CHICAGO--(BUSINESS WIRE)--Coeur Mining, Inc. (“Coeur” or the “Company”) (NYSE: CDE) today provided an update on the 44,500-meter (146,000-foot) drilling program at its 100%-owned Silvertip operation located in northern British Columbia. This program has been primarily focused on infill drilling to support ongoing mine planning efforts and has successfully discovered several new mineralized zones. Given the success of this initial program, the Company has approved and commenced a US$4 million second phase focused on expanding resources and testing prospective targets located on the mine’s 93,000-acre (37,650 hectare) land package.

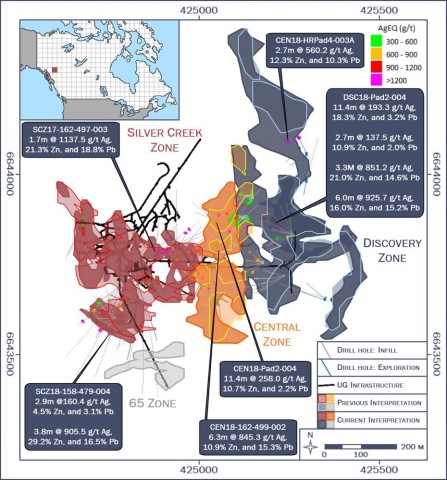

“Results from exploration at Silvertip during the first half of 2018 have demonstrated both the quality of the known resource and the strong potential for significant mine life extensions,” said Mitchell J. Krebs, Coeur’s President and Chief Executive Officer. “Drilling targeted three zones with a particular emphasis on upgrading resources to reserves in the Central Zone, where results also confirmed the continuity of mineralization in zones previously thought to be discrete. At the Silver Creek and Discovery zones, both close to existing underground infrastructure, drilling has successfully delineated and expanded the resource through the identification of newly discovered mineralized zones and feeder structures. We look forward to continued exploration success during the program’s second phase.”

Select highlights are included below and in the Company’s presentation materials available on its website at www.coeur.com. Please see “Cautionary Statements” for additional information regarding drill results. For a complete table of all drill results at Silvertip, please refer to the following link: http://www.coeur.com/_resources/pdfs/180725_SILVERTIP_Exploration_PR_Appendix_v2.pdf

Highlights

- First phase of 2018 drill program completed ahead of schedule and under budget – Since commencing in December 2017, six rigs have drilled over 44,500 meters (146,000 feet) at a total capitalized cost of US$9.2 million. This compares to a budgeted program of US$10 million to drill 30,000 meters (98,000 feet). Results from Silvertip’s drilling program received through early July are expected to support an updated resource model with a maiden reserve estimate, both of which are expected to be included in an updated technical report later this year.

-

Three zones were tested – Silver Creek, Central and Discovery – and

each has exceeded grade and thickness expectations.

- Drilling confirms continuity and suggests greater mineralized thicknesses at Central Zone – Prior to drilling, our modeling was based on limited drill data and depicted discrete pods of mineralization in the Central Zone. However, our new infill drilling now demonstrates these pods are part of thicker, more continuous manto horizons. Significant intercepts in the zone include hole CEN18-162-499-002, which returned 6.3 meters (20.7 feet) at 845.3 grams per tonne (“g/t”) (24.7 ounces per ton (“oz/t”)) silver, 10.9% zinc and 15.3% lead, or 1,788.6 g/t (52.2 oz/t) in silver equivalent1 (“AgEq”) terms. Mineralization at Central Zone is near existing underground infrastructure and remains open to the north, south and at depth.

-

Surface drilling at Discovery Zone intercepts substantial new

mineralization – Located immediately east of Central Zone, the

new drilling has intercepted several zones of previously

undiscovered mineralization as well as multiple, stacked, manto

horizons, for example hole DSC18-Pad2-004 cut:

- 11.4 meters (37.4 feet) at 193.3 g/t (5.6 oz/t) silver, 18.3% zinc and 3.2% lead, or 1,039.5 g/t (30.3 oz/t) AgEq1;

- 2.7 meters (8.9 feet) at 137.5 g/t (4.0 oz/t) silver, 10.9% zinc and 2.0% lead, or 644.4 g/t (18.8 oz/t) AgEq1;

- 3.3 meters (10.8 feet) at 851.2 g/t (24.8 oz/t) silver, 21.0% zinc and 14.6% lead, or 2,183.8 g/t (63.7 oz/t) AgEq1; and,

- 6.0 meters (19.7 feet) at 925.7 g/t (27.0 oz/t) silver, 16.0% zinc and 15.2% lead, or 2,076.9 g/t (60.6 oz/t) AgEq1.

Discovery Zone remains open to the north, south, east and at depth.

-

Drilling at Silver Creek Zone was successful in delineating

multiple stacked manto horizons and previously unknown vertical

feeders – Drilling has delineated previously unrecognized vertical

feeders paralleling the Camp Creek Fault as well as areas with

multiple stacked manto horizons in the Silver Creek Zone. These zones

of mineralization are adjacent to existing mine workings and remain

open to the south, southeast and at depth. An example of the stacked

mantos at Silver Creek include hole SCZ18-158-479-006, which cut:

- 2.9 meters (9.5 feet) at 160.4 g/t (4.7 oz/t) silver, 4.5% zinc and 3.1% lead, or 422.7 g/t (12.3 oz/t) AgEq1; and,

- 3.8 meters (12.5 feet) at 905.5 g/t (26.4 oz/t) silver, 29.2% zinc and 16.5% lead, or 2,633.5 g/t (76.8 oz/t) AgEq1.

Silvertip

Coeur completed its acquisition of the Silvertip mine in late 2017. Since then, the Company’s exploration focus has been on resource definition and conversion within three previously known zones, Silver Creek, Central and Discovery, with up to six diamond core drill rigs active. Coeur’s new drill results have indicated an expanded and more continuous resource model as illustrated in the Silvertip plan view map shown above.

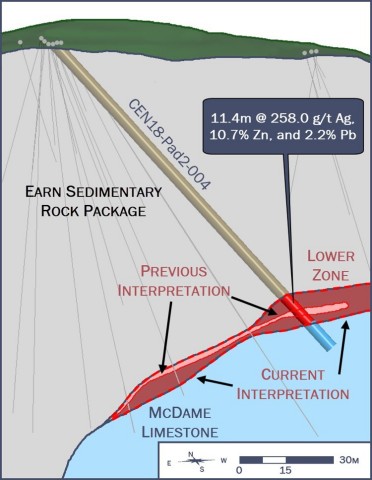

At Central Zone, up to four surface and underground rigs completed approximately 17,700 meters (58,000 feet) of drilling in 103 holes. Initial modeling portrayed the Central Zone as a discontinuous zone composed of discrete pods of manto-style mineralization due to insufficient drilling data. New infill drill holes have discovered continuity between the discrete pods and assay results have indicated metal grades exceeding prior expectations. The newly modeled thickness within these manto zones may be amenable to more efficient high-volume mining methods. Resource growth from Central Zone represents short- and mid-term opportunities to add additional mining areas located near existing infrastructure.

The cross-sectional view (shown above) of a Central Zone intercept illustrates how drilling has indicated thicker resource mineralization than previously modeled.

At Discovery Zone, drilling activity targeted resource infill and expansion with up to two surface rigs drilling a combined 6,700 meters (22,000 feet) in 22 holes. Several mineralized zones with thicknesses exceeding 14 meters (approximately 45 feet) were intercepted with grades comparable to, or exceeding, those reported historically. Drilling at Discovery has also demonstrated the possible presence of multiple stacked manto horizons forming a thicker ore zone, which has the potential to increase tonnage and mine-ability. Because of the success in the first phase of drilling this zone, the Company plans to continue here with up to two surface drill rigs in the second half of 2018 with the goal of expanding the resource to the north, south, and down-dip to the east.

At Silver Creek, up to two surface rigs completed 4,100 meters (13,500 feet) of drilling in 14 holes within the main manto horizon. This drilling has demonstrated the potential for resource expansion along the north-south Camp Creek Fault, where multiple mineralized stacked manto horizons were intercepted. Underground drilling at Silver Creek targeted vertically-oriented feeders with up to two underground rigs completing 15,800 meters (51,800 feet) in 121 holes. The program successfully discovered two new feeder systems in the area. Surface drilling later this year will continue to test mineralized manto and feeder zones along the Camp Creek Fault. Due to their geometry, these new mineralized vertical feeder structures may be amenable to long hole stoping, which may provide for more efficient and cost-effective mining than drift-and-fill in the original mine plan.

The Company approved a second phase of Silvertip’s exploration program, which commenced in early July, with a budget of approximately US$4 million, consisting of US$1.5 million of capitalized resource infill drilling, and US$2.5 million of expensed resource expansion drilling. The Company expects to complete a total of at least 18,000 meters (59,000 feet) of surface drilling by year-end.

About Coeur

Coeur Mining, Inc. is a well-diversified, growing precious metals producer with five mines in North America. Coeur produces from its wholly-owned operations: the Palmarejo silver-gold complex in Mexico, the Silvertip silver-zinc-lead mine in British Columbia, the Rochester silver-gold mine in Nevada, the Kensington gold mine in Alaska, and the Wharf gold mine in South Dakota. In addition, the Company has interests in several precious metals exploration projects throughout North America.

Cautionary Statements

This news release contains forward-looking statements within the meaning of securities legislation in the United States and Canada, including statements regarding exploration efforts and plans, exploration expenditures, drill results, resource conversion and upgrade, mine life extension, drilling, grade, thickness, mining volume and timing for publication of a technical report. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause Coeur's actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, the risk that anticipated resource conversion and upgrade are not attained, the risk that planned drilling programs may be curtailed or canceled due to budget constraints or other reasons, the risks and hazards inherent in the mining business (including risks inherent in developing large-scale mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), changes in the market prices of gold and silver and a sustained lower price environment, the uncertainties inherent in Coeur's production, exploratory and developmental activities, including risks relating to permitting and regulatory delays, ground conditions, grade variability, any future labor disputes or work stoppages, the uncertainties inherent in the estimation of gold and silver reserves, changes that could result from Coeur's future acquisition of new mining properties or businesses, the loss of any third-party smelter to which Coeur markets silver and gold, the effects of environmental and other governmental regulations, the risks inherent in the ownership or operation of or investment in mining properties or businesses in foreign countries, Coeur's ability to raise additional financing necessary to conduct its business, make payments or refinance its debt, as well as other uncertainties and risk factors set out in filings made from time to time with the United States Securities and Exchange Commission, and the Canadian securities regulators, including, without limitation, Coeur's most recent reports on Form 10-K or Form 10-Q. Actual results, developments and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward-looking statements. Coeur disclaims any intent or obligation to update publicly such forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, Coeur undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Coeur, its financial or operating results or its securities.

Christopher Pascoe, Coeur's Director, Technical Services and a qualified person under Canadian National Instrument 43-101, approved the scientific and technical information concerning Coeur's mineral projects in this news release. For a description of the key assumptions, parameters and methods used to estimate mineral reserves and resources, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, socio-political, marketing or other relevant factors, Canadian investors should refer to the Technical Reports for each of Coeur's properties as filed on SEDAR at www.sedar.com.

Notes

- For purposes of silver equivalence, metals prices of US$20.00/oz silver, US$1.30/lb zinc and US$1.05/lb lead were used.

- The potential quantity and grade for the deposits described herein are conceptual in nature. There is insufficient exploratory work to define a mineral resource and it is uncertain if further exploration will result in the applicable target being delineated as a mineral resource.

- Analytical testing for drill core samples from Silvertip was completed by Bureau Veritas on location in Whitehorse, Yukon, Canada and Vancouver, British Columbia, Canada. Analyses for silver, zinc, and lead were completed by 4-acid digestion with an ICP-ES finish. Over limits were completed by gravimetric, peroxide fusion, and titration methods, respectively.

Silvertip 2017 Year-End Resources

| Grade | ||||||||||||

| Silver | Zinc | Lead | ||||||||||

| Tonnes | Short tons | (g/t) | (oz/t) | (%) | (%) | |||||||

| Indicated Resources | 2,349,000 | 2,589,000 | 352 | 10.26 | 9.41% | 6.74% | ||||||

| Inferred Resources | 460,000 | 507,000 | 343 | 9.89 | 9.81% | 6.18% | ||||||

Notes to Mineral Resource Estimates

- Effective December 31, 2017.

- CIM definitions were followed for mineral resources.

- Mineral resources are in addition to mineral reserves and do not have demonstrated economic viability. Inferred mineral resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be considered for estimation of mineral reserves, and there is no certainty that the inferred mineral resources will be realized.

- Cut-off grade of 200 g/t AgEq was used for the calculation of the resource.

- Rounding of tons and ounces, as required by reporting guidelines, may result in apparent differences between tons, grade, and contained metal content.

- As described above, the preliminary economic analysis set forth in this release is subject to obtaining an amended permit allowing for a mining rate of 1,000 tonnes per day on a year-round basis.