SAN JOSE, Calif.--(BUSINESS WIRE)--Adobe (Nasdaq:ADBE) today released its Social Media Intelligence Report analyzing paid, earned and owned social media trends for Q1. Key findings of the Adobe Digital Index report show that Facebook’s ad business continued to grow with click through rate (CTR) and ad impressions increasing by double-digits quarter-over-quarter (QoQ), 20 percent and 41 percent respectively. While revenue per visit (RPV) coming from Facebook grew by two percent QoQ, RPV from Twitter and Tumblr declined by 23 percent and 36 percent respectively, following a strong holiday quarter.

Leveraging its unparalleled data set, Adobe’s Social Media Intelligence Report is the industry’s most comprehensive analysis and is based on 260 billion Facebook ad impressions, 226 billion Facebook post impressions, 17 billion referred visits from social networking sites, and seven billion brand post interactions including comments, likes and shares. Paid social data is derived from aggregated Adobe Marketing Cloud data.

“Social media continued to grow even after a strong holiday quarter and the seasonal slowdown expected in Q1,” said Tamara Gaffney, principal analyst, Adobe Digital Index. “Marketers are learning how to best reach their audiences across different social media channels and companies like Facebook are making changes to their algorithms and adding functionalities like auto-play of videos, which impact brands and users and how they engage with content.”

Additional findings include:

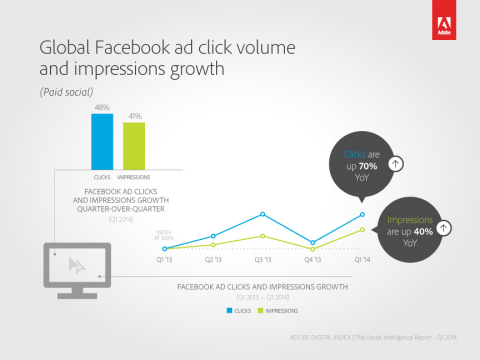

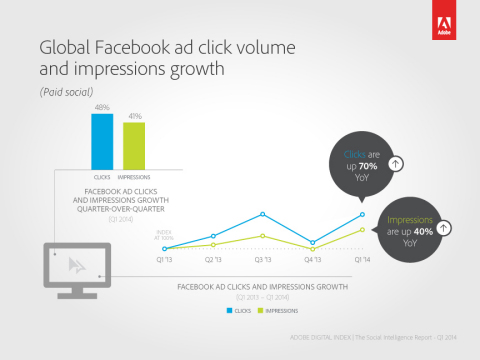

- Paid Social Trends: Facebook ad clicks and impressions are on the rise with clicks continuing to outpace impressions. Facebook’s ad clicks increased 70 percent year-over-year (YoY) and 48 percent quarter-over-quarter (QoQ), with ad impressions up 40 percent and 41 percent, respectively. Facebook’s ad CTR jumped 160 percent YoY and 20 percent QoQ. However, Facebook’s cost per click (CPC) dipped two percent YoY and 11 percent QoQ following a strong holiday season.

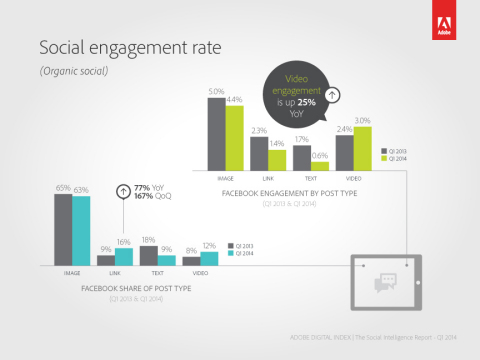

- Earned Social Trends: Brand posts with embedded video gained traction in Q1 – with 58 percent more engagement QoQ and 25 percent growth YoY. Facebook video plays increased 785 percent YoY and 134 percent QoQ following auto-plays for videos being implemented in Q4 2013. Meanwhile, text-only Facebook brand posts are losing share and engagement, but posts with links rose 167 percent QoQ and 77 percent YoY.

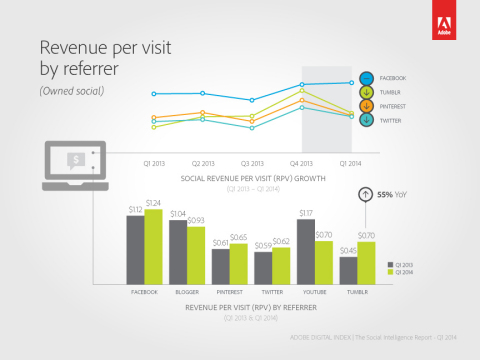

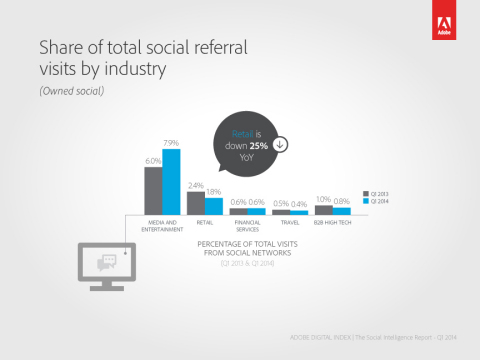

- Owned Social Trends: Twitter and Facebook referred RPV increased YoY (5 percent and 11 percent, respectively), but Twitter driven RPVs dipped 23 percent QoQ. Tumblr referred RPV is up 55 percent YoY, but slumped 36 percent QoQ. LinkedIn stood out with a 15 percent share of social traffic to B2B high-tech sites. Only Facebook drove more traffic (52 percent) to B2B high-tech sites in Q1.

Helpful Links

- Adobe Digital Index: Social Intelligence Report

- Adobe Digital Index Portal on CMO.com

- Adobe CMO.com blog post

About Adobe Digital Index

Adobe Digital Index publishes research on digital marketing and other topics of interest to senior marketing and e-commerce executives across industries. Research is based on the analysis of select, anonymous and aggregated data from over 5,000 companies worldwide that use Adobe Marketing Cloud to obtain actionable data and analysis of activity on their websites. The Social Intelligence Report and other reports and insights are available here.

About Adobe Systems Incorporated

Adobe is changing the world through digital experiences. For more information, visit www.adobe.com.

© 2014 Adobe Systems Incorporated. All rights reserved. Adobe and the Adobe logo are either registered trademarks or trademarks of Adobe Systems Incorporated in the United States and/or other countries. All other trademarks are the property of their respective owners.