MINNEAPOLIS--(BUSINESS WIRE)--Buffalo Wild Wings, Inc. (NASDAQ:BWLD) today announced that it has filed definitive proxy materials with the U.S. Securities and Exchange Commission (“SEC”) in connection with the company’s upcoming 2017 Annual Meeting of Shareholders (“Annual Meeting”) to be held on June 2, 2017. Buffalo Wild Wings shareholders of record at the close of business on April 13, 2017 are entitled to vote at the Annual Meeting. The proxy statement and other important information related to the Annual Meeting can be found on the company’s website at ir.buffalowildwings.com.

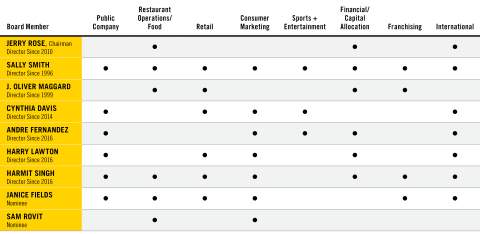

The Buffalo Wild Wings Board of Directors unanimously recommends that shareholders vote the YELLOW proxy card “FOR” the election of all nine of the Board’s experienced and highly-qualified director nominees: Cynthia L. Davis, Andre J. Fernandez, Janice L. Fields, Harry A. Lawton, J. Oliver Maggard, Jerry R. Rose, Sam B. Rovit, Harmit J. Singh and Sally J. Smith.

In connection with the filing of the proxy statement, the Buffalo Wild Wings Board mailed the following letter to shareholders:

VOTE THE ENCLOSED YELLOW PROXY CARD TODAY

“FOR”

ALL OF BUFFALO WILD WINGS’ HIGHLY-QUALIFIED DIRECTOR NOMINEES

April 21, 2017

Dear Fellow Shareholder:

We are writing to encourage you to elect our highly-qualified directors at the upcoming Buffalo Wild Wings 2017 Annual Meeting of Shareholders, to be held on June 2, 2017.

Please use the enclosed YELLOW proxy card to vote “FOR” each of Buffalo Wild Wings’ nine nominees: Cynthia L. Davis, Andre J. Fernandez, Janice L. Fields, Harry A. Lawton, J. Oliver Maggard, Jerry R. Rose, Sam B. Rovit, Harmit J. Singh and Sally J. Smith. We urge you to vote by telephone, by Internet or by signing and dating the YELLOW proxy card and returning it in the postage-paid envelope provided.

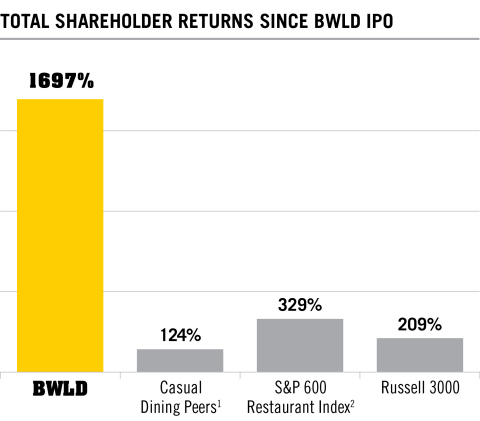

This year’s Annual Meeting is a particularly important one. After generating industry-leading total shareholder returns for our shareholders since our IPO in 2003 – indeed, $10,000 invested in our stock at the IPO was worth more than $175,000 on March 31, 2017 – our Board and management team are under attack from a short-term-focused hedge fund, Marcato Capital Management, LP, that seeks to upend our winning formula and business strategy.

We have made considerable efforts to resolve this unnecessary proxy contest, but Marcato has rejected every one of our proposals. We believe that Marcato’s plans for the business – involving a massive refranchising of our company-owned stores, among other things – will not create sustainable shareholder value but will create substantial risk.

BUFFALO WILD WINGS HAS DELIVERED FOR SHAREHOLDERS1

Our record of outstanding performance is compelling. If you invested with us at our IPO, ten years ago, five years ago, three years ago or even just a year ago, you have earned a return that exceeds the median return generated by other casual dining restaurant companies.1

We have also outperformed those peers, on average, in key operating and financial metrics such as same store sales, restaurant level margins, returns on invested capital and growth of earnings per share, among other things, over most time periods.3 Our earnings per share have grown at a compounded annual rate of more than 18% over the last ten years. Returns on the capital we have deployed in the business exceed the returns generated by our peers on their capital and far exceed our cost of capital.

And we are not sitting still.

We recognize that the casual dining sector in the United States is pressured by economic, technological and demographic trends and that growth in the number of restaurants in the United States has exceeded the growth in population. All casual dining chains face these headwinds. To stay ahead of the competition and continue to grow globally, we need to remain at the forefront of innovation in our industry.

To help us do this, we have made some significant changes to our leadership team, strategy and Board of Directors. We added three extraordinary individuals to our Board of Directors in October, 2016 – Andre J. Fernandez, Harry A. Lawton and Harmit J. Singh. At this upcoming Annual Meeting, we have nominated, and hope you will elect, two more new directors with deep restaurant experience – Janice L. Fields and Sam B. Rovit.

Notably, Mr. Rovit was initially nominated by Marcato and, after careful and deliberate evaluation by our Governance Committee, we believe Mr. Rovit will contribute to our Board.

We therefore enthusiastically nominated him ourselves.

Ms. Fields’ qualifications speak for themselves. She served as the President of McDonald's USA, LLC and she is simply one of the best chain restaurant operators in North America.

These five new directors bring important and relevant experience and further diversity to our Board as we face the industry’s challenges; they are energetic and proven leaders from the restaurant, food service, technology, retailing and consumer sectors.

We are also asking you to re-elect four members of the Board who have tenure and who bring critical insights into our future based on their history with the company. In addition to helping steer the company through a very successful period, all of these board members have exceptional careers in restaurants, food service, retailing and financial services. Included in this group is Sally Smith, our Chief Executive Officer, who has led the company since our IPO and its astounding 1697% growth in share price since that time.

The nine Buffalo Wild Wings director candidates on the YELLOW proxy card strike the right balance between continuity and fresh perspectives while maintaining a high level of relevant expertise.

Our proposed Board – which, if elected, will be one of the shortest-tenured Boards in the casual dining sector at an average of just 3.8 years of service – brings fresh perspectives, financial acumen and great enthusiasm for our business and all our shareholders. We will help Buffalo Wild Wings continue its record of industry leadership and creation of shareholder value.

This past year, we have also named a new Chairman of the Board and rotated the Chairs of each of our committees. We have re-examined our executive compensation programs – which have always received strong shareholder support – to focus them even more tightly on metrics that we believe will be critical to the business going forward. And, four of our longer-serving directors have retired or will retire as of the upcoming Annual Meeting to provide Board seats to new directors that bring us fresh perspective.

Our strategy is focused on driving sales and profitability through our innovative approach to the global casual dining market. We are focused on extending our unique offerings – elevating the social, entertainment and sports aspects of dining – to population-dense urban locations with smaller footprint restaurants and expanding our takeout and delivery business. In addition, we are implementing exciting in-restaurant technologies and programs that enhance every fan’s sports-watching experience throughout the day, including take-out options for fans hosting parties at home. We are also focused on profitability initiatives that will drive productivity and improve margins over the longer term. And we are optimizing our mix of owned restaurants and franchised restaurants while we adjust our balance sheet through additional leverage and stock buybacks.

WE BELIEVE MARCATO HAS NO CREDIBLE PLAN

Despite the extraordinary record of performance at Buffalo Wild Wings and our continuous work to innovate and improve performance, Marcato is advocating that the only three independent directors who have served for more than a year be removed from the Board. This aggressive proposal would remove highly valuable and critical institutional knowledge and expertise. Marcato has proposed that, in their stead, you should elect a hedge fund manager who has never created value for shareholders while serving on public company boards;4 a former Buffalo Wild Wings employee who left the company by mutual agreement and vastly exaggerates his achievements at Buffalo Wild Wings; and a former restaurant executive who refused even to meet with, or be interviewed by, the Chairman of our Board during our Board nominee vetting process.

Why would you do that?

Marcato has provided no credible plan for sustainable growth in shareholder value. Removing all of our longer-serving directors will leave the Board bereft of institutional knowledge, to say nothing of the gaps in our experience base it would create.

Our management team and Board have invested significant effort in engaging with Marcato. Our Board has evaluated and debated all of Marcato’s suggestions openly and objectively, with the advice of an independent financial advisor. Some of Marcato’s ideas had merit (many of which we had been considering ourselves) and were welcomed. We have implemented or are implementing them. In our view, the remainder of Marcato’s suggestions, however, would add substantial risk to our business, with no identifiable, long-term benefit.

Marcato appears primarily focused on having us sell 80% of our company-owned restaurants to franchisees. We have engaged an outside financial advisor to review this plan and believe Marcato’s analysis is based on a lack of understanding of our business and unrealistic assumptions. We continuously evaluate the right mix of owned and franchised restaurants and will continue to do so; we recently announced, for example, that we are going to sell approximately 70 restaurants. Marcato’s vastly more aggressive and unproven plan, however, simply does not pencil out.

Given our focus on extending our successful long-term track record, we will not support risky financial engineering strategies that provide an unlikely and modest short-term benefit but create substantial long-term risk. We do not believe that is what you want us to do, nor would you be well-served by it.

Instead, we trust that you want us to implement strategies and programs that are calculated to sustain our exceptional long-term performance without undue risk. If that is indeed what you desire, we encourage you to vote “FOR” each of Buffalo Wild Wings’ nine nominees today by telephone, by Internet or by signing and dating the YELLOW proxy card and returning it in the postage-paid envelope provided. No matter how few shares you own, it is important that all shareholders have their voices heard in this critically important decision regarding your investment. We further encourage you to discard any proxy materials sent to you by Marcato.

We thank you for your continued support.

Sincerely,

|

Jerry R. Rose

/s/ Jerry R. Rose

Chairman of the Board |

Cynthia L. Davis

/s/ Cynthia L. Davis Independent Director |

Andre J. Fernandez

/s/ Andre J. Fernandez Independent Director |

||||||

|

Harry A. Lawton III

/s/ Harry A. Lawton III Independent Director |

J. Oliver Maggard

/s/ J. Oliver Maggard Independent Director |

Harmit J. Singh

/s/ Harmit J. Singh Independent Director |

||||||

|

Sally J. Smith /s/ Sally J. Smith CEO & President and Director |

James M. Damian /s/ James M. Damian

Independent Director (retiring |

Michael P. Johnson /s/ Michael P. Johnson

Independent Director (retiring |

||||||

If you have any questions or require any assistance with voting your

shares,

please contact the company’s proxy solicitor listed below:

MacKenzie Partners, Inc.

105 Madison Avenue

New York, New York 10016

proxy@mackenziepartners.com

Call

Collect: (212) 929-5500

or

Toll-Free (800)

322-2885

Email: proxy@mackenziepartners.com

Lazard Ltd is serving as financial advisor and Faegre Baker Daniels is serving as legal advisor to the company.

About the Company

Buffalo Wild Wings, Inc., founded in 1982 and headquartered in Minneapolis, is a growing owner, operator and franchisor of Buffalo Wild Wings® restaurants featuring a variety of boldly-flavored, made-to-order menu items including its namesake Buffalo, New York-style chicken wings. The Buffalo Wild Wings menu specializes in 21 mouth-watering signature sauces and seasonings with flavor sensations ranging from Sweet BBQ™ to Blazin'®. Guests enjoy a welcoming neighborhood atmosphere that includes an extensive multi-media system for watching their favorite sporting events. Buffalo Wild Wings is the recipient of hundreds of "Best Wings" and "Best Sports Bar" awards from across the country. There are currently more than 1,220 Buffalo Wild Wings locations around the world.

To stay up-to-date on all the latest events and offers for sports fans and wing lovers, like Buffalo Wild Wings on Facebook, follow @BWWings on Twitter and visit www.BuffaloWildWings.com.

Cautionary Statement Regarding Certain Information

This communication contains “forward-looking statements” within the meaning of the federal securities laws. Such statements include statements concerning anticipated future events and expectations that are not historical facts. All statements other than statements of historical fact are statement that could be deemed forward-looking statements. Actual results may vary materially from those expressed or implied by forward-looking statements based on a number of factors, including the factors described under “Risk Factors” in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 25, 2016, as updated or supplemented by subsequent reports we file with the SEC. We do not assume any obligation to publicly update any forward-looking statement after they are made, whether as a result of new information, future events or otherwise.

Important Information

Buffalo Wild Wings, Inc., its directors and certain of its executive officers and employees are participants in the solicitation of proxies from Buffalo Wild Wings shareholders in connection with its 2017 annual meeting of shareholders to be held on June 2, 2017. Information concerning the identity and interests of these persons is available in the definitive proxy statement Buffalo Wild Wings filed with the SEC on April 21, 2017.

Buffalo Wild Wings has filed a definitive proxy statement in connection with its 2017 annual meeting. The definitive proxy statement, any amendments thereto and any other relevant documents, and other materials filed with the SEC concerning Buffalo Wild Wings are (or will be, when filed) available free of charge at http://www.sec.gov and http://ir.buffalowildwings.com. Shareholders should read carefully the definitive proxy statement and any other relevant documents that Buffalo Wild Wings files with the SEC when they become available before making any voting decision because they contain important information.

| 1 | Source: Company filings and FactSet. Market data as of March 31, 2017. BWLD became publicly traded on November 21, 2003. Casual dining peers include BBRG, BJRI, BLMN, CAKE, California Pizza Kitchen, CBRL, CHUY, DENN, DIN, DRI, EAT, IRGT, P.F. Chang’s, RRGB, RT, TXRH. Casual dining peers index represents median total shareholder return of the peer set. BBRG, BLMN, CHUY, IRGT and TXRH included as of respective IPO dates. California Pizza Kitchen and P.F. Chang’s data included until buyouts in July 2011 and July 2012, respectively. P.F. Chang’s is excluded from five-year total shareholder return comparison. | |

| 2 | Constituents include BH, BJRI, BOBE, CHUY, PLAY, DIN, LOCO, FRGI, RRGB, RT, RUTH, SHAK, SONC and WING. | |

| 3 | Performance as compared to the mean of the peer group over one, three, five and ten year periods. Peers include BBRG, BRJI, BLMN, CAKE, CBRL, CHUY, DENN, DIN, DRI, EAT, IRGT, RRGB, RT and TXRH. Same store sales figures are as reported. Where consolidated same store sales is not reported (i.e., DIN, DRI, TXRH), the figures used in the analysis reflect the weighted average same store sales by concept (i.e., DIN, DRI) or by ownership type (i.e., TXRH). Domestic same stores sales used for DIN, DENN and BLMN. Restaurant level margins are calculated as restaurant revenues less COGS, labor, occupancy and operating expenses. Restaurant level margins include marketing expenses in all cases except for DRI, prior to FY 2014, and RT, and include any reported one-time adjustments. EPS analysis utilizes adjusted fiscal year EPS, as reported, only for years in which each company was public. Mean EPS CAGR for the peer group excludes IRG due to negative EPS in FY 2016. EBITDA calculated as operating income, less stock-based comp and pre-opening expenses when not accounted for in the reported figure, plus depreciation and amortization. EBITDA is adjusted for impairment and closure expenses and one-time items. ROIC is calculated as after-tax EBIT divided by the average sum of total debt and total shareholders’ equity over a given fiscal year. EBIT is calculated as operating income, less stock-based comp and pre-opening expenses when not excluded in the reported figure, and is adjusted for impairment and closure expenses and one-time items. | |

| 4 |

NCR’s stock price declined approximately 8% during Mr. McGuire’s tenure on its board; Borders Group’s stock price declined approximately 77% during Mr. McGuire’s tenure as a director; Borders Group ultimately filed for bankruptcy following Mr. McGuire’s tenure as chairman. |

|