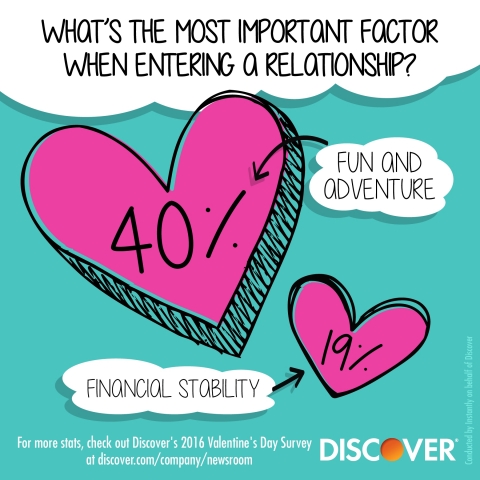

RIVERWOODS, Ill.--(BUSINESS WIRE)--People looking for love seek fun over finances, according to Discover’s 2016 Valentine’s Day Survey. The national survey included adults, ages 18 and over, in various stages of relationships. When asked to pick which was the most important factor when entering into a relationship, 40 percent chose fun and adventure, followed by physical attraction at 29 percent, financial stability at 19 percent and starting a family at 12 percent.

The survey also shows that once in a relationship, people place a higher value on their partner’s finances as their relationship gets more serious. Among those dating, 59 percent consider their significant other’s financial stability to be very or extremely important. Once engaged, that level of importance jumps to 82 percent.

Engaged couples also communicate more about their finances, with 44 percent saying they discuss finances with their significant other at least once a week, compared to 11 percent of those dating.

To Gift or Not to Gift?

Did your significant other tell you not to buy him or her a Valentine’s Day gift? If so, there’s a good chance they’re still hoping for one. Of the 75 percent who told their partner not to bother with a gift, 28 percent honestly meant it, while 47 percent think it would be nice to be surprised with a gift.

Valentine’s Day Spending Trends: Millennials to Spend Twice as Much as Baby Boomers

Discover’s survey also asked about expected Valentine’s Day spending. Overall, consumers say they’ll spend an average of $143 on their sweetheart this Valentine’s Day, with Millennials, ages 18 to 34, planning to spend the most at $185 on average. That figure is more than double the $70 that Baby Boomers, ages 55 and over, plan to spend.

Credit cards are expected to be the most popular form of payment this Valentine’s Day, with 49 percent of shoppers planning to charge their purchases. Forty-four percent say they’ll use cash, 43 percent debit cards and 10 percent will redeem credit card rewards.

Compared to 10 years ago, credit card use is expected to be up 26 percent, debit card use up 13 percent, and the use of cash down 28 percent, according to figures from Discover’s 2006 Valentine’s Day Survey.

This year, 44 percent of consumers say they’ll do most of their Valentine’s Day shopping in-store, versus 18 percent who will primarily shop online. In addition, 91 percent say they do their shopping a week or more before Valentine’s Day.

About Discover’s 2016 Valentine’s Day Survey

The national survey of 2,023 consumers ages 18 and over was commissioned by Discover and conducted by Instantly, an independent survey research firm, from January 19 to 22, 2016. The maximum margin of sampling error was ±5 percentage points with a 95 percent level of confidence.

About Discover

Discover Financial Services (NYSE: DFS) is a direct banking and payment services company with one of the most recognized brands in U.S. financial services. Since its inception in 1986, the company has become one of the largest card issuers in the United States. The company issues the Discover card, America's cash rewards pioneer, and offers private student loans, personal loans, home equity loans, checking and savings accounts and certificates of deposit through its direct banking business. It operates the Discover Network, with millions of merchant and cash access locations; PULSE, one of the nation's leading ATM/debit networks; and Diners Club International, a global payments network with acceptance in more than 185 countries and territories. For more information, visit www.discover.com/company.