TLALNEPANTLA DE BAZ, Mexico--(BUSINESS WIRE)--Mexichem, S.A.B. de C.V. (BMV: MEXCHEM*) (“the Company” or “Mexichem”) today announced its unaudited results for the third quarter of 2017. The figures have been prepared in accordance with International Financial Reporting Standards (“NIIF” or “IFRS”), having US dollars as the functional and reporting currency. All comparisons are made against the same period of the prior year. Unless specified to the contrary all figures are in millions. In some cases, percentages and numbers have been rounded.

Please note that the presentation of Mexichem’s 2016 third quarter results reflect the effects of several actions taken by the Company in 2016 and in the first quarter of 2017. A detailed review of these actions and their impact can be found on Page 17 of this release. It is highly recommended that you read these Clarifications prior to analyzing the Company´s 3Q17 results.

Third Quarter 2017 Financial and Operating Highlights (compared to 3Q16):

- Revenues increased 8% to $1.5 billion.

- EBITDA was $297 million a 21% increase compared to Adjusted EBITDA* of $245 million.

- EBT was $152 million up 37% from Adjusted EBT* of $111 million.

- Consolidated Net Income increased 24% to $91 million vs Adjusted Consolidated Net Income and Net Majority Income totaled $61 million.

- Cash Flow before dividends was up 87% to $148 million and Free Cash Flow increased 5% to $68 million.

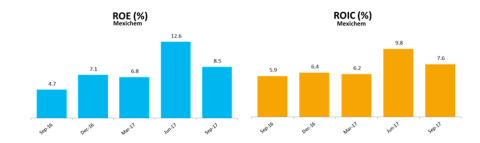

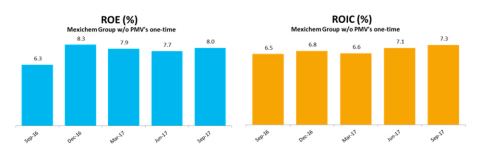

- TTM Adjusted ROE* was 8.0% and TTM Adjusted ROIC* was 7.3%, up 170 bps and 80 bps, respectively.

*Adjusted figures for the comparable period in 2016 exclude the impact of the asset write-off and the subsequent one-time benefit related to the accident at PMV’s VCM plant.

CONSOLIDATED SELECTED FINANCIAL RESULTS

| mm US$ | Third Quarter | January - September | ||||||||||

| Selected Financial Results | 2017 | 2016 | %Var. | 2017 | 2016 | % Var. | ||||||

| Net Sales | 1,505 | 1,394 | 8% | 4,363 | 4,072 | 7% | ||||||

| Operating Income | 196 | 385 | -49% | 548 | 398 | 38% | ||||||

| EBITDA | 297 | 468 | -37% | 838 | 643 | 30% | ||||||

| EBITDA Margin | 19.7% | 33.6% | -1,387 bps | 19.2% | 15.8% | 341 bps | ||||||

| EBT | 152 | 335 | -55% | 386 | 266 | 45% | ||||||

| Consolidated Net Income (Loss) | 91 | 230 | -61% | 236 | 164 | 44% | ||||||

| Net Majority Income | 61 | 161 | -62% | 180 | 191 | -6% | ||||||

| Operating Cash Flow Before Capex | 215 | 166 | 29% | 380 | 340 | 12% | ||||||

| Cash Flow Before Dividends | 148 | 79 | 87% | 172 | 20 | 751% | ||||||

| Free Cash Flow | 68 | 65 | 5% | 40 | -22 | N/A | ||||||

| Total CAPEX (Organic & JV) | -67 | -87 | -23% | -208 | -320 | -35% | ||||||

| Adjusted Operating Income* | 196 | 162 | 21% | 548 | 460 | 19% | ||||||

| Adjusted EBITDA* | 297 | 245 | 21% | 838 | 705 | 19% | ||||||

| Adjusted EBITDA Margin* | 19.7% | 17.5% | 218 bps | 19.2% | 17.3% | 190 bps | ||||||

| Adjusted EBT* | 152 | 111 | 37% | 386 | 328 | 18% | ||||||

| Adjusted Consolidated Net Income* | 91 | 73 | 24% | 236 | 220 | 7% | ||||||

| Adjusted Net Maj. Income* | 61 | 73 | -17% | 180 | 223 | -19% | ||||||

*Given that Mexichem’s reported earnings results (including the impact of the asset write-off related to the accident at PMV’s VCM plant) differ substantially from its reported operating results (without the write-off), for clarification purposes, since the incident the Company´s quarterly reports have contained reported EBIT, EBITDA and net income including the one-time net effect related to PMV´s VCM plant, as well as*Adjusted EBIT, EBITDA and net income which exclude that effect. In the 1Q17 and 2Q17 the only effect recorded was business interruption insurance coverage, which is not considered to be a one-time effect. In the 3Q17 there was not recorded any business interruption insurance coverage, therefore the report for 3Q17 does not include a presentation of adjusted figures.

Nine Months 2017 Financial and Operating Highlights (compared to first Nine Months 2016)

- Revenues Increased 7% to $4.4 billion.

- EBITDA was $838 million a 19% increase compared to Adjusted EBITDA* of $705 million.

- EBT was $386 million, up 18% from Adjusted EBT* of $328 million.

- Consolidated Net Income increased 7% vs Adjusted Consolidated Net Income and Net Majority Income was $180 million.

- Cash Flow before dividends increased to $172 million from $20 million and Free Cash Flow increased to $40 million from a negative of $22 million.

Company Narrows EBITDA Guidance to High End of Range; Expects 2017 EBITDA to be 20%-25% Above 2016 Reported EBITDA of $884 million.

MANAGEMENT COMMENTARY

Performance and Outlook

The third quarter was a very active period for Mexichem. We announced a definitive agreement to acquire 80% of Netafim, faced and overcame significant issues due to the hurricane in Texas and successfully completed a $1 billion global bond offering to fund the Netafim acquisition. Throughout all this activity, Mexichem demonstrated the resilience and the strength of our business model and strategies.

Mexichem’s results continued to benefit from our balanced growth strategy, prioritizing vertical integration, a broad portfolio increasingly comprised of specialty products, and diversification across key global markets. In the third quarter, we posted EBITDA growth of 21% over the adjusted results of the similar period last year, on revenue growth of 8%. This strong performance reflected Mexichem’s significant scale as a vertically-integrated PVC producer, our leadership in the manufacturing and supply of Fluor products, and our positioning in high growth specialty markets, particularly in Datacom products. Third quarter EBITDA growth was led by double-digit, year-on year increases in our Vinyl and Fluor Business Groups and in our Fluent US/Canada Business Unit as well as solid year-on-year progress in Fluent Europe. These favorable factors more than offset the impact of lower year-on-year comparisons in Fluent LatAm and AMEA, where abrupt increases in PVC prices, shortages of PVC due to “force majeure” conditions, and slower economic conditions temporarily reduced profitability.

We are pleased by the strong EBITDA growth showed in the third quarter, which has put us firmly on track to achieve the high end of our guidance range for full year 2017.

Our Vinyl Business Group’s EBITDA results were driven primarily by the benefits of its vertical integration across the ethane to PVC value chain following our multi-year investment in Mexichem’s ethylene cracker joint venture, as well as significant price increases compared to 2016 levels. Higher third quarter PVC prices reflected positive global supply and demand factors, as well as short term increases due to the “force majeure” conditions that took effect in the wake of hurricane Harvey’s impact on the Texas Gulf Coast.

In the Fluor Business Group, we saw significant revenue growth in both our upstream and downstream businesses, for the first time in several quarters. Demand from the major end markets for our fluorspar products, namely steel and cement, has been improving, and refrigerant gas prices continue trending above last year’s levels.

Results in our Fluent Business Group were mixed. Higher raw material costs tied to higher PVC prices weighed on the Group’s EBITDA performance mainly in Fluent LatAm where our products are mainly based on PVC. Despite this headwind, Fluent Europe and Fluent US/Canada were able to post solid increases in EBITDA compared to last year’s third quarter, primarily driven by strong demand for Datacom products.

In summary, our third quarter results were a solid reflection of the strategy we put in place almost four years ago, when we took actions to significantly improve our margin performance by building a diversified, yet complementary business portfolio through investing in vertical integration, organic projects and in acquisitions. Our companywide EBITDA margin was nearly 20%, and for the trailing twelve months our adjusted returns on equity and invested capital reached 8.0% and 7.3%, respectively, representing improvements of 170 basis points and 80 basis points, respectively, over last year’s levels.

A major growth initiative that we announced in the third quarter was our agreement to acquire an 80% stake in Netafim, the world’s largest irrigation company with 2016 sales of $855 million. In addition to positioning Mexichem as the leader in the high growth micro irrigation market, this is a transformative acquisition for our entire organization as it accelerates our drive into specialty products and solutions—providing a platform from which to create industrial solutions around our existing product lines. In September, we successfully completed an international bond offering that raised $1 billion at very attractive interest rates to fund the Netafim transaction, which is expected to close in early December.

Thanks to our strong operating cash flow, Mexichem has a track record of paying down acquisition-related debt quickly. In the first nine months of 2017, Operating Cash Flow before Capex was $380 million (12% higher than first nine months of 2016), Free Cash Flow was $40 million a $62 million swing from the negative $22 million in the first nine months of 2016, and we anticipate returning to our target Net Debt to EBITDA leverage ratio of below 2x within 18 months after the completion of the Netafim acquisition.

Recent media reports mentioned sanctions imposed by the Mexican Nacional Banking and Securities Commission (CNBV) on several individuals, one of whom is a member of Mexichem´s board of directors. The Company states that was never either part of the investigation nor was it sanctioned. Mexichem has continually strengthened its corporate governance structure and its compliance with applicable regulations, including those relating to transactions related to its securities. None of the processes indicated have any effect with respect to the Company.

Looking ahead, we expect Mexichem’s strong performance to continue in the fourth quarter. Our Vinyl Business Group stands to benefit from its vertical integration and better pricing compared to last year; the Fluor Business Group is positioned to capture improved demand in its upstream operations and higher refrigerant gas prices; and our Fluent Business Group, while affected by higher input prices, is seeing strong demand for its Datacom products, and we expect a pick-up in LatAm results. Based on our EBITDA performance to date and our visibility, we have narrowed our EBITDA guidance to the high end of the original range we provided, and now expect EBITDA growth of 20% to 25% from 2016 levels.

As we look to 2018, we continue to focus on increasing returns and rolling out cross selling initiatives and operating efficiencies across our organization. We believe Mexichem is well positioned to continue to drive organic growth and that the synergies and opportunities provided by Netafim will make this an excellent acquisition for our Company. We have strong tailwinds in most of our businesses, and at the same time, our strategies are yielding positive results. This combination underpins our expectations for Mexichem’s strong performance in 2018.

REVENUES

Third quarter 2017 revenues were $1.5 billion, up $111 million, or 8%, from 3Q16 led by higher sales in all our Business Groups.

Revenue growth in our Resins, Compounds, and Derivatives business units continues to be driven by positive market dynamics in the PVC industry and supply constraints in the US due to the impact of hurricane Harvey which resulted in additional PVC price increases in September. These factors generated a 7% increase in revenues on a 1% decrease in volumes, reflecting higher prices as well as the successful integration our acquisition of U.K.-based Vinyl Compounds, Ltd.

Fluent Business Group revenues grew 5% or $35 million. Healthy revenue growth in AMEA, Europe and US/Canada of 10%, 9% and 8%, respectively, more than compensated for the 2% decline in LatAm, resulting primary from a slower than expected economic recovery in Brazil.

Fluor Business Group revenues increased 22%, fueled by significant revenue growth in both our upstream and downstream businesses, for the first time in several quarters driven by demand from the major end markets for our upstream products (met and acid grade fluorspar mainly), namely the steel and cement industries, and higher refrigerant gas prices mainly in Europe.

In 3Q17 the exchange rate translation effect had a positive impact on consolidated sales of $14 million, mainly due to the appreciation of the Euro and the Real against the US dollar.

For the 9M17 consolidated revenues increased $291 million or 7% year-on-year to $4.4 billion. On a constant currency basis, total sales would have increased 8% year-on-year. Foreign currency translations reduced total sales by $29 million mainly coming from Turkish lira and the GBP devaluations of 23% and 9% respectively, partially offset by an 11% Real revaluation in Brazil. Out of this 33%, 34% and 34% correspond to Vinyl, Fluor and Fluent Business Groups, respectively.

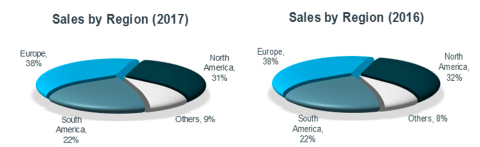

SALES BY REGION (DESTINATION)

The United States represented 16% of total sales by destination in 9M17, Germany accounted for 8% and Brazil and the UK represented 7% and 6%, respectively.

EBITDA

EBITDA in 3Q17 was $297 million, compared to $468 million reported in the third quarter of last year, when the one-time net benefit of $224 million associated with the PMV incident was recognized. EBITDA increased 21% compared to 3Q16 adjusted EBITDA of $245 million. EBITDA margin in 3Q17 was 19.7%, a 218 bps increase vs. adjusted EBITDA margin in the 3Q16.

Despite the “Force Majeure” declared on September 1, 2017 due to the landfall of hurricane Harvey, the Vinyl and Fluor Business Group´s EBITDA increased $55 million (compared to adjusted figures in 3Q16), and $9 million, respectively, while Fluent USA/Canada and Europe posted double digit and high single digit EBITDA growth, respectively. These positive results are explained by: i) Higher PVC prices when compared to the 3Q16; ii) increased profitability from the vertical integration in our Vinyl Business Group due to the start-up of commercial operations of the ethylene cracker; iii) Improved refrigerant gas prices in the U.S. associated with the ITC resolution announced by the Company on March 23th, 2017, as well as a better refrigerant gases price environment in the EU; and iv) better than expected Fluent sales of “Last Mile” natural gas distribution pipes in the U.S.A. EBITDA improvements were partially offset by Fluent LatAm which was impacted by the challenging economic environment, primarily in Brazil.

In 3Q17 the translation effect does not impact EBITDA due that currency devaluations and revaluations in the countries where the functional and reporting currency is not the US dollar, offset each other.

For the first nine months of 2017, EBITDA was $838 million, increases of 30% and 19%, respectively, vs reported and Adjusted EBITDA in 9M16. EBITDA margin was 19.2%. On a constant currency basis, there was an impact of $6 million on EBITDA. Exclusive of this impact, EBITDA would have grown 31% and 20% compared to the first nine months reported and adjusted EBITDA for 2016, respectively. This put us on track to achieve the higher end of our EBITDA guidance range, and now we expect a 20% to 25% EBITDA increase vs reported 2016 EBITDA of $884 million.

OPERATING INCOME

For the 3Q17, Mexichem reported operating income of $196 million, compared to the $385 million reported in the third quarter of 2016 when the one-time net benefit of $224 million associated with the PMV incident was recognized. Operating income increased 21% compared to the $162 million adjusted operating income for 3Q16. The increase in operating income was mainly the result of the factors mentioned above.

For the 9M17, operating income was $548 million, compared to the $398 million reported in the same period of 2016, an increase of 38%, while compared to the adjusted numbers (without PMV’s one-time effect), operating income increased 19%.

FINANCIAL COSTS

During 3Q17 financial costs declined by $6 million or 12% compared to the 3Q16. This can be explained by monetary gains of $5 million related to the net obligations (liabilities less assets when liabilities are higher than assets) booked in currencies other than the functional and/or reporting currency for each country and $1 million related to hyperinflationary benefits from Venezuela.

For the first 9M17 financial costs rose by $28 million or 21% to $163 million compared to the same period in 2016. This increase is mainly related to the company’s debt denominated in Mexican pesos, as this currency appreciated against the US dollar during the period, generating an FX loss of $19 million in the period, while in 2016 the Mexican peso depreciated against the US dollar and a gain of $18 million was registered. The prior year impact was partially offset by monetary gains of $7 million related to the company’s net obligations (liabilities less assets when liabilities are higher than assets) booked in currencies other than the functional and/or reporting currency for each country and $2 million related to hyperinflationary benefits from Venezuela.

TAXES

In 3Q17 cash tax declined 5% or $2 million compared to 3Q16 due to changes in the mix of Mexichem´s subsidiaries that generate net gains and those with net losses. The effective tax rate increased to 41% compared to 29% in 3Q16. This was mainly due to the reduction of the deferred tax asset. During 3Q17 Mexichem used some of its net operating losses (deferred tax asset) to offset taxable income associated with foreign exchange gains generated by the 4.9% Mexican peso appreciation effect against US dollar. This appreciation generated a tax FX gain in the holding company in Mexico where the highest proportion of the US dollar denominated debt of Mexichem is allocated.

For the first 9M17, cash taxes decreased from $128 million to $104 million mainly due to the impact of a currency appreciation in dollar denominated account receivables mainly in our Fluor Business Group reducing their taxable base, while deferred taxes reduced for the reason explained above related to the appreciation of the Mexican peso against the US dollar in relation to the dollar denominated debt in the holding company.

CONSOLIDATED NET INCOME (LOSS) AND MAJORITY INCOME (LOSS)

In 3Q17, the Company reported Consolidated Net Income of $91 million and a Net Majority Income of $61 million, compared to a reported Consolidated Net Income and Net Majority income of $230 million and $161 million in the 3Q16 when the one-time benefit associated with PMV’s incident was recognized. Without that one-time effect, Consolidated Net Income and Net Majority Income in 3Q16 were both $73 million

On an adjusted basis, Income from continuing operations before income tax increased 37% in the 3Q17, while Consolidated Net Income increased by 24%, due to the tax effects mentioned above. However, Income from continuing operations after cash tax increased 57%, mainly due to the use of bonus depreciation in our cracker JV in Texas.

On an adjusted basis Majority Net Income for the quarter declined 17% mainly as a result of higher deferred taxes (non-cash) due to the appreciation of the Mexican peso against US dollar which reduces deferred tax asset and generates a deferred tax expense. Without the deferred taxes impact, net income in 3Q17 would have increase more than 20%.

| mm US$ | Third Quarter | ||||||||||

| Income statement | 2017 | 2016 |

2016 w/o one time item |

%

17/Adj. 16 |

|||||||

| Income (loss) from continuing operations before income tax | 152 | 335 | 111 | 37% | |||||||

| Cash tax | 34 | 36 | 36 | -5% | |||||||

| Income (loss) from continuing operations after cash tax | 118 | 299 | 75 | 57% | |||||||

| Deferred taxes | 28 | 61 | (6) | N/A | |||||||

| Income (loss) from continuing operations | 90 | 238 | 81 | 11% | |||||||

| Discontinued operations | 1 | (8) | (8) | N/A | |||||||

| Consolidated net income (loss) | 91 | 230 | 73 | 24% | |||||||

| Minority stockholders | 30 | 69 | (0) | N/A | |||||||

| Net income (loss) | 61 | 161 | 73 | -17% | |||||||

For the first nine months of 2017, the Company posted $236 million and $180 million in Consolidated Net Income and Net Majority Income respectively, compared to the $164 million and $191 million reported in the same period of 2016.

On an adjusted basis, Income from continuing operations before income tax was 18% higher, nonetheless Consolidated Net Income increased 7%, as a result of the tax effects mentioned above. However, Income from continuing operations after cash tax increased 41%, due to the use of bonus depreciation in our cracker JV in Texas.

Net Majority Income decreased 19% from 9M16 to 9M17 on an adjusted basis because all the effects abovementioned. Without the deferred taxes impact explained above, Net Majority Income in 3Q17 would have increased more than 1.5%.

| mm US$ | January - September | ||||||||||

| 2017 | 2016 | 2016 w/o one time item |

%

17/Adj. 16 |

||||||||

| Income (loss) from continuing operations before income tax | 386 | 266 | 328 | 18% | |||||||

| Cash tax | 104 | 128 | 128 | -19% | |||||||

| Income (loss) from continuing operations after cash tax | 282 | 139 | 200 | 41% | |||||||

| Deferred taxes | 47 | (35) | (30) | N/A | |||||||

| Income (loss) from continuing operations | 235 | 174 | 230 | 2% | |||||||

| Discontinued operations | 1 | (10) | (10) | N/A | |||||||

| Consolidated net income (loss) | 236 | 164 | 220 | 7% | |||||||

| Minority stockholders | 56 | (27) | (3) | N/A | |||||||

| Net income (loss) | 180 | 191 | 223 | -19% | |||||||

OPERATING CASH FLOW HIGHLIGHTS

| mm US$ | Third Quarter | January - September | ||||||||||||

| 2017 | 2016 | %Var. | 2017 | 2016 | % Var. | |||||||||

| EBITDA | 297 | 468 | -37% | 838 | 643 | 30% | ||||||||

| One time non-cash Items | 0 | -220 | -100% | 0 | 57 | -100% | ||||||||

| Adjusted EBITDA minus cash item* | 297 | 248 | 19% | 838 | 700 | 20% | ||||||||

| Cash Tax | -34 | -36 | -5% | -104 | -128 | -19% | ||||||||

| Net Interest | -35 | -37 | -5% | -108 | -113 | -4% | ||||||||

| Bank Commissions | -8 | -9 | -10% | -21 | -20 | 4% | ||||||||

| Exchange rate gains (losses) | -5 | -10 | -49% | -17 | -25 | -31% | ||||||||

| Change in Trade Working Capital | 0 | 10 | -97% | -208 | -74 | 182% | ||||||||

| Operating Cash Flow Before Capex | 215 | 166 | 29% | 380 | 340 | 12% | ||||||||

| CAPEX (Organic) | -54 | -50 | 9% | -148 | -150 | -1% | ||||||||

| CAPEX (Total JV) | -19 | -69 | -73% | -105 | -299 | -65% | ||||||||

| CAPEX JV (OXY SHARE) | 6 | 32 | -80% | 45 | 129 | -65% | ||||||||

| NET CAPEX JV | -13 | -37 | -66% | -60 | -170 | -65% | ||||||||

| Total CAPEX (organic & JV) | -67 | -87 | -23% | -208 | -320 | -35% | ||||||||

| Cash Flow Before Dividends | 148 | 79 | 87% | 172 | 20 | 751% | ||||||||

| Dividends | -80 | -14 | 468% | -132 | -42 | 214% | ||||||||

| Free Cash Flow | 68 | 65 | 5% | 40 | -22 | N/A | ||||||||

- Operating Cash Flow before Capex grew 29% in the quarter as a result of higher EBITDA (without the PMV one-time non-cash impact), lower cash taxes and lower net interest costs and exchange rate losses. Working capital needs in the quarter increased vs 3Q16 due to the start-up of the cracker JV in Texas, and higher PVC and refrigerant gas prices, which increased accounts receivable and inventories.

- Capital expenditures in 3Q17 decreased by 23% to $67 million, $6 million of which was invested in the ethylene cracker, $7 million as carryover in PMV, and $54 million allocated to organic projects.

NET WORKING CAPITAL

| 2017 Variation | 2016 Variation | |||||||||||||

| sep-17 | dec-16 | D ($) | sep-16 | dec-15 | D ($) | |||||||||

| Working Capital | 392 | 184 | -208 | 319 | 246 | -74 | ||||||||

As of September 30, 2017, working capital needs increased by $208 million compared to December 2016. This is $134 million higher than the change in working capital of $74 million from September 2016 to December 2015 for the reasons described above.

FINANCIAL DEBT

| Last Twelve Months | ||||||

| Sep 2017 | Dec 2016 | |||||

| Net Debt USD million | 1,563 | 1,587 | ||||

| Net Debt/EBITDA 12 M | 1.4x | 1.8x | ||||

| Net Debt/Adj EBITDA 12 M | 1.5x | 1.7x | ||||

| Interest coverage | 5.6x | 4.6x | ||||

| Adj interest coverage | 5.5x | 4.8x | ||||

| Outstanding shares (millions) | 2,100 | 2,100 | ||||

| Net debt USD includes $1.2 million of letters of credit with maturities of more than 180 days that for covenant purposes are considered gross debt, although they are not booked in the accounting debt. |

Total financial debt as of September 30, 2017 was $2.3 billion, plus $1.2 million in letters of credit with maturities of more than 180 days for a total financial debt of $2.3 billion, while cash and cash equivalents totaled $740 million, resulting in net financial debt of $1.6 billion.

The Net Debt/EBITDA ratio was 1.4x at September 30, 2017, while Interest Coverage was 5.6x. The Net Debt /Adjusted EBITDA ratio was 1.5x and Adjusted Interest Coverage was 5.5x. Adjusted EBITDA in this case excludes the one-time benefit net of expenses accrued in 3Q16, and the benefit from our assembly insurance coverage included in the property policy at the PMV plant that was recognized in 4Q16.

On September 27, 2017 Mexichem, reported that it successfully completed a 144A / Reg S US$1 billion bond offering. The offering was comprised of two tranches: a US$500 million bond that has a coupon of 4.00% and matures in October 2027 and a US$500 million bond that has a coupon of 5.50% and mature in January 2048. The proceeds of the offering will be used to finance Mexichem’s recently announced acquisition of Netafim, the world’s largest micro-irrigation company, and for other corporate purposes.

The competitive rates at which the bonds were placed and the fact that the offering was more than 8 times oversubscribed, demonstrate the market’s confidence in Mexichem’s growth strategy, future prospects and disciplined financial management.

CONSOLIDATED BALANCE SHEET

| mm US$ | |||||||

| Balance sheet | Sep 2017 | Dec 2016 | |||||

| Total assets | 8,788 | 8,354 | |||||

| Cash and temporary investments | 740 | 714 | |||||

| Receivables | 1,137 | 848 | |||||

| Inventories | 681 | 606 | |||||

| Others current assets | 471 | 392 | |||||

| Long term assets | 5,759 | 5,794 | |||||

| Total liabilities | 4,942 | 4,772 | |||||

| Current portion of long-term debt | 53 | 58 | |||||

| Suppliers | 1,426 | 1,270 | |||||

| Other current liabilities | 600 | 657 | |||||

| Long-term debt | 2,248 | 2,241 | |||||

| Other long-term liabilities | 615 | 546 | |||||

|

Consolidated shareholders' equity |

3,846 | 3,582 | |||||

| Minority shareholders' equity | 950 | 904 | |||||

| Majority shareholders' equity | 2,896 | 2,678 | |||||

| Total liabilities & shareholders' equity | 8,788 | 8,354 | |||||

Financial Assets

On April 20th, 2016, an explosion occurred in the VCM plant inside the Petrochemical Pajaritos Complex, where two of the three facilities of PMV are located (VCM and Ethylene). The chlorine and caustic soda plant is located on a separate site. There was no damage to the chlorine-caustic soda plant, but there was business interruption in the supply of raw material. The VCM plant (Clorados III) is the one that sustained most of the damage, the major economic impact of which was the write-off of the asset and the shutdown of that plant.

Mexichem’s assets including those in PMV are adequately insured at insurance issuance date replacement value, while the related non-cash charge was calculated at book value. The Company’s insurance coverage includes: i) environmental responsibility, ii) damage to property, iii) damage to assets during assembly process, iv) business interruption, v) liability for damage to third parties, and vi) liability of directors and officers.

During FY16 PMV recognized charges of: i) $285 million related to asset write-off, of which $276 million were recognized in other expenses and $9 million recognized in other comprehensive income (equity), respectively; and ii) $42 million related to amounts of indemnifications, legal expenses, and other costs. Together this represented a charge in our P&L of $318 million and $9 million to our Balance Sheet. Additionally, during the 9M17 we recognized $1.9 million of other expenses related to PMV incident.

During the third quarter of 2016, PMV gathered sufficient information to decide to recognize the account receivable related to insurance coverage, which for the full year 2016 amounted to $276 million related to property damage ($220 million), assembly insurance coverage ($20 million), and third-party expenses and expenses incurred under directors’ and officers’ coverage ($36 million). The one-time expenses were offset by the full year account receivable which generated a net expense effect of $42 million. During 9M17 we add to the account receivable we recognized during 3Q16 and 4Q16, the $1.9 million expenses mentioned in previous paragraph.

Finally, during FY16, 1Q17 and 2Q17 PMV and Resins, Compounds and Derivatives recognized income of $51 million, $17 million and $14 million, respectively, for business interruption that offset fixed costs that were not absorbed and its margin.

PMV has presented its claims to its insurance companies. As of the end of 3Q17 PMV recovered i) $7.5 million related to third party expenses and ii) $32 million from business interruption. Resins, Compounds and Derivatives received $6 million from business interruption on its insurance claims. The rest have yet to be recovered.

Contingent Asset

PMV together with its shareholders, Mexichem & Pemex, are evaluating several strategic options for the business in the future, which is why the Company adopted a conservative policy with respect to the monetary amount recognized in the account receivable, reflecting the stated cash value of the plant as of December 31st, 2015. When the business plan is finalized, the exact dollar amount of the account receivable could change.

Contingent Liability

As a result of the VCM Plant (Clorados III) incident described in the contingent asset disclosure, PMV performed an environmental assessment to determine if any pollutants were deposited in areas surrounding the facility, delivered the report to the environmental authorities and is working with them in order to determine, if any, the environmental damages. Also, PMV could be responsible for third party injuries, if any. Based on the information the Company has as of this report, there is no evidence that there are additional relevant liabilities.

As mentioned previously, depending on the decision taken by PMV and its shareholders, once the future of the business is determined, PMV will evaluate the impacts on the rest of its assets in the Pajaritos Complex. The remaining fixed asset value of the PMV’s plants inside Pajaritos Complex was $198 million as of September 30, 2017.

CONSOLIDATED INCOME STATEMENT

| mm US$ | Third Quarter | ||||||||||

| INCOME STATEMENT | 2017 | 2016 | 2016 w/o one time item |

%

17/Adj. 16 |

|||||||

| Net sales | 1,505 | 1,394 | 1,394 | 8% | |||||||

| Cost of sales | 1,137 | 1,073 | 1,073 | 6% | |||||||

| Gross profit | 368 | 321 | 321 | 15% | |||||||

| Operating expenses | 172 | (64) | 159 | 8% | |||||||

| Operating income (loss) | 196 | 385 | 162 | 21% | |||||||

| Financial cost | 44 | 50 | 50 | -12% | |||||||

| Equity in income of associated entity | (0) | 0 | 0 | N/A | |||||||

| Income (loss) from continuing operations before income tax | 152 | 335 | 111 | 37% | |||||||

| Cash tax | 34 | 36 | 36 | -5% | |||||||

| Deferred taxes | 28 | 61 | (6) | N/A | |||||||

| Income tax | 62 | 97 | 30 | 108% | |||||||

| Income (loss) from continuing operations | 90 | 238 | 81 | 11% | |||||||

| Discontinued operations | 1 | (8) | (8) | N/A | |||||||

| Consolidated net income (loss) | 91 | 230 | 73 | 24% | |||||||

| Minority stockholders | 30 | 69 | (0) | N/A | |||||||

| Net income (loss) | 61 | 161 | 73 | -17% | |||||||

| EBITDA | 297 | 468 | 245 | 21% | |||||||

| mm US$ | January - September | ||||||||||

| INCOME STATEMENT | 2017 | 2016 | 2016 w/o one time item |

% 17/Adj. 16 |

|||||||

| Net sales | 4,363 | 4,072 | 4,072 | 7% | |||||||

| Cost of sales | 3,316 | 3,094 | 3,094 | 7% | |||||||

| Gross profit | 1,047 | 978 | 978 | 7% | |||||||

| Operating expenses | 499 | 580 | 518 | -4% | |||||||

| Operating income (loss) | 548 | 398 | 460 | 19% | |||||||

| Financial cost | 163 | 135 | 135 | 21% | |||||||

| Equity in income of associated entity | (1) | (3) | (3) | -63% | |||||||

| Income (loss) from continuing operations before income tax | 386 | 266 | 328 | 18% | |||||||

| Cash tax | 104 | 128 | 128 | -19% | |||||||

| Deferred taxes | 47 | (35) | (30) | N/A | |||||||

| Income tax | 151 | 93 | 98 | 54% | |||||||

| Income (loss) from continuing operations | 235 | 174 | 230 | 2% | |||||||

| Discontinued operations | 1 | (10) | (10) | N/A | |||||||

| Consolidated net income (loss) | 236 | 164 | 220 | 7% | |||||||

| Minority stockholders | 56 | (27) | (3) | N/A | |||||||

| Net income (loss) | 180 | 191 | 223 | -19% | |||||||

| EBITDA | 838 | 643 | 705 | 19% | |||||||

OPERATING RESULTS BY BUSINESS GROUP

VINYL Business Group (39% and 44% of Mexichem’s sales (before eliminations) and EBITDA respectively, in 2017)

| mm US$ | Third Quarter | January - September | ||||||||||||

| Vinyl | 2017 | 2016 | %Var. | 2017 | 2016 | % Var. | ||||||||

| Volume (K Tons) | 636 | 633 | 1% | 1,920 | 1,894 | 1% | ||||||||

| Total Sales* | 581 | 537 | 8% | 1,752 | 1,535 | 14% | ||||||||

| Operating Income | 79 | 267 | -70% | 229 | 74 | 211% | ||||||||

| Adjusted Operating Income | 79 | 44 | 82% | 229 | 135 | 69% | ||||||||

| EBITDA | 130 | 299 | -56% | 367 | 171 | 115% | ||||||||

| Adjusted EBITDA | 130 | 75 | 73% | 367 | 233 | 58% | ||||||||

|

|

||||||||||||||

| *Intercompany sales were $37 million and $38 million in 3Q17 and 3Q16, respectively. And as of September 2017, and 2016 were $134 million and $111 million, respectively. |

| mm US$ | Third Quarter | January - September | ||||||||||||

| Resins, Compounds & Derivatives | 2017 | 2016 | %Var. | 2017 | 2016 | % Var. | ||||||||

| Volume (K Tons) | 558 | 562 | -1% | 1,709 | 1,653 | 3% | ||||||||

| Total Sales* | 562 | 523 | 7% | 1,703 | 1,495 | 14% | ||||||||

| Operating Income | 83 | 43 | 93% | 218 | 133 | 65% | ||||||||

| EBITDA | 128 | 69 | 85% | 339 | 211 | 61% | ||||||||

|

|

||||||||||||||

| *Intercompany sales were $46 million and $45 million in the 3Q17 and 3Q16, respectively, and as of September 2017 and 2016 were $156 million and $136 million, respectively. Of these amounts $9 million and $7 million were invoiced to PMV in 3Q17 and 3Q16, respectively and $22 million and $25 million accrued to September 2017 and 2016. |

| mm US$ | Third Quarter | January - September | ||||||||||||

| PMV | 2017 | 2016 | %Var. | 2017 | 2016 | % Var. | ||||||||

| Volume (K Tons) | 87 | 79 | 11% | 235 | 333 | -29% | ||||||||

| Total Sales* | 29 | 22 | 31% | 76 | 98 | -23% | ||||||||

| Operating Income | -3 | 225 | N/A | 11 | -59 | N/A | ||||||||

| Adjusted Operating Income | -3 | 1 | N/A | 11 | 3 | 284% | ||||||||

| EBITDA | 2 | 230 | -99% | 27 | -40 | N/A | ||||||||

| Adjusted EBITDA | 2 | 6 | -66% | 27 | 22 |

23% |

||||||||

|

|

||||||||||||||

| *Intercompany sales invoiced to Resins, Compounds and Derivatives were $2 million and $1 million in 3Q17 and 3Q16, respectively. And, as of September 2017 and 2016 were $4 million and $32 million, respectively. |

In 3Q17, the Vinyl Business Group reported a 1% increase in volumes, and 8% growth in sales to $581 million, reflecting better PVC dynamics globally. Due to the impact of hurricane Harvey, PVC prices increased even further in September especially in the U.S.

Also, results continue to benefit from the integration of Vinyl Compounds, Ltd into our Compounds business.

EBITDA for the Vinyl Business Group was $130 million, compared to $299 million in 3Q16, when the one-time benefit of $224 million associated to PMV (revenue of $252 million net of $28 million in expenses for the 3Q16) was recognized. EBITDA increased 73%, compared to the adjusted EBITDA of 3Q16, this growth being a result of the improved trends mentioned above, better PVC market conditions (prices and volumes), product mix, efficiencies in our operations, and the benefits of our increased vertical integration across the ethane to PVC value chain due to the start of commercial operations of our JV ethylene cracker in Texas. EBITDA margin was 22.4% in 3Q17 compared to 14% in the 3Q16 on an adjusted basis. Ebitda for the Vinyl Business Group was slightly negatively affected by our cracker´s shut down due to the impact of Hurricane Harvey and the “force majeure” condition that our VCM supplier declared, which also forced us to declare a “force majeure” on our PVC business and caused a significant reduction in our compounds business due to the abrupt increases in PVC prices. These last two effects should not impact our fourth quarter results.

For the quarter, Resins, Compounds and Derivatives revenues and EBITDA increased 7% and 85%, respectively, to $562 million and $128 million from 3Q16 levels. Volumes declined 1% to 558 thousand tons. Revenues benefited from better PVC market conditions, further price increases due to the impact of hurricane Harvey, and our strategic acquisition of Vinyl Compounds, Ltd. EBITDA improved mainly due to a decline in our PVC cost of production because of our increased vertical integration and its associated benefits in the Vinyl Business Group. Operating income for Resins, Compounds and Derivatives was $83 million, an increase of 93% from the adjusted $43 million registered in the third quarter of 2016.

In 3Q17, PMV sales were $29 million, the majority of which came from our chlorine-caustic soda operations. It is important to note that EBITDA in PMV was positive $2 million in 3Q17, which is fully related to its operations, as the business interruption insurance coverage expired in 2Q17.

In the 9M17, the Vinyl Business Group’s sales increased 14% due to better market conditions in PVC. EBITDA was $367 million, 58% higher than in 9M16 on an adjusted basis, mainly because of better PVC trends and increased vertical integration across the ethane to PVC value chain and its associated benefits, implying a 20.9% EBITDA margin, while in 9M16 Adjusted EBITDA Margin was 15.2%.

FLUENT Business Group (50% and 37% of Mexichem’s sales (before eliminations) and EBITDA, respectively, in 2017)

| mm US$ | Third Quarter | January - September | ||||||||||||

| Fluent | 2017 | 2016 | %Var. | 2017 | 2016 | % Var. | ||||||||

| Sales | 785 | 750 | 5% | 2,257 | 2,203 | 2% | ||||||||

| Fluent LatAm | 279 | 283 | -2% | 818 | 808 | 1% | ||||||||

| Fluent Europe | 357 | 327 | 9% | 1,006 | 991 | 2% | ||||||||

| Fluent US & Canada | 120 | 111 | 8% | 341 | 299 | 14% | ||||||||

| Fluent AMEA | 34 | 31 | 10% | 108 | 111 | -2% | ||||||||

| Intercompany Eliminations | (5) | (2) | 104% | (16) | (6) | 182% | ||||||||

| Operating Income | 71 | 84 | -15% | 203 | 227 | -10% | ||||||||

| EBITDA | 107 | 119 | -10% | 309 | 328 | -6% | ||||||||

In 3Q17, the Fluent Business Group’s sales were $785 million, a 5% increase compared to the $750 million reported one year ago. Sales in AMEA showed a 10% increase, while revenues in Europe and US/Canada rose 9% and 8%, respectively. Operations in LatAm, continued to reflect the impact of a challenging economic environment in Brazil, while Colombia has seen modest improvement.

| 3Q16 | mm US$ | 3Q17 | 3Q17 | 3Q17/3Q16 | |||||||||||

| Sales | Sales | FX | Total | % Var | |||||||||||

| 283 | Fluent LatAm | 279 | 2 | 281 | -1% | ||||||||||

| 327 | Fluent Europe | 357 | -9 | 348 | 6% | ||||||||||

| 111 | Fluent US/Canada | 120 | 0 | 120 | 8% | ||||||||||

| 31 | Fluent AMEA | 34 | 0 | 34 | 10% | ||||||||||

| -2 | Intercompany Eliminations | -5 | 0 | - 5 | 150% | ||||||||||

| 750 | Total | 785 | -7 | 778 | 4% | ||||||||||

On a constant currency basis, total sales in the Fluent Business Group would have been $778 million, a $7 million benefit year-over-year, mainly as a result of a 5% appreciation of the Euro which was offset by depreciation of the Turkish Lira.

Third quarter EBITDA was $107 million, a 10% decrease compared to the 3Q16, mainly impacted by shortages of PVC due to the “force majeure”, abrupt increases in PVC prices which could not be passed though immediately and the economic environment prevailing in Brazil. It is noteworthy that EBITDA margin in the US/Canada continued to improve, this time by 114 bps to 19% vs 3Q16; while margins in Europe remained relatively stable at 14%. Fluent´s Consolidated EBITDA margin was 13.6%. Operating income decreased 15% to $71 million.

EBITDA for the 3Q17 was benefited from currency translation effects of $1 million.

For the first 9 months of 2017 revenues increased 2%, impacted by $9 million by a translation effect. On a neutral currency neutral basis, sales would have been $2,266 million growing by 3% vs. same period 2016.

| 9M16 | mm US$ | 9M17 | 9M17 | 9M17/9M16 | |||||||||||

| Sales | Sales | FX | Total | % Var | |||||||||||

| 808 | Fluent LatAm | 818 | -21 | 797 | -1% | ||||||||||

| 991 | Fluent Europe | 1,006 | 31 | 1,037 | 5% | ||||||||||

| 299 | Fluent US/Canada | 341 | -1 | 340 | 14% | ||||||||||

| 111 | Fluent AMEA | 108 | 0 | 108 | -3% | ||||||||||

| -6 | Intercompany Eliminations | -16 | 0 | - 16 | 167% | ||||||||||

| 2,203 | Total | 2,257 | 9 | 2,266 | 3% | ||||||||||

For the first nine months of 2016 EBITDA declined 6% compared to the same period in 2016 due to the abovementioned effects. EBITDA margin was 13.7%.

On a constant currency basis EBITDA for the nine months ended on September 2017 would have decreased 5% to $312 million, implying an EBITDA margin of 13.8%.

FLUOR BUSINESS GROUP (11% and 23% of Mexichem’s sales (before eliminations) and EBITDA, in 2017)

| mm US$ | Third Quarter | January - September | ||||||||||||

| Fluor | 2017 | 2016 | %Var. | 2017 | 2016 | % Var. | ||||||||

| Sales | 177 | 145 | 22% | 495 | 449 | 10% | ||||||||

| Operating Income | 56 | 46 | 20% | 153 | 136 | 13% | ||||||||

| EBITDA | 68 | 59 | 15% | 192 | 174 | 10% | ||||||||

In 3Q17, the Fluor Business Group reported a 22% increase in sales, reflecting significant growth in both the upstream and the downstream parts of the business due to improved demand for the fluorspar from the cement and steel industries for fluorspar, as well as, in higher refrigerant gas prices because of the ITC resolution announced by Mexichem on March 23th, 2017 and better than expected refrigerant gas prices in Europe.

EBITDA grew 15% year-over-year to $68 million, implying an EBITDA margin of 38.4%. Operating income was $56 million, a 20% year-over-year increase. Revenues were up 10% in the first nine months of 2017 to $495 million, YTD EBITDA increased by 10% to $192 million while EBITDA margin was 38.7%. In the first nine months of 2017, operating income increased 13% to $153 million.

Clarifications

- As reported in 4Q16, as part of our core strategy of shifting to higher margin products in our Fluent Business Group, at the end of 1Q16 we decided to exit from our pressure pipe business in the US, which impacted our Fluent US/ AMEA Business. This decision was made in order to shift our capacity from pressure pipes, where products have low margins to Datacom, where margins are higher. As a result, our 1Q16 consolidated figures and Fluent segment figures differ from those presented in this report. This is due to the reclassification of Fluent’s pressure pipe business as discontinued operations, which had a net effect of $4 million, $7 million and $7 million on revenues and $1.4 million, $2.4 million and $2.3 million on EBITDA during 1Q16, 2Q16 and 3Q16, respectively.

- In 2016, Mexichem performed an analysis to determine whether the company is the “agent” or “principal” in terms of IAS 18 Revenue, in order to determine how freight costs should be recorded and reported on our P&L. The conclusion was that the company is “principal” and that freight costs should be included in Cost of Goods Sold (COGS) instead of Sales, General and Administrative Expenses (SG&A), as it was during the first three quarters of 2016 and in previous years. Consequently, in the fourth quarter of 2016, we reclassified the FY16 freight costs from SG&A to COGS.

The freight costs related to the 1st, 2nd, 3rd and 4th quarters of 2016 were $73 million, $79 million, $78 million and $70 million, respectively. For the 2016 1st, 2nd, and 3rd quarters freight costs impacted 4Q16 COGS. This reclassification does not have any effect on EBITDA, but it does have an effect on reported gross profit.

The restructured figures with the abovementioned effects are shown in Appendix I.

- Effective 1Q17, management has decided to separate reporting of the Fluent Group’s US and AMEA operations. From this quarter forward we will report four business regions for Fluent, namely: LatAm. Europe, US and AMEA.

- As announced in our 4Q16 earnings report, Mexichem’s Audit Committee and Board of Directors have authorized a change in the Company’s accounting policy related to fixed asset valuation from the revaluation method to the historical cost recognition method. Effective in 1Q17, Mexichem reduced its fixed assets by $452 million, deferred taxes by $136 million and equity value by $316 million on its balance sheet by eliminating the revaluation value that has been accrued since Mexichem adopted IFRS in 2010. For comparative purposes, starting with this quarterly report, and during 2017, Mexichem will include Appendix I and Appendix II in its quarterly information showing the 2016 changes in depreciation on the Income Statement, as well as the changes in fixed assets, deferred taxes and equity value on its Balance Sheet as if the accounting policy change would have been authorized in 1Q16. Additional details are contained on page 25.

- On February 27th, Mexichem announced that its ethylene cracker 50/50 joint venture with Occidental Chemical Corporation (OxyChem), a subsidiary of Occidental Petroleum Corporation (NYSE:OXY), which is located at OxyChem’s Ingleside, Texas complex, began operations on schedule and on budget. The ethylene cracker is currently in a production stabilization phase. The cracker, which will be operated by OxyChem, has the capacity to produce 1.2 billion pounds (550,000 metric tons) of ethylene per year and provide OxyChem with an ongoing source of ethylene for manufacturing vinyl chloride monomer (VCM), which Mexichem will use to produce polyvinyl chloride (PVC resin) and PVC piping systems. The companies have a 20-year supply agreement. Due to this, all the figures in this report include the results of Ingleside Ethylene, LLC.

RECENT EVENTS

For all the news please visit the following webpage http://www.mexichem.com/news/

Conference Call Details:

Mexichem will host a conference call to discuss its 3Q17 results on October 26, 2017 at 10:00 am Mexico City /11:00 NY. To access the call, please dial 001-855-817-7630 (Mexico), or 1-888-349-0106 (United States) or 1-412-902-0131 (International). All callers should dial in a minimum of 15 minutes prior to the start time and ask for the Mexichem conference call.

The call will also be available through an audio only live webcast http://services.choruscall.com/links/mexichem161027.htmluntil January 26, 2018http://services.choruscall.com/links/mexichem150722.html. A replay of the call will be available approximately two hours after the end of the call. The replay can be accessed via Mexichem’s website at www.mexichem.comwww.mexichem.com

RECONCILIATION SUMMARY BY BUSINESS GROUP

Third Quarter 2017 Financial and Operating Highlights

| Quarter | Sales | EBITDA | EBITDA Margin | EBITDA Adjusted | EBITDA Margin Adjusted | |||||||||||||||||||||||||||

| mm US$ | 3Q16 | 3Q17 | %Var. | 3Q16 | 3Q17 | %Var. | 3Q16 | 3Q17 | bps | 3Q16 | 3Q17 | %Var. | 3Q16 | 3Q17 | bps | |||||||||||||||||

| Vinyl | 537 | 581 | 8% | 299 | 130 | -57% | 55.7% | 22.4% | - 3,327 | 75 | 130 | 73% | 14.0% | 22.4% | 838 | |||||||||||||||||

| Fluent | 750 | 785 | 5% | 119 | 107 | -10% | 15.9% | 13.6% | - 226 | 119 | 107 | -10% | 15.9% | 13.6% | - 226 | |||||||||||||||||

| Fluor | 145 | 177 | 22% | 59 | 68 | 15% | 40.8% | 38.6% | - 225 | 59 | 68 | 15% | 40.8% | 38.6% | - 225 | |||||||||||||||||

| Energy | 0 | 0 | 0 | 0 | - | 0 | 0 | - | ||||||||||||||||||||||||

| Eliminations/ Holding | -38 | -38 | 0% | -9 | -8 | -11% | 24.7% | 22.2% | - 256 | -9 | -8 | -11% | 24.7% | 22.2% | - 256 | |||||||||||||||||

| Mexichem Consolidated | 1,394 | 1,505 | 8% | 468 | 297 | -37% | 33.6% | 19.7% | - 1,387 | 245 | 297 | 21% | 17.5% | 19.8% | 220 | |||||||||||||||||

| 3Q16 | mm US$ | 3Q17 | 3Q17 | 3Q17/3Q16 | ||||||||||||||

| Sales | Sales | FX | Total | % Var | ||||||||||||||

| 537 | Vinyl | 581 | -8 | 573 | 7% | |||||||||||||

| 750 | Fluent | 785 | -7 | 778 | 4% | |||||||||||||

| 1,287 | Ethylene (Vinyl + Fluent) | 1,366 | -15 | 1,351 | 5% | |||||||||||||

| 145 | Fluor | 177 | 1 | 178 | 23% | |||||||||||||

| 0 | Energy | 0 | 0 | 0 | ||||||||||||||

| -38 | Eliminations / Holding | -38 | 0 | - 38 | 0% | |||||||||||||

| 1,394 | Total | 1,505 | -14 | 1,491 | 7% | |||||||||||||

|

|

|

|||||||||||||||||

| 3Q16 | 3Q16 Adj. | mm US$ | 3Q17 | 3Q17 | 3Q17/3Q16 | |||||||||||||

| EBITDA | EBITDA | EBITDA | FX | Total | % Var | |||||||||||||

| 299 | 75 | Vinyl | 130 | -1 | 129 | 72% | ||||||||||||

| 119 | 119 | Fluent | 107 | 1 | 108 | -9% | ||||||||||||

| 418 | 194 | Ethylene (Vinyl + Fluent) | 237 | 0 | 237 | 22% | ||||||||||||

| 59 | 59 | Fluor | 68 | 0 | 68 | 15% | ||||||||||||

| 0 | 0 | Energy | 0 | 0 | 0 | |||||||||||||

| -9 | -9 | Eliminations / Holding | -8 | 0 | - 8 | -11% | ||||||||||||

| 468 | 245 | Total | 297 | 0 | 297 | 21% | ||||||||||||

Sub=Subtotal

First Nine Months 2017 Financial and Operating Highlights

| Sales | EBITDA | EBITDA Margin | EBITDA Adjusted | EBITDA Margin Adjusted | ||||||||||||||||||||||||||||

| mm US$ | 9M16 | 9M17 | %Var. | 9M16 | 9M17 | %Var. | 9M16 | 9M17 | bps | 9M16 | 9M17 | %Var. | 9M16 | 9M17 | bps | |||||||||||||||||

| Vinyl | 1,535 | 1,752 | 14% | 171 | 367 | 115% | 11.1% | 20.9% | 980 | 233 | 367 | 58% | 15.2% | 20.9% | 578 | |||||||||||||||||

| Fluent | 2,203 | 2,257 | 2% | 328 | 309 | -6% | 14.9% | 13.7% | - 118 | 328 | 309 | -6% | 14.9% | 13.7% | - 118 | |||||||||||||||||

| Fluor | 449 | 495 | 10% | 174 | 192 | 10% | 38.7% | 38.7% | 8 | 174 | 192 | 10% | 38.7% | 38.7% | 8 | |||||||||||||||||

| Energy | 1 | 1 | 0% | 1 | 1 | - | 1 | 1 | - | |||||||||||||||||||||||

| Eliminations / Holding | -116 | -142 | 22% | -31 | -31 | 0% | 26.2% | 21.5% | - 468 | -31 | -31 | 0% | 26.2% | 21.5% | - 468 | |||||||||||||||||

| Mexichem Consolidated | 4,072 | 4,363 | 7% | 643 | 838 | 30% | 15.8% | 19.2% | 341 | 705 | 838 | 19% | 17.3% | 19.2% | 190 | |||||||||||||||||

| 9M16 | mm US$ | 9M17 | 9M17 | 9M17/9M16 | ||||||||||||||

| Sales | Sales | FX | Total | % Var | ||||||||||||||

| 1,535 | Vinyl | 1,752 | 10 | 1,761 | 15% | |||||||||||||

| 2,203 | Fluent | 2,257 | 9 | 2,266 | 3% | |||||||||||||

| 3,738 | Ethylene (Vinyl + Fluent) | 4,009 | 19 | 4,028 | 8% | |||||||||||||

| 449 | Fluor | 495 | 10 | 505 | 12% | |||||||||||||

| 1 | Energy | 1 | 0 | 1 | ||||||||||||||

| -116 | Eliminations / Holding | -142 | 0 | -142 | 22% | |||||||||||||

| 4,072 | Total | 4,363 | 29 | 4,392 | 8% | |||||||||||||

|

|

|

|||||||||||||||||

| 9M16 | 9M16 | mm US$ | 9M17 | 9M17 | 9M17/9M16 | |||||||||||||

| EBITDA | EBITDA Adj | EBITDA | FX | Total | % Var | |||||||||||||

| 171 | 233 | Vinyl | 367 | 1 | 368 | 58% | ||||||||||||

| 328 | 328 | Fluent | 309 | 3 | 312 | -5% | ||||||||||||

| 499 | 560 | Ethylene (Vinyl + Fluent) | 676 | 4 | 680 | 21% | ||||||||||||

| 174 | 174 | Fluor | 192 | 2 | 194 | 11% | ||||||||||||

| 1 | 1 | Energy | 1 | 0 | 1 | |||||||||||||

| -31 | -31 | Eliminations / Holding | -31 | 0 | -31 | 0% | ||||||||||||

| 643 | 705 | Total | 838 | 6 | 844 | 20% | ||||||||||||

About Mexichem

Mexichem is a global leader in plastic piping, one of the most cost-efficient PVC producer and one of the world’s largest chemical and petrochemical companies. Mexichem contributes to global development by delivering an extended portfolio of products to high growth sectors such as infrastructure, housing, Datacom, water management, among others. With operations in over 30 countries, Mexichem’s global footprint includes more than 18,000 employees, 120 plants, 2 fluorite mines, 15 R&D laboratories and 8 training academies. Mexichem has annual revenues of US$5.4 billion, it has over 50 years of history and more than 30 years trading on the Mexican Stock Exchange. The company is member of the Mexican Stock Exchange Sustainability Index and the sustainability emerging markets index FTSE4Good.

Forward-looking Statements

In addition to historical information, this press release contains "forward-looking" statements that reflect management's expectations for the future. The words “anticipate,” “believe,” “expect,” “hope,” “have the intention of,” “might,” “plan,” “should” and similar expressions generally indicate comments on expectations. The final results may be materially different from current expectations due to several factors, which include, but are not limited to, global and local changes in politics, the economy, business, competition, market and regulatory factors, cyclical trends in relevant sectors; as well as other factors that are highlighted under the title “Risk Factors” on the annual report submitted by Mexichem to the Mexican National Banking and Securities Commission (CNBV). The forward-looking statements included herein represent Mexichem’s views as of the date of this press release. Mexichem undertakes no obligation to revise or update publicly any forward-looking statement for any reason unless required by law.”

Mexichem has implemented a Code of Ethics that rules its relationships with its employees, clients, suppliers and general groups. Mexichem’s Code of Ethics is available for consulting in the following link: http://www.mexichem.com/Codigo_de_etica.html Additionally, according to the terms contained in the Securities Exchange Act No 42, Mexichem Audit Committee established a mechanism of contact, which allows that any person that knows the unfulfillment of operational and accounting records guidelines and lack of internal controls of the Code of Ethics, from the Company itself or from the subsidiaries that this controls, file a complaint which is anonymously guaranteed. The whistleblower program is facilitated by a third party. The telephone number in Mexico is 01-800-062-12-03. The website is http://www.ethic-line.com/mexichem and contact e-mail is mexichem@ethic-line.com. Mexichem’s Audit Committee will be notified of all complaints for immediate investigation.

INDEPENDENT ANALYSTS

Currently, the following investment firms have analysts who cover Mexichem:

1. -Actinver

2. -Bank of America Merrill Lynch

3. -Banorte-Ixe

4. -Barclays

5. -BBVA Bancomer

6. -Bradesco BBI

7. -BTG Pactual

8. -Citigroup

9. -Credit Suisse

10. -GBM-Grupo Bursátil Mexicano

11. -Grupo Santander

12. -HSBC

13. -Intercam

14. -Invex Casa de Bolsa

15. -Interacciones

16. -ITAU BBA

17. -JP Morgan

18. -Morgan Stanley

19. -Monex

20. -UBS

21. -Vector

INTERNAL CONTROL

Mexichem’s bylaws provide the existence of the Audit and Corporate Practices Committees, intermediate corporate organs constituted in agreement with the applicable law to assist the Board of Directors to carry on their functions. Through these committees and the external auditor, it is given reasonable safety that transactions and company’s acts are executed and registered in accordance with the terms and parameters set by the Board and directives of Mexichem, the applicable law and different general guidelines, criterion and IFRS (International Financial Reporting Standards).

APPENDIX I: CONSOLIDATED RESTRUCTURED FIGURES OF QUARTERLY RESULTS AS A CONSEQUENCE OF FLUENT BUSINESS GROUP’S DISCONTINUED OPERATIONS, FREIGHT RECLASSIFICATIONS AND FIXED ASSET ACCOUNTING POLICY CHANGES

CHANGES 1Q16

| mm US$ | Changes reported in 1Q16 | ||||||||||||

| INCOME STATEMENT | 1Q16 reported | Disc.operations and freight reclassification | Fixed assets | Disc.operations, freight reclassification and fixed assets | 1Q16 adjusted | ||||||||

| Net sales | 1,262 | (4) | - | (4) | 1,258 | ||||||||

| Cost of sales | 903 | 67 | (8) | 59 | 962 | ||||||||

| Gross Profit | 359 | (71) | 8 | (63) | 296 | ||||||||

| Operating expenses | 250 | (72) | (3) | (75) | 175 | ||||||||

| Operating Income | 109 | 1 | 11 | 12 | 121 | ||||||||

| Financial cost | 43 | - | - | - | 43 | ||||||||

| Equity income of associated entities | (1) | - | - | - | (1) | ||||||||

| Income from continued operations before income tax | 67 | 1 | 11 | 12 | 79 | ||||||||

| Cash tax | 40 | - | - | - | 40 | ||||||||

| Deferred tax | (22) | 1 | 4 | 5 | (17) | ||||||||

| Income Tax | 18 | 1 | 4 | 5 | 23 | ||||||||

| Income from continued operations | 49 | - | 7 | 7 | 56 | ||||||||

| Discontinued Operations | 1 | - | - | - | 1 | ||||||||

| Net Consolidated Income | 50 | - | 7 | 7 | 57 | ||||||||

| Minority Interest | (1) | - | - | - | (1) | ||||||||

| Net Majority Income | 51 | - | 7 | 7 | 58 | ||||||||

| EBITDA | 200 | 1 | - | 1 | 201 | ||||||||

CHANGES 2Q16

| mm US$ | Changes reported in 2Q16 | ||||||||||||

| INCOME STATEMENT | 2Q16 reported | Disc.operations and freight reclassification | Fixed assets | Disc.operations, freight reclassification and fixed assets | 2Q16 adjusted | ||||||||

| Net sales | 1,427 | (7) | - | (7) | 1,420 | ||||||||

| Cost of sales | 998 | 70 | (8) | 62 | 1,060 | ||||||||

| Gross Profit | 429 | (77) | 8 | (69) | 360 | ||||||||

| Operating expenses | 549 | (79) | - | (79) | 470 | ||||||||

| Operating Income | (120) | 2 | 8 | 10 | (110) | ||||||||

| Financial cost | 43 | - | - | - | 43 | ||||||||

| Equity income of associated entities | (3) | - | - | - | (3) | ||||||||

| Income from continued operations before income tax | (160) | 2 | 8 | 10 | (150) | ||||||||

| Cash tax | 52 | - | - | - | 52 | ||||||||

| Deferred tax | (82) | 1 | 2 | 3 | (79) | ||||||||

| Income Tax | (30) | 1 | 2 | 3 | (27) | ||||||||

| Income from continued operations | (130) | 1 | 6 | 7 | (123) | ||||||||

| Discontinued Operations | 1 | (1) | - | (1) | - | ||||||||

| Net Consolidated Income | (129) | - | 6 | 6 | (123) | ||||||||

| Minority Interest | (96) | - | - | - | (96) | ||||||||

| Net Majority Income | (33) | - | 6 | 6 | (27) | ||||||||

| EBITDA | (29) | 2 | - | 2 | (27) | ||||||||

CHANGES 3Q16

| mm US$ | Changes reported in 3Q16 | ||||||||||||

| INCOME STATEMENT | 3Q16 reported | Disc.operations and freight reclassification | Fixed assets | Disc.operations, freight reclassification and fixed assets | 3Q16 adjusted | ||||||||

| Net sales | 1,400 | (7) | - | (7) | 1,393 | ||||||||

| Cost of sales | 1,012 | 69 | (8) | 61 | 1,073 | ||||||||

| Gross Profit | 388 | (76) | 8 | (68) | 320 | ||||||||

| Operating expenses | 14 | (79) | - | (79) | (65) | ||||||||

| Operating Income | 374 | 3 | 8 | 11 | 385 | ||||||||

| Financial cost | 50 | - | - | - | 50 | ||||||||

| Equity income of associated entities | - | - | - | - | - | ||||||||

| Income from continued operations before income tax | 324 | 3 | 8 | 11 | 335 | ||||||||

| Cash tax | 36 | - | - | - | 36 | ||||||||

| Deferred tax | 57 | 1 | 2 | 3 | 60 | ||||||||

| Income Tax | 93 | 1 | 2 | 3 | 96 | ||||||||

| Income from continued operations | 231 | 2 | 6 | 8 | 239 | ||||||||

| Discontinued Operations | (7) | (2) | - | (2) | (9) | ||||||||

| Net Consolidated Income | 224 | - | 6 | 6 | 230 | ||||||||

| Minority Interest | 69 | - | - | - | 69 | ||||||||

| Net Majority Income | 155 | - | 6 | 6 | 161 | ||||||||

| EBITDA | 466 | 2 | - | 2 | 468 | ||||||||

CHANGES 4Q16

| mm US$ | Changes reported in 4Q16 | ||||||||||||

| INCOME STATEMENT | 4Q16 reported | Disc.operations and freight reclassification | Fixed assets | Disc.operations, freight reclassification and fixed assets | 4Q16 adjusted | ||||||||

| Net sales | 1,260 | 18 | - | 18 | 1,278 | ||||||||

| Cost of sales | 1,230 | (205) | (10) | (215) | 1,015 | ||||||||

| Gross Profit | 30 | 223 | 10 | 233 | 263 | ||||||||

| Operating expenses | (122) | 232 | (1) | 231 | 109 | ||||||||

| Operating Income | 152 | (9) | 11 | 2 | 154 | ||||||||

| Financial cost | 28 | - | - | - | 28 | ||||||||

| Equity income of associated entities | 1 | - | - | - | 1 | ||||||||

| Income from continued operations before income tax | 123 | (9) | 11 | 2 | 125 | ||||||||

| Cash tax | 62 | - | - | - | 62 | ||||||||

| Deferred tax | (20) | (3) | 5 | 2 | (18) | ||||||||

| Income Tax | 42 | (3) | 5 | 2 | 44 | ||||||||

| Income from continued operations | 81 | (6) | 6 | - | 81 | ||||||||

| Discontinued Operations | (5) | 6 | - | 6 | 1 | ||||||||

| Net Consolidated Income | 76 | - | 6 | 6 | 82 | ||||||||

| Minority Interest | 11 | - | - | - | 11 | ||||||||

| Net Majority Income | 65 | - | 6 | 6 | 71 | ||||||||

| EBITDA | 247 | (6) | - | (6) | 241 | ||||||||

CHANGES FY16

| mm US$ |

Changes reported in 2016 |

||||||||||||

| INCOME STATEMENT |

2016 reported |

Disc.operations and freight reclassification |

Fixed assets |

Disc.operations, freight reclassification and fixed assets |

2016 adjusted |

||||||||

| Net sales | 5,349 | - | - | - | 5,349 | ||||||||

| Cost of sales | 4,143 | 1 | (34) | (33) | 4,110 | ||||||||

| Gross Profit |

1,206 |

(1) |

34 |

33 |

1,239 |

||||||||

| Operating expenses | 691 | 2 | (4) | (2) | 689 | ||||||||

| Operating Income |

515 |

(3) |

38 |

35 |

550 |

||||||||

| Financial cost | 164 | - | - | - | 164 | ||||||||

| Equity income of associated entities | (3) | - | - | - | (3) | ||||||||

| Income from continued operations before income tax |

354 |

(3) |

38 |

35 |

389 |

||||||||

| Cash tax | 190 | - | - | - | 190 | ||||||||

| Deferred tax | (67) | - | 13 | 13 | (54) | ||||||||

| Income Tax |

123 |

- |

13 |

13 |

136 |

||||||||

| Income from continued operations |

231 |

(3) |

25 |

22 |

253 |

||||||||

| Discontinued Operations | (10) | 3 | - | 3 | (7) | ||||||||

| Net Consolidated Income |

221 |

- |

25 |

25 |

246 |

||||||||

| Minority Interest | (17) | - | - | - | (17) | ||||||||

| Net Majority Income |

238 |

- |

25 |

25 |

263 |

||||||||

| EBITDA |

884 |

- |

- |

- |

884 |

||||||||

APPENDIX II: CONSOLIDATED RESTRUCTURED FIGURES OF BALANCE SHEET BY QUARTER AS A CONSEQUENCE OF FIXED ASSET ACCOUNTING POLICY CHANGES

| mm US$ | ||||||||||||||||||||||||||||||||||||

| Consolidated 2015 | Adjustments | Consolidated 2015 Adjusted | Consolidated March 2016 | Adjustments | Consolidated March 2016 Adjusted | Consolidated June 2016 | Adjustments | Consolidated June 2016 Adjusted | Consolidated September 2016 | Adjustments | Consolidated September 2016 Adjusted | Consolidated December 2016 | Adjustments | Consolidated December 2016 Adjusted | ||||||||||||||||||||||

| Current Assets | ||||||||||||||||||||||||||||||||||||

| Cash and Cash equivalents | 653 | - | 653 | 586 | - | 586 | 662 | - | 662 | 651 | - | 651 | 714 | - | 714 | |||||||||||||||||||||

| Net Account Receivable | 884 | - | 884 | 975 | - | 975 | 988 | - | 988 | 1,277 | - | 1,277 | 1,181 | - | 1,181 | |||||||||||||||||||||

| Other current assets | 698 | - | 698 | 716 | - | 716 | 702 | - | 702 | 704 | - | 704 | 644 | - | 644 | |||||||||||||||||||||

| Assets held for sale | 17 | - | 17 | 16 | - | 16 | 15 | - | 15 | 15 | - | 15 | 21 | - | 21 | |||||||||||||||||||||

| Total Current Assets | 2,252 | - | 2,252 | 2,293 | - | 2,293 | 2,367 | - | 2,367 | 2,647 | - | 2,647 | 2,560 | - | 2,560 | |||||||||||||||||||||

| Property, plant and equipment | 4,203 | (471) | 3,732 | 4,305 | (462) | 3,843 | 4,167 | (456) | 3,711 | 4,213 | (450) | 3,763 | 4,202 | (452) | 3,750 | |||||||||||||||||||||

| Net other assets | 2,215 | - | 2,215 | 2,242 | - | 2,242 | 2,228 | - | 2,228 | 2,222 | - | 2,222 | 2,044 | - | 2,044 | |||||||||||||||||||||

| Total Assets | 8,670 | (471) | 8,199 | 8,840 | (462) | 8,378 | 8,762 | (456) | 8,306 | 9,082 | (450) | 8,632 | 8,806 | (452) | 8,354 | |||||||||||||||||||||

| Current Liabilities | ||||||||||||||||||||||||||||||||||||

| Bank loans and current portion of long-term debt | 44 | - | 44 | 61 | - | 61 | 62 | - | 62 | 64 | - | 64 | 58 | - | 58 | |||||||||||||||||||||

| Suppliers and letters of credit of suppliers | 1,201 | - | 1,201 | 1,240 | - | 1,240 | 1,244 | - | 1,244 | 1,292 | - | 1,292 | 1,270 | - | 1,270 | |||||||||||||||||||||

| Other current liabilities | 554 | - | 554 | 513 | - | 513 | 604 | - | 604 | 558 | - | 558 | 645 | - | 645 | |||||||||||||||||||||

| Liabilities associated with asset held for sale | 20 | - | 20 | 16 | - | 16 | 15 | - | 15 | 18 | - | 18 | 13 | - | 13 | |||||||||||||||||||||

| Total Current Liabilities | 1,819 | - | 1,819 | 1,830 | - | 1,830 | 1,925 | - | 1,925 | 1,932 | - | 1,932 | 1,986 | - | 1,986 | |||||||||||||||||||||

| Bank loans and long-term debt | 2,291 | - | 2,291 | 2,280 | - | 2,280 | 2,264 | - | 2,264 | 2,249 | - | 2,249 | 2,241 | - | 2,241 | |||||||||||||||||||||

| Long-term other liabilities | 882 | (142) | 740 | 931 | (137) | 794 | 815 | (135) | 680 | 889 | (132) | 757 | 682 | (136) | 546 | |||||||||||||||||||||

| Total Liabilities | 4,992 | (142) | 4,850 | 5,041 | (137) | 4,904 | 5,004 | (135) | 4,869 | 5,070 | (132) | 4,938 | 4,909 | (136) | 4,773 | |||||||||||||||||||||

| Capital stock | 1,755 | - | 1,755 | 1,755 | - | 1,755 | 1,755 | - | 1,755 | 1,755 | - | 1,755 | 1,755 | - | 1,755 | |||||||||||||||||||||

| Retained earnings | 1,007 | 256 | 1,263 | 1,074 | 263 | 1,337 | 1,036 | 269 | 1,305 | 1,192 | 274 | 1,466 | 1,126 | 281 | 1,407 | |||||||||||||||||||||

| Other comprehensive income | 140 | (569) | (429) | 154 | (572) | (418) | 192 | (575) | (383) | 176 | (577) | (401) | 98 | (582) | (484) | |||||||||||||||||||||

| Controlling interest | 2,902 | (313) | 2,589 | 2,983 | (309) | 2,674 | 2,983 | (306) | 2,677 | 3,123 | (303) | 2,820 | 2,979 | (301) | 2,678 | |||||||||||||||||||||

| Non-controlling interest | 776 | (16) | 760 | 816 | (16) | 800 | 775 | (15) | 760 | 889 | (15) | 874 | 918 | (15) | 903 | |||||||||||||||||||||

| Total stockholders’ equity | 3,678 | (329) | 3,349 | 3,799 | (325) | 3,474 | 3,758 | (321) | 3,437 | 4,012 | (318) | 3,694 | 3,897 | (316) | 3,581 | |||||||||||||||||||||