BOSTON--(BUSINESS WIRE)--Fidelity Clearing & Custody Solutions today introduced its “New Advice Value Drivers,” which provides a modern hierarchy—or “value stack”— for wealth management firms to articulate and help in delivering greater value to their clients. Amidst regulatory, investor and technology shifts, many firms are taking a hard look at their value propositions, and 81 percent of firm leaders surveyed agree that they need to deliver value differently in the future.

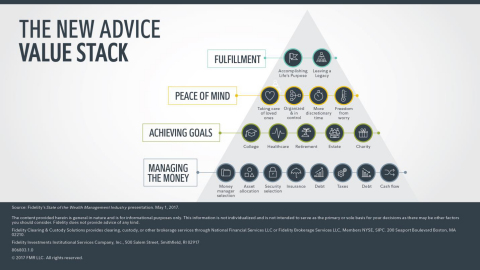

The new advice value stack—inspired by Bain & Company’s recent “Elements of Value”1 —suggests that advisors start by managing their clients’ money, build upon that to help clients achieve their goals and peace of mind, and then ultimately help clients reach fulfillment: a sense that they’ve accomplished their life’s purpose and are leaving a legacy.

“Advisory firms are being challenged to ‘create more value’ with their investor clients. But how do they do that? Through the New Advice Value Drivers—delivering better outcomes for clients, building digital into your DNA and creating sustainable, enduring firms,” said Sanjiv Mirchandani, president of Fidelity Clearing & Custody Solutions. “To achieve success, firms must be methodical in how they deliver value and be open to delivering it differently in order to move up through the layers of the value stack.”

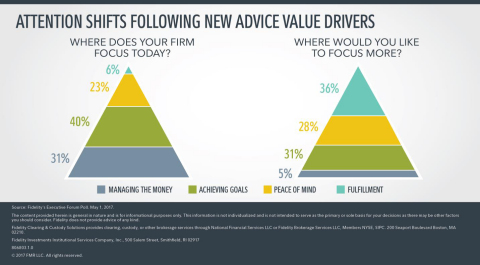

This fresh look at how to deliver value was presented at Fidelity’s 19th annual Executive Forum, a gathering of 350 wealth management firm leaders, representing more than $1.2T in assets under management. In a poll conducted after the New Advice Value Drivers were presented, the most dramatic shift occurred at the very top and bottom of the current and future value stacks. Today, only 6 percent of firms focus on fulfillment— the top layer of the stack. In the future, only 5 percent of firms will focus primarily on managing the money—the bottom of the stack. This up-ending of firm leaders’ focus indicates their desire to make this strategic shift. The center two levels of the current and future stacks remain comparable, indicating that achieving goals and creating peace of mind for clients will continue to be core pillars of investment advice. Building digital into their DNA was the most important driver of how firm leaders believed they would achieve this value creation—32 percent of firm leaders said they would look to leverage technology and digital enhancements within their businesses.

To learn more about Fidelity’s New Advice Value Drivers and the steps firms can take to achieve success, go to http://go.fidelity.com/valuedrivers.

About Fidelity’s Executive Forum and Poll

Fidelity’s

Executive Forum brings together leaders from 350 of the top wealth

management firms in the industry to share insights and drive

transformation in their firms. The two day event featured Fidelity

speakers, panels and industry thought leaders and was hosted May 1-2,

2017 in Orlando, Florida. The event is hosted by Fidelity’s Clearing &

Custody Solutions, which administers more than $1.9 trillion in combined

assets. The 2017 Executive Forum Poll was conducted at the Executive

Forum on May 1, 2017 with attendees of Sanjiv Mirchandani’s State of

the Wealth Management Industry presentation. 118 attendees in total

participated in the survey, which was conducted via mobile device,

immediately following the session. Respondents were senior executives

from Fidelity client firms, including RIAs, broker-dealers, family

offices and banks.

About Fidelity Investments

Fidelity’s mission is to inspire

better futures and deliver better outcomes for the customers and

businesses we serve. With assets under administration of $6.2 trillion,

including managed assets of $2.3 trillion as of May 31, 2017, we focus

on meeting the unique needs of a diverse set of customers: helping more

than 26 million people invest their own life savings, 23,000 businesses

manage employee benefit programs, as well as providing more than 12,500

financial advisory firms with investment and technology solutions to

invest their own clients’ money. Privately held for 70 years, Fidelity

employs 45,000 associates who are focused on the long-term success of

our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about.

The content provided herein is general in nature and is for informational purposes only. This information is not individualized and is not intended to serve as the primary or sole basis for your decisions as there may be other factors you should consider. Fidelity does not provide advice of any kind.

Fidelity Clearing & Custody Solutions provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC. 200 Seaport Boulevard Boston, MA 02210.

Fidelity Institutional Asset Management® (FIAM®) provides products and services to investment professionals, plan sponsors, and institutional investors through Fidelity Investments Institutional Services Company, Inc., 500 Salem Street, Smithfield RI 02917.

806803.1.0

© 2017 FMR LLC. All rights reserved.

1 Source: Eric Almquist, Bain & Company, “The Elements of Value,” Harvard Business Review, September 2016 https://hbr.org/2016/09/the-elements-of-value