--(BUSINESS WIRE)--Wolters Kluwer Tax & Accounting:

What: With the Fourth of July upon us, we celebrate Independence Day by emphasizing the tax benefits available to those who have helped to preserve and protect that independence.

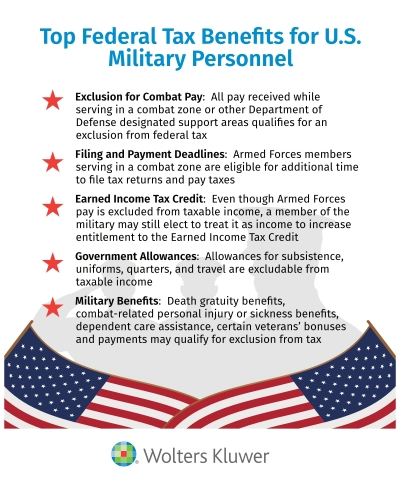

Why: Over the years, Congress has added provisions to the Tax Code that relieve some of the tax burdens otherwise owed and extended some of the tax deadlines applicable to members of the military. The attached infographic outlines the top federal tax benefits for U.S. military members.

Who: Tax expert Mark Luscombe, JD, LL.M, CPA, Principal Federal Tax Analyst at Wolters Kluwer Tax & Accounting, is available to discuss the federal tax benefits for military in more detail.

Contact: To arrange interviews with Mark Luscombe or other federal and state tax experts from Wolters Kluwer Tax & Accounting on this or any other tax-related topics, please contact:

| NICOLE YOUNG | BRENDA AU | |||

| 347-931-1055 | 847-267-2046 | |||