COLUMBUS, Ohio--(BUSINESS WIRE)--The U.S. Department of Housing and Urban Development (HUD) recently released production data for its Lean mortgage insurance program, which finances seniors housing properties, for the fiscal year ending Sept. 30, 2015. Over the course of the fiscal year, the program closed $2.7 billion of loan volume, a reduction of 35.7% as compared to the previous year’s total of $4.2 billion and 53.4% less than HUD’s record total of $5.8 billion in 2013.

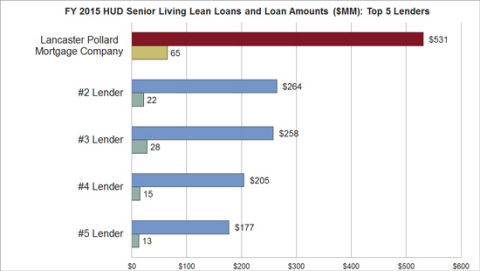

A total of 291 loans were closed as the program continues to serve as an important source of debt capital to the seniors housing industry. Forty lenders closed loans within the program with the largest volume of activity generated by Lancaster Pollard, who closed 65 loans totaling $531 million, or 22.3% of the total loans and 19.7% of the total loan amount. The Columbus, Ohio-based firm again leads in both number of loans and transaction amount. The firm has been the top HUD Lean lender since fiscal year 2010.

“While the historically high volume HUD experienced in 2013 and 2014 predictably has slowed as much of the refinance activity has curtailed, the options provided by the HUD Lean program continue to be very beneficial to our clients,” said Kass Matt, president of Lancaster Pollard.

Over the past six fiscal years, Lancaster Pollard has generated the largest volume of HUD Lean activity with 461 loans totaling $3.4 billion. The 65 loans totaling $531 million the firm closed in fiscal year 2015 were more than double that of the next closest lender on the list in both loans closed and total loan amount.

“With interest rates remaining below long-term historical averages throughout 2015, we were able to close 55 refinancings utilizing the FHA Sec. 232/223(f) and 223(a)(7) programs, reducing rates for our clients and better positioning them for the future,” said Matt. “In addition, we closed 10 loans through the FHA Sec. 232 and 241(a) programs that provided funds for new construction, expansion and substantial renovations, allowing our clients to improve their facilities to better serve their residents.”

Despite the reduction in overall volume the past two years, HUD continues to be a popular option for many seniors housing owners due to its attractive interest rates, long terms and nonrecourse feature. Its sustained popularity is evident in its recent renewal of contracted underwriters, which will continue to allow HUD to process applications in an efficient manner.

“We recognize the important role the HUD Lean program plays in the world of seniors housing finance and we look forward to continuing to use it as a valuable debt financing option for our clients in addition to our full range of investment banking, mortgage banking, private equity, balance sheet financing, M&A and investment advisory services,” said Matt.

Source: U.S. Department of Housing and Urban Development, Office of Healthcare Programs, Section 232 – LEAN, Number of Initial Endorsements and Mortgage Amounts by lender at Firm Commitment, FYE2015 (Sept 30, 2015).