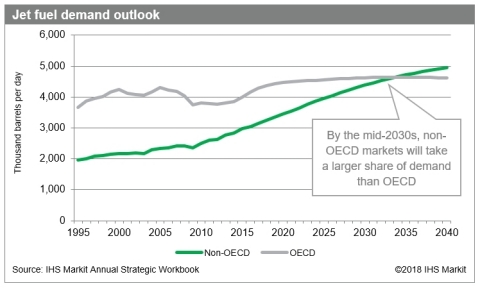

OECD markets currently hold 58 percent of the jet-fuel market. By 2040, IHS Markit expects OECD markets to account for about 48 percent of world jet-fuel demand as non-OECD markets, driven by growth in Asia, begin to overtake OECD markets in the mid-2030s. China, India and Indonesia are all rapidly growing aviation markets, and both Thailand and Japan are boosting capacity.

The Middle East is the next biggest contributor to jet-fuel demand growth, with approximately 340,000 barrels per day growth to 2040, gaining a 2 percent market share to reach 9 percent of global jet demand. IATA forecasts a doubling of passenger traffic in the region during the next 10 years and to this end, a host of new airport construction projects are underway, and Gulf carriers have been expanding aggressively, IHS Markit said.

“Despite growth in passenger traffic, growth in Middle Eastern jet-fuel markets will not be as strong as expected, as efficiency gains are expected to work through the fleet to a greater degree than in most other regions,” Sayal said. “Overall, Middle East jet-fuel demand is nevertheless the fastest growing, with an annual rate of 2.2 percent, growing by 40 percent by 2040, versus the current 530,000 barrels per day demand in 2018.”

Efficiency is a critical market driver, as the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) gets underway in 2021, IHS Markit said. (CORSIA is a U.N. climate initiative and market-based measure designed to reduce emissions from the international air transportation sector.) “From the mid-2020s, efficiency gains can be expected to accelerate,” Vertz said.

While efficiency gains have averaged slightly more than 1 percent per year on a fuel per passenger-km basis, the advent of newer, fuel-efficient aircraft could hasten efficiency gains, and take-up of these more efficient models is likely to accelerate in a higher oil price environment, IHS Markit said.

Other contributors to growth include deregulation of the airline industry, which drove greater accessibility, as well as price competition, which has been boosted by internet search capabilities that provide price transparency, Sayal said. “Greater use of regional airports by the low-cost carriers has also resulted in expansion of smaller exports, forcing legacy operators to adapt,” Sayal said.

One example of this growth is in Europe. Southern Europe has registered jet-fuel gains of more than 90,000 barrels per day during the last five years compared to growth of 50,000 barrels of jet fuel in Northern Europe, IHS Markit said. Furthermore, European countries are investing strongly in airport expansion CAPEX, including the UK, Germany and Turkey. Backed by this expanded capacity, IHS Markit expects European jet-fuel demand growth rates will be sustained, albeit at more moderate rates than the current highs, averaging nearly 1.5 percent annually during the next 10 years, then 0.6 percent to 2040. Localized congestion and capacity constraints, as well as alternative transportation modes, however, will temper prospects in some region, IHS Markit said.

Africa currently runs second to the Middle East in terms of jet-fuel demand growth rates, despite a modest 200,000 barrels per day contribution to overall growth in 2040, IHS Markit said. While IHS Markit projects a cautiously optimistic annual growth rate of just above two percent to 2040, the region currently underperforms in terms of air traffic demand, but some markets could double during the next decade, assuming infrastructure funding is secured. With average annual growth rates of less than 1.5 percent each, CIS and Latin America are expected to register a lackluster performance through 2040, mainly due to a lack of construction projects, a lower level of market access, and uncertain tourism and freight development, IHS Markit said.

“With a strong demand outlook, refiners will be looking to ensure high jet-fuel yields to meet demand, and supply will be boosted, but not necessarily in the regions that have the most growth, which means regional supply imbalances will worsen to 2040,” Sayal said. “Europe will continue to increase its important requirements, and the CIS markets will also become increasingly vulnerable to imbalances.”

Sustainable aviation fuels (SAF) are low-carbon fuels, mainly biojet, which are produced from sustainable oil crops. Biojet can be blended with conventional jet fuel to reduce the carbon footprint of air travel by as much as 80 percent. However, adoption of these fuels remains limited, in part by the prohibitive production costs, which is nearly double that of conventional jet fuel. Without changes in policy support and stronger market incentives, infrastructure investors are hesitant to invest in these SAFs, IHS Markit said. This may change, however, as worldwide efforts to reduce carbon dioxide (CO2) emissions gather pace and CORSIA goes into effect. With this in mind, SAFs are expected to play a greater role in the fuel mix toward the end of the forecast period, IHS Markit said.

Finally, substitution for traditional jet fuel demand may eventually come from electricity and electric planes, although IHS Markit does not expect market penetration to begin until at least 2040, and then initially only for short-haul commuter trips.

Higher oil prices also could dampen the growth outlook for jet fuel, IHS Markit said.

To speak with Louise Vertz or Sandeep Sayal, contact Melissa Manning at melissa.manning@ihsmarkit.com. For more information on the IHS Markit analysis: IHS Markit Refining and Marketing Insight: Jet fuel demand flies high, but some clouds on the horizon analysis, contact Adam.breen@ihsmarkit.com.

About IHS Markit (www.ihsmarkit.com)

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions. Headquartered in London, IHS Markit is committed to sustainable, profitable growth.

IHS Markit is a registered trademark of IHS Markit Ltd. and/or its affiliates. All other company and product names may be trademarks of their respective owners © 2018 IHS Markit Ltd. All rights reserved.