MINNEAPOLIS--(BUSINESS WIRE)--Buffalo Wild Wings, Inc. (NASDAQ:BWLD) today mailed a letter to its shareholders in connection with the company’s upcoming 2017 Annual Meeting of Shareholders (“Annual Meeting”) to be held on June 2, 2017. The Buffalo Wild Wings Board of Directors unanimously recommends that shareholders vote the YELLOW proxy card “FOR” the election of all nine of the Board’s experienced and highly-qualified director nominees: Cynthia L. Davis, Andre J. Fernandez, Janice L. Fields, Harry A. Lawton, J. Oliver Maggard, Jerry R. Rose, Sam B. Rovit, Harmit J. Singh and Sally J. Smith.

All materials regarding the Board’s recommendation can be found at http://www.buffalowildwings.com/en/2017-annual-meeting/.

The full text of the letter follows:

VOTE THE ENCLOSED YELLOW PROXY CARD TODAY

“FOR” ALL OF

BUFFALO WILD WINGS’ HIGHLY QUALIFIED DIRECTOR NOMINEES

May 15, 2017

Dear Fellow Shareholder:

We are less than three weeks away from the Buffalo Wild Wings 2017

Annual Meeting of Shareholders, which will be held on June 2nd.

As you probably know by now, Marcato Capital Management, L.P.

(“Marcato”) is seeking to have you vote to remove every independent

director who has served on our Board for more than eight months. Marcato

wants you to take this radical step so that there is room for Marcato to

add its hand-picked substitutes, who have neither the experience with

the company nor the skills that we believe are necessary to continue

Buffalo Wild Wings’ history of success.

Buffalo Wild Wings has performed well as a business and as an investment. The company has generally outperformed its casual dining peers on key operational and financial metrics. Not surprisingly, shareholders have been rewarded as well – the total return earned by our shareholders over the one-, three-, five- and ten-year periods ended April 28, 2017, for example, exceed the median returns generated by our casual dining peers.1

We encourage you to vote for all our nominees, who have helped Buffalo Wild Wings generate these returns. Please protect the value of your investment by voting the enclosed YELLOW proxy card “FOR” ALL nine of our company’s highly qualified director nominees: Cynthia L. Davis, Andre J. Fernandez, Janice L. Fields, Harry A. Lawton, J. Oliver Maggard, Jerry R. Rose, Sam B. Rovit, Harmit J. Singh and Sally J. Smith.

MARCATO’S AGGRESSIVE REFRANCHISING PROPOSAL IS UNPRECEDENTED, RECKLESS AND POTENTIALLY VALUE DESTRUCTIVE

Marcato has offered no plan for operating Buffalo Wild Wings

differently, except that Marcato believes we should sell nearly all our

restaurants to franchisees. Specifically, Marcato is suggesting that we

announce the sale of 500+ restaurants to be completed by 2020. No

casual dining company has ever completed such an aggressive transition.

Marcato accuses us of "dismissing" its refranchising proposal. This is absolutely untrue. Buffalo Wild Wings' management and Board, along with our financial advisor, have thoroughly analyzed Marcato’s proposal and have run complex models to assess the potential benefits of a sale of the vast majority of our assets. Further, between August and December 2016, the company and its financial advisors engaged in multiple in-person, telephonic and e-mail discussions with Marcato to present our analysis and demonstrated clearly our reasons for disagreeing with Marcato’s analysis and proposal.

We firmly believe that, in the absence of data about the market for our restaurants and given what history there is of such a major undertaking, it would be imprudent to announce and embark on such a dramatic transformation at this time. As fiduciaries of your investment, we cannot in good faith undertake such an aggressive endeavor with such a significant risk of destruction of shareholder value.

At Buffalo Wild Wings, we make decisions based on rigorous analysis of

data. We are currently selling 80 carefully chosen restaurants in our

portfolio, using an investment bank that Marcato has used and presumably

respects. We will learn valuable facts about the strength of the market

for our assets during that process. Based on these facts, we will assess

if further refranchising creates greater value for our shareholders.

MARCATO'S ANALYSIS IS BASED ON FLAWED ASSUMPTIONS

A number of Marcato’s assumptions are untested, speculative, aggressive or simply impossible.

For example, Marcato’s analysis assumes:

1. We can sell more than 500 stores by 2020 at a 6x EBITDA;

2. We can repurchase shares for 8x-9x EBITDA through 2020, before suddenly re-rating to 13x EBITDA;

3. We will trade at 13x after refranchising, a higher multiple than observed for any comparable casual dining peer, including highly franchised companies;

4. We can reduce G&A, as a percentage of system-wide sales, below where we believe is achievable, while appropriately supporting our business;

5. A scale refranchising will not negatively impact the company’s 5% royalty rate;

6. We will continue to develop new restaurants during the proposed refranchising period, even refranchising more restaurants than Buffalo Wild Wings owns today; and

7. We can achieve a lower tax rate than what would be realized in a highly franchised system.

We do not believe there is any evidence that these assumptions are likely to turn out to be true. And, as fiduciaries for all shareholders, we do not believe it would be responsible to launch a massive refranchising effort on the basis of untested and unrealistic assumptions, particularly at a time when the casual dining sector in general and Buffalo Wild Wings are facing strong revenue and cost pressures.

Marcato’s own director nominee, Lee Sanders (who Marcato has touted as an expert in franchising) has privately questioned the sustainability of the valuation multiples that could be achieved in such a massive refranchising, explaining that the market will become oversaturated, causing the value of each asset to decrease.

“Too much available product in the market will cause a commensurate decline in value and demand over a 2-3 year period.” (Lee Sanders, August 2016 email)2

For evidence that such a refranchising would be feasible and create value, Marcato references the refranchising programs of certain quick-service restaurants (QSR) – or fast food concepts. The operations and business models of QSRs are much simpler to execute than those of casual dining restaurants like Buffalo Wild Wings, and, accordingly, the franchisee market for QSRs is deeper, and the need for corporate ownership is lower. QSRs do not have the complexity of employing servers, running an alcohol program or scheduling labor around sports and entertainment events. Additionally, the capital requirements are lower and there is less technology, loyalty program and menu complexity.

Don’t just take our word for it. The independent analysts at

Dougherty & Co. agree with this important distinction between QSRs and

casual dining restaurants:

“Casual dining restaurants are significantly more complex than

running a QSR operation and we believe much harder to standardize

operations and service.” (Dougherty & Co., April 2017)2

THE APPLEBEE’S REFRANCHISING EXERCISE IS INFORMATIVE

One example of a casual dining restaurant executing a major refranchising was Applebee's, which is a significant part of DineEquity, Inc. Applebee's is comparable to Buffalo Wild Wings, and we have studied this process and its results. It informs our inclination to be cautious even as we sell 80 restaurants.

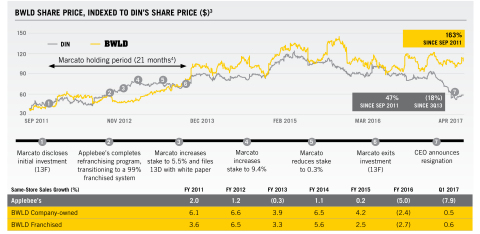

Marcato was very supportive of the major refranchising at Applebee’s of approximately 480 stores, a process that took five years. However, same-store sales growth has struggled following Applebee’s transition to an approximately 99% franchised system and the stock has significantly underperformed.

After Marcato championed the refranchising at Applebee’s, Marcato held DineEquity stock for only a short time. Then Marcato sold its entire position. DineEquity’s shares have declined 18% since Marcato’s exit.

The accompanying chart highlights DineEquity's operating and stock performance compared to Buffalo Wild Wings. The stock of DineEquity has underperformed the casual dining sector because Applebee’s has struggled as a business now that it is fully franchised. In each of the last two quarters, Applebee's has had same-store sales declines of more than 7%!

We do not want Buffalo Wild Wings to be the next Applebee's.

BUFFALO WILD WINGS REGULARLY REVIEWS ITS COMPANY-OWNED AND FRANCHISED

RESTAURANTS TO ACHIEVE OPTIMAL MIX

We continuously review our portfolio of restaurants. We do not target a specific franchise mix, as the optimal balance is dependent upon many factors that change over time.

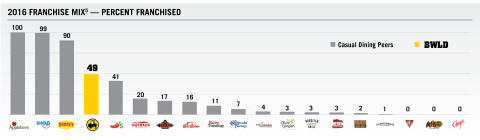

It is important to observe, however, how rare a 90% franchisee model is in the casual dining sector. Among other things, for the system to perform well, it is important to have a significant number of company-owned restaurants so the company can remain in the timely flows of increasingly changing customer tastes and preferences.

The only casual dining peers with a greater franchise mix than Buffalo Wild Wings are DineEquity (Applebee’s and IHOP) and Denny’s. Notably, IHOP and Denny’s are substantially easier to operate. Their "Family Restaurant" model, with no alcohol, limited technology and less differentiation is much more straightforward.

PROTECT THE VALUE OF YOUR INVESTMENT –

VOTE THE ENCLOSED

YELLOW PROXY CARD TODAY

We encourage you to protect the value of your investment in Buffalo Wild Wings by using the enclosed YELLOW proxy card to vote “FOR” each of Buffalo Wild Wings’ nine nominees by telephone, by Internet, or by signing and dating the enclosed YELLOW proxy card and returning it in the postage-paid envelope provided. No matter how few shares you own, it is important that all shareholders have their voices heard in this critically important decision regarding your investment. We further encourage you to discard any proxy materials sent to you by Marcato.

We thank you for your continued support.

Sincerely,

|

Jerry R. Rose

/s/ Jerry R. Rose

Chairman of the Board |

Cynthia L. Davis

/s/ Cynthia L. Davis Independent Director |

Andre J. Fernandez

/s/ Andre J. Fernandez Independent Director |

|||

|

Harry A. Lawton III

/s/ Harry A. Lawton III Independent Director |

J. Oliver Maggard

/s/ J. Oliver Maggard Independent Director |

Harmit J. Singh

/s/ Harmit J. Singh Independent Director |

|||

|

Sally J. Smith

/s/ Sally J. Smith CEO & President and Director |

James M. Damian

/s/ James M. Damian Independent Director (retiring 2017) |

Michael P. Johnson

/s/ Michael P. Johnson Independent Director (retiring 2017) |

If you have any questions or require any assistance with voting your

shares, please contact the company’s proxy solicitor listed below:

MacKenzie Partners, Inc.

105 Madison Avenue

New

York, New York 10016

Call Collect: (212) 929-5500

or

Toll-Free

(800) 322-2885

Email: proxy@mackenziepartners.com

Lazard Ltd is serving as financial advisor and Faegre Baker Daniels is serving as legal advisor to the company.

About the Company

Buffalo Wild Wings, Inc., founded in 1982 and headquartered in Minneapolis, is a growing owner, operator and franchisor of Buffalo Wild Wings(R) restaurants featuring a variety of boldly-flavored, made-to-order menu items including its namesake Buffalo, New York-style chicken wings. The Buffalo Wild Wings menu specializes in 21 mouth-watering signature sauces and seasonings with flavor sensations ranging from Sweet BBQ(TM) to Blazin'(R). Guests enjoy a welcoming neighborhood atmosphere that includes an extensive multi-media system for watching their favorite sporting events. Buffalo Wild Wings is the recipient of hundreds of "Best Wings" and "Best Sports Bar" awards from across the country. There are currently more than 1,220 Buffalo Wild Wings locations around the world.

To stay up-to-date on all the latest events and offers for sports fans and wing lovers, like Buffalo Wild Wings on Facebook, follow @BWWings on Twitter and visit www.BuffaloWildWings.com.

Cautionary Statement Regarding Certain Information

This communication contains “forward-looking statements” within the meaning of the federal securities laws. Such statements include statements concerning anticipated future events and expectations that are not historical facts. All statements other than statements of historical fact are statement that could be deemed forward-looking statements. Actual results may vary materially from those expressed or implied by forward-looking statements based on a number of factors, including the factors described under “Risk Factors” in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 25, 2016, as updated or supplemented by subsequent reports we file with the SEC. We do not assume any obligation to publicly update any forward-looking statement after they are made, whether as a result of new information, future events or otherwise.

Important Information

Buffalo Wild Wings, Inc., its directors and certain of its executive officers and employees are participants in the solicitation of proxies from Buffalo Wild Wings shareholders in connection with its 2017 annual meeting of shareholders to be held on June 2, 2017. Information concerning the identity and interests of these persons is available in the definitive proxy statement Buffalo Wild Wings filed with the SEC on April 21, 2017.

Buffalo Wild Wings has filed a definitive proxy statement in connection with its 2017 annual meeting. The definitive proxy statement, any amendments thereto and any other relevant documents, and other materials filed with the SEC concerning Buffalo Wild Wings are (or will be, when filed) available free of charge at http://www.sec.gov and http://ir.buffalowildwings.com. Shareholders should read carefully the definitive proxy statement and any other relevant documents that Buffalo Wild Wings files with the SEC when they become available before making any voting decision because they contain important information.

1 Source: FactSet. Market data as of April 28, 2017. Casual dining peers include BBRG, BJRI, BLMN, CAKE, CBRL, CHUY, DENN, DIN, DRI, EAT, IRGT, RRGB, RT and TXRH. BBRG, BLMN, CHUY and IRGT included as of respective IPO dates. California Pizza Kitchen and P.F. Chang’s data included only in ten-year analysis, due to buyouts in July 2011 and July 2012, respectively.

2 Permission to use quotations neither sought nor obtained.

3 Source: Company filings and FactSet. Market data as of April 28, 2017. DIN’s total shareholder return since Marcato 13D filing on December 19, 2012 to exit was 13.2%.

4 Holding period calculated from initial disclosure and exit based on 13F filings.

5 Source: Company filings. Individual concept data shown for BLMN, DIN, DRI, EAT and IRG. Excludes concepts with less than 100 units.