BOSTON--(BUSINESS WIRE)--MarketsFlow, Inc. has the first of its kind AI powered investment and portfolio optimization platform. A true financial services maverick, SEC registered investment advisor MarketsFlow, is shunning the widely accepted ETF investment trend, being able to offer a unique automated service to assist both retail and institutional investors in their quest to outperform market averages.

According to CEO Tom Nash, an MBA with formal training and experience in data science technologies, “MarketsFlow has a unique opportunity to exploit the void left by an investment industry whose embrace of ETF’s has caused individual stocks to become increasingly neglected and mispriced.”

For the last 3 years MarketsFlow’s platform has been rigorously tested and continuously perfected with live and back-tested portfolios that consistently outperformed the Eureka 50 and S&P benchmarks.

In early 2018 MarketsFlow was funded by a heavily oversubscribed equity offering through Crowdcube, surpassing its initial target by over 150%.

Critical to the funding effort’s success was the firm’s performance in international competitions against digital wealth management rivals – in which it bested the efforts of multi-billion dollar Wall Street behemoths. Among the accolades garnered by MarketsFlow were nominations in six categories at the 2018 Fund Technology and WSL Awards, as well as that competition’s Best Broker-Dealer Research prize in both 2017 and 2018.

As part of its ongoing innovation and strive for ever improving portfolio performance, MarketsFlow has chosen to work with some of the most experienced and sharpest minds in the financial sector.

As Nash said, “Adam Tyrrell, our portfolio manager, is a CFA-trained pro, whose technical analysis algorithms serve to ferret out mispriced stocks and are the beating heart of our platform. His resume includes over ten years’ investment management experience with such organizations as Aberdeen Investment Management and Scottish Widows.”

MarketsFlow recently bolstered their capabilities on the fundamental analysis side by hiring Bill Matson and Tim Shanahan.

Bill has a long record of solid investment performance and was the co-author of Data Driven Investing, a highly regarded analysis of stock market inefficiencies.

Tim has over four decades of experience advising high net worth individuals, corporate executives, retirement plans and companies.

Tim, Bill and Adam serve as MarketsFlow’s portfolio managers, blending the most profitable facets of their respective styles to create valuable synergies and leveraging these synergies with the firm’s award-winning technology.

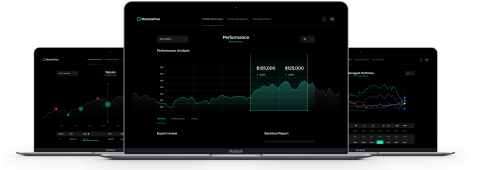

MarketsFlow is offering U.S. investors a self-optimized portfolio solution, as well as an option to have their portfolio expertly managed by MarketsFlow. The self-managed option allows clients access to the intelligent MarketsFlow platform with a low minimum investment of $30,000, whereas the MarketsFlow-managed option will require a $100,000 minimum investment. The fees on offer are highly competitive starting at 0.8% for the self-managed portfolio option and 1% for the MarketsFlow managed portfolio service, scaling down to 0.7% depending on portfolio size.

Using Schwab as their prime broker and custodian, MarketsFlow offers a highly advanced platform for portfolio construction, allocation and re-balancing.