ALEXANDRIA, Va.--(BUSINESS WIRE)--Small and mid-sized companies are significantly more likely to allow business travelers to use non-transparent payment methods such as personal credit cards or cash advances, according to new research released today by the GBTA Foundation, the education and research arm of the Global Business Travel Association. When looking at usage of corporate credit cards, Central Travel Accounts (CTAs) and virtual cards, adoption is consistent regardless of company size, showing these methods are accessible for a variety of companies.

The 2017 Business Travel Payments Study, conducted in partnership with AirPlus International, revealed corporate credit card use remains widespread with 9 of 10 travel programs using them. While corporate cards are almost universal, more than half of travel programs report using virtual payments. Non-corporate payment methods - such as cash - still play a role as well.

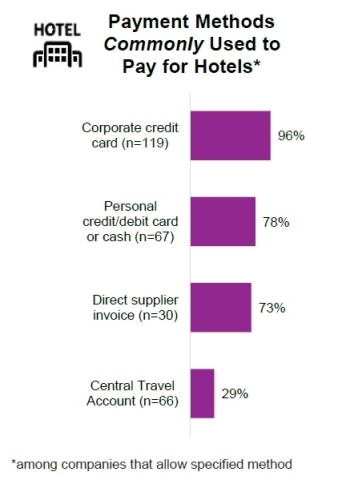

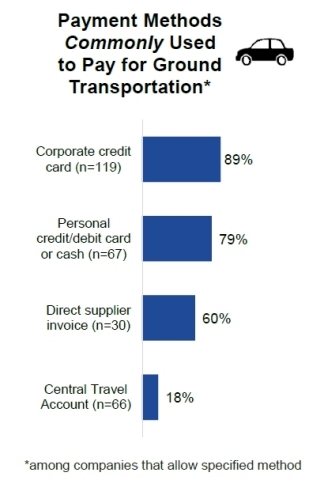

Additionally, the study also revealed what payment methods companies use for various travel expenses. Non-corporate payment methods are used for more than just meals as one might expect. In fact, they are commonly used for hotels and ground transportation as well.

“The persistence of non-corporate methods like cash, supplier invoices, personal cards or company cash advances may reflect the prevalence of infrequent and non-employee travel,” said Monica Sanchez, director of research for the GBTA Foundation. “Regardless of the reason, these methods can pose problems including reduced spend visibility making it difficult to both track and enforce policy compliance and to perform back-offices functions such as reconciliation and reimbursement as well.”

Rebates & Fees: What You Don’t Know Can Cost Your Company

Many payment providers offer an annual rebate to corporate card customers, however, if companies do not meet spend targets, or do not pay their bills on time, they may only receive a partial rebate. While 92 percent of travel managers say their company has a rebate agreement with their primary corporate card providers, a full 22 percent do not know if their company is receiving the full amount. This suggests many companies do not carefully track the return on investment of their card program.

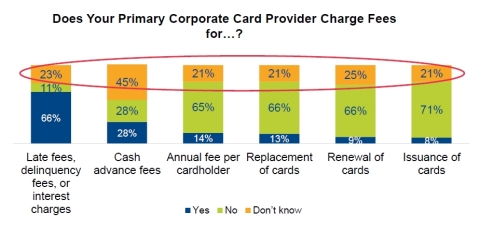

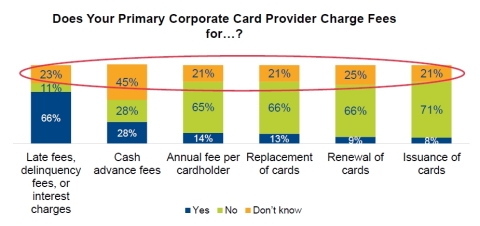

Travel programs can also incur fees when using corporate payment products, yet a portion of travel managers do not even know if their provider charges them various fees – including common fees like cash advance or foreign exchange fees. This could lead to unexpected costs for organizations.

“Many times, one team negotiates the payment contract (e.g. procurement or finance) while another team actually executes on that contract (e.g. travel). It is critical that these teams work together during contract negotiation to maximize their cost benefits as it relates to paying for business travel,” states Rebecca Kilby, CEO and President of AirPlus International Inc.

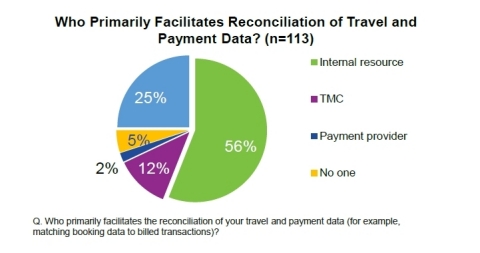

Additionally, a majority of companies rely primarily on an internal resource to facilitate reconciliation of travel and payment data rather than employing an automated reconciliation process. As a result, when companies have a time-consuming reconciliation process, it can hurt their bottom line.

The Data is in the Details

One of the advantages of corporate payment products is that they improve spend visibility. Even with new technology such as mobile apps that parse data from receipts and invoices seemingly making corporate products less necessary, it appears corporate products do still have an advantage when it comes to spend visibility. A large majority of travel managers are satisfied with the level of data obtained from CTAs (74 percent) and corporate cards (73 percent), compared to only 48 percent who are satisfied with the level of data obtained from personal cards/cash. For many travel programs, detailed expense data is critical to track policy compliance.

More Information

The report, 2017 Business Travel Payment Methods, is available exclusively to GBTA members by clicking here and non-members may purchase the report through the GBTA Foundation by emailing pyachnes@gbtafoundation.org.

The GBTA Foundation will host a webinar with the support of AirPlus on November 7, 2017 at 2pm ET to discuss the findings of the study and encourage travel programs to think about different payment methods available and what the best solutions are for their program. Register today.

Methodology: The GBTA Foundation conducted an online survey of 137 U.S. travel managers from May 23 – June 6, 2017. Respondents qualified because they were a travel manager/buyer or procurement officer and have at least some input in making decisions about payment solutions providers and policies.

About AirPlus

AirPlus is a leading international provider of payment solutions for the day-to-day management of business travel. More than 49,000 corporate clients count on AirPlus for the payment and analysis of their business trip costs. Products and services such as central bill accounts, single-use virtual cards, corporate cards and online management tools are marketed worldwide under the AirPlus International brand. The AirPlus Company Account is the most successful central bill account based on UATP. For more information, please visit www.airplus.com/us/en

About the GBTA Foundation

The GBTA Foundation is the education and research foundation of the Global Business Travel Association (GBTA), the world’s premier business travel and meetings trade organization headquartered in the Washington, D.C. area with operations on six continents. Collectively, GBTA’s 9,000-plus members manage more than $345 billion of global business travel and meetings expenditures annually. GBTA provides its growing network of more than 28,000 travel professionals and 125,000 active contacts with world-class education, events, research, advocacy and media. The Foundation was established in 1997 to support GBTA’s members and the industry as a whole. As the leading education and research foundation in the business travel industry, the GBTA Foundation seeks to fund initiatives to advance the business travel profession. The GBTA Foundation is a 501(c)(3) nonprofit organization. For more information, see gbta.org and gbta.org/foundation.