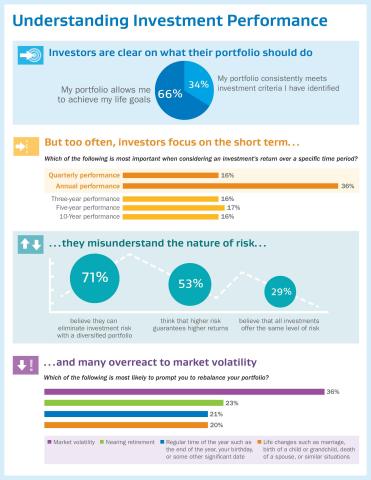

NEW YORK--(BUSINESS WIRE)--A focus on short-term financial performance and misunderstandings about the nature of investment risk may have an impact on American investors’ financial well-being. According to a new TIAA-CREF survey, 36 percent of respondents look to one-year performance as the most important indicator of an investment’s return, with an additional 16 percent looking to quarterly performance as most important. Nearly half (47 percent) have purchased a fund based on its performance during the previous year rather than looking at its performance over a longer-term investment horizon such as five or 10 years.

“It’s important to look at the big picture when evaluating investment performance. One year or one quarter is a short period of time when you consider that many individuals are investing for 30 years or more,” said Roger W. Ferguson, president and chief executive officer of TIAA-CREF. “Fortunately, investors can avail themselves of a range of resources, including professional financial advice, which can help them make well-informed investment decisions and build portfolios designed to meet their specific financial goals—whatever they may be.”

While investors continue to grapple with the challenges of market volatility, it’s even more critical for them to understand key investment concepts around diversification, asset allocation, risk and returns. However, among those surveyed, 71 percent of American investors believe they can eliminate investment risk by having a diversified portfolio; in fact, while a diversified portfolio can help to manage investment risk, there is no way to eliminate it altogether. Similarly, although investors should maintain an appropriate level of risk in their portfolios, many are unclear about how that works: 53 percent think that higher risk guarantees higher returns.

All investors would benefit from better access to financial education on these topics. But for Gen Y, the challenges posed by unpredictable markets and their impact on investing decisions are even more pronounced. While 29 percent of all respondents misunderstand the nature of various asset classes, indicating that they believe that all investments offer the same level of risk, 40 percent of Gen Y report the same, and 64 percent of Gen Y think that higher risk guarantees higher returns.

Investing for Better Outcomes

Despite some misconceptions about investment performance, American investors have a clear picture of what they want from their portfolio. Two-thirds of investors believe it’s more important that their portfolio allows them to achieve their life goals, such as funding a comfortable retirement or paying for a college education, versus one-third who place more importance on a portfolio that consistently meets specific investment criteria, such as a certain percentage return.

In order to achieve their objectives for their investments, however, investors need to ensure they are not taking actions that can undermine long-term performance. For instance, 36 percent of respondents say that market volatility is the most likely reason they would rebalance their portfolio – in contrast to most advisors’ recommendation to ride out market fluctuations as part of a long-term investing strategy. Fewer say they are most likely to rebalance when most advisors would recommend – at a regular time of year like a birthday (21 percent) or after a life change such as marriage, the birth of a child or grandchild, or the death of a spouse (20 percent).

“Having a well-defined vision of one’s financial goals is a good first step for investors,” said Ferguson. “Once you have set your priorities, a financial advisor can help you find the approach that is right for you. By looking at your risk tolerance and your short-term and long-term goals, a financial advisor can help you pick the investment options that may work best with your financial plan.”

No matter what’s going on in the market, TIAA-CREF has focused on delivering long-term results for our clients at competitive costs for nearly 100 years. Morningstar has awarded 65 percent of TIAA-CREF mutual funds and variable annuities overall ratings of 4 and 5 stars,1 and the organization has won the Lipper Award for Overall Best Large Fund Company, based on delivering risk-adjusted returns, for three years in a row.2

For more information on the survey, please read the 2015 TIAA-CREF Built to Perform Executive Summary. TIAA-CREF offers a wealth of market research, investment performance reports and other insights for investors to leverage as they evaluate their portfolios. Visit https://www.tiaa-cref.org/public/performance for more information.

Survey Methodology

The survey was conducted by KRC Research from Oct. 7 to 12, 2015, via an online survey of 1,000 U.S. adults who are employed, who contribute to an employer-sponsored retirement plan or an individual retirement account, and who make or share in financial decision making for their household. The survey was not conducted among TIAA-CREF participants, and the survey questions and responses did not reference or concern any TIAA-CREF product, service or client experience.

About TIAA-CREF

TIAA-CREF (www.tiaa-cref.org) is a national financial services organization with $834 billion in assets under management (as of 9/30/2015) and is the leading provider of retirement services in the academic, research, medical and cultural fields.

Disclosures

The material is for informational purposes only and should not be regarded as a recommendation or an offer to buy or sell any product or service to which this information may relate. Certain products and services may not be available to all entities or persons. Past performance does not guarantee future results.

Diversification is a technique to help reduce risk. It is not guaranteed to protect against loss.

Rebalancing does not protect against loss or guarantee that an investor’s goals will be met.

TIAA-CREF products may be subject to market and other risk factors. See the applicable product literature, or visit www.tiaa-cref.org for details.

Investment products, insurance and annuity products: are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity, and may lose value.

You should consider the investment objectives, risks, charges and expenses carefully before investing. Please call 877-518-9161or log on to www.tiaa-cref.org for current product and fund prospectuses that contain this and other information. Please read the prospectuses carefully before investing.

TIAA-CREF Individual & Institutional Services, LLC, Teachers Personal Investors Services, Inc., and Nuveen Securities, LLC, Members FINRA and SIPC, distribute securities products.

© 2015 Teachers Insurance and Annuity Association of America-College Retirement Equities Fund (TIAA-CREF), 730 Third Avenue, New York, NY 10017

C28104

1 Morningstar ratings based on the lowest cost share class for each mutual fund, based on U.S. open end mutual funds; CREF Variable Accounts; and the Life Funds. For a fund or account with multiple share classes and the same pricing, the share class with the longest performance history is used. Please note Morningstar rates CREF group variable annuities within the open end mutual fund universe. Morningstar ratings may be higher or lower on a monthly basis. Morningstar is an independent service that rates mutual funds. The top 10 percent of funds or accounts in an investment category receive five stars, the next 22.5 percent receive four stars and the next 35 percent receive three stars. Morningstar proprietary ratings reflect historical risk-adjusted performance and can change every month. They are calculated from the fund or account’s three-, five- and ten-year average annual returns in excess of 90-day Treasury bill returns with appropriate fee adjustments, and a risk factor that reflects fund or account performance below 90-day T-bill returns. The overall star ratings are Morningstar’s published ratings, which are weighted averages of its three-, five- and ten-year ratings for periods ended September 30, 2015. Past performance cannot guarantee future results. For current performance and rankings, please visit www.tiaa-cref.org/public/tcfpi/InvestResearch.

2 The Lipper Award is given to the group with the lowest average decile ranking of three years’ Consistent Return for eligible funds over the three-year period ended 11/30/12, 11/30/13 and 11/30/14 respectively. TIAA-CREF was ranked among 36 fund companies in 2012 and 48 fund companies in 2013 and 2014 with at least five equity, five bond, or three mixed-asset portfolios. Past performance cannot guarantee future results. For current performance and rankings, please visit www.tiaa-cref.org/public/tcfpi/InvestResearch.