HOUSTON--(BUSINESS WIRE)--Global demand, and in particular Asian demand, for monosodium L-glutamate (MSG) -- the sometimes controversial flavor enhancer -- is growing, in part due to significant economic and cultural shifts in several countries, according to new analysis from IHS (NYSE: IHS), the leading global source of critical information and insight.

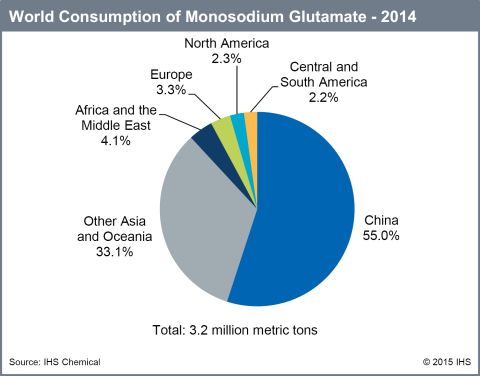

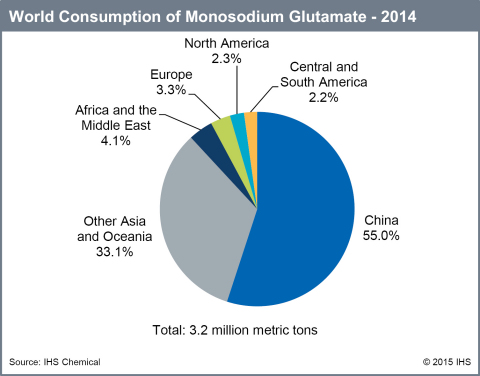

According to the IHS Chemical Economics Handbook: Monosodium Glutamate Report, in 2014, world demand for MSG was estimated at more than 3 million metric tons (MMT) which is valued at $4.5 billion. Asia was responsible for approximately 88 percent of world MSG consumption in 2014, with China alone accounting for 55 percent of world consumption and approximately 65 percent of global production. As the world’s largest producer, China is also the world’s largest exporter of MSG, providing nearly 44 percent of global exports.

During the period of 2014 to 2019, IHS expects global demand for MSG to increase by almost four percent annually to nearly 3.9 MMT. However, the most significant increases in demand for this mature product will be in Thailand, Indonesia, Vietnam and China, followed by Brazil and Nigeria.

“While many western consumers have mixed feelings about MSG, and there has been considerable debate on its use, for many consumers, particularly in developing countries, MSG is considered an affordable luxury,” said Marifaith Hackett, senior manager of the food and nutrition service at IHS Chemical and the principal analyst behind the report, along with Adam Bland, Takeshi Masuda, and Lei Zeng from IHS Chemical. “MSG is a mature product, so overall global growth is not huge, but this is still a major market for producers. China is the leading producer and consumer of MSG, but we are seeing considerable growth in Thailand, Indonesia, Vietnam, Brazil and Nigeria.”

MSG occurs naturally in some foods like tomatoes, cheeses, truffles and soybeans, but in commercial practice, it is produced by the fermentation of sugar or starch from feedstocks such as corn, sugar beets, sugarcane and cassava. MSG is widely used by food processors in convenience foods, snacks, canned soups, instant noodles, condiments, seasoning blends, and by restaurants and food service providers.

What is most interesting, Hackett said, is where the growth for MSG is occurring and what is driving demand growth. “MSG is a staple ingredient in many Asian cuisines,” she said, “but its use has expanded significantly in China and countries such as Nigeria and Brazil, where incomes are rising and more women are moving into the workforce. These factors, as well as improvements in living standards and expansion of the middle class, are big factors driving MSG consumption growth. Busier lifestyles, increased urbanization and changes in dietary patterns are driving greater demand for convenience foods, snacks and seasonings, which, in turn, will stimulate MSG consumption in these countries.”

Africa and the Middle East accounted for approximately 4 percent of world MSG consumption in 2014, but demand in West Africa, where MSG complements the staple diet of potatoes, rice, noodles and soup, is expected to see strong growth during the study period. The region is entirely reliant on imports to satisfy its growing demand. While Central and South America was responsible for just 2 percent of world MSG demand, Brazil is a net exporter of MSG, and leads the region in consumption. The country will continue to drive demand growth during 2014 to 2019.

MSG triggers a savory taste sensation known as umami, which many in scientific and gastronomic circles now credit as the fifth human taste (the other four tastes are salty, sweet, bitter and sour). Detractors of MSG point to its association with some adverse physiological symptoms (such as headaches) commonly referred to as the “Chinese Restaurant Syndrome.” In contrast, the U.S. Food and Drug Administration (FDA), which classified MSG as “generally recognized as safe” (GRAS) in 1959, stands by its conclusion that MSG is safe for the general population at normal levels of consumption.

MSG as a commercial product is a Japanese invention, and its development was originally driven by the noble goal of improving poor Japanese diets more than a century ago. In 1908, Kikunae Ikeda, Ph.D., a Tokyo chemistry professor, sought to manufacture ‘a good, inexpensive seasoning to make bland, nutritious food tasty’1. He was the first to isolate glutamate from sea kelp, the primary ingredient in flavorful Japanese soup stocks.

In Japan, MSG is known as Ajinomoto, a word that means “the essence of taste.” Ajinomoto is also the name of the company best known for producing MSG globally. Much like the Coca Cola® brand has long been recognized as one of the most iconic American brands, Ajinomoto® is a household name in Japan. Ironically, Ajinomoto no longer manufactures MSG in Japan, although domestic production of high-value-added seasoning blends using imported MSG continues. Now the world’s second-largest MSG producer behind Shandong Fufeng Group of China, Ajinomoto operates wholly and partly owned plants in Brazil, Peru, the U.S., France, Indonesia, Malaysia, Thailand and Vietnam.

Europe was responsible for just 3 percent of world MSG consumption in 2014, and growth is expected to be minimal as consumer preferences for foodstuffs that contain few or no additives are expected to restrain consumption growth in the region, especially in Western Europe. In North America, the story for MSG is much the same. The increased consumer interest in foods that contain no artificial ingredients (such as added MSG) is expected to suppress the growth of MSG consumption in the U.S. and Canada. In Mexico, taxes on high-calorie packaged foods (“junk food”), widespread concerns about obesity, and the growing interest in healthier eating habits have lowered demand for some MSG-containing foods, reducing MSG consumption as a consequence.

“MSG is the most recognized and highly debated food additive in the world,” Hackett said, “and the attitudes regarding its use are very different depending upon which socioeconomic groups or cultures are being polled. It is an interesting dynamic--there is a very strong East/West divide when it comes to views on MSG.”

To speak with Marifaith Hackett, please contact Melissa Manning at melissa.manning@ihs.com. For more information on the IHS Chemical Economics Handbook: Monosodium Glutamate Report, please contact Nisha.Keskar@ihs.com.

Source: Gastronomica: The Journal of Food and Culture, Vol. 5, No. 4, PP 33-49, 2005.1

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of insight, analytics and expertise in critical areas that shape today’s business landscape. Businesses and governments in more than 150 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS is committed to sustainable, profitable growth and employs about 8,800 people in 32 countries around the world.

IHS is a registered trademark of IHS Inc. All other company and product names may be trademarks of their respective owners. © 2015 IHS Inc. All rights reserved.