PALO ALTO, Calif.--(BUSINESS WIRE)--Nickel, a new smartphone-centered service that helps teens make better financial decisions, launched today. Developed in consultation with leading psychologists and financial experts, Nickel is the first simple, go-everywhere solution that helps time-strapped parents teach their children about money through empowerment instead of hand-holding.

Financial know-how is a major problem for today’s young people; a 2012 poll from ING Direct and Capital One found that 87 percent of teens admit they don’t know much about personal finance. This lack of basic skills and practical experience contributes to the “next generation of poor,” as young adults increasingly burdened with student debt, loan delinquency and bankruptcy are moving back home to live with their parents because they can’t afford to live on their own. At the heart of the problem lies a lack of experience meeting financial obligations and undisciplined spending. See stats here.

Nickel does what overworked parents, schools and financial instruments (like cash or debit cards) cannot: provide “contextual education” at the actual point their child is making a purchase decision. Psychologists have proven this is the best time to learn financial lessons that will stick.

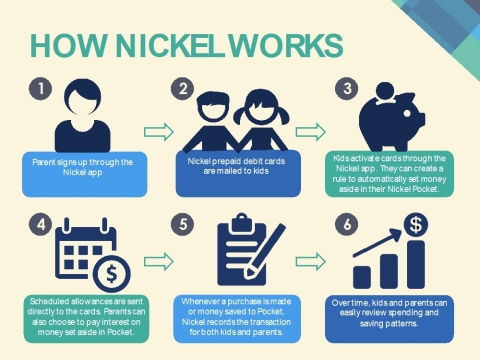

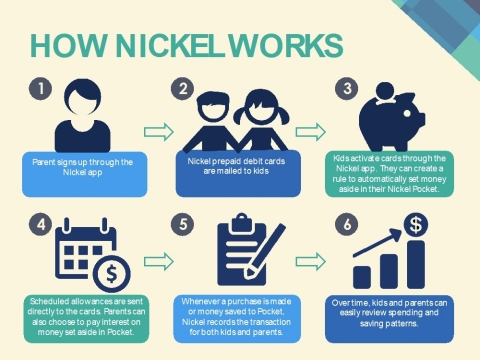

How Nickel Works

Through the Nickel mobile app and its associated Nickel MasterCard Prepaid Card, parents can set up an automatic allowance and send money to their child at any time. When a kid plans to make a purchase, they can confirm whether they really want to spend or if they’d prefer to set the money aside for the future. As an incentive, parents have the option of paying interest to their children for any money they choose to save.

Nickel allows both kids and their parents to see where money is being spent at all times; it even allows parents to automatically prevent purchases from being made from undesirable outlets, such as liquor stores or casinos.

“Our goal is to help teach the next generation how to feel both financially responsible and financially empowered,” says Nickel Co-Founder Oliver Deighton. “With Nickel by their side, teens are gently guided to make better choices that can result in a more positive financial future.”

“In my work as a psychologist specializing in money,” says Ph.D. Psychologist, Barbara Nusbaum, “parents continuously ask me ‘How do I teach my kids about money? How do I teach them to spend, save, and share responsibly?’ Using technology, the sweet spot of teens, Nickel gives parents a valuable opportunity to teach their children about money and values, every time they make a purchase.”

Cost and Availability

Nickel is currently available exclusively in the Apple App Store. Through the app, parents can set up an account and order the Nickel MasterCard Prepaid Card. The cost per month is $5 per child. Parents can try the product free for the first two months.

About Nickel

Nickel is the go-everywhere mobile solution to teaching kids better financial management and responsibility, while helping parents understand and control their children’s finances. Developed in conjunction with parents as well as leaders in the fields of finance, economics, education, and psychology, Nickel is found in the Apple App Store or online at www.nickel.co.