WINDSOR, Conn.--(BUSINESS WIRE)--Voya Financial, Inc. (NYSE:VOYA), announced today that its Retirement business has enhanced Voya’s myOrangeMoney ® online, interactive educational participant experience with new financial planning features to support people with special needs and their caregivers. As the latest addition to the company’s suite of digital, educational retirement-planning tools and resources, plan participants who are part of the special needs community now have access to information that can help address the unique planning circumstances they may face when preparing for the future.

“At Voya, serving the special needs community and their caregivers through our Voya Cares program is an extension of our vision to be America’s Retirement Company as we support all individuals and families with their holistic financial planning needs,” said Heather Lavallee, president of Tax-Exempt Markets for Voya’s Retirement business. “We are proud to be taking the lead in such a comprehensive manner, including through our online participant experience. This aligns with Voya’s broader focus on culture and being a different kind of company that cares about our mission and the millions of people we serve.”

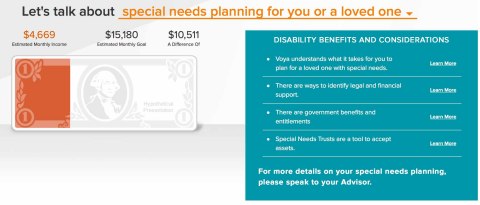

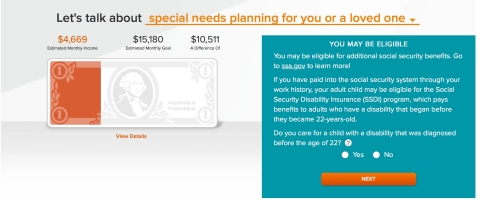

All retirement plan participants will have access to the new functionality through Voya’s award-winning myOrangeMoney website. 1 Based on a few questions that are presented to them; individuals are prompted to consider their eligibility for certain government benefits, such as Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI). In addition to these specific government programs, participants can also learn more about a number of other important topics for their planning needs such as, broader special needs planning guidance; specialized legal and financial resources; additional government benefits including Medicare and Medicaid; as well as background on special needs trusts and the important role they can play within one’s financial strategy.

Voya has begun to shine a light on the issues that people living with special needs and disabilities and their families and caregivers face daily. To help bridge the gap of where people can go for help, educational resources are made available through the Voya Cares ™ resource center , which provides further information and support for those with a disability or their caregivers.

“As part of our commitment to being the retirement industry’s leading resource for special needs planning, integration into our participant experience online is critical,” added Christine Lange, senior vice president, Retirement Digital Solutions for Voya Financial. “Caring for a family member when you are no longer working is something that most people do not often consider. By providing access to key information and resources, we can help educate participants to make better planning decisions and choices.”

The innovative myOrangeMoney website experience is helping millions of Americans change the way they manage and engage with their retirement plan. Since its launch in 2014, the website has helped thousands of workers contribute over $200 million more into their retirement accounts. 2 In addition to this latest enhancement, Voya has added Social Security and retirement health care cost modeling functions. Personalized videos have also been incorporated to give plan participants a snapshot of their saving status, while educating them on the positive actions they can take now to achieve their future goals. Additional features, such as financial wellness tools, are scheduled for the early half of 2018.

As an industry leader and advocate for greater retirement readiness, Voya Financial is committed to delivering on its vision to be America’s Retirement Company ® . Our goal is to make a secure financial future possible for everyone — one person, one family, one institution at a time.

1. Recipient of DALBAR’s 2017 Communications Seal for the participant website and mobile app, representing excellence in financial services communications.

2. The myOrangeMoney ® DataMart for the period of July 1, 2014 – Sept. 30, 2017; products and services are offered through the Voya ® family of companies.

About Voya Financial ®

Voya Financial, Inc. (NYSE: VOYA), helps Americans plan, invest and protect their savings — to get ready to retire better. Serving the financial needs of approximately 14.7 million individual and institutional customers in the United States, Voya is a Fortune 500 company that had $8.6 billion in revenue in 2017. The company had $555 billion in total assets under management and administration as of Dec. 31, 2017. With a clear mission to make a secure financial future possible — one person, one family, one institution at a time — Voya’s vision is to be America’s Retirement Company ® . Certified as a “Great Place to Work” by the Great Place to Work ® Institute, Voya is equally committed to conducting business in a way that is socially, environmentally, economically and ethically responsible. Voya has been recognized as one of the 2018 World’s Most Ethical Companies ® by the Ethisphere Institute, one of the 2018 World’s Most Admired Companies by Fortune magazine and one of the Top Green Companies in the U.S. by Newsweek magazine. For more information, visit voya.com . Follow Voya Financial on Facebook , LinkedIn and Twitter @Voya .