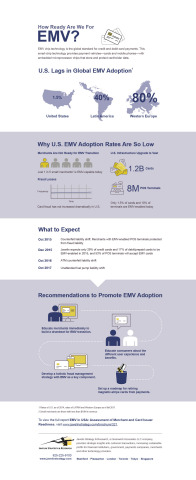

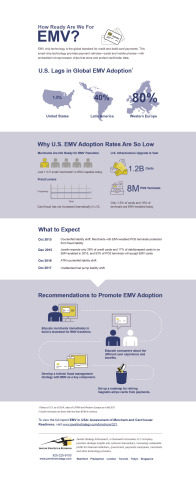

SAN FRANCISCO--(BUSINESS WIRE)--The U.S. roadmap for the deployment of EMV has existed since 2012, providing the payment industry with plenty of time to prepare for the transition from magnetic-stripe cards to smart cards. Now, with only 18 months until the most important phase of the transition, the payment industry is gearing up for the big switch. Today, Javelin Strategy & Research released “EMV in USA: Assessment of Merchant and Card Issuer Readiness” report, which assesses the current state of merchant and issuer readiness to provide a cohesive view of where the industry stands today for issuers and merchants. It also examines where these stakeholders will be by the impending liability shift milestone in 2015 and what it will cost for them to get to EMV ubiquity.

By the end of 2015, it is forecasted that 166 million EMV credit cards will be in circulation in the U.S. (29% of the total), and 105 million EMV debit and prepaid cards (17% of the total). Issuers are only just beginning to move to mainstream EMV card issuance beyond high-worth and international-traveler- focused cards. Issues related to the lack of a common application identifier (AID) have to be resolved before mass issuance of debit cards. It is therefore forecasted that it will take until the end of 2018 for EMV card ubiquity to reach 96% of credit cards and 98% of debit and prepaid cards.

“With exactly 18 months to go until the EMV liability shift for merchants and issuers, clearly a great deal of work remains if the U.S. card payment industry is to smoothly transition from magnetic-stripe cards to chip cards,” said Nick Holland, Senior Analyst, Payments for Javelin Strategy & Research. “Before the shift can take place, the industry needs to focus on primarily educating consumers and merchants, while in tandem developing a roadmap for retiring the magnetic-stripe from card payments.”

Javelin Strategy & Research report assesses the current state of merchant and issuer readiness and where the industry stands to transition to EMV by 2018. It is based on executive interviews with the card payment industry, online survey of small businesses, and a survey of fraud victims.

Learn More: EMV in USA: Assessment of Merchant and Card Issuer Readiness

Related Javelin Research

- Payment Card Data Security Report: Combating Breaches, Perfecting EMV, and Safeguarding Mobile Payments

- Online and Mobile Retail Payment Authentication: Preventing Fraud in the Age of Data Breaches and Malware

- EMV: Moving Toward Ubiquity

About Javelin Strategy & Research

Javelin Strategy & Research, a Greenwich Associates LLC company, provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.