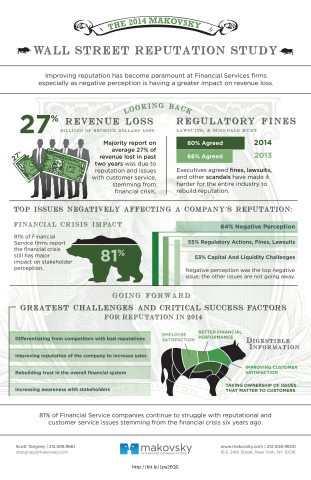

NEW YORK--(BUSINESS WIRE)--The 2014 Makovsky Wall Street Reputation Study released today revealed that financial services companies continue to struggle with reputational and customer services issues stemming from the financial crisis six years ago. Eighty-one percent (81%) of communications, investor relations and marketing executives surveyed last month said the financial crisis continues to have a major effect on stakeholder perceptions of their companies.

The study revealed this negative perception is taking an even bigger toll on sales, as the companies interviewed reported an average business loss of 27% -- equaling billions of dollars -- in the last two years as reputational and customer service issues persist. This average loss was significantly higher in the past 12 months, than reported in the 2013 study.

These are major findings of the 2014 Makovsky Wall Street Reputation Study, designed to determine the state of reputation of the financial industry and identify best practices and emerging trends. This third annual study was conducted by Ebiquity in May 2014.

“The financial crisis has left scars and those scars may be permanent,” said Scott Tangney, Executive Vice President of Makovsky. “The majority of companies told us they continue to face constant reputation and customer satisfactions issues related to trust, regulation, products, liquidity and capital, financial performance, and compensation. The standing of many has been diminished with nearly half of executives telling us that the crisis fallout made their firm competitively vulnerable allowing with their closest or direct competitors to gain an advantage.”

Improving reputation has become paramount at financial services firms according to the study, especially as negative perception is having a greater impact on revenue loss. “This sour climate is here to stay for the foreseeable future as the majority of executives in charge of financial brands and corporate reputation believe it will still take up to five more years to restore their company’s reputation to pre-financial crisis levels,” said Tangney.

When asked to rank the issues that negatively affected their company’s reputation over the last 12 months, the top three 2014 responses from communications, marketing and investor relations executives at financial firms were:

- Negative perception of the financial services industry (64%);

- Regulatory investigations, actions and fines or lawsuits (55%); and

- Capital and liquidity challenges (53%).

The importance of each of these issues has increased compared with last year’s results. In addition, 52% of the firms surveyed said financial performance and excessive bonuses dragged on their reputation in the past 12 months. Fifty percent (50%) reported customer dissatisfaction and corporate governance were negatively charged issues for their company.

Looking to the next 12 months, financial services firms said their greatest reputational challenges will be:

- Differentiating from financial firms and competitors with bad reputation problems;

- Improving the reputation of the company to increase sales, (a +300% increase over 2013 findings);

- Rebuilding trust in the overall financial system; and

- Increasing awareness with stakeholders also ranked high in 2014 (a 200% increase over 2013 findings).

“The top challenges to financial services companies in rebuilding reputation have been consistent over the past three years,” said Tangney. “At the same time, we have seen certain negative issues that we believed had been resolved or become less important – like liquidity challenges, problematic products, and compensation – being thrust back into the limelight to the detriment of corporate and industry image.”

To understand current communications strategies being deployed at financial services brands, the 2014 Makovsky Wall Street Reputation Study explored emerging factors that were most critical in the next 12 months to strengthen corporate reputation. At least six out of ten of executives ranked each of the following initiatives as “very important” to achieving stronger reputation:

- Improve customer satisfaction (64%);

- Take ownership of issues that matter to customers (64%);

- Employee satisfaction (60%); and

- Better financial performance (60%).

Research Methodology

Ebiquity, formerly Echo Research, completed 225 interviews with executives and managers responsible for the management and supervision of communications, investor relations or marketing at large and mid-sized publicly traded and private financial services institutions. The type of companies surveyed included banks, brokerage firms, asset management firms, insurance companies, real estate companies, credit card companies, mortgage lender, venture capital firms and credit unions and financial technology firms. Respondent titles included Chief Marketing Officer, Vice President, Director and Manager/Supervisor. The study conducted online and completed in May 2014. The margin of error associated with this level of reporting is +/- 6.5% at a 95% confidence level.

About Makovsky

Founded in 1979, Makovsky (www.makovsky.com) is one of the nation’s largest and most influential independent integrated communications firms. The firm attributes its success to its original vision: that the Power of Specialized Thinking™ is the best way to build reputation, sales and fair valuation for a client. Based in New York City, the firm has agency partners with nearly 2,000 professionals in 100 cities through IPREX (IPREX.com), the second largest worldwide public relations agency partnership, of which Makovsky is a founder.

About Ebiquity

Ebiquity is a leader in above- and below-line communications tracking and research, providing independent data-driven insights to the global media, CMO and CCO community to continuously improve clients' business performance.

Click here to view the Infographic