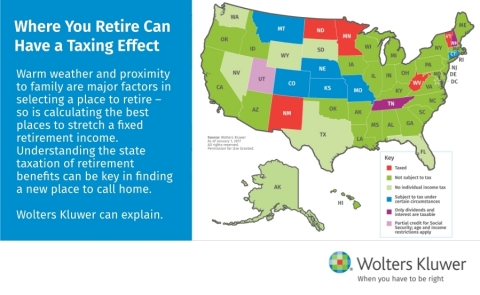

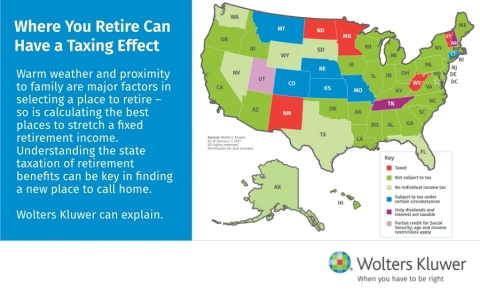

NEW YORK--(BUSINESS WIRE)--While the allure of warmer weather or being close to family are major factors in selecting a place to retire — so is calculating the best places to stretch a fixed retirement income. Understanding the current state tax treatments of retirement benefits can be a key step in deciding where to establish new, post-career roots.

Taxability of Retirement Benefits Varies State to State

Currently, seven states do not tax individual income – retirement or otherwise: Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming. Two other states – New Hampshire and Tennessee – impose income taxes only on dividends and interest (5 percent flat rate for both states). In the other 41 states and the District of Columbia, tax treatment of retirement benefits varies widely. For example, some states exempt all pension income or all Social Security income. Other states provide only partial exemption or credits and some tax all retirement income.

States exempting pension income entirely for qualified individuals are Illinois, Mississippi and Pennsylvania. States that exempt or provide a credit for a portion of pension income include: Alabama, Arkansas, Colorado, Delaware, Georgia, Hawaii, Iowa, Kentucky, Louisiana, Maine, Maryland, Michigan, Missouri, Montana, New Jersey, New Mexico, New York, Ohio, Oklahoma, Oregon, South Carolina, Utah, Virginia and Wisconsin. States where pension income is taxed include: Arizona, California, Connecticut, District of Columbia, Idaho, Indiana, Kansas, Massachusetts, Minnesota, Nebraska, North Carolina, North Dakota, Rhode Island, Vermont and West Virginia.

A total of 13 states impose tax on Social Security income: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont and West Virginia. These states either tax Social Security income to the same extent that the federal government does or provide limited breaks for Social Security income, often for lower-income individuals.

Significant State Tax Reforms

States enacting changes to their income tax laws for retirement plans in 2016 include:

- Minnesota: Military retirement pay (including pensions) is deductible. (Change is effective beginning with 2016 tax year.)

- New Jersey: The gross (personal) income tax exclusion on pension and retirement income is increased over a four-year period from $20,000 to $100,000 for married taxpayers filing jointly, from $15,000 to $75,000 for single and head-of-household filers, and from $10,000 to $50,000 for married taxpayers filing separately. (Change is effective beginning with the 2017 tax year.)

- Rhode Island: Taxpayers who have reached the Social Security retirement age are eligible for a $15,000 exemption on their retirement income. This exemption applies to single taxpayers with federal adjusted gross incomes of up to $80,000 and for joint taxpayers with federal adjusted gross incomes of up to $100,000 that are otherwise qualified (these amounts will be adjusted annually for inflation). (Change is effective beginning with 2017 tax year.)

- South Carolina: A new deduction for military retirement income is allowed. For taxpayers under 65 years of age, the deduction is $5,900 for the 2016 tax year, but increases by $2,900 each year until it is fully phased-in at $17,500 in 2020. For taxpayers 65 years of age or older, the deduction is $18,000 for the 2016 tax year, but increases by $3,000 each year until it is fully phased-in at $30,000 in 2020. (Change is effective beginning with 2016 tax year.)

For More Information

For additional detail on the state taxation of retirement benefits and

other tax factors to consider, click here.

To

arrange an interview with a federal or state tax expert from Wolters

Kluwer Tax & Accounting on this or any other tax-related topic, please

contact Laura Gingiss, 847-267-2213 or Brenda Au, 847-267-2046.

About Wolters Kluwer Tax & Accounting

Wolters Kluwer Tax & Accounting is a leading provider of software solutions and local expertise that helps tax, accounting, and audit professionals research and navigate complex regulations, comply with legislation, manage their businesses and advise clients with speed, accuracy and efficiency.

Wolters Kluwer Tax & Accounting is part of Wolters Kluwer N.V. (AEX: WKL), a global leader in information services and solutions for professionals in the health, tax and accounting, risk and compliance, finance and legal sectors. Wolters Kluwer reported 2016 annual revenues of €4.3 billion. The company, headquartered in Alphen aan den Rijn, the Netherlands, serves customers in over 180 countries, maintains operations in over 40 countries and employs 19,000 people worldwide. Wolters Kluwer shares are listed on Euronext Amsterdam (WKL) and are included in the AEX and Euronext 100 indices. Wolters Kluwer has a sponsored Level 1 American Depositary Receipt program. The ADRs are traded on the over-the-counter market in the U.S. (WTKWY).

For more information about our solutions and organization, visit www.wolterskluwer.com, follow us on Twitter, Facebook, LinkedIn, and YouTube.