FORT LAUDERDALE, Fla.--(BUSINESS WIRE)--National Beverage Corp. (NASDAQ:FIZZ) today announces results for the third quarter of its 2017 Fiscal Year.

|

Investor Conscience |

|

• Nine-month earnings surpassed results for entire year FY 2016 by 27%. |

|

• EPS for the trailing twelve months was $2.05, achieving a new milestone. |

|

• Third quarter Revenues grew over 20% to $195 million. |

|

• Third quarter EPS increased 117% to $ .52. |

|

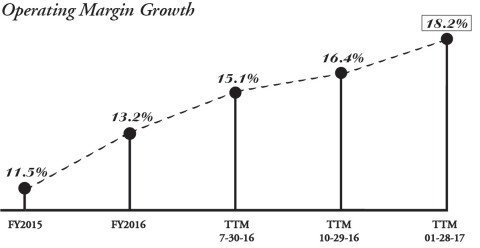

• TTM January 28, 2017 operating margin growth climbs to 18.2%. |

|

For the twelve months ended January 28, 2017 and January 30, 2016: |

||||||||||

|

(Dollars in millions except EPS) |

||||||||||

| Revenues |

Op. Income |

Net Income |

EPS |

EBITDA* | ||||||

| FY 2017 | $ 794 | $ 145 | $ 95 | $2.05 | $ 157 | |||||

| YOY Growth | 15% | 70% | 71% | 71% | 62% | |||||

| FY 2016 | $ 690 | $ 85 | $ 56 | $1.20 | $ 97 | |||||

“In conventional times, great things happen if great choices, great strategies, great teams and great fortune all align! We are in the depth of this unique time. Simultaneously, a very rare phenomenon comprising consumers, aggressive retailers and a new Mindfulness here at National Beverage . . . ignited an innovativeness that is extremely compelling to observe,” stated Nick A. Caporella, Chairman and Chief Executive Officer.

“Consumers are stimulating a dynamic that I have never before witnessed and this has resulted in retailers converting more and more aisle space to healthier products. I feel we are very much at the forefront of this new dynamic,” continued Caporella, speaking at a recent management conference.

“I am extremely proud that we finished our third quarter with industry-leading performance and that we are on course for having our record-setting year. Those of you who are joyous relative to our products and shareholders that rejoice in their appreciation and distributions – we hold you all in high esteem. The future has never been as exciting,” smiled Caporella.

|

Solid FIZZ Facts |

|

• Greatest performing third quarter ever. |

|

• Cash balances of $106 million after January distribution payment of $70 million. |

|

• Soda pop crossover consumers hydrate nearly the same in winter and summer periods. |

|

• 75% through FY2017 – results reflect a record year in the making. |

|

• Second cash distribution to be announced prior to FY2017 year end. |

|

• Special dividend based on length of time held – forthcoming announcement. |

|

• LaCroix + Shasta SDA (soft drink alternative) Brand Values reflect – Contrails! |

FIZZ IS – HEALTHY SPARKLING, ALL-WAYS!

National Beverage’s iconic brands are the genuine essence . . . of America

“Patriotism” – If Only We Could Bottle It!

| National Beverage Corp. | |||||||||||||||||||||

| Consolidated Results for the Periods Ended | |||||||||||||||||||||

| January 28, 2017 and January 30, 2016 | |||||||||||||||||||||

|

|

|||||||||||||||||||||

|

|

(in thousands, except per share amounts) |

||||||||||||||||||||

| Sparkling Performance | Three Months Ended | Nine Months Ended | |||||||||||||||||||

| Jan. 28, 2017 | Jan. 30, 2016 | Jan. 28, 2017 | Jan. 30, 2016 | ||||||||||||||||||

| Bottled water consumption will | |||||||||||||||||||||

| surpass carbonated soft drinks |

Net Sales |

$ 194,564 | $ 161,687 | $ 614,852 | $ 525,751 | ||||||||||||||||

| this year as the largest beverage | |||||||||||||||||||||

| category in the U.S. (1) | Net Income | $ 24,285 | $ 11,236 | $ 77,884 | $ 43,661 | ||||||||||||||||

| LaCroix is the fastest growing | Earnings Per | ||||||||||||||||||||

|

natural sparkling water brand.(2) |

Common Share |

||||||||||||||||||||

| Basic | $ .52 | $ .24 | $ 1.67 | $ .94 | |||||||||||||||||

| National Beverage innovates | Diluted | $ .52 | $ .24 | $ 1.67 | $ .93 | ||||||||||||||||

| as Natural as it Sparkles. | |||||||||||||||||||||

| Average Common Shares | |||||||||||||||||||||

| Outstanding | |||||||||||||||||||||

| Basic | 46,566 | 46,448 | 46,561 | 46,420 | |||||||||||||||||

| Diluted | 46,763 | 46,707 | 46,764 | 46,648 | |||||||||||||||||

This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve risks, uncertainties and other factors described in the Company's Securities and Exchange Commission filings which may cause actual results or achievements to differ from the results or achievements expressed or implied by such statements. The Company disclaims an obligation to update or announce revisions to any forward-looking statements.

*Although the Company reports its financial results in accordance with accounting principles generally accepted in the United States ("GAAP"), management believes that the disclosure of EBITDA, a non-GAAP financial measure, may provide users with additional insights into the operating performance of the business. EBITDA (in millions) of $157.0 and $96.7 for the 12 months ended January 28, 2017 and January 30, 2016, respectively, is calculated by adding the following expenses back to Net Income: Depreciation and Amortization of $12.6 and $11.8; Net Interest (Income) Expense of ($.3) and $.2; and Provision for Income Taxes of $49.3 and $29.0.

(1) Zenith International data - all channels

(2) SPINS (Specialty Products Industry Natural Stores) scan data 52 weeks ending January 22, 2017.