NEWARK, N.J.--(BUSINESS WIRE)--PGIM Investments is proud to announce that the PGIM Fixed Income portfolio managers of the Prudential Total Return Bond Fund (PDBZX) have been named Morningstar’s 2017 Fixed-Income Fund Manager of the Year. PGIM Investments is the global retail manufacturer and distributor of PGIM, Inc., the $1 trillion global investment management businesses of Prudential Financial, Inc. (NYSE:PRU) – a top 10 asset manager globally.1

The five-star rated fund is managed by Robert Tipp, CFA; Michael Collins, CFA; and Richard Piccirillo and Gregory Peters, who together average 27 years of investment experience. PGIM Fixed Income is a leading provider of active global fixed income solutions that has been managing assets for over 140 years, and is one of the largest and most experienced fixed income managers in the industry.

In recognizing the portfolio management team, Morningstar’s Brian Moriarty states, “The overall group is run by CIO Mike Lillard, and his earlier role as head of risk management gives a window into the priorities of the team and this fund. This portfolio carries well-defined risk guidelines and benefits from the methodical, deep, and broad research across sectors and disciplines of roughly 125 portfolio managers, 100 analysts, and 50 quantitative and risk-management pros.”2

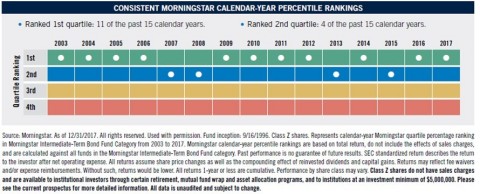

In 2017, the Prudential Total Return Bond Fund outperformed its benchmark, the Bloomberg Barclays U.S. Aggregate by 3.08%, ranking in the top 2%3 of its Morningstar category. Over the last 10 years it has outperformed its benchmark by 1.98% annually and ranked in the top 1%3 of the category by return and top 2%3 by information ratio. It has spent the last 15 consecutive years ranked among the top half of its peers, with 11 of those years being in the top quartile.3

The Fund also became the #1 active3 asset-gathering fund in the Morningstar intermediate-term bond category and the #2 active3 asset-gathering fund across all Morningstar categories. The Fund ended the year with $30 billion in assets under management.

“The managers of the Prudential Total Return Bond Fund have consistently sought to provide investors with the best opportunities in all sectors of the fixed income market. The team’s stewardship of the Fund and their consistent results reflect PGIM Fixed Income’s vision to be widely regarded as a premier, active global fixed income manager,” said Michael Lillard, head of PGIM Fixed Income and chief investment officer.

"It’s an honor to be recognized by Morningstar,” said Stuart Parker, CEO and president of PGIM Investments. “This award is not only acknowledgment of the incredible contributions of this team, but is a testament to our world-class fixed income capabilities that add value to our clients and shareholders.”

Established in 1988, the Morningstar Fund Manager of the Year award recognizes portfolio managers who demonstrate excellent investment skill and the courage to differ from the consensus to benefit investors. To qualify for the award, managers’ funds must have not only posted impressive returns for the year, but also must have a record of delivering outstanding long-term risk-adjusted performance and of aligning their interests with shareholders.

About PGIM Investments

PGIM Investments offers more than 100 funds globally across a broad spectrum of asset classes and investment styles. Clients can also choose from a variety of investment vehicles such as closed-end funds, managed accounts, and target date funds such as the Prudential Day One Mutual Fund series. All products draw on PGIM’s globally diversified investment platform that encompasses the expertise of managers across fixed income, equities and real estate.

About PGIM and Prudential Financial, Inc.

With 14 consecutive years of positive third-party institutional net flows, PGIM, the global asset management businesses of Prudential Financial, Inc. (NYSE: PRU), ranks among the top 10 largest asset managers in the world with more than $1 trillion in assets under management as of Sept. 30, 2017. PGIM’s businesses offer a range of investment solutions for retail and institutional investors around the world across a broad range of asset classes, including fundamental equity, quantitative equity, public fixed income, private fixed income, real estate and commercial mortgages. Its businesses have offices in 16 countries across five continents. For more information, please visit pgim.com.

PGIM is a business of Prudential Financial, Inc. (NYSE: PRU), a financial services leader with operations in Asia, Europe and Latin America. Its additional businesses offer a variety of products and services, including life insurance, annuities and retirement-related services. For more information, please visit news.prudential.com.

1 Pensions & Investments Top Money Managers list,

5/29/17. Represents assets managed by Prudential Financial as of

12/31/2016.

2 Brian Moriarty, “Nominees for 2017

Fixed-Income Fund Manager of the Year,” published Jan. 22, 2018, on

Morningstar.com.

3 Fund (Class Z) Morningstar rankings:

1-year: 2% (18/986), 3-year: 3% (23/847), 5-year: 3% (27/778), 10-year:

1% (5/554); are based on risk-adjusted returns, do not include the

effects of sales charges, and are calculated using Morningstar Direct

software against all funds in the Morningstar Intermediate-Term Bond

category. Morningstar rankings (Class Z) are based on total return, do

not include the effects of sales charges, and are calculated against all

funds in the Morningstar Intermediate-Term Bond Category.

The Fund Manager of the Year award winners are chosen based on research and in-depth qualitative evaluation by Morningstar’s Manager Research Group.

Morningstar Awards 2017. © 2018 Morningstar, Inc. All rights reserved. Prudential Total Return Bond Fund (PDBZX) awarded U.S. Fixed-Income Fund Manager of the Year. The Fund Manager of the Year award winners are chosen based on research and in-depth qualitative evaluation by Morningstar’s Manager Research Group.

Morningstar’s Manager Research Group consists of various wholly owned subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research Services LLC. Analyst Ratings are subjective in nature and should not be used as the sole basis for investment decisions. Analyst Ratings are based on Morningstar’s Manager Research Group’s current expectations about future events and therefore involve unknown risks and uncertainties that may cause such expectations not to occur or to differ significantly from what was expected. Analyst Ratings are not guarantees nor should they be viewed as an assessment of a fund’s or the fund’s underlying securities’ creditworthiness. This press release is for informational purposes only; references to securities in this press release should not be considered an offer or solicitation to buy or sell the securities.

Morningstar Ratings may not be customarily based on adjusted historical returns. If so, an investment's independent Morningstar Rating metric is compared against the retail mutual fund universe breakpoints to determine its hypothetical rating for certain time periods. The Morningstar Rating for funds, or “star rating,” is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

Prudential Total Return Bond Fund received 5 stars for Class A, B, Q, R2, R4 and Z shares. For the overall, 3-, 5- and 10-year periods, respectively, as of 12/31/17: Prudential Total Return Bond Fund (Class A) was rated 5 stars out of 847 funds, 5 stars out of 847 funds, 5 stars out of 778 funds, and 5 stars out of 554 funds, respectively; Prudential Total Return Bond Fund (Class B) was rated 5 stars out of 847 funds, 4 stars out of 847 funds, 4 stars out of 778 funds, and 5 stars out of 554 funds, respectively; Prudential Total Return Bond Fund (Class Q) was rated 5 stars out of 847 funds, 5 stars out of 847 funds, 5 stars out of 778 funds, and 5 stars out of 554 funds, respectively; Prudential Total Return Bond Fund (Class Z) was rated 5 stars out of 847 funds, 5 stars out of 847 funds, 5 stars out of 778 funds, and 5 stars out of 554 funds, respectively.

The Fund may invest in high yield (“junk”) bonds (up to 30%), which are subject to greater credit and market risks; foreign securities (up to 30%), which are subject to currency fluctuation and political uncertainty; mortgage-related securities which are subject to prepayment risks; short sales, which involve costs and the risk of potentially unlimited losses; leveraging techniques, which may magnify losses; and derivative securities, which may carry market, credit, and liquidity risks. The Fund may not be invested in all sectors at a given time. Fixed income investments are subject to interest rate risk, and their value will decline as interest rates rise. Diversification does not assure a profit or protect against loss in declining markets. U.S. government securities and U.S. Treasury bills are backed by the full faith and credit of the U.S. government, are less volatile than equity investments, and provide a guaranteed return of principal at maturity. These risks may increase the Fund’s share price volatility.

This material is being provided for informational or educational purposes only and does not take into account the investment objectives or financial situation of any client or prospective clients. The information is not intended as investment advice and is not a recommendation about managing or investing your retirement savings. Clients seeking information regarding their particular investment needs should contact a financial professional.

Mutual fund investing involves risk. Some mutual funds have more risk than others. The investment return and principal value will fluctuate, and shares, when sold, may be worth more or less than the original cost. Investors should be prepared to bear this loss. The risks associated with the fund are explained more fully in the fund’s prospectus. There is no guarantee the fund’s objectives will be achieved. Diversification and asset allocation do not guarantee a profit or protect against loss in declining markets.

Consider a fund’s investment objectives, risks, charges and expenses carefully before investing. The prospectus and the summary prospectus contain this and other information about the fund. Contact your financial professional for a prospectus and the summary prospectus. Read them carefully before investing.

Mutual funds are distributed by Prudential Investment Management Services LLC, a Prudential Financial company. PGIM Fixed Income is a unit of PGIM. © 2018 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

0314349-00001-00