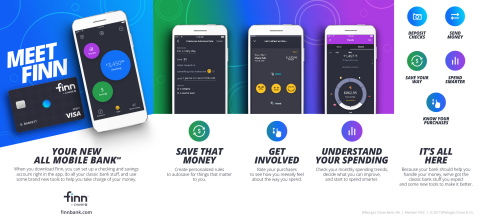

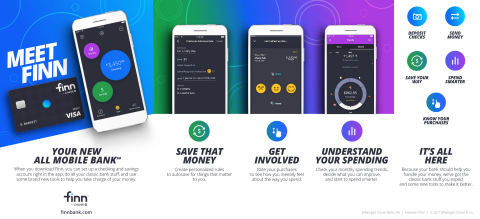

NEW YORK--(BUSINESS WIRE)--Chase today unveiled Finn by Chase℠, a new all-mobile bank that gives consumers greater control of their everyday spending and saving - and happiness - through a completely mobile experience.

Finn℠ offers a new perspective on banking through customized tools that help consumers build savings and reflect on everyday spending, from a daily cup of coffee to a vacation with friends.

The bank designed Finn by working closely with millennials for more than a year to understand their unique money challenges and what influences their spending. Research found that emotions played a large part in their decisions, but they didn’t have a way to understand the impact it had on their financial lives.

“When it comes to money, millennials told us they don’t want to feel like they’re being judged,” said Bill Wallace, CEO of Digital at Chase. “So, we designed Finn to put them in charge, no matter where or how they’re spending.”

To help millennials play a more active role in managing their finances, Finn offers tools that let them:

- Rate purchases: Customers can rate transactions as something they “want” or “need,” and assign emojis for how those purchases made them feel.

- Automatically build savings: Customers save by setting personal autosave rules on their terms, like saving $5 every time they go shopping. Set it and forget it!

- Stop overspending: Finn only lets customers spend what they have.

“We continue to invest in technology that makes banking easier for our customers, and gives them the confidence they need for their financial future,” said Thasunda Duckett, CEO of Consumer Banking at Chase. “Finn is yet another way we’re innovating for millennials by designing a product that lets them spend and save on their terms.”

Finn provides all of the capabilities of a traditional checking and savings account, but does it through a fully mobile experience. The new app is supported by Chase’s digital account opening platform, which allows consumers to sign up directly from their phone and start banking in minutes.

The Finn debit card gives customers fee-free access to more than 29,000 Chase and other ATMs which they can find by checking the ATM locator in, of course, Finn on their phone.

Finn by Chase debuts for iOS users today in St. Louis and will roll out to additional U.S. cities and Android users next year. For more information, please visit finnbank.com or find Finn in the App Store.

To watch a demo of the Finn by Chase experience, please click here.

Opening more accounts through mobile

Chase will begin offering its open-by-mobile capability to Chase checking and savings accounts later this year.

The mobile-first experience will deliver customers a fast, easy way to set up an account and start banking in minutes, wherever, whenever.

Chase continues to invest in mobile innovation for its customers through capabilities such as QuickDeposit, Chase QuickPay® with Zelle® and Chase Pay®. The bank has the number one rated mobile app among large banks with 29 million active users, up 60% from 2014.

About Chase

Chase is the U.S. consumer and commercial banking business of JPMorgan Chase & Co. (NYSE:JPM), a leading global financial services firm with assets of $2.6 trillion and operations worldwide. Chase serves nearly half of America’s households with a broad range of financial services, including personal banking, credit cards, mortgages, auto financing, investment advice, small business loans and payment processing. Customers can choose how and where they want to bank: 5,200 branches, 16,000 ATMs, mobile, online and by phone. For more information, go to Chase.com.