BOSTON--(BUSINESS WIRE)--To help investors make the most of their hard-earned money, Fidelity Investments® has introduced Model CD Ladders strategies that enable investors to build a CD ladder in three simple steps:

1. Select the time frame (1, 2 or 5 years)

2. Designate how much to invest from which Fidelity account

3. Review and purchase the ladder

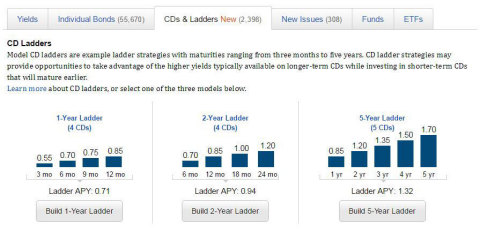

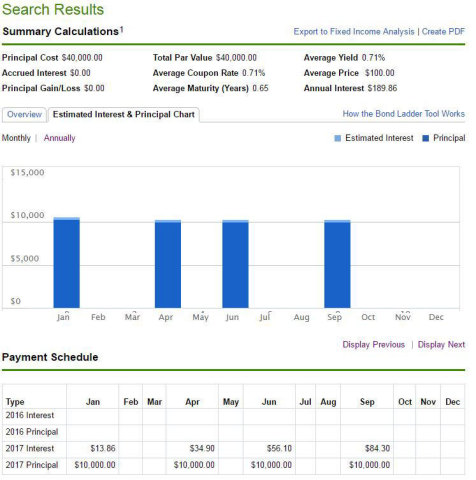

A CD ladder can benefit investors looking to generate extra income versus what they can in a savings or checking account. In fact, the FDIC reports savings accounts currently earn an average national rate of .06 percent and checking accounts .04 percent, while a one- and five-year CD ladder on Fidelity.com earns .71 percent and 1.21 percent1, respectively.

A ladder provides an opportunity to earn higher yields typically available on longer-term CDs while simultaneously investing in shorter-term CDs that will mature earlier. For example, the one-year Model CD ladder consists of four CDs with different maturity dates, or “rungs”—three, six, nine and 12 months—so that every three months an investor receives income. Anyone can view the new Model CD Ladders, which are updated every 15 minutes, and customers can currently implement a CD ladder in a Fidelity brokerage or IRA account.

Do Not Overlook Your Short-Term Cash Investments Needs

Having the right amount of cash in a liquid account is critical for covering ongoing living expenses and ensuring there is enough in case of an emergency. However, excess uninvested cash kept in a savings or checking account can result in missed opportunities to generate more income.

“In the current low rate environment, investors are looking for better returns on cash but aren’t sure what to do about it,” said Richard Carter, vice president of fixed income at Fidelity. “These CD ladders offer higher rates than typical cash deposits, without compromising on FDIC insurance. Investors can more easily meet their investing income needs with the ladder strategies that suggest the highest yielding CDs among the hundreds available on Fidelity.com each day.”

Brokered CDs: Competition Boosts Your Bottom Line

Most investors are familiar with seeing local banks displaying CD rates and may think that is the best yield available, when in fact they may be able to do better.

Brokerage firms like Fidelity provide access to many “brokered CDs” at once, making it more convenient to compare CDs against a number of attributes such as expected yield, maturity date and FDIC insurance. Every day Fidelity offers between 100 to 200 new issue CDs available from multiple banks, which can benefit an investor if they think they’ll exceed the $250,000 FDIC insurance limit per bank. By purchasing brokered CDs from multiple banks, investors can receive insurance from each, even if they fund the CD purchases from a single Fidelity account.

Carter said, “Ultimately the Model CD Ladders can help investors think through which of the three models best suit their own personal balance between yield and liquidity. By holding the new issue CDs within the ladder until each matures, the investor will incur no transaction costs for building, implementing, and maintaining their CD Ladder at Fidelity2.”

CD Education and Resources

For investors looking for additional information on how CDs and CD ladders can complement their portfolios, Fidelity offers resources in its online Learning Center and on Fidelity.com, including:

- What is a CD? (article)

- CD ladders: Discovering certificate of deposit strategies (video)

- Understanding Fidelity’s Model CD Ladders (PDF)

In addition, Fidelity Viewpoints outlines short-term savings strategies in a recent Viewpoint, “Four ways to earn more on your savings.”

Fidelity’s Model CD Ladders Strategies in Pictures

All images are for illustration purposes only. Data contained within are from screenshots taken Sept. 26, 2016.

About Fidelity Investments

Fidelity’s goal is to make

financial expertise broadly accessible and effective in helping people

live the lives they want. With assets under administration of $5.6

trillion, including managed assets of $2.1 trillion as of August 31,

2016, we focus on meeting the unique needs of a diverse set of

customers: helping more than 25 million people invest their own life

savings, nearly 20,000 businesses manage employee benefit programs, as

well as providing nearly 10,000 advisory firms with investment and

technology solutions to invest their own clients’ money. Privately held

for nearly 70 years, Fidelity employs 45,000 associates who are focused

on the long-term success of our customers. For more information about

Fidelity Investments, visit https://www.fidelity.com/about.

Investing involves risk, including the risk of loss.

Any fixed income security sold or redeemed prior to maturity may be

subject to a substantial gain or loss.

Your ability to sell a CD on

the secondary market is subject to market conditions. If your CD has a

step

rate, the interest rate of your CD may be higher or lower than

prevailing market rates. The initial rate on a

step rate CD is not

the yield to maturity. If your CD has a call provision, which many step

rate CDs do,

please be aware the decision to call the CD is at the

issuer's sole discretion. Also, if the issuer calls the CD,

you may

be confronted with a less favorable interest rate at which to reinvest

your funds. Fidelity makes

no judgment as to the credit worthiness

of the issuing institution.

For the purposes of FDIC insurance coverage limits, all depository

assets of the account holder at the

institution issuing the CD will

generally be counted toward the aggregate limit (usually $250,000) for

each

applicable category of account. FDIC insurance does not cover market

losses. All the new-issue

brokered CDs Fidelity offers are FDIC

insured. In some cases, CDs may be purchased on the secondary

market

at a price that reflects a premium to their principal value. This

premium is ineligible for FDIC

insurance. For details on FDIC

insurance limits, visit FDIC.gov.

Model CD Ladders are provided for educational purposes and are not

intended to serve as the primary

basis for your investment,

financial or tax planning decisions.

Fidelity makes new-issue CDs available without a separate transaction

fee. Fidelity Brokerage Services

LLC and National Financial

Services LLC receive compensation for participating in the offering as a

selling

group member or underwriter.

Fidelity Investments and Fidelity are registered service marks of FMR

LLC.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Investments

Institutional Services Company, Inc.,

500 Salem Street, Smithfield,

RI 02917

National Financial Services LLC, Member NYSE, SIPC,

200 Seaport

Boulevard, Boston, MA 02110

774480.1.0

© 2016 FMR LLC. All rights reserved.

1 As of Sept. 26, 2016 at 8:30 a.m. EDT

2 If

you want to sell your CD on the secondary market, Fidelity Brokerage

Services LLC ("FBS") may charge you a concession. This concession will

be applied to your order, and you will be provided the opportunity to

review it prior to submission for execution