ATLANTA--(BUSINESS WIRE)--Businesses looking for quicker, lower-cost access to financing have an ally in Atlanta-based FINSYNC, and its network of bank, credit union and lending partners.

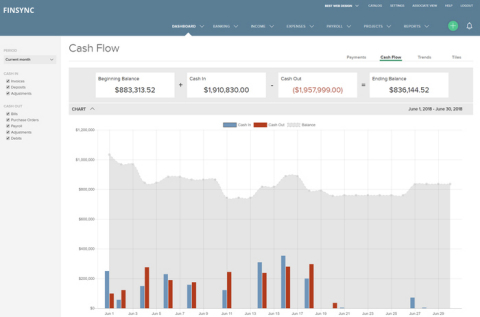

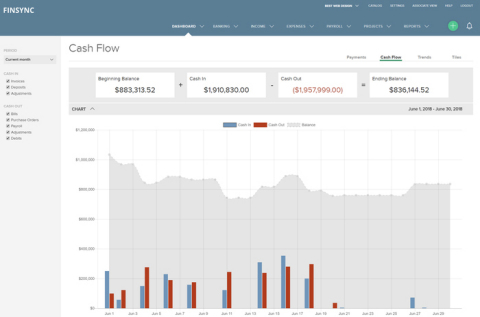

Most businesses struggle to manage and forecast cash flow, an issue magnified when leverage (business financing) is applied to the business. By contrast, businesses using FINSYNC to manage cash flow have a powerful dashboard that helps them centralize control of payments and gain an actionable, calendar view of projected payments.

Recognizing an opportunity to back businesses who are more financially organized and aware of their cash flow position, a number of industry leaders, including Credibly, have pledged their support, with over $1 billion in credit already available through the network to help businesses with what FINSYNC calls “Capital On Demand.”

“We are excited about this milestone and what it means for small business owners trying to seize timely opportunities to grow or for those who can simply take comfort knowing capital is there when needed most. Through FINSYNC, a positive payments history is rewarded with fast, on demand access to capital for inventory, equipment, repairs, or just to make payroll,” says Tucker Mathis, CEO of FINSYNC.

In addition to business loans and lines of credit, FINSYNC also supports cash advances on invoices (invoice financing or factoring). Eagle Business Credit is an early network participant who offers lower rates to businesses who apply for financing through FINSYNC. CEO of Eagle, Ian Varley, commented “The combination of FINSYNC’s accounting system, online payments platform and lender’s portal allows us to process requests for cash advances at a fraction of the time and cost compared to traditional methods. The process is completely streamlined. We are passing our savings on to the businesses we fund in an effort to help them grow.”

A philosophical shift in the small business credit market is underway. Tucker explains, “With equity investing, the concept of a risk-adjusted rate of return is fundamental, but those same principals shouldn’t be applied to credit for early stage and small businesses. Burdening a small business with high interest loans actually adds additional risk. So, it’s imperative we leverage technology to drive down the cost of financing for both borrower and lender.”

Partners agree. Bill Long, CEO of North Carolina based Spirit Community Bank - In Organization, says, “We started the LLC for the organization of our new bank on the FINSYNC platform and use it for payments, payroll and accounting. It’s been a fantastic experience. We intend to offer FINSYNC to our business customers to help them get financially organized. We’re also looking forward to the efficiencies and revenue it will bring our bank.”

Near term enhancements to the FINSYNC user experience include expanding the system’s business owner training capabilities. As a business owner uses the system, it teaches them what metrics they need to track and improve in order to manage cash flow effectively and gain access to growth capital.

Tucker adds “What’s required for a loan or cash advance to be approved or a credit limit increased shouldn’t be a mystery to the applicant. The next wave of innovation in small business lending is being driven by the need for greater transparency and collaboration between borrower and lender. That’s only possible at scale with synchronized applications, greater automation and an equation that balances all parties’ long-term best interests.”

About FINSYNC

FINSYNC is an all-in-one payments platform that helps businesses centralize control of cash flow, automate accounting and grow. In a single platform, businesses can collect income, pay bills, process payroll and leverage FINSYNC’s network of lending partners to access capital on demand. Businesses benefit with improved operational efficiency, lower operating costs and quicker access to growth capital.

FINSYNC’s

Twitter

FINSYNC’s

Facebook

FINSYNC’s

LinkedIn