SOUTHFIELD, Mich.--(BUSINESS WIRE)--Premium audio system sales in new vehicles are expected to grow from just over 8.6 million units globally in 2014 to more than 11.6 million units in 2021, with branded speaker system sales expected to grow from more than 8.7 million units to 11.1 million units in the same timeframe, according to the IHS Automotive forecasts for these systems. IHS Automotive is a global provider of critical information and insight to the automotive industry and part of IHS, Inc. (NYSE: IHS).

Recent global research from IHS confirms consumer demand for these systems is high, with 95 percent of respondents across four key automotive markets preferring to have a brand name car audio system. Among these, 70 percent indicated that a brand name audio system would influence their vehicle purchase decision. In addition, 44 percent of those willing to pay for a premium audio system wished it would be standard equipment on their next vehicle.

Brand Preferences Matter; Bose, Sony and Alpine Lead

Across all four key countries surveyed, for respondents in the US, UK, China and Germany who indicated a brand preference for their audio system (95 percent), 70 percent indicated that a brand name audio system would influence the car purchasing decision, with over half of that cohort indicating that the brand in question would be the deciding factor.

With the exception of China, Bose is the most ‘influential’ audio brand in the four countries surveyed. In China, Sony led the rankings.

Given these findings, OEMs wanting to conquest a buyer in the US, UK or Germany, may consider offering a Bose hi-fi system as a compelling way to improve conquest rates.

Sony, however, is the most recognized brand overall in all four countries, with established brand leadership in China. However, when respondents were asked how they recognize the brand – whether car audio, home audio or other sources – Alpine emerged as the most recognized car audio brand.

Bose is the number one brand owned or previously owned by respondents in the US and Germany, while Sony is noted as the number one brand owned or previously owned by respondents in China and the UK.

Brand Loyalty, Reputation and Quality Influences Respondents

Respondents in all countries predominantly indicated they would choose the same brand again, with US respondents reflecting the highest loyalty at 91 percent. Respondents in the UK and Germany trailed slightly, while 23 percent of respondents in China indicated they would not buy the same brand again, significantly more than other countries.

“According to our survey, respondents in all countries predominantly chose to stay with the same audio brand they had used previously," said Celina Li, senior analyst, infotainment systems at IHS Automotive. "In essence, if consumers can be encouraged to buy a branded audio system, they tend to stick with that brand in the future.”

Among those choosing Bose as their preferred premium audio brand in the US, UK and Germany, primary reasons provided were reputation and good quality/sound. Other secondary factors included positive reviews and the fact that consumers use Bose products elsewhere.

For consumers surveyed in China, Sony likewise ranked highest due to good quality/sound, followed by brand reputation and word of mouth, an attribute that did not resonate as a high influencer among consumers in the other countries.

Consumers Willing to Pay for Premium Audio

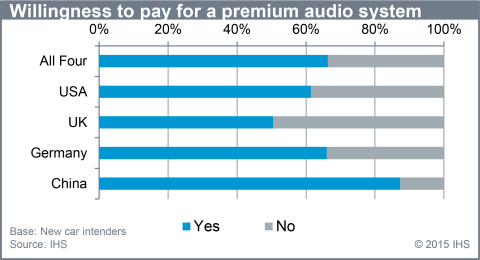

Overall, consumers across the four countries surveyed generally prefer a premium car audio system. More than 67 percent of the new car intenders surveyed would be willing to invest in a premium car audio system.

From a price perspective, respondents in the US, UK and Germany indicated a willingness to spend, on average, between $2,224 and $2,841 USD on a premium audio system in their new vehicle, with respondents in China indicating an even greater willingness to pay more – up to $3,174 on a premium audio system, potentially because they value luxury systems such as premium audio that can suggest high social status, and would therefore pay a premium price for it.

However, there are consumers not willing to pay for premium audio as well. Reasons range from those who feel that premium audio systems could come standard in new vehicles, to other reasons such as the idea that they are “too expensive.” This suggests that a decent proportion of respondents who aren’t willing to pay for premium audio systems might in fact desire one, but feel that it should come standard.

About the Report

The IHS Automotive report includes findings on premium and branded audio preferences among consumers. For the study, more than 4,000 vehicle owners intent on purchasing a new vehicle within the next 36 months were surveyed, representing four key automotive markets – the US, China, Germany and the United Kingdom. Results varied by region but shared some common themes. The report covers a number of categories, including vehicle purchase intentions, respondent profiles, premium audio brand recognition and research, music listening preferences, audio quality and willingness to pay for various technologies and types of audio systems in new vehicles. Additional regional findings from the report will be forthcoming in future releases. The full comprehensive report is available for purchase here.

###

About IHS Automotive (www.ihs.com/automotive)

IHS Automotive, part of IHS Inc. (NYSE: IHS), offers clients the most comprehensive content and deepest expertise and insight on the automotive industry available anywhere in the world today. With last year’s addition of Polk, IHS Automotive now provides expertise and predictive insight across the entire automotive value chain from product inception—across design and production—to the sales and marketing efforts used to maximize potential in the marketplace. No other source provides a more complete picture of the global automotive industry. IHS is the leading source of information, insight and analytics in critical areas that shape today’s business landscape. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS is committed to sustainable, profitable growth and employs about 8,800 people in 32 countries around the world.

IHS is a registered trademark of IHS Inc. All other company and product names may be trademarks of their respective owners. © 2015 IHS Inc. All rights reserved.

If you prefer not to receive news releases from IHS, please email michelle.culver@ihs.com. To read our privacy policy, click here.