LONDON--(BUSINESS WIRE)--The global insurance software market is expected to grow at a CAGR of close to 5% during the forecast period, according to Technavio’s latest report.

In this report, Technavio covers the market outlook and growth prospects of the global insurance software market for 2016-2020. By deployment models, this market is segmented into on-premises and software as a service (SaaS)-based models.

The on-premises model enables an organization to install the software in-house, after paying a license fee that includes IT support and maintenance fees. The SaaS-based model, on the other hand, is based on upfront implementation costs, ongoing pay-per-use fees, technical support services, system maintenance, and upgrades.

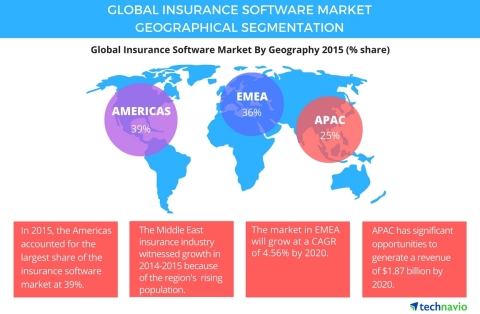

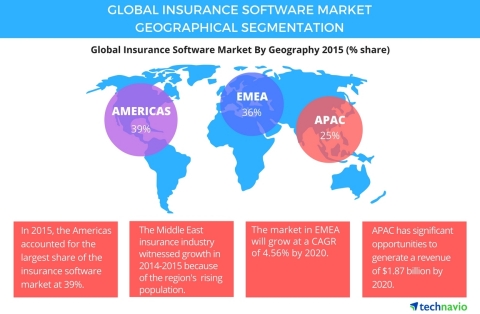

Technavio’s research study segments the global insurance software market into the following regions:

- Americas

- EMEA

- APAC

Americas: largest software insurance market

Insurance service providers across the Americas are looking to consolidate policy administration systems to improve efficiency and eradicate the issues arising due to multiple administration systems. Insurers are adopting a more strategic approach toward IT investments by investing in a single consolidated policy administration system (PAS), instead of maintaining multiple systems.

“EIS Group, where insurance software is being deployed in the Americas, is an insurance software provider. Its personal and commercial insurance operations will use EIS Suite for the processes like core underwriting, policy administration, billing, claims, and customer management processes. A license agreement with the company covers 15 years of use of EIS Suite, and the system deployment will span multiple years,” says Ishmeet Kaur, one of the lead analysts at Technavio for enterprise application research.

Request a sample report: http://www.technavio.com/request-a-sample?report=55246

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

EMEA: market driven by booming economy in the Middle East

The Middle East is witnessing a steep rise in its population, high economic development, favorable regulatory environment, and increasing awareness about the insurance products and their benefits, which led to an expansive growth of the insurance industry in the 2014-2015 period. The main factors that have facilitated the growth of the insurance industry in the Middle East with the rising demands include focusing on economic diversification of various countries and the 2015 implementation of compulsory health insurance schemes in countries such as Dubai and Qatar.

EMEA is witnessing increasing competitiveness in the insurance software market space with a large number of local and foreign insurance companies vying for dominance. The growing competition is affecting the profitability of newly established and small insurance companies. Union Insurance, a Dubai-based insurance company that caters to both for individuals and organizations, entered into a multi-year agreement of insurance software with Computer Sciences Corporation (CSC). Union Insurance implemented CSC’s Integral Group Health, Integral Life, and Integral point-of-sale systems to manage its life insurance products. Such competitiveness will drive the insurance software market in EMEA and it is forecast to grow at a CAGR of 4.56% during the forecast period.

APAC: market driven by presence of large customer base

“APAC presents a healthy opportunity for insurers seeking growth, as the region has a growing number of consumers looking to buy insurance. The regulators across the region also continue to strengthen solvency, protect consumers, and encourage new products in the insurance sector, such as private health insurance. The insurance software market in APAC is expected to grow at a CAGR of 4.51% during the forecast period,” says Ishmeet.

Computer Professionals Inc. (CPI), one of the prominent vendors in the region, announced the implementation of GENiiSYS insurance software solution. This software provides an integrated insurance system that supports Asia United Insurance’s objective of growing its business nationwide. Additionally, it also streamlines business processes and automates transactions and minimizes manual operation.

The top vendors in the global insurance software market highlighted in the report are:

- Microsoft

- Oracle

- Salesforce

- SAP

Browse Related Reports:

- Global Insurance Brokerage Market 2016-2020

- Insurance IT Spending Market in the US 2016-2020

- Global Mobile Phone Insurance Market 2016-2020

Become a Technavio Insights member and access all three of these reports for a fraction of their original cost. As a Technavio Insights member, you will have immediate access to new reports as they’re published in addition to all 6,000+ existing reports covering segments like data center, cloud computing, and M2M and connected devices. This subscription nets you thousands in savings, while staying connected to Technavio’s constant transforming research library, helping you make informed business decisions more efficiently.

About Technavio

Technavio is a leading global technology research and advisory company. The company develops over 2000 pieces of research every year, covering more than 500 technologies across 80 countries. Technavio has about 300 analysts globally who specialize in customized consulting and business research assignments across the latest leading edge technologies.

Technavio analysts employ primary as well as secondary research techniques to ascertain the size and vendor landscape in a range of markets. Analysts obtain information using a combination of bottom-up and top-down approaches, besides using in-house market modeling tools and proprietary databases. They corroborate this data with the data obtained from various market participants and stakeholders across the value chain, including vendors, service providers, distributors, re-sellers, and end-users.

If you are interested in more information, please contact our media team at media@technavio.com.