AKRON, Ohio--(BUSINESS WIRE)--Americans expect their bank to actively help them make better financial decisions, and most feel their bank is failing to provide it. That’s one of the main takeaways from Part I of the 2017 Segmint Consumer Bank Marketing Report, an annual look at consumer attitudes and expectations related to banking and bank technology.

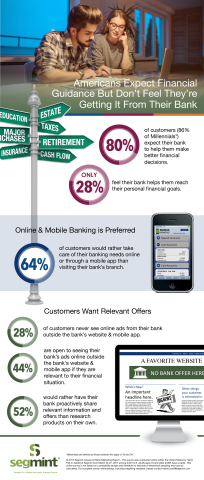

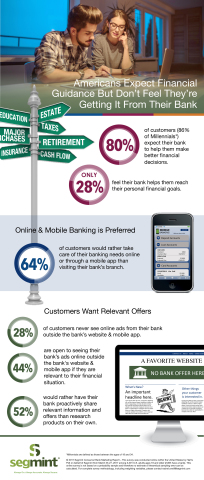

Of the more than 2,000 U.S. adults surveyed, 80 percent (and 86 percent of Millennials) expect their bank to provide them with information to help make better financial decisions. Even with such high expectations, just over a quarter (28 percent) of bank customers feel their bank provides them with information that helps them reach their personal financial goals and life events such as paying for college, saving for a down payment on a home, etc.

“Broad marketing and loose demographic assumptions are not enough to win customers or build loyalty in today’s environment,” said Rob Heiser, president and CEO of data-driven, software solutions company, Segmint. “Customers expect more than a one size fits all approach to banking. Banks have all the data they need to provide a highly personalized experience, and they owe it to their customers.”

Instead of grouping customers together by age, gender or location, Segmint leverages patented technology to take a bank’s data and assign Key Lifestyle Indicators® (KLIs) to each customer based on real-time transactional behavior, actual activities and interests. Through KLIs, Segmint empowers banks to provide customized information and offers specific to each customer’s financial needs and goals.

By the time data is collected and analyzed, data driven marketing campaigns without Segmint can take weeks or months to finally deploy. Segmint compresses the time between campaign audience creation and execution down to minutes, allowing for individually tailored mass communication at scale.

Additional findings of Part I of the 2017 Segmint Consumer Bank Marketing Report:

- The majority of bank customers (52 percent) would rather have their bank proactively share information and offers relevant to their needs than research products on their own.

- Only 11 percent of bank customers feel they receive too much communication from their bank trying to sell them different products and services.

- Nearly one in four (24 percent) bank customers (and 32 percent of Millennial bank customers) don’t have a good understanding of all of the products and services their financial institution offers.

- More than a quarter of bank customers (28 percent) never see online advertisements from their bank outside of the bank’s website and mobile app.

- The overwhelming majority of bank customers (89 percent) trust that their bank protects their personal information.

Additional results from Part I of the 2017 Segmint Consumer Bank Marketing Report, including an infographic and breakdowns by gender, age, bank type and other demographics are available on the Segmint website. Segmint will release additional survey findings in Part II of the report later this year. The second part of the report will further analyze consumer’s preference for targeted and personalized communication from their banks.

Survey Methodology

This survey was conducted online within the United States by Harris Poll on behalf of Segmint from March 23-27, 2017 among 2,201 U.S. adults ages 18 and older (2,065 have a bank). This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated.

About Segmint

Segmint, Inc. is a leading provider of secure data-driven software for companies in highly regulated industries such as financial services. Segmint’s patented software activates large quantities of data by integrating predictive analytics, campaign management, multichannel message delivery and campaign reporting into one secure solution. Segmint’s Key Lifestyle Indicator® technology (KLIs®) helps organizations better understand their customers by analyzing actual consumer transaction data to anticipate real-time interests and needs. Segmint empowers companies to deliver relevant, personalized and secure marketing experiences across all channels at the precise moment customers are considering a purchase.